A business transfer agreement details the terms of the sale of transferred goods or services. While there are several ways to buy and sell businesses, each one’s structure could provide several obligations that can be included in a business transfer agreement.

Our Business Sample Agreements show several examples on the drafting of such agreements and the provisions that come along with them. These can be modified by users based on the specifics of their own drafted agreements and can be downloaded in both Word Doc and PDF file formats.

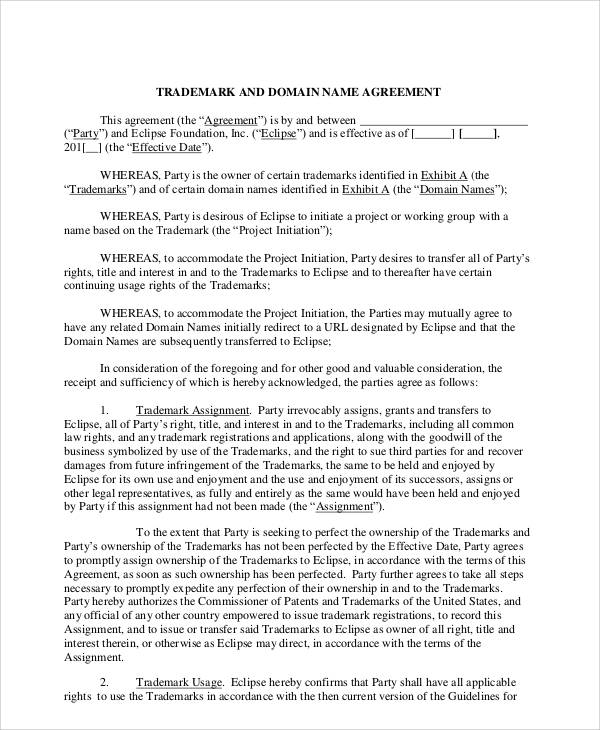

Business Trademark Transfer Agreement

Simple Business Transfer Agreement in DOC

Business Asset Transfer Agreement Example

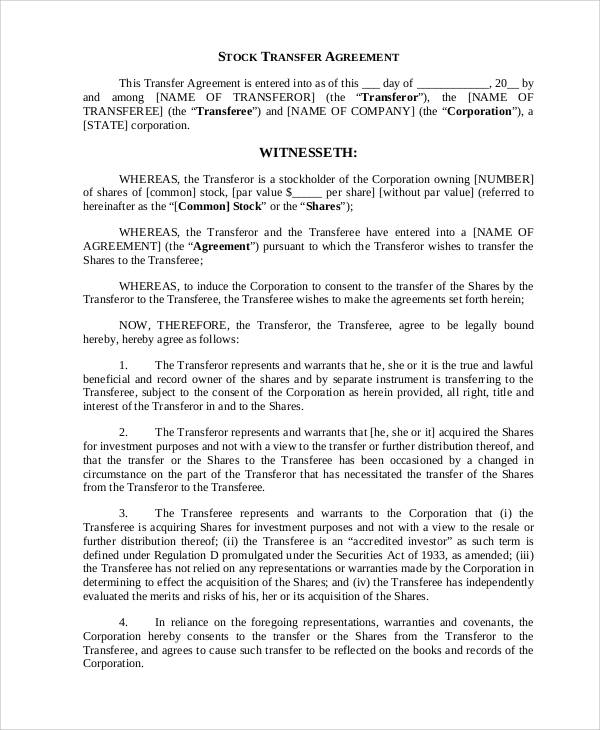

Business Stock Transfer Agreement Format

Business ownership can be transferred in several ways. An immediate transfer of ownership can be effected by an outright sale, which can be advantageous to the seller by means of an outright cash availability. This can be either be used as immediate capital that can be used either for expansion of the seller’s other business ventures or as additional equity for the company.

A gradual sale based on installment is also preferred where the buyer’s payments are financed usually by a bank who will guarantee payment. This can be done by the financing bank issuing a bank guarantee wherein the liability of the buyer will be absorbed by the bank should he fail to fulfill his obligations. A gradual sale is advantageous to both buyer and seller in the sense that the seller is guaranteed a monthly income from the gradual sale and the buyer not having to shell out a massive cash requirement outright. In place of a transfer of ownership, a lease agreement may be made for the temporary transfer of ownership until such time the buyer is able to complete the payment.

