As an entrepreneur, you will notice that each business transaction has a dual effect. Each of these transactions is documented in separate accounts in compliance with the Double Entry System of accounting management. This system refers to the principle that every debit means equal credit and all these transactions must be recorded in the company’s general ledger accounts to ensure the accuracy of the debit and credit amounts. This detail will be the basis for their balance sheets.

FREE 10+ Trial Balance Samples & Templates in PDF | MS Word

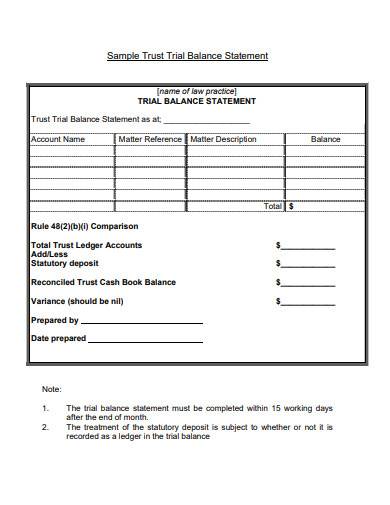

1. Sample Trust Trial Balance Statement Template

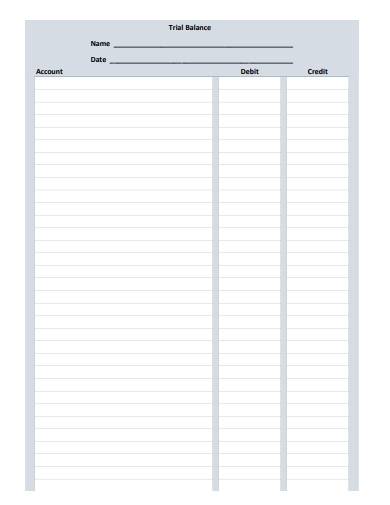

2. Sample Trial Balance Template

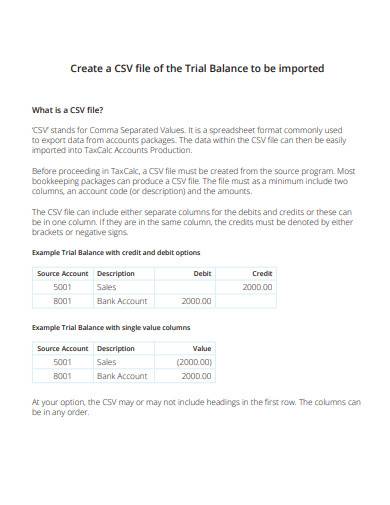

3. Basic Trail Balance Template

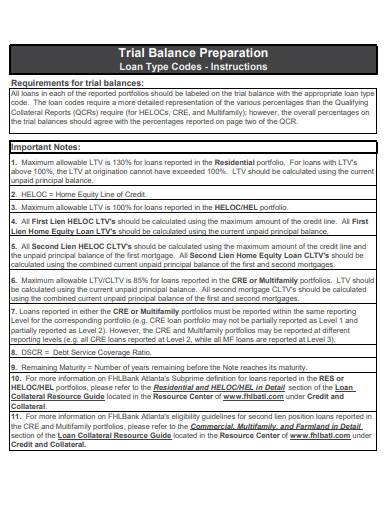

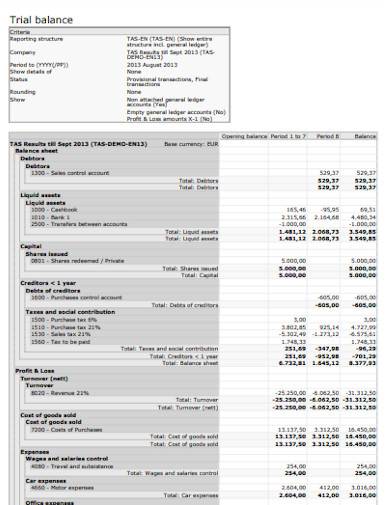

4. Trial Balance Preparation Template

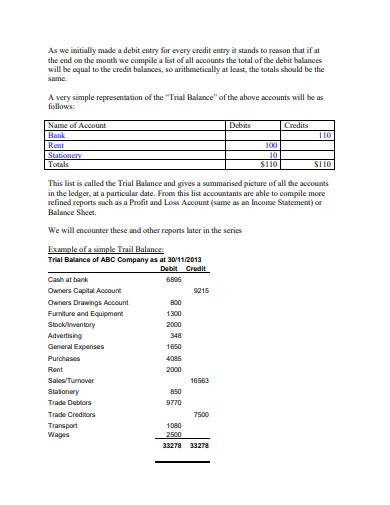

5. Sample Making sense of a Trial Balance Template

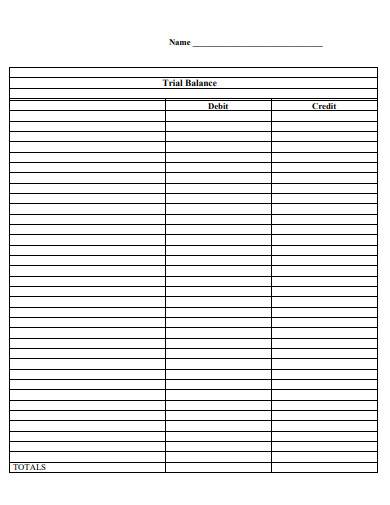

6. Simple Trail Balance Template

7. Trail Balance Sheet Template

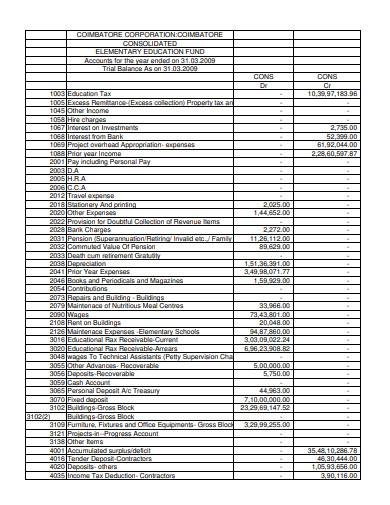

8. Elementary Education Fund Trail Balance Template

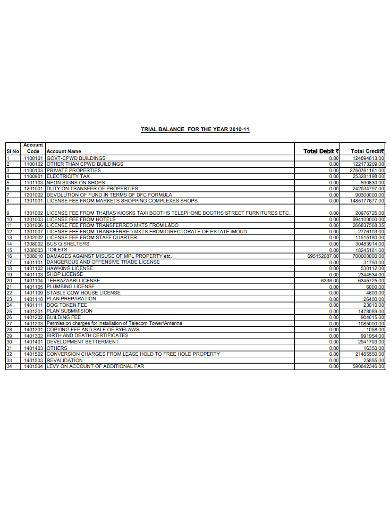

9. Trail Balance for Year Template

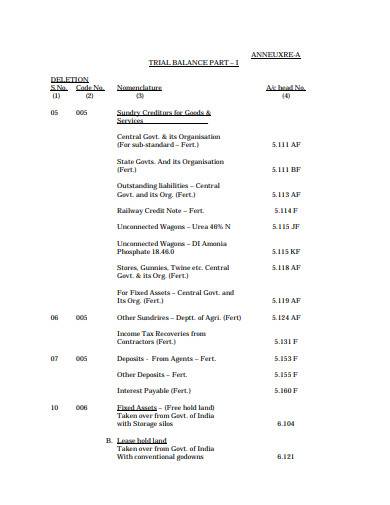

10. Food Corporation Trail Balance Template

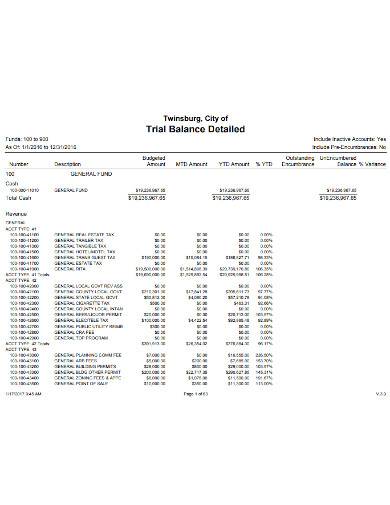

11. Trial Balance Detailed Template

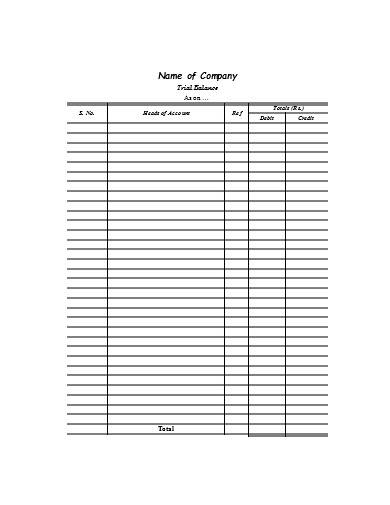

12. Company Trial Balance Template

What is a Trial Balance?

A trial balance is an accounting document that contains the list of all accounts in a business’s general ledger in which balances for both debit and credit should be equal and accurate, otherwise, it will signal errors in mathematical calculations in their accounting system. Trial balances can be used to collect and organize business financial statements which provide financial reports about the health of the company. Other functional documents that business owners can use include an income statement which shows if the business is earning profits or not and a business balance sheet which provides information on liabilities, assets, and equity at a given point in time.

