Have you ever experienced doing financial planning? When was the last time you did it? Sometimes, when we come to meet the word “financial planning”, we always associate it with office works with a professional financial planner on the table, and struggling with a set of complicated documents with full of numbers that you have to accomplish before the deadline. Financial planning does involve professionals. It even requires documents that allows you engage with numbers and be reminded of your goals. In this article, you will be able to know more about what a financial action plan is and how to create one.

10+ Financial Action Plan Samples

1. Personal Financial Action Plan Template

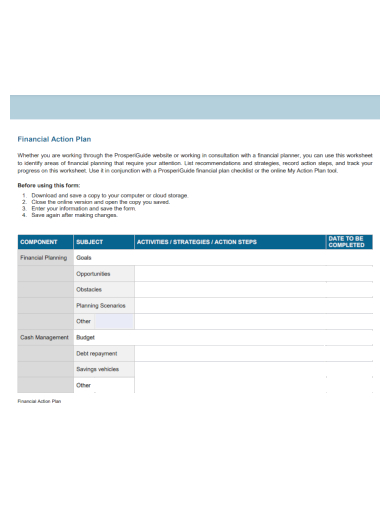

2. Financial Action Plan

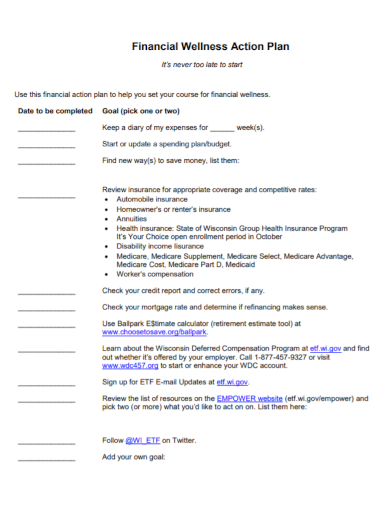

3. Financial Wellness Action Plan

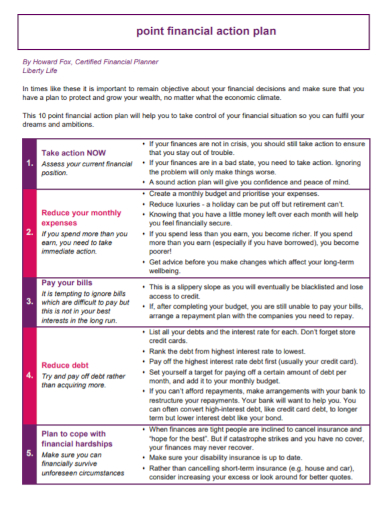

4. Sample Financial Action Plan

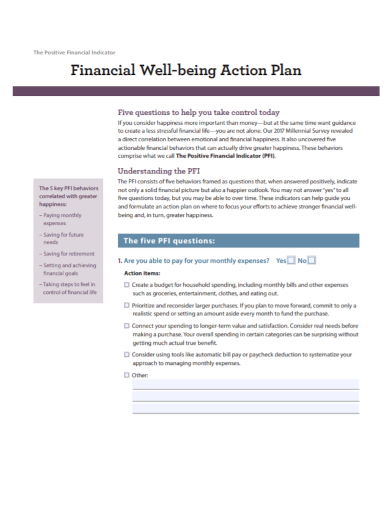

5. Financial Well-Being Action Plan

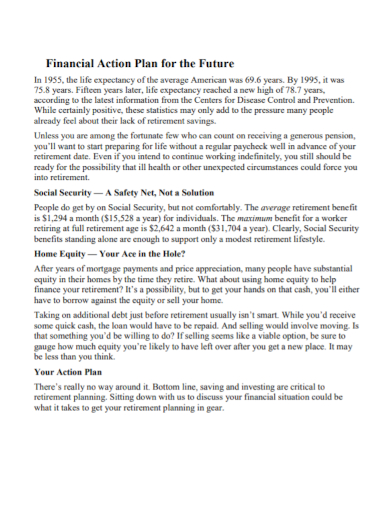

6. Future Financial Action Plan

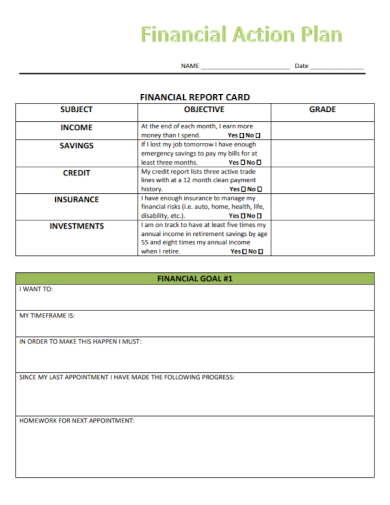

7. Financial Report Action Plan

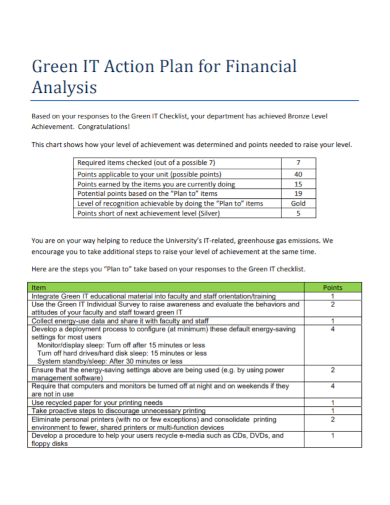

8. Financial Analysis Action Plan

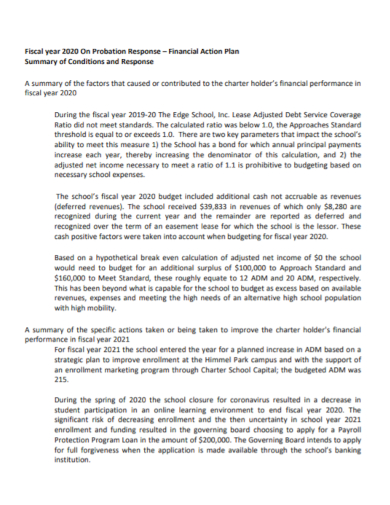

9. Financial Year Action Plan

10. Financial Inclusion Action Plan

11. Home Financial Action Plan

What is a Financial Action Plan?

A financial action plan is a type of plan that allows you to have appropriate methods on how to budget your money in order to make progress in achieving your goals. Having a real plan will help you know what you exactly want to have. It will also definitely make your goals happen. A financial action plan is something that you should write together with the goals and objectives you have at hand and some strategies or actionable steps that are considered to be measurable. Make sure that these steps contributes to the progress of your action plan.

Financial planning simply means having to set goals and writing down effective steps on how to achieve them with the use of your money. Those financial plans that are written professionally encompasses different aspects in a person’s life such as investing, financial forecasting, having insurance, risk management, debt management, assets and liabilities, etc. Each of the items on the list has an individual set of steps to make it happen. It is more than just budgeting. It also covers how you are going to spend your money. Some of the financial plans are 100 pages long, but it still depends on the content.

Five Components of a Financial Plan

Below are the components of a financial plan that would guide us in the entire planning process.

1. Define your financial goals – this is essential in providing a target for your plan. Sometimes, creating goals can be a little bit exhausting especially if you are confused or still not sure about it. However, you have to instill in your minds that goals are designed to give you a path that leads to your success.