Before a business transfer agreement can be made, both the seller and the buyer must decide on which kind of sale is being made to determine the parts of the ownership transfer. This can be through an entity sale wherein the stocks or interests in the business are sold by the seller while he retains all the physical inventories in the business through a Limited Liability Corporation or LLC agreement. Another option is an asset sale wherein the seller sells all the assets to the buyer while the seller continues to own the stocks or LLC interests.

Our website offers additional agreement samples like Business Confidentiality Agreements and Business Investment Agreements. Please click on the links to view the examples and edit or modify them according to your own specifics after downloading them all for free.

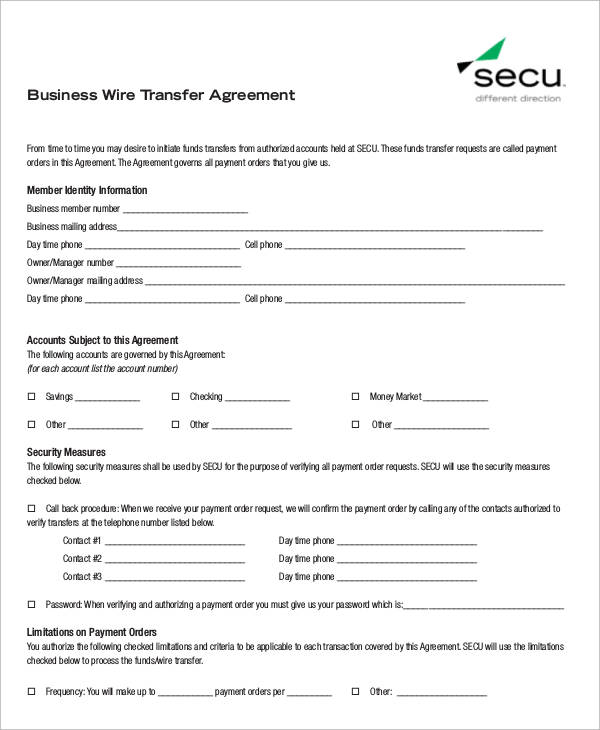

Business Wire Transfer Agreement

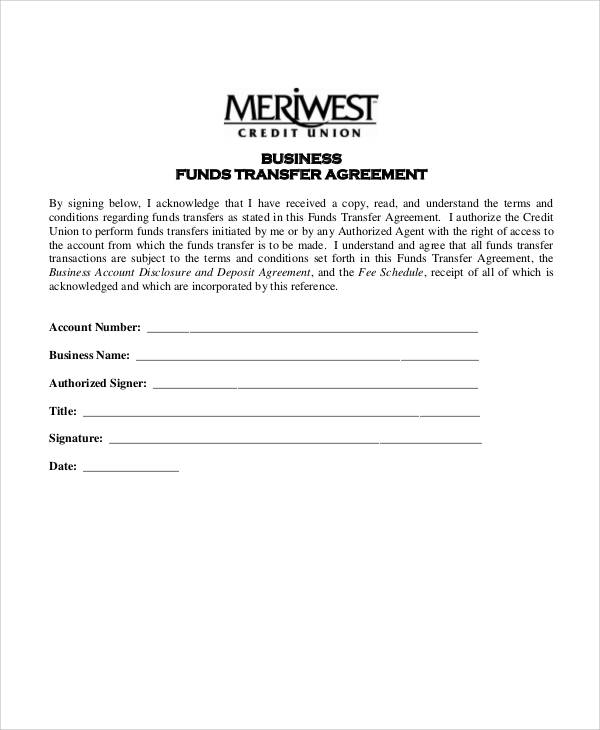

Business Account Funds Transfer Agreement

As indicated earlier, the way a business is being structured will determine how a transfer of ownership will be carried out. A sole proprietorship may find it easy for the seller to transfer ownership since he has full and complete control of the business. In a partnership, only when both partners agree on the transfer of share of the company’s assets and interests will a transfer be successful. Shares may be freely transferable in a corporation but may face several restrictions applied by the company. It’s best for both the seller and buyer to agree on the best terms possible and draft the transfer agreement based on agreed principles.

For even more agreement samples, please check out our Business Consulting Agreements that are all free to download and modify to specifications.

Related Posts

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Car Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Horse Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Option Agreement Samples In MS Word | Google Docs | Apple Pages | PDF