10+ Call Option Agreement Samples

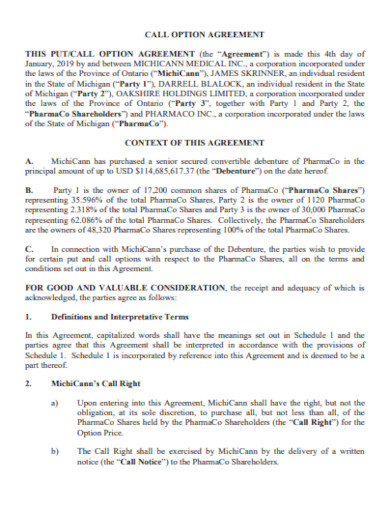

1. Sample Buyer Call Option Agreement Template

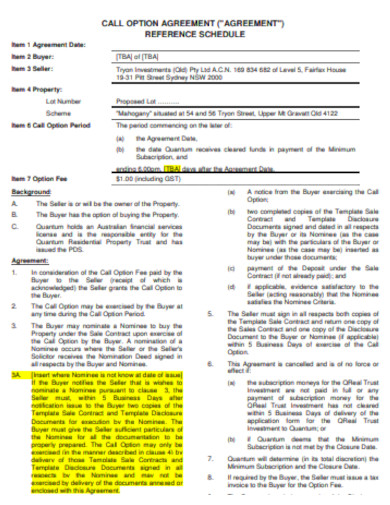

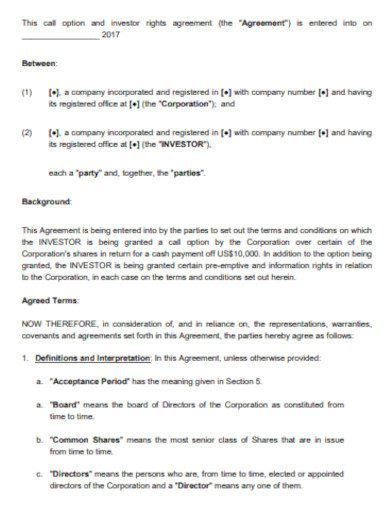

2. Sample Call Option Agreements Template

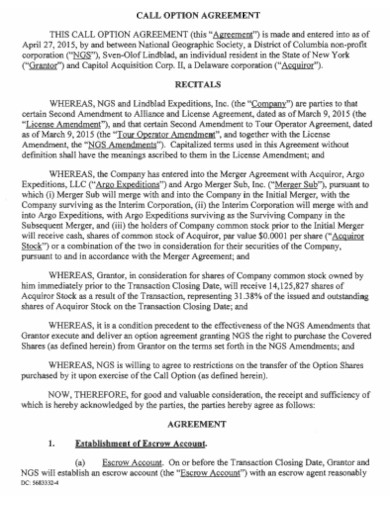

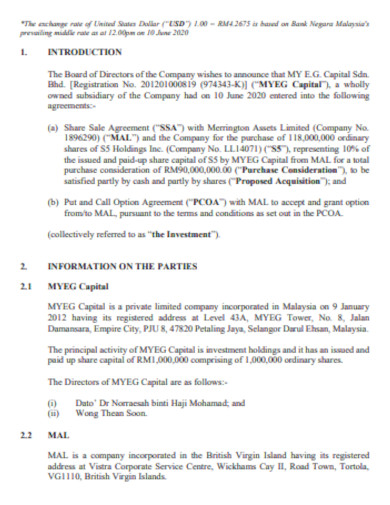

3. Sample Company Call Option Agreement Template

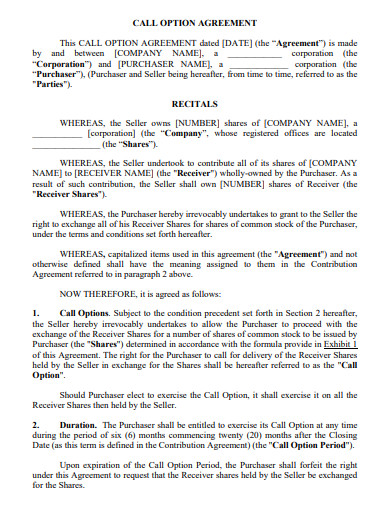

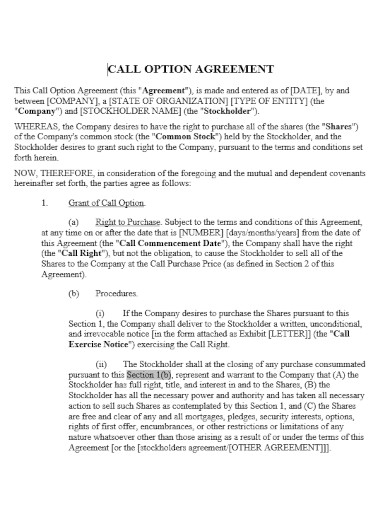

4. Sample Call Option Agreeement Document

5. Sample Amendment to Call Option Agreement

What is a Call Option Agreement?

A call option agreement is a sample contract that gives the buyer the right, but not the obligation, to purchase a specific amount of shares, assets, or financial instruments at a predetermined price, within a specified time frame. This type of agreement is commonly used in various sectors, including real estate, stock markets, and business transactions, where potential buyers seek to secure the option to buy at today’s price, with the view that the value is likely to increase in the future.

Understanding the Basics of Call Option Agreements

At its core, a call option agreement involves two parties: the buyer and the seller. The buyer of the call option pays a premium for the right to exercise the option at a future date, while the seller receives the premium with the obligation to sell the underlying asset if the buyer chooses to exercise the option.

Key Components of a Call Option Agreement

When delving into the intricacies of a call option agreement, it’s crucial to understand its fundamental components. These elements dictate the terms of the contract and sample outline the rights and obligations of both the buyer and the seller.

Strike Price

The strike price, also known as the exercise price, is the predetermined rate at which the buyer of the call option can purchase the underlying asset. This price is fixed and agreed upon by both parties at the inception of the contract, regardless of the future market price fluctuations.

Premium

The premium is essentially the cost of the option itself. It is the price paid by the buyer to the seller for the rights that the call option confers. The premium is non-refundable and is kept by the seller whether or not the buyer exercises the option.

Expiration Date

This is the cut-off point for exercising the option. Beyond this date, the call option ceases to exist. The expiration date is critical because it adds a time value to the option, with the value potentially decreasing as the date approaches if the option is not “in the money” (when the market price is above the strike price). You can also see more templates like Option to Buy Agreement Samples.

Underlying Asset

