The reconciliation statement process begins by reviewing each transaction recorded in both sets of records and verifying that they match. If a transaction appears in one set of record sample but not in the other, it is considered a discrepancy that needs to be investigated. Any discrepancies identified are noted, and adjustments are made to the company’s financial report or bank statement to correct the errors. The primary purpose of a reconciliation statement is to ensure that a company’s internal financial records accurately reflect its financial projections. By reconciling the company’s records with those of the bank, the reconciliation statement ensures that all financial transactions have been recorded correctly and that there are no errors or omissions that could impact the company’s financial statements.

FREE 10+ Reconciliation Statement Samples and Templates in MS Word | PDF

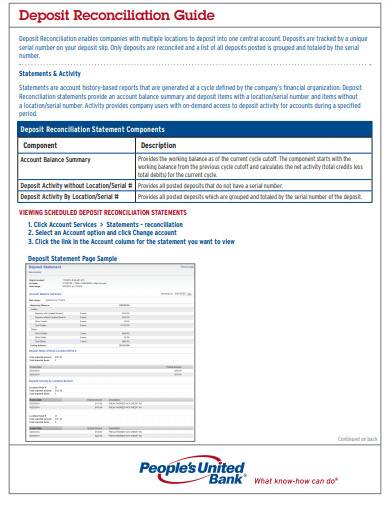

1. Deposit Reconciliation Guide Template

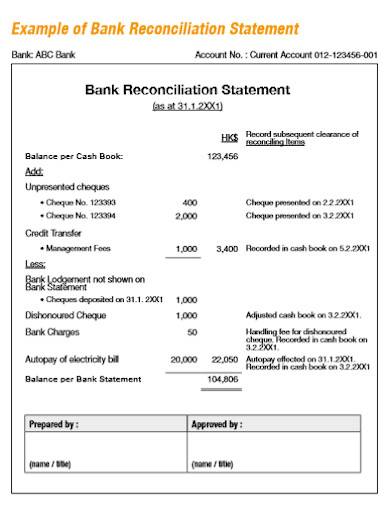

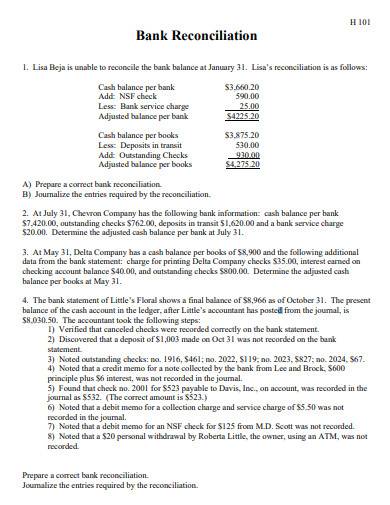

2. Example of Bank Reconciliation Statement

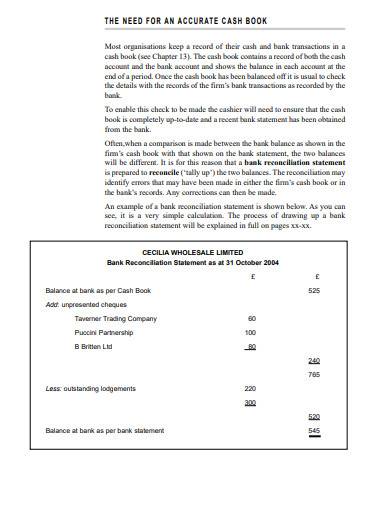

3. Bank Reconciliation Statement Example

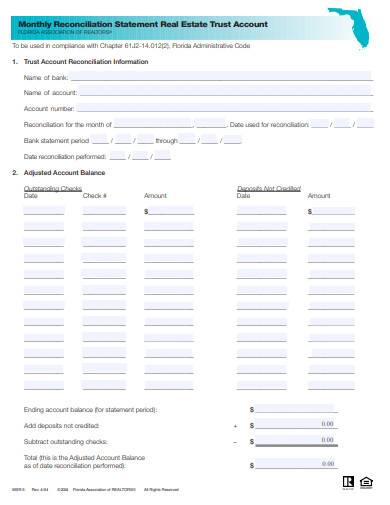

4. Blank Monthly Reconciliation Statement

5. Bank Reconciliation Template

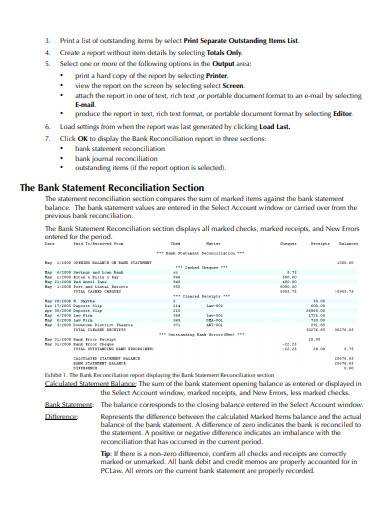

6. Bank Reconciliation Statement Report Template

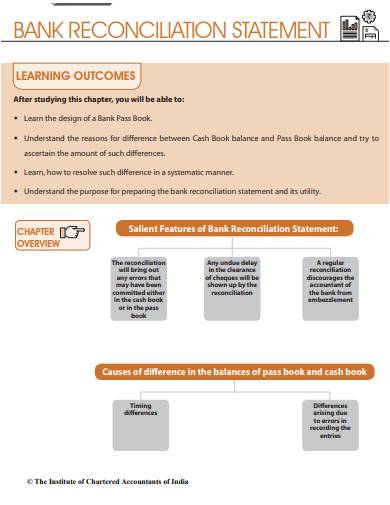

7. Bank Reconciliation Statement in PDF

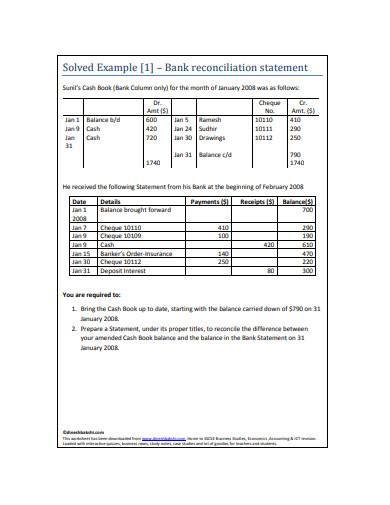

8. Bank Reconciliation Statement Solved

9. Bank Reconciliation Statement Guide

10. Printable Bank Reconciliation Statement

11. Simple Bank Reconciliation Statement

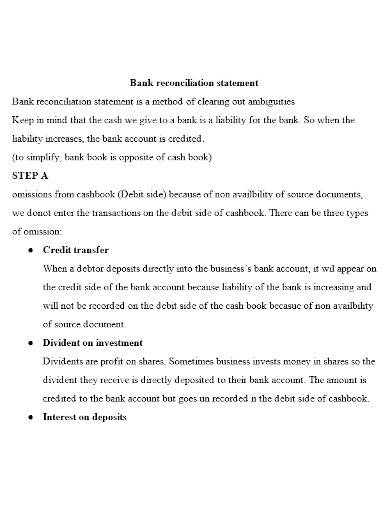

What is Reconciliation Statement?

A reconciliation statement is a financial document that plays a crucial role in ensuring the accuracy and reliability of a company’s financial records. This statement compares two sets of financial records to ensure that they are in agreement and to identify any discrepancies or errors that need to be corrected.

How To Make Reconciliation Statement?

The two sets of financial records being compared in a reconciliation statement are typically a bank statement and a company’s internal financial records. The bank statement shows all the transactions processed by the bank for the period under review, while the company’s internal financial records show all the transactions recorded in the company’s accounting system during the same period. The process of making a reconciliation statement involves comparing two sets of financial records and identifying any discrepancies between them. Here are the steps to follow when making a reconciliation statement:

Step 1- Gather the necessary financial records

Collect the bank statement and the company’s internal financial records for the period under review. This period could be a month, a quarter, or a year, depending on the company’s accounting practices. Review the bank statement Go through the bank statement and check each transaction listed. Make sure that all the transactions are relevant to the company and have been recorded correctly. Identify any discrepancies, such as missing or duplicate transactions.