How to Prepare a Trial Balance

Business management and strategic planning can utilize trial balances to make logical and effective business decisions. This document allows business owners to review and study their income statements to determine and understand their income and expenses over a specific period of time. A trial balance is usually prepared to review and ensure that the accuracy of different transactions is recorded in the business’s ledger accounts as well as to prepare their accounting statements.

Step 1: Determine the Balance of Every Ledger Account

Every business transaction is initially recorded using journal entries which follow the basic accounting principles and goes into the ledger accounts used for these transactions. Balances of these accounts are being determined and closed accordingly to the remaining credit or debit balances.

Step 2: Document Debit or Credit Balances in the Trial Balance

The lasting credit or debit balance on different ledger accounts must be documented in the trial balance. Each balance for each ledger account must also be recorded in the credit or debit columns.

Step 3: Compute the Total of the Debit Column and Credit Column

Determine the total amount under the debit and credit column by documenting all debit and credit balances of different ledger accounts in the debit column such as furniture and stocks and the credit column of the trial balance which includes capital and interests.

Step 4: Review if the Debit and Credit Balances are Balanced

In the last step, review and check whether the total of the document’s debit column matched the total of the credit column. The balances on both columns must tally, otherwise, there will be an indication that errors were made when recording the transactions in the account ledger.