2. Make rough cash flow projections – cash flow projections are made to provide an analysis and answers the questions that starts with “what if…” We are aware that no one can predict the future,, so it would be more practical if you are going to test your plans, the assumptions, and its capability to handle unexpected events.

3. Risk assessment – risks can be addressed in different forms. It can be in a form of insurance, savings, investments, financial strategies, and even in your planning methods.

4. Define an investment strategy – having a good investment strategy will help you reflect on your goals and outline your cash flow projections.

5. Review your plan regularly – take note that when you start having a financial plan, it would be a never-ending process. It is important to build a foundation through planning.

FAQs

What is the structure of a financial plan?

You have to set goals and gather financial data. Then, try to assess your financial status and develop an action plan. After that, carry out the plan and monitor it.

What are the three things that a financial action plan should specify?

It should be able to specify what the goal is, how much money is needed, and when will the goal be achieved.

Why is it important to build an emergency fund?

Emergency funds serve as a separate savings account made for unexpected events or outflows of cash. This may be applicable in some instances like having loss of income, accidents, illness, and others.

As the timeframe of your financial action plan goes on, consider reviewing it. Check if it is still realistic and if it is still worthy to stick to. If it goes otherwise, revise the plan. If you need help in writing a financial action plan, you may approach some finance officers and professionals and even use a software or application in the internet. Check some of the financial action plan samples in the article.

Related Posts

FREE 10+ Daily Action Plan Samples [ Sales, Marketing, Emergency ]

FREE 10+ Healthcare Corrective Action Plan Samples in PDF

FREE 10+ Manufacturing Corrective Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Project Corrective Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Business Corrective Action Plan Samples in PDF

FREE 10+ Audit Corrective Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Incident Corrective Action Plan Samples in MS Word | Google Docs | Apple Pages PDF

FREE 10+ Remediation Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Assessment Action Plan Samples in MS Word | Google Docs | PDF

FREE 10+ Workplace Emergency Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Business Emergency Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ School Emergency Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Event Emergency Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Church Emergency Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Recruitment Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF