One of the key benefits of an annuity statement is that it provides an annuitant with a snapshot of their annuity contracting agreement at a given point in time. By reviewing their annuity statement, an annuitant can get a clear picture of how much income they can expect to receive from their annuity and when they can expect to receive it. This can be particularly important for retirees who rely on their annuity income report to cover their living prepaid expenses.

FREE 10+ Annuity Statement Samples and Templates in MS Word | PDF

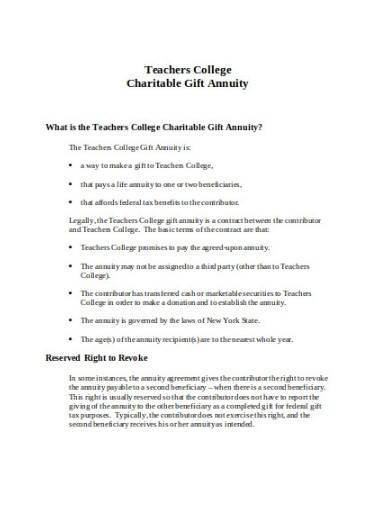

1. Charitable Gift Annuity Statement

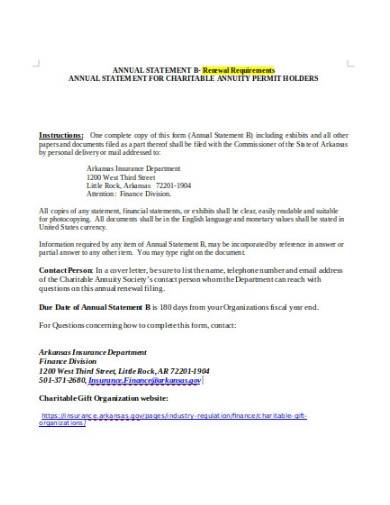

2. Annual Annuity Statement Template

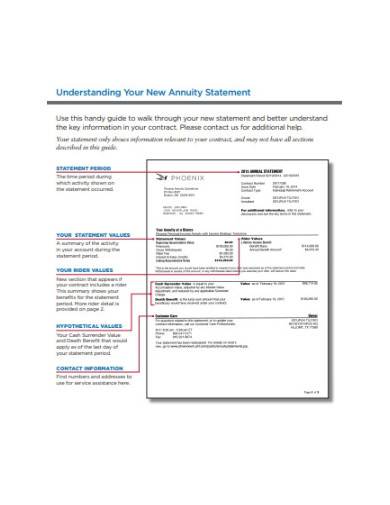

3. New Annuity Statement Template

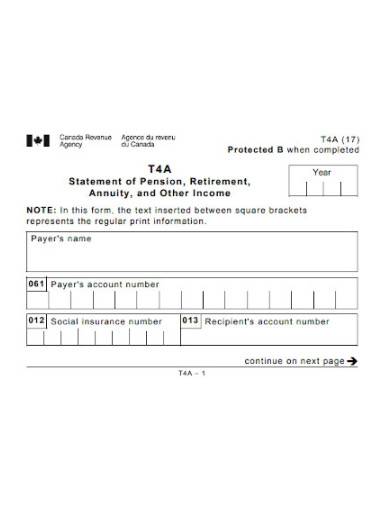

4. Annuity Statement Template

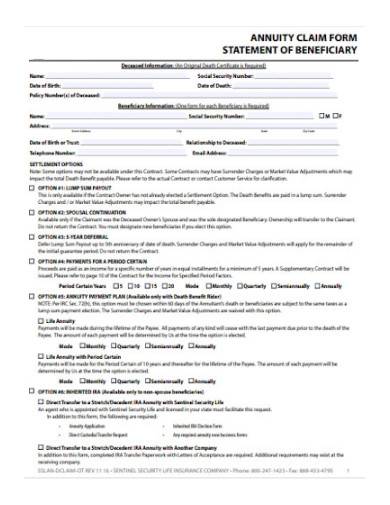

5. Annuity Claim Form Template

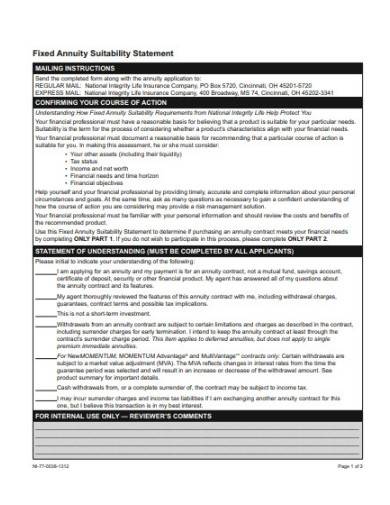

6. Fixed Annuity Suitability Statement

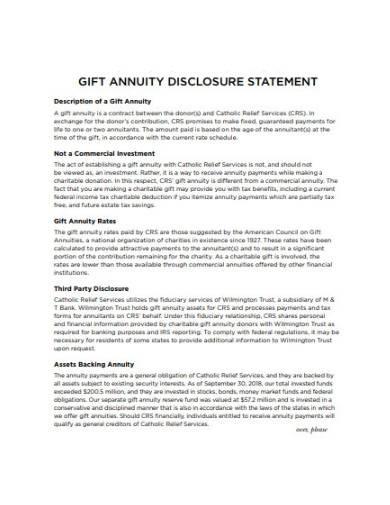

7. Annuity Disclosure Statement Template

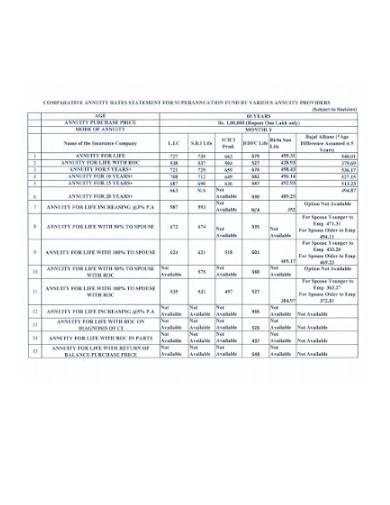

8. Annuity Rates Statement Example

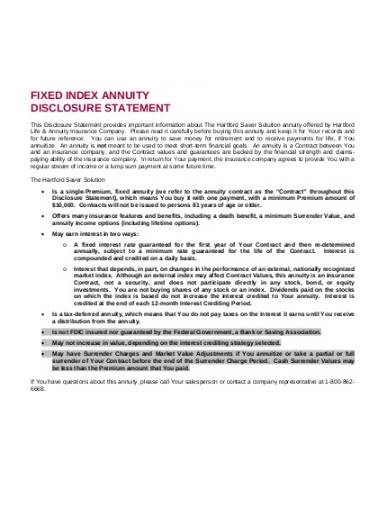

9. Fixed Index Annuity Disclosure Statement

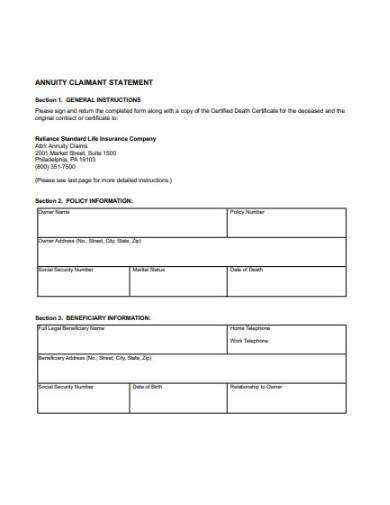

10. Sample Annuity Claimant Statement

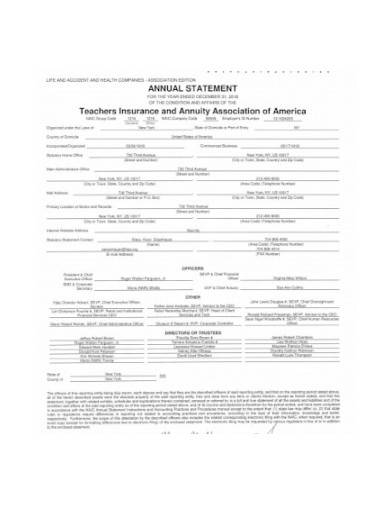

11. Annual Statement Template

What is Annuity Statement?

An annuity statement is a document that provides details about an annuity contract. An annuity is a financial product proposal that provides a regular stream of income in exchange for a lump sum or periodic payment terms. An annuity statement typically includes information such as the name of the annuitant, the type of annuity, the amount of the annuity payments, the frequency of the payments, and the length of the annuity term. It may also include information about fee proposal, expenses, and taxes associated with the annuity contract. Annuity statements are typically sent to annuitants on a regular basis, such as annually or quarterly, to provide updates on the status of their annuity contracts.

How To Make Annuity Statement?

An annuity statement typically includes information about the annuitant, such as their name and address, as well as details about the annuity contract. This information includes the type of annuity, the amount of the annuity payments, the frequency of the payments, and the length of the annuity term. Annuity statements are typically created by the annuity provider and are sent to annuitants on a regular basis, such as annually or quarterly. However, if you are an annuitant and you want to create your own annuity statement for your personal records, you can follow these steps:

Step 1-Gather information

