Accounting plays an important role in business. It does not only take care of the finances, but it also helps in managing the future of an enterprise. Accounting practices can direct businesses to their goals. In most accounting firms, bookkeeping is a practice that accountants have to master. Since a large company has a wider financial scope compared to a smaller business, owners hire the best bookkeepers to look after their journal and general ledger. Yet, small businesses and self-employed business persons must also consider bookkeeping as a vital part of their financial ventures. Even an enterprise with small business operations needs bookkeeping to record financial transactions. Understandably, partnering with an accounting firm can cost part of the business income. But that would not hinder a business to benefit from bookkeeping services. Also, there are downloadable bookkeeping templates if you own a small business or self-employed.

What Is Bookkeeping?

When it comes to finances, businesses always take it seriously. There is no other way to keep a business operating other than channeling money into it. That said, every business in the industry has to keep an eye on their income and expenses. How to do it? Bookkeeping will organize the financial transaction of the company by documenting business receipts, checks, cash disbursements, and sales. Missing one of these could affect the business drastically. If the business lost a receipt, it lost deduction, which may add up in payment for taxes.

Bookkeeping: How Important Is It?

Great bookkeeping can help businesses save economically. That is why balanced, precise, and organized financial records likewise make the business gain trust from new investors and loan providers since they can look into the monetary status before giving you the amount that you need. Though other factors needed consideration to make sure that the business is on the right track, stabilizing financial conditions through bookkeeping lessens the burden of overspending. With bookkeeping, the business will understand where their capital is going. Thus, encouraging bookkeeping is the secret of a successful business.

