When many of us dreamed and wanted to build, own, and run a company or a business empire, some of us just wanted to buy or own company’s shares or stocks, or better yet, entirely buying out the company in which we can have control over that particular company policies, decisions, or management and operation style.

If you are one of those aspirants who wants to achieve pretty much the same dream, you would have to gain some knowledge and insights on how certain things work, especially in terms of legitimacy and paperwork processes. To make it butter-smooth for you, you can easily check out some Sample Agreements on this page that you might consider useful.

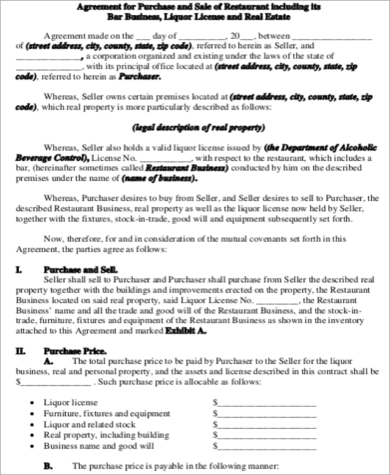

Business Buyout Agreement Template

Small Business Buyout Agreement

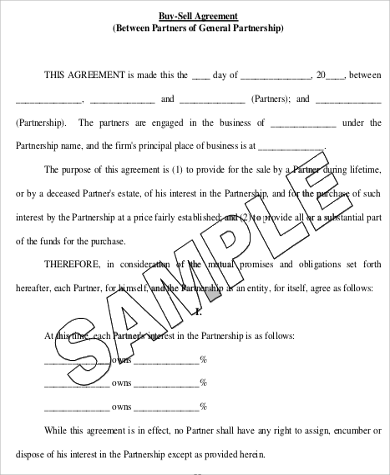

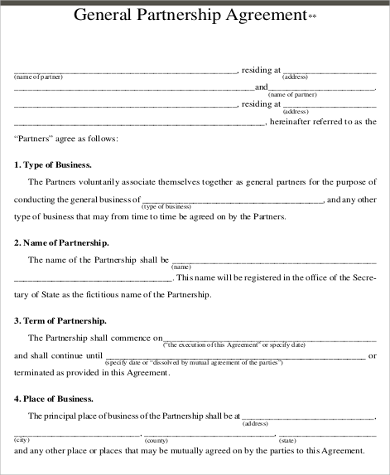

Business Partnership Buyout Agreement

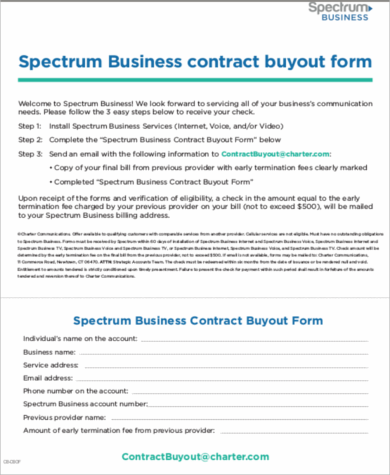

Business Contract Buyout Form

A business buyout, as Tradingsim would simply define it, is the purchase of a company where the ruling or controlling interest is being transferred from one entity to another. As it may seem that the entire company is being bought, it is necessary to put it in mind that it is only 51% or more of that certain company’s stock is bought. As you may want to calculate your risk or carefully consider all of your options before executing a business buyout, you can take advantage of our Sample Business Consulting Agreements in which you can definitely gain some important insights from and which you might consider useful in giving you reasonable and out-of-the-box ideas before coming up with a business buying-out decision, and most importantly, it is for free.

Kinds of Company Buyouts

- Leveraged Buyout – this type of company buyout happens when either a certain individual or an entity or another company by financing a huge portion of the target company through capital or through buying that company’s major stocks. It is said that the target company can be or will be the collateral against the initial capital or major stocks that acted as a loan by the certain entity against the target company.

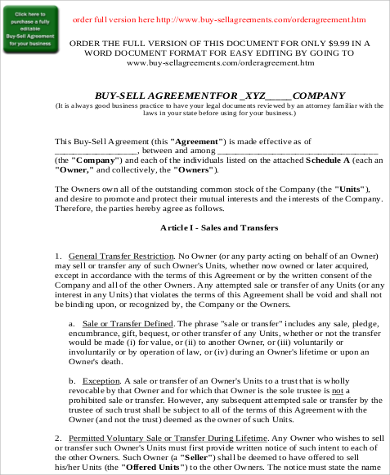

Standard Business Buyout Agreement

Business Partnership Agreement Example

Business Buyout Agreement Format

Kinds of Company Buyouts (continued)

- Friendly Takeover Buyout – this type of business buyout would barely occur, but when it does, it would appeal easy peasy to those who wanted or who has expressed some controlling interest on the certain company. The offer for this type of business buyout will indeed contain explicit details in terms of the purchasing agreement, which will be usually approved by the company’s shareholders. After transferring the company ownership from one entity to another, it is highly recommended to secure Business Development Agreements right ahead for security and standard operation measures.

- Hostile Takeover – this type of takeover or buyout happens when the buyer or the bidder would have an attempt or consistently attempts to completely bypass the company’s board so that they can be able to get a hold of or purchase the target company. Most often than not, the board will initially reject the ruse or the initial offer from the buyer or bidder, which would usually result to having the bidder or buyer go directly to he shareholders to exercise their right of purchasing the target company.

- Management Buyout – this is when the management team of a particular company expresses their interest and joins their resources altogether to pursue their interest of taking over and taking control in the company.

Related Posts

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Car Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Horse Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Option Agreement Samples In MS Word | Google Docs | Apple Pages | PDF