The underlying asset is what the call option is based on. It can be a variety of instruments like stocks, bonds, commodities, or real estate. The specific details of the asset, including the quantity and quality, are specified in the agreement.

Option Type

There are two types of call options: American and European. An American option can be exercised at any time before the expiration date, while a European option can only be exercised on the expiration date itself.

Rights and Obligations

The agreement outlines the rights of the buyer to purchase the asset and the obligations of the seller to sell the asset if the option is exercised. It’s important to note that the buyer is not obligated to exercise the option.

Terms and Conditions

This section includes any additional terms, such as transferability of the option, any restrictions, and the circumstances under which the agreement format may be terminated.

Legal and Regulatory Compliance

The agreement must adhere to the legal and regulatory framework governing the trading of options in the relevant jurisdiction. This includes disclosures, reporting requirements, and adherence to securities laws.

Understanding these components is vital for anyone involved in trading or dealing with call options. They form the blueprint of the agreement and affect the potential profitability and risk associated with the option.

Advantages of Entering a Call Option Agreement

Call option agreements offer various advantages to buyers:

- Leverage: Buyers can control a large number of shares or a significant asset with a relatively small amount of capital.

- Flexibility: They provide the flexibility to exercise the option if the market conditions are favorable.

- Risk Management: The buyer’s risk is limited to the premium paid, making it a tool for hedging against other sample investments.

Uses of Call Option Agreements

Call option agreements serve a multitude of purposes in various financial and business scenarios. Here are some of the primary uses:

Speculation

Investors often use call options to speculate on the future price increase of an underlying asset. By purchasing a call option, they can benefit from any upside movement in the asset’s price without having to invest the full amount required to own the asset outright.

Hedging

Call options can act as a risk management tool. Investors holding a short position in the market might use call options to hedge against potential losses. If the market price rises unexpectedly, the call option can offset the losses from the short position.

Income Generation

Sellers of call options, also known as writers, earn income through the premiums paid by the buyers. For investors with a large portfolio of stocks, selling call options can be a way to generate additional revenue.