FREE 10+ Bookkeeping Templates for Self Employed in PDF

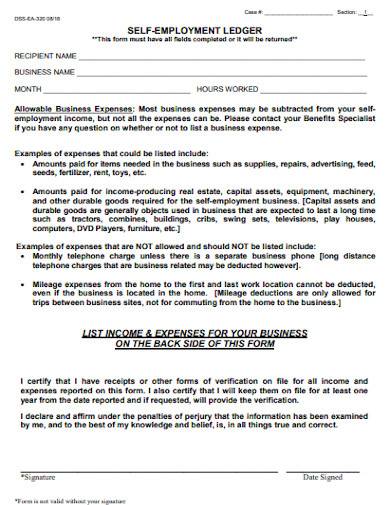

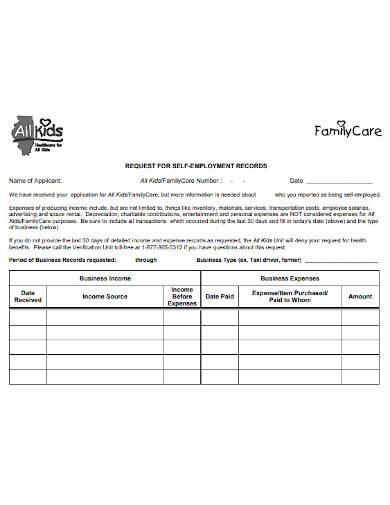

1. Self-Employment Book Keeping Ledger Template

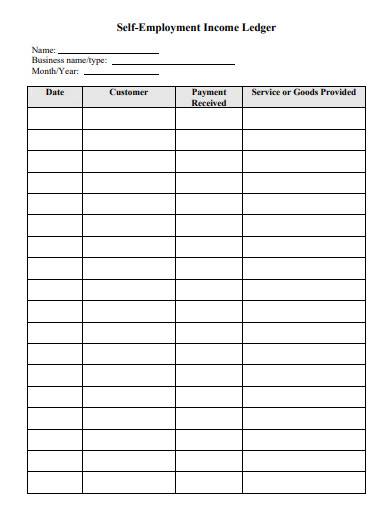

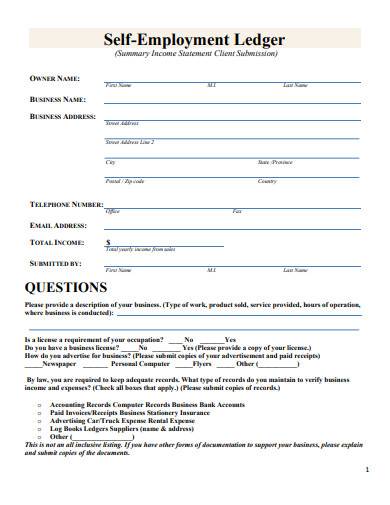

2. Self-Employment Income Ledger

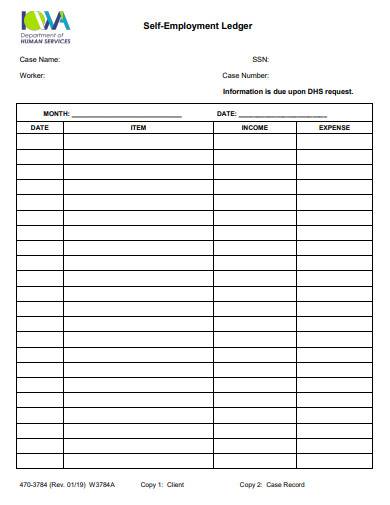

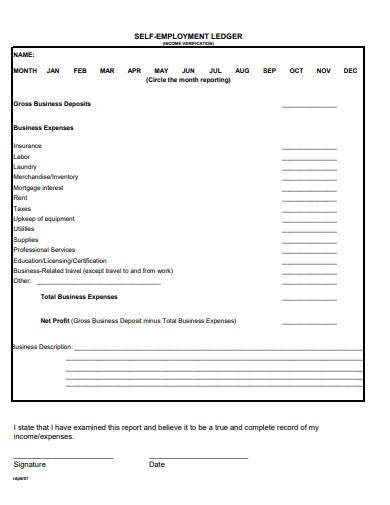

3. Sample Self-Employment Ledger Template

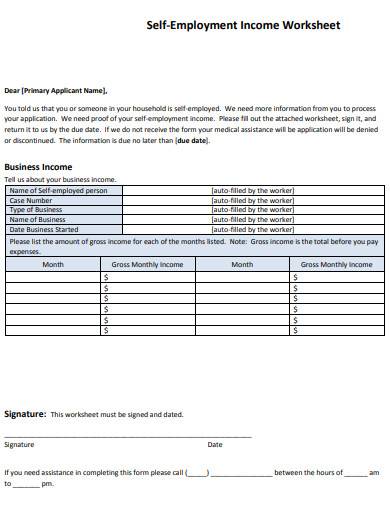

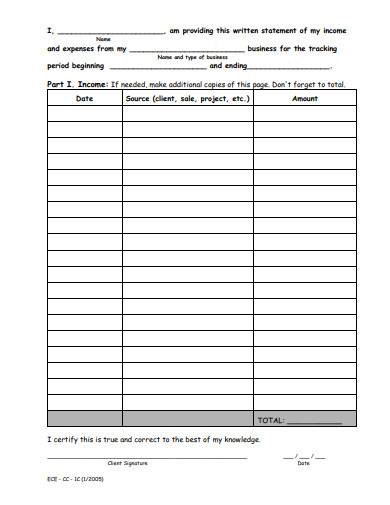

4. Book Keeping Self-Employment Income Worksheet

5. Self-Employment Income Book Keeping Worksheet

6. Self-Employment Book Keeping Records

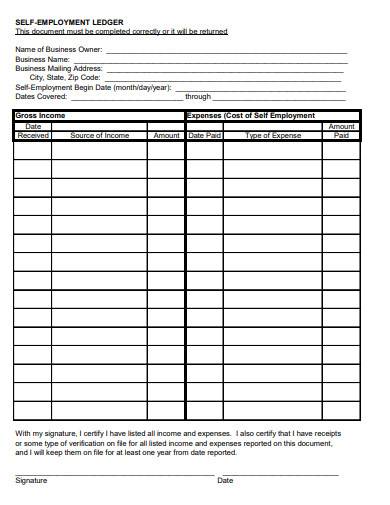

7. Formal Book Keeping Self Employment Ledger

8. Enrollment Book Keeping Self-Employment Ledger

9. Self-Employment-Ledger in PDF Template

10. Self-Employment Book Keeping Ledger Form

How to Record Bookkeeping Data for Self-Employed

Undeniably, bookkeeping is an important system in a business. It will record and classify every accounting transaction of a company. Also, bookkeeping will include methods in recording those transactions. For small businesses, either the owners have to set their bookkeeping system or hire a professional to set it up. But if you are self-employed, you will do it on your own. In reality, hiring staff to grow the business may result in hiring a controller. But a small business does not need that. If you want to anticipate gradual growth, as self-employed, you can handle your bookkeeping system all by yourself.

