One will not be able to survive without having the means to acquire resources, including business owners. Cash is one of the essential components that hold a company to its grounds—the lifeblood of businesses. Hence, business management must maintain a cash flow statement, including a cash flow forecast. The cash flow forecast allows business owners to predict the cash flow of the company for it to survive. In this article, you will be able to learn and understand the importance of a cash flow forecast, and why it should not be ignored by businesses regardless of their domain. This article also provides sample cash flow forecasts that you can use as a reference.

FREE 10+ Cash Flow Forecasting Samples & Templates in PDF | MS Word

Below are sample templates of a cash flow forecast that you can access anytime. These templates come with pre-formatted layouts and suggestive content that you can edit freely using PDF and MS Word file formats. Check them out!

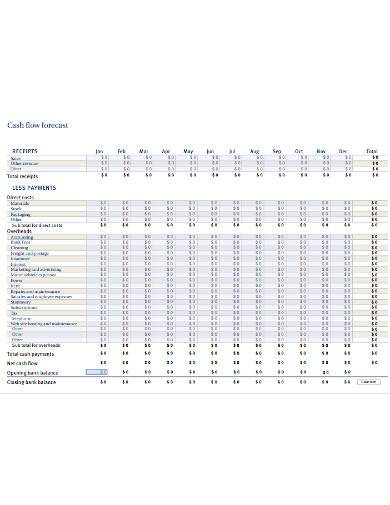

1. Sample Cash Flow Forecasting Template

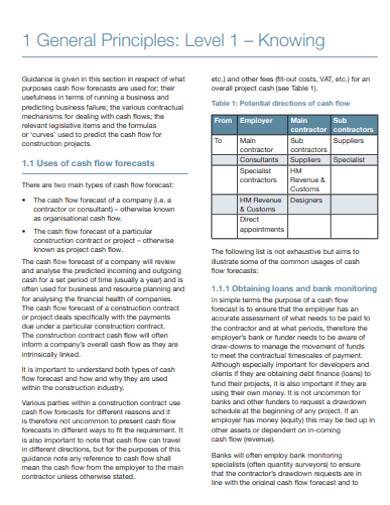

2. General Cash Flow Forecasting Template

3. Cash Flow Forecasting Module Template

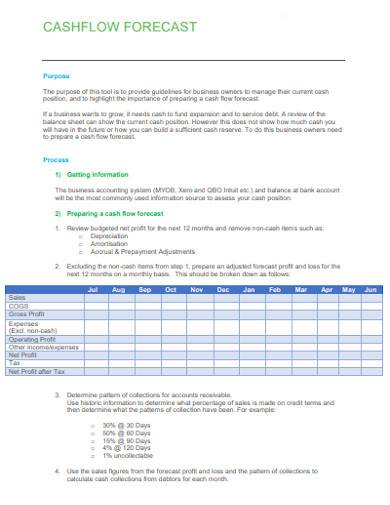

4. Basic Cash Flow Forecasting Template

5. Bank Cash Flow Forecasting Template

6. Cash Flow Analysis Forecasting Template

7. Standard Cash Flow Forecasting Template

8. Cash Flow Forecasting Problems Template

9. Financial Cash Flow Forecasting Template

10. Cash Flow Management and Forecasting Module Template

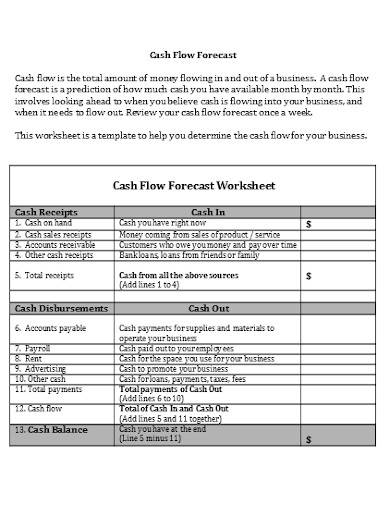

11. Cash Flow Forecast Worksheet Template

What Is Cash Flow Forecast?

According to an article from Medium, the inability to check the cash flow of a company is an insufficient approach for businesses. Although keeping a profit and loss statement and a balance sheet or any financial statements enables a business to evaluate its financial status, ignoring cash flow should not be necessary. Checking cashflow—the inflows and outflows of your business—allows you to generate a company-saving action in the form of cash flow forecasts.

A cash flow forecast is a written document that allows business owners to estimate the inflows and outflows of cash in their business. With this, entrepreneurs can determine shortfalls in cash balances. It also helps businesses to assess if revenues, costs, and profits—the trading performances of a company—is equal to cash. Besides that, cash flow forecasts enable business owners to analyze if the company has achieved the goals stated in its business plan.

How To Prepare a Cash Flow Forecast

A cash flow forecast serves a vital role in a company’s sustainability and success. That is why it is imperative to make sure that all written data and figures are useful and timely, even though these are only projections. So, if you are about to prepare an accounting form, the likes of a cash flow forecast for your company, make sure you do it right. We have some basic tips that will increase the accuracy of your cash flow forecast in the steps listed below.

1. Prepare the Needed Information

The cash flow forecast must obtain financial information that is appropriate for the business. Generally, this information includes sales growth estimates, general cost increases, internal salary, wage increases, and more. These data and figures can be based on the company’s previous performances and operations. Nonetheless, the data and information placed in the cash flow forecast must represent the same recording period. You can make use of a blank checklist to ensure that all necessary information is gathered.

2. Format the Cash Flow Forecast

Once you have already prepared the essential data for your cash flow forecast, the next thing you need to do is to create its format. Basically, the cash flow forecast is presented in paragraphs and tables. So, if you want to use both, make sure that you have software that allows you to do so. Either way, make sure that whatever format you prefer to use, it will be able to showcase the data and figures accurately.

3. Include an Introduction and Company Branding

To make your cash flow forecast more efficient, you may want to include a brief introduction before you present your projected data. By this, you state the purpose of the cash flow forecast and its process. It would also be best to assert the timeframe of the forecast. Besides that, indicating your company branding—business name, logo, tagline, contact details, and company address would also make your cash flow forecast professional.

4. Fill out the Cash Flow Forecast

After you have placed an introduction in your cash flow forecast, it’s time to fill out the cash flow spreadsheet. To make it look organized and clear, you may itemize each data and group together similar information. Categorize your cash flow forecast with cash inflows and cash outflows. Then, indicate the projected figures on each, depending on its period—daily, weekly, monthly, or annually.

FAQs

What are the uses of Cash Flow Forecasting?

Having a cash flow forecast does not only help company owners in decision-making, but it provides more essential uses that can help a company to survive. A cash flow forecast allows management to monitor company stocks, generate concrete investment strategies, evaluate business borrowing needs, ensures enough cash, check a project’s viability, and avoid cash shortfalls.

What should be in a Cash Flow Forecast?

There are three essential elements that every cash flow forecast must have to present accurate data and gain effective results. First is the company’s estimated likely sales, projected payment timings, and estimated costs. With these critical elements, the management will be able to asses the projected cash flow over a period that will help them in business management.

What is the difference between the Cash Flow Statement and Cash Flow Forecast?

A cash flow statement represents actual data and information on business transactions. It analyzes the inflow and outflow of cash in three different areas—operations, investment, and financing. Since the transaction information for CFS has already taken place, it is more likely to be less detailed. On the other hand, the cash flow forecast allows business owners to evaluate cash flows from previous transactions to project cash flows in the future.

A cash flow forecast is a financial statement that is necessary for companies to have to make sure that there is no financial deficiency in their business, especially small businesses. The cash flow forecast presents the projected inflows and outflows of cash in a business, and this allows company owners to stay prepared for any shortfalls. For a company to make a profit and remain competitive, its projections cannot afford inaccuracies.

Related Posts

FREE 10+ Writing Journal Entry Samples and Templates in MS Word | PDF

FREE 10+ Double Entry Journal Samples and Templates in MS Word | PDF

FREE 5+ Stock Ledger Samples and Templates in MS Excel | PDF

FREE 10 + Revenue Recognition Samples & Templates in PDF | MS Word

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word