Step 2: Review the company’s internal financial records

Go through the company’s internal financial records for the same period and check each transaction recorded. Make sure that all the transactions are relevant and have been recorded correctly. Identify any discrepancies, such as missing or duplicate transactions. Compare the two sets of records Compare the bank statement with the company’s internal financial records to identify any discrepancies. Record any discrepancies on a separate sheet.

Step 3: Make necessary adjustments

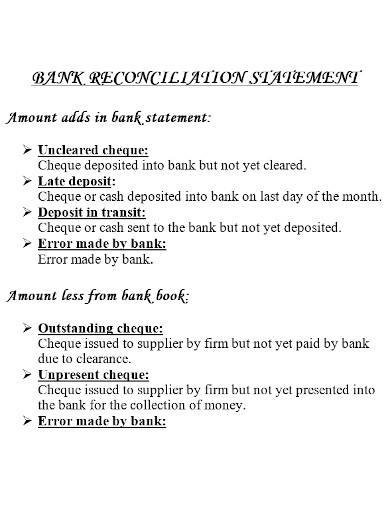

Adjust the company’s internal financial records or the bank statement to correct any discrepancies identified. For example, if a transaction appears in the bank statement but not in the company’s internal financial records, add it to the company’s internal financial records.

Step 4: Finalize the reconciliation statement

Once all the discrepancies have been identified and corrected, prepare a reconciliation statement. This statement should summarize the differences between the two sets of records and show the adjustments made to reconcile them.

How often should a reconciliation statement be prepared?

The frequency of preparing a reconciliation statement depends on the company’s accounting practices. However, most companies prepare a reconciliation statement at least monthly to ensure that their financial records are up to date and accurate.

What are some common discrepancies that can be identified in a reconciliation statement?

Some common discrepancies that can be identified in a reconciliation statement include missing transactions, duplicate transactions, errors in transaction amounts, and timing differences between the bank statement and the company’s internal financial records.

Who is responsible for preparing a reconciliation statement?

The responsibility for preparing a reconciliation statement typically falls on the company’s accounting or finance department. However, the company’s management team and auditors may also be involved in the process to ensure that the reconciliation statement is accurate and reliable.

In conclusion, a reconciliation statement is a vital financial document that plays a crucial role in ensuring the accuracy and reliability of a company’s financial records. By comparing the company’s internal financial records with those of the bank, the reconciliation statement helps identify discrepancies and errors that could impact the company’s financial statements. As such, reconciliation statements are a valuable tool for businesses to maintain financial integrity, prevent fraud, and make informed business decisions.

Related Posts

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word

FREE 7+ Annuity Review Checklist Samples and Templates in MS Word | PDF

FREE 11+ Liability checklist Samples & Templates in PDF | MS Word

FREE 11+ Annuity Checklist Samples & Templates in PDF | MS Word

FREE 10+ Nonprofit Accounting Samples in PDF | MS Word