1. Consider Bookkeeping Templates

Indeed, handling a bookkeeping system with a computer is a lot easier. Why do you need to do bookkeeping manually? Assuming that you have no background in accounting, that makes you less knowledgeable about bookkeeping. If you are to make a bookkeeping system, you have to know the data you are to deal with. It is not just about recording numbers, because bookkeeping is so much more than that. Remember that you have to record business transactions involving some essential documents, such as receipt samples, checks, and cash disbursements. You need to keep all of these so you can monitor all of your financial deals. For you to record these documents properly, you can use bookkeeping templates for self-employed. A template will help you document the data even without a computerized bookkeeping system.

2. Understand Assets, Liabilities, and Equity

Before jumping into your system, learn your basic accounts—assets, liabilities, and equity. Knowing these is easy. Let us start with your assets. The assets of your business are the things you own, like the inventory and receivable accounts. Unlike assets, the liabilities are those things your business owes or the accounts payable. Some examples of these are the money you need to pay to your suppliers, banks, loan providers, mortgages, and any debt on the accounting worksheet. Lastly, equity is the remaining interest to an owner has after the liabilities are deducted from the asset of the business.

3. Keeping the Finances Balanced

The basic accounts will help you balance your business. Make sure to track every transaction with assets, liabilities, and equity. After that, record these accounts correctly and place them in the right place. To keep the balance sheet stable, you can use the accounting equation. This equation is simple. So, to know if the business is balanced, the assets should be equal to the liabilities plus the equity. If not, then you have no claims left for your assets. Thus, if the business is unbalanced, assess which account you need to fix.

4. Learn the Basics of Income Statement

Aside from business accounts, a self-employed individual needs to know the basics of financial statements. That said, you need to learn about the revenue, expenses, and costs of your business. Revenue is the money that you make in selling products or services. In other words, revenue is the income of your business. Also called as costs of goods sold, costs are the financial resources the business use to purchase or manufacture the goods and services it offers to its customers. And the list of expenses is the money that the business spent to continue the operations not related to products and services sold.

FAQs

What does a bookkeeper do?

A bookkeeper’s job is to record all of the business’s accounts, known as the general ledger. As a bookkeeper, he or she is responsible for tracking all sales transactions that include assets, liabilities, and equity.

What are the basic bookkeeping skills?

Today, being a bookkeeper requires computer literacy. That will give a bookkeeper an edge to other candidates. If you want a bookkeeping job, you need to have good communication skills, knowledge of bookkeeping principles, and an interest in improving your knowledge in accounting.

What is the difference between accounting and bookkeeping?

The difference between accounting and bookkeeping can be hard to distinguish. Accounting processes the summarization, interpretation, and communication of financial transactions while bookkeeping focuses on identifying, measuring, and recording financial transactions.

As a self-employed individual, you need to put extra effort into keeping the finances of your business afloat. You have to work harder than the regular business owners because you are juggling every business transaction on your own. Rather than being overwhelmed with the tasks you need to accomplish, start learning the things you need to keep the business running, especially if it includes money. When it comes to bookkeeping, always know your account first. Remember that there are tools you can use to make your task easier, and you have to take a chance on them.

Related Posts

FREE 10+ Writing Journal Entry Samples and Templates in MS Word | PDF

FREE 10+ Double Entry Journal Samples and Templates in MS Word | PDF

FREE 5+ Stock Ledger Samples and Templates in MS Excel | PDF

FREE 10 + Revenue Recognition Samples & Templates in PDF | MS Word

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word