The types of debts that collection firms collect tend to be specialized. For example, an agency might only collect unpaid bills that are less than two years old and total at least $200. A good collection firm will also confine its activities to debt collection within the limits period, which varies by state. The debt is not too old and the creditor can still pursue it lawfully if it is within the statute of limitations. The creditor pays the collector a percentage of the amount collected, usually between 25% and 50%. Credit cards, medical bills, automotive loans, personal loans, business loans, student loans, and even unpaid utility and cell phone bills are all collected by debt collection companies.

10+ Debt Collection Agreement Samples

When a collection agency or firm attempts to recover past-due debts from borrowers, this is known as debt collection. If you haven’t paid loan or credit card payments and they are badly past due, a debt collector may approach you. If you co-signed a transaction or are an authorized user on someone else’s credit card, you may be approached by a debt collection agency seeking payment for money owed to you. Debt collectors are private companies that collect debts on behalf of another company. If a debt collector operates for the original creditor, the creditor pays a percentage of the debt gathered to the debt collector.

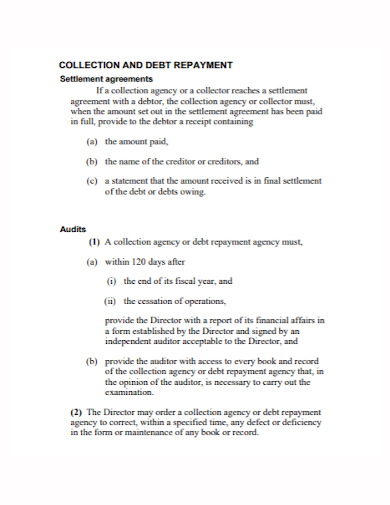

1. Debt Collection Payment Settlement Agreement

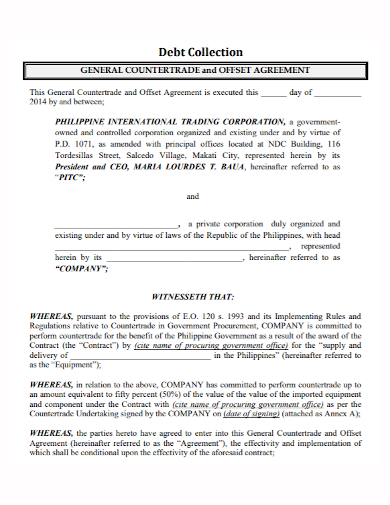

2. Debt Collection Offset Agreement

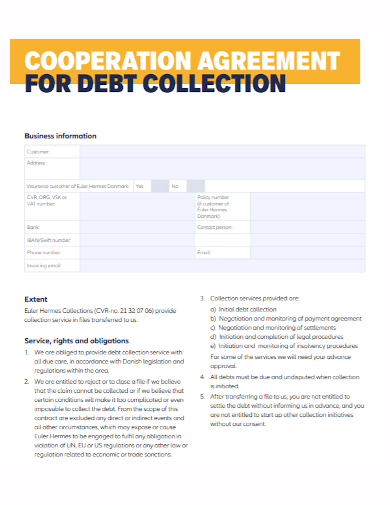

3. Cooperation Debt Collection Agreement

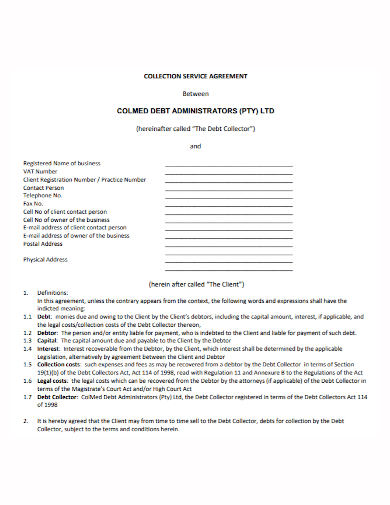

4. Debt Administrator Collection Agreement

5. Debt Collection Services Agreement

6. Debt Collection Billing Agreement

7. Debt Collection Service Level Agreement

8. Sample Debt Collection Agreement

9. General Debt Collection Agreement

10. Attorney Client Debt Collection Agreement

11. Court Debt Collection Agreement

How Does it Work?

Debt collection methods may differ depending on the company collecting the debt. Some organizations specialize in a certain type of debt, such as medical debt or student loan debt. Others may be dealing with debt that dates back a few years. Others may refuse to deal with debt if the statue of limitations has passed, which varies depending on where you live. Collection agencies can pursue old debt as soon as it is a few months past due, and they can pursue it indefinitely after that. It depends on the collection agency, the amount you owe, and the sort of debt you have.

If you have unpaid past-due debt, your original creditor will usually notify you via written notices and phone calls. For example, if you defaulted on an old student loan, your lender will attempt to contact you to bring the account current. It will finally end if it is unable to persuade you to pay what you owe. This is usually when the debt collector takes over from the original creditor.

Debt collection agencies and collectors will contact you using the information on file. Your current address, contact information, and even relatives’ contact details are all utilized. Debt collectors may utilize personal banking information, such as savings and investment accounts, to establish if you have the financial means to repay a debt if they can. To collect previous debts, several states allow wage garnishment.

Some collection agencies also negotiate agreements with clients for less than the amount owed for difficult-to-collect debts. Debt collectors may also send cases to lawyers who will pursue lawsuits against clients who refuse to pay the debt collector.

FAQs

How reputable collectors operate?

While some debt collection firms engage in unethical activities, the majority adhere to the rules and recover money from past-due accounts in a professional manner. Debt collection services that are reputable will send letters to the address you provided to your creditor. Agencies might send letters to your new address in an attempt to recover a debt if they can see that you’ve moved. You should not be harassed or threatened if collection companies function properly. If a company tells you that you’ll be arrested, that the cops are on their way, or that someone is after you, they aren’t acting legally.

Why do you have to explore the payment options?

When it comes to paying off your debt, you usually have two choices. You have the option of paying off your balance in one lump sum or over time. The best option for you will be determined by your financial situation and the amount of debt you owe. Calculate how much you can put down before making a selection on a plan. You might be able to work out a payment plan that is less than what you owe, or you could work with a credit counselor or enroll in a debt management program.

Creditors and debt collection companies can legally collect money owing to them by collecting a past-due debt. If you’ve been late on payments or haven’t paid any at all, you owe it to businesses to repay them. Otherwise, you may receive a slew of phone calls and letters from debt collectors attempting to collect a debt. While you may owe money, you have the right not to be subjected to fraudulent or abusive debt collection tactics. You can take immediate action if someone is pressuring you to collect a debt. To submit a complaint, contact federal agencies or your state attorney general.

Related Posts

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Car Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Horse Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Option Agreement Samples In MS Word | Google Docs | Apple Pages | PDF