Strategic Acquisitions

In business, a call option agreement can be a strategic move for a company that plans to expand through acquisitions. By securing a call option, a company can lock in a purchase price for a target company or asset, giving them the flexibility to execute the acquisition when it best suits their financial and strategic timeline.

Real Estate Development

Real estate developers often use call options to control property without the immediate need for a large capital outlay. This allows them to secure development rights and seek necessary approvals before committing to the full purchase.

Employee Incentives

Companies may grant call options to employees as part of their compensation package. These options can increase employee loyalty and motivation, as the potential financial reward from exercising the options is tied to the company’s performance.

Potential Risks and Considerations

While there are benefits, there are also risks to consider:

- Premium Loss: If the option is not exercised, the buyer loses the premium paid.

- Market Volatility: The value of the option is tied to market conditions, which can be unpredictable.

- Time Decay: As the expiration date approaches, the value of the option may decrease if it remains out of the money.

Real-World Examples of Call Option Agreements

In the stock market, call options are a popular means of speculative investment or hedging. For instance, if an investor believes that the stock of Company XYZ is poised to rise from its current price of $50, they might purchase a call option with a strike price of $55 for a premium. If the stock price exceeds $55 before expiration, the investor can exercise the option to realize a profit.

In real estate, a developer might use a call option agreement to secure the right to purchase land. The developer pays the landowner a premium for the right to buy the property at a set price within a certain period. If the development plans are approved and the land value increases, the developer can exercise the option to acquire the property at a price below market value.

6. Sample Put and Call Option Agreement Template

7. Sample Trading Call Option Agreement Template

8. Sample Stock Call Option Agreement Template

9. Sample Investors Call Option Agreement Template

10. Sample Call Option Service Agreement Template

11. Sample Printable Call Option Agreement Template

How do I Get an Call Option Agreement?

- Contact a Broker or Financial Institution: If it’s for stocks or other financial instruments, brokers can facilitate the purchase of call options.

- Real Estate Agent or Lawyer: For real estate or business assets, these professionals can draft a call option agreement.

- Online Trading Platforms: Many platforms offer the ability to trade options for individual investors.

- Direct Agreement: In private transactions, the parties can negotiate directly and draft an agreement with legal assistance. You can also see more templates like Option to Buy Agreement Samples.

How do you Create Call Option Agreement?

Creating a call option agreement typically involves the following steps:

1. Identify the Asset: Clearly define the asset or assets the call option is being written for, whether it’s stocks, real estate, or other property.

2. Determine the Parties: Establish who the buyer (option holder) and seller (option writer) of the call option will be.

3. Set the Terms:

- Strike Price: Agree upon the price at which the buyer can purchase the asset.

- Premium: Decide on the cost of the option that the buyer will pay to the seller.

- Expiration Date: Choose the date by which the option must be exercised.

- Quantity: Specify the number of shares or assets the option pertains to.

- Draft the Agreement: Write the contract, outlining all the terms, rights, and obligations of both parties. It’s often advisable to use a template or seek legal guidance to ensure all necessary clauses are included.

4. Review Legal Requirements: Ensure the agreement adheres to the relevant laws and regulations of the jurisdiction in which it will be executed.

5. Signatures: Both parties should review the final draft of the agreement and sign it, making it legally binding.

6. Witness or Notarize: Depending on the asset and jurisdiction, the agreement may need to be witnessed or notarized.

7. Exchange Consideration: The buyer provides the premium to the seller, completing the initial transaction.

8. Fulfillment: If the buyer exercises the option, the seller is obligated to transfer the asset at the agreed strike price.

9. Legal Filing: If required, file the agreement with the appropriate regulatory body or legal entity.

Who are the Parties to the Call Option Agreement?

The parties to a call option agreement are the option holder (buyer) and the option writer (seller). The buyer holds the right to purchase the underlying asset, and the seller has the obligation to sell the asset if the buyer exercises the option.

Why use an Call Option Agreement?

A call option agreement is used to secure the right to buy an asset at a set price within a certain period, offering the potential for profit if the asset’s value increases, while limiting the loss to the option’s premium if the value decreases.

Related Posts

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Car Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Horse Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Option Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 9+ Project Management Agreement Samples in DOC | PDF