Accounting management is one of the crucial aspects of business management. These businesses utilize absorption costing which is an accounting method that enables them to identify the cost of one unit of output which is an important area that businesses must understand and comprehend to use efficiently. This method is used in inventory management to put a value on its directory. It contains details on the cost of materials and labor as well as variable and fixed overhead costs of manufacturing.

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

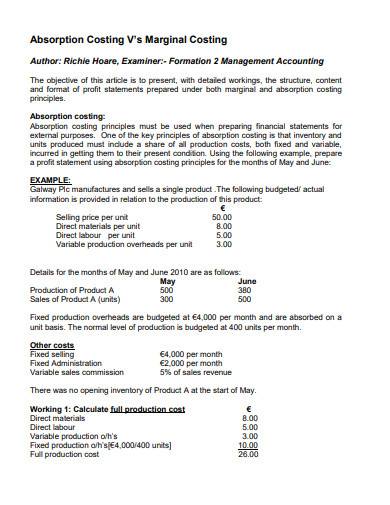

1. Absorption Marginal Costing Template

2. Absorption and Variable Costing Template

3. Sample Marginal Absorption Costing Template

4. Absorption Costing Form Template

5. Simple Absorption Costing Template

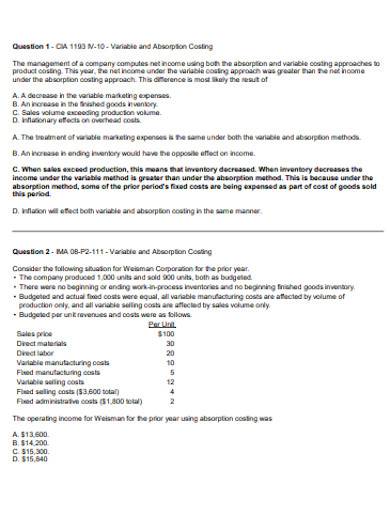

6. Sample Variable and Absorption Costing Template

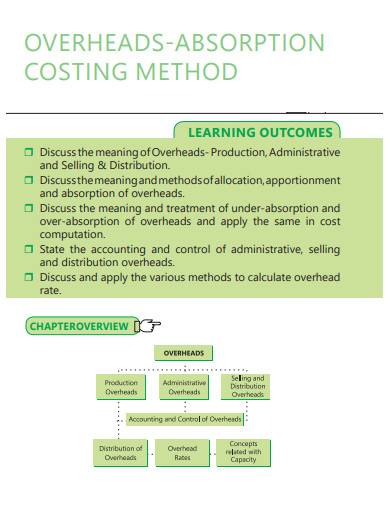

7. Absorption Costing Methods Template

8. Basic Absorption Costing Template

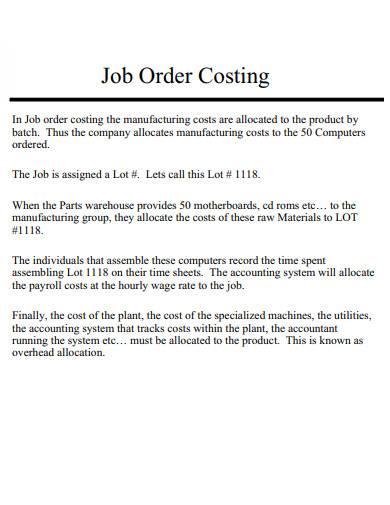

9. Absorption Job Order Costing Template

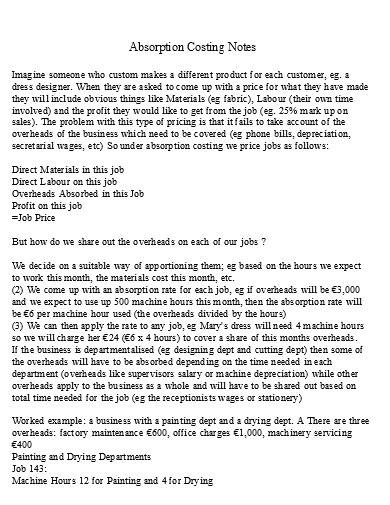

10. Absorption Costing Notes Template

What is an Absorption Costing?