Collect all the relevant information about your annuity contract, including the type of annuity, the amount of the annuity payments, the frequency of the payments, and the length of the annuity term. You should also gather information about any fees, expenses, and taxes associated with your annuity contract.

Step 2-Choose a format

Decide on the format you want to use for your annuity statement. You can create a simple table or spreadsheet, or you can use a more detailed template that includes additional information, such as the annuity provider’s contact information and details about any riders or options on your annuity contract.

Step 3-Organize the information

Once you have all the necessary information and chosen a format, organize the information into the appropriate categories, such as “annuity payments” and “fees and expenses.” Create the statement: Use your chosen format to create your annuity statement. Be sure to include all the relevant information and present it in a clear and organized manner.

Step 4-Review and update

Review your annuity statement regularly and update it as needed to reflect any changes to your annuity contract, such as changes in the amount or frequency of your payments or changes in the fees and expenses associated with your annuity.

How often will I receive my annuity statement?

Annuity statements are typically sent to annuitants on a regular basis, such as annually or quarterly, to provide updates on the status of their annuity contracts.

How can I access my annuity statement?

Annuity statements are typically sent to annuitants by mail or email. If you have not received your annuity statement, you can contact your annuity provider to request a copy.

Can I create my own annuity statement?

Yes, if you are an annuitant, you can create your own annuity statement for your personal payment records. You can gather all the relevant information about your annuity contract and use a simple table or spreadsheet to organize the information.

In conclusion, an annuity statement is an essential document that provides important information about an annuity contract. It is a valuable tool for retirement planning and can help annuitants make informed decisions about their retirement income. By reviewing their annuity statement regularly and asking questions if necessary, annuitants can ensure that their annuity contract continues to meet their needs and objectives over time.

Related Posts

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word

FREE 7+ Annuity Review Checklist Samples and Templates in MS Word | PDF

FREE 11+ Liability checklist Samples & Templates in PDF | MS Word

FREE 11+ Annuity Checklist Samples & Templates in PDF | MS Word

FREE 10+ Nonprofit Accounting Samples in PDF | MS Word