FAQs

What are the main types of trial balances?

Trial balances have three main types which are the unadjusted trial balance, the adjusted trial balance, and the post-closing trial balance.

What are the elements of a trial balance?

The five elements of a trial balance are the credits and debits to every account from transactions that occurred during a specific accounting period, the associated account names, account numbers, the dates of the accounting period, and the total amount of all debit and credit balances.

What are the dissimilarities between trial balances and balance sheets?

The main difference between a trial balance and a balance sheet is their scope of work. Balance sheets not only document account balances within the company but also its liabilities, assets, and equity while trial balances are used to track the company’s finances during the entire year and can be prepared whenever the company needs them.

A trial balance is an accounting tool or document used by companies or businesses to prepare and create balance sheets and other documents such as financial statements which are used by auditors. Trial balances are used to review balances between the debit and credit columns of the business’s general ledger, enabling businesses to identify any accounting mistakes. A trial balance is commonly used by bookkeepers or accountants before they issue formal financial statements and business owners as a summary of their account performance within an accounting period.

Related Posts

FREE 10+ Double Entry Journal Samples and Templates in MS Word | PDF

FREE 5+ Stock Ledger Samples and Templates in MS Excel | PDF

FREE 10 + Revenue Recognition Samples & Templates in PDF | MS Word

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word

FREE 7+ Annuity Review Checklist Samples and Templates in MS Word | PDF