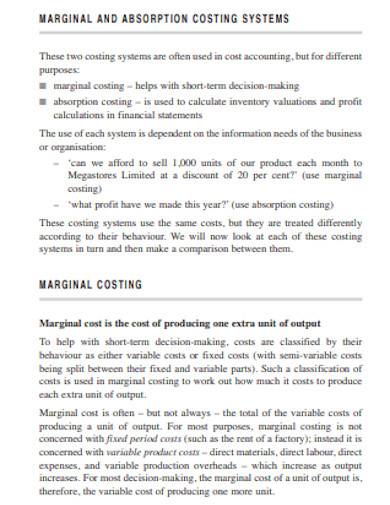

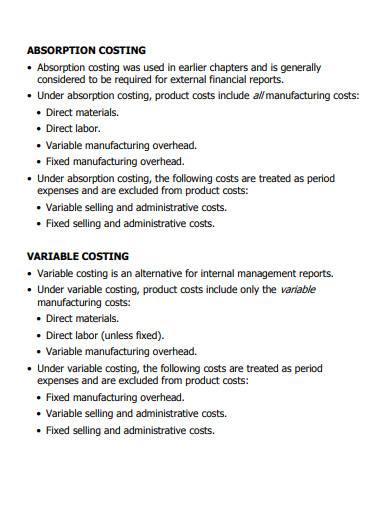

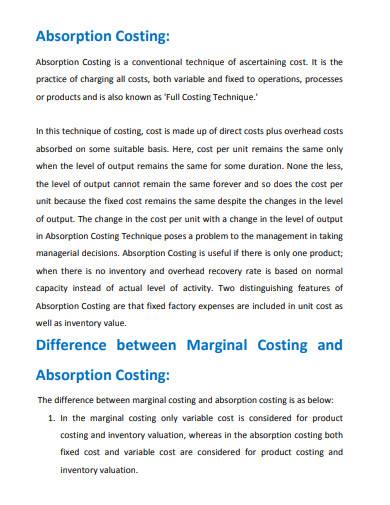

An absorption costing, sometimes referred to as full costing, is a costing system or method that is used to capture all costs that come with manufacturing a certain product. It includes all direct and indirect costs like direct materials, direct labor, cost stated in rent payment invoices, and insurance. The costs associated with producing a product include the salary of employees which is documented using a compensation plan template, raw materials used in manufacturing the item, and the entire overhead costs.

How to Quantify Absorption Costing

Absorption costing refers to the method of collecting the costs that comes with the production process and distributing them to each product. This method is a requirement that companies must follow in compliance with the accounting standards to provide inventory valuation as stated in their company balance sheet. The product might include a range of both fixed and variable costs which remains an asset until the time that the inventory is sold which will be charged to the cost of the goods that were sold.

Step 1: Determine the Costs

Start by determining the costs that were incurred with the production of an item or product and allocate them to various cost pools. Cost pools refer to expenses categorized based on the activity. This includes group marketing campaigns, customer service action plans, and research development plans.

Step 2: Allocate Variable and Fixed Manufacturing Overhead

The variable overhead costs are the individual costs like supervision and indirect materials then once completed, you can put this information into your income statements while fixed manufacturing overhead refers to the rent, heating, and electricity bills used during the production process.

Step 3: Identify the Use of Each Cost

After allocating the costs, determine every amount used during the production process then identify the usage for each activity like the number of hours spent in labor or in operating a piece of equipment throughout the process.

Step 4: Calculate the Allocation

Calculating the allocation rate will tell you the cost per unit. To do this, add the costs for the direct materials, direct labor, variable manufacturing overhead costs, and fixed manufacturing overhead costs. Then divide the total by the number of units produced.

FAQs

What are the benefits of calculating the absorption cost?

By performing absorption costing, you can take each cost associated with the production process into account and then determine the correct plan for your product pricing strategy proposal. You can also track your profit, which enables small companies to easily track their costs, and absorption costing is beneficial for businesses that have a constant demand for their products.

What is the indirect and direct cost of absorption costing?

Direct costs refer to the costs that can be directly mapped out to a certain product or service such as raw materials and labor while indirect costs refer to the costs that cannot be traced to a certain product or service like utilities, rent, and insurance.

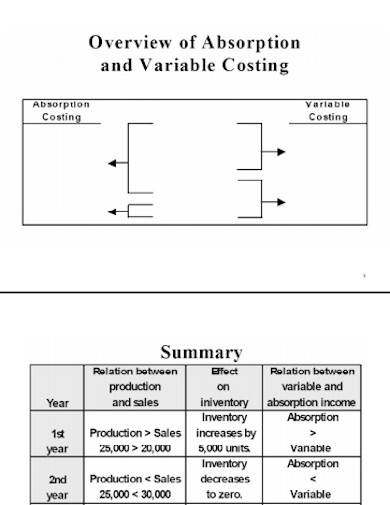

What is the difference between absorption costing and variable costing?

Absorption costing includes all manufacturing costs which means both direct and indirect costs while variable costing only includes direct costs in the cost of a certain product and indirect costs are treated as a period expense and recorded in the income statement.

Absorption costing is also known as full absorption costing and full costing is a method of accounting used to determine the costs associated with the manufacturing of a specific product. It is used by businesses or companies for their external financial reports and income tax reports. This method includes costs on a production’s direct materials, direct labor, and variable and fixed manufacturing overhead costs.

Related Posts

FREE 10+ Writing Journal Entry Samples and Templates in MS Word | PDF

FREE 10+ Double Entry Journal Samples and Templates in MS Word | PDF

FREE 5+ Stock Ledger Samples and Templates in MS Excel | PDF

FREE 10 + Revenue Recognition Samples & Templates in PDF | MS Word

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word

FREE 7+ Annuity Review Checklist Samples and Templates in MS Word | PDF