Company managers or officers who do not directly perform accounting duties might find revenue recognition to have little effect on their roles and responsibilities. However, revenue recognition involves accounting principles that contain important implications for a company’s short and long-term viability as well as on how they will be handling certain company operational plans including enterprise sales plans, expense management, loan collections, and more. Revenue recognition is referred to as an accounting principle that provides an outline of the specified conditions under which revenue is acknowledged.

FREE 10 + Revenue Recognition Samples & Templates in PDF | MS Word

1. Sample Revenue Recognition Template

2. Workday Revenue Recognition Template

3. Revenue manufacturers Recognition

4. Sample Industry Revenue Recognition Template

5. Sample Software Revenue Recognition Template

6. Contract-Based Revenue Recognition Template

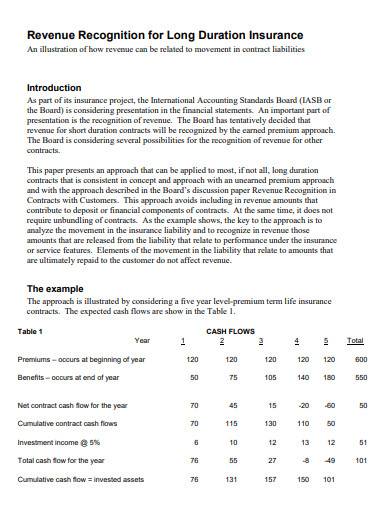

7. Revenue Recognition for Long Duration Insurance Template

8. New Revenue Recognition Framework Template

9. Revenue Recognition Transformation Template

10. Revenue Recognition by Real Estate Developers Template

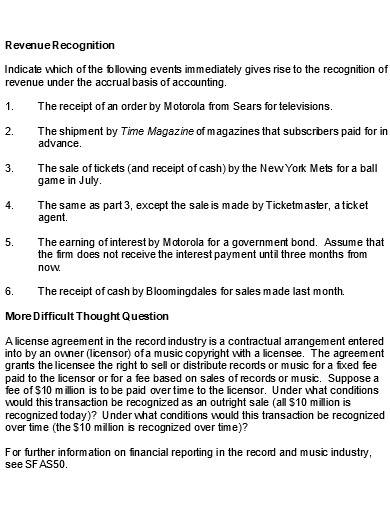

11. Simple Revenue Recognition Template

What is a Revenue Recognition?

Revenue recognition is a Generally Accepted Accounting Principle (GAAP) that identifies the process and schedule in which revenue must be recorded and recognized as an item in the business financial statements. This principle declares that a company or organization’s revenue should be recognized only when the product or service being bought by the customer has been delivered. When your company earns a sale, the revenue from it must be recorded so it could reflect on your income statement.

How to Establish Revenue Recognition

Revenue is the most important aspect of a company and is considered the heart of business management plans and performance. Revenue recognition helps companies that sell various types of products and services in eliminating inconsistencies and provides a framework to guide companies in their accrual accounting. To complete the process of revenue recognition, companies or businesses must enter into a contract agreement with their customer, agree on their duties, agree on the price of the transaction, provide the price to the obligations, and satisfy the outlined conditions and obligations.

Step 1: Link the Agreement with a Certain Customer

A contract is the central aspect of revenue recognition as it will be closely associated with the document. In most cases, revenue is recognized at many points of time during the duration of the agreement, making it a reasonable framework to establish the schedule and amount of revenue recognition.

Step 2: Identify the Price of the Transaction

After clearly identifying the performance obligation in the agreement, determine the transaction price in the contract. The price refers to the amount of consideration that a customer must pay in exchange for its receipt of services and products.

Step 3: Make Sure that the Price and Performance Obligations are Matched

Once you have identified the performance obligations and transaction prices with the contract, you can now allocate the prices to the obligations. Match the price to the performance obligation that fits best to the amount of consideration.

Step 4: Recognize the Revenue Once the Obligations are Completed

The revenue will be recognized as the services or products are delivered to the correct customer. This is considered to happen when the customer takes control of the service or product.

FAQs

What are the conditions for revenue recognition?

To recognize revenue, the risks and rewards of ownership must be transferred to the buyer from the seller, the seller losses their control over the sold goods, and the payment terms and collection, amount of revenue, and the cost of revenue are reasonably measured.

What are the common methods used in revenue recognition?

The most common methods used in revenue recognition include a sales-based method, installment method, completed-contract method, and percentage-of-completion method.

What is the five-step model of revenue recognition?

The five-step model of revenue recognition starts with contract identification then identification of performance obligations, identification of transaction price, allocation of the transaction price, and revenue recognition.

Revenue recognition is an accounting principle that determines the procedure and timing by which revenue must be recorded and acknowledged as an element in a financial statement. This principle states that revenue is only realized when the purchased goods or services have been provided or delivered to the customer. If revenue is acknowledged in an accurate and timely manner, the business income statement will show the overview of the company’s financial status or health in real-time.

Related Posts

FREE 10+ Writing Journal Entry Samples and Templates in MS Word | PDF

FREE 10+ Double Entry Journal Samples and Templates in MS Word | PDF

FREE 5+ Stock Ledger Samples and Templates in MS Excel | PDF

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word

FREE 7+ Annuity Review Checklist Samples and Templates in MS Word | PDF