Money matters is something that you shouldn’t take lightly. You need to be smart with the way you handle your income, expenses, and investments. If not, you might find yourself in debt. What is debt? Debt can be caused by a multitude of factors. Some of the causes may be the consequence of costly life events, such as having children or moving to a new home, while others may be the result of poor money management or inability to make timely payments. If you’re in an unfortunate situation such as this one, it might be difficult to get out of it. To be released of this difficulty, you must strike an agreement with your debt collector or collection agency. Are you looking for some help? Look no further! In this article, we provide you with free and ready-to-use samples of Debt Settlement Agreement that you could use– whether as debtor or collector– for your convenience. Keep on reading to find out more!

10+ Debt Settlement Agreement Samples

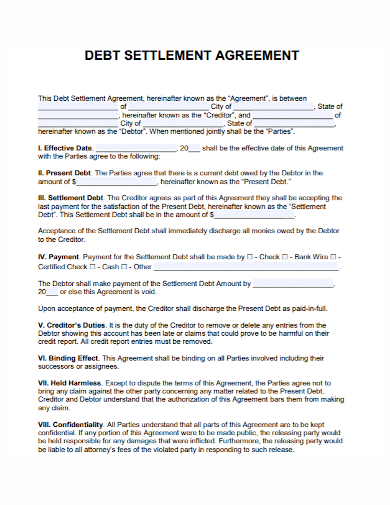

1. Debt Settlement Agreement Template

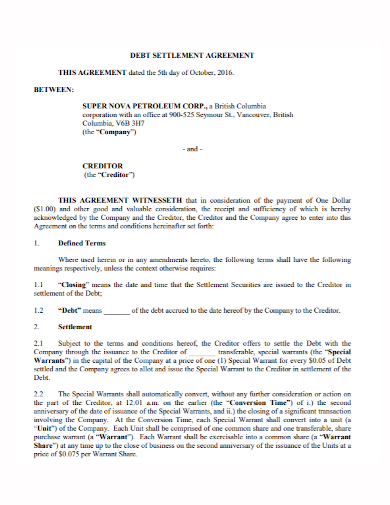

2. Debt Settlement Agreement

3. Sample Debt Settlement Agreement

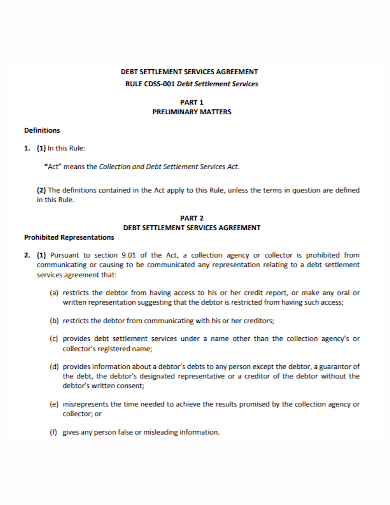

4. Debt Settlement Services Agreement

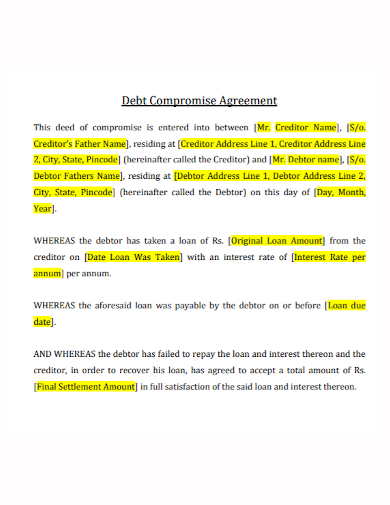

5. Debt Compromise Settlement Agreement

6. Employee Debt Settlement Agreement

7. Debt Settlement Annual Report Agreement

8. Debt Settlement Analyst Services Agreement

9. Corporation Debt Settlement Agreement

10. Debt Collection Payment Settlement Agreement

11. Debt Settlement Contract Agreement

What Is a Debt Settlement Agreement?

A debt settlement agreement is a contract between a creditor and a debtor that allows them to re-negotiate or compromise on a debt. This is typically the situation when a person wishes to make a final payment on a debt owing to them. It’s for resolving a dispute in which you accept you owe at least some money or have received legal advice indicating you’ll have to pay at least portion of the money demanded.

How to Make a Debt Settlement Agreement

This agreement can be legally enforced by printing it on non-judicial stamp paper, paying the stamp duty according to state legislation, and signing it with the signatures of both parties. In this agreement, it’s crucial not to leave anything out. You need draft a well-written and complete contract, and our great templates listed above can help you out with this so that you don’t have to write from scratch. Aside from that, you can follow these steps in making your own:

1. Identify the Creditor or Collection Agency.

Fill in the first blank area in the first paragraph with the creditor’s legal name. Document the Creditor’s Street Address on the second blank line. Finally, the city and state connected with the creditor’s street address must be filled in on the third and fourth blank places.

2.Determine who the debtor is.

This is the person or entity who is responsible for repaying the Creditor for the money owing to them. In the remainder of this paragraph, we’ll have to document the same information we provided on the Creditor. Write down the Debtor’s Full Name in this section. Add the Debtor’s Street Address, City, and State of Residence.

3. Indicate the present and settlement debt.

We’ll need to document the total current debt owed to the Creditor by the Debtor. In addition, the Settlement Debt is the amount of money that the Debtor has agreed to pay in the way specified here in consideration for the Creditor’s debt forgiveness. In this part, write this amount on the blank line after the dollar sign.

4. To be effective, both parties must sign this document.

The contract’s final condition will be to bind both parties to its provisions. This can only be accomplished with both parties’ Dated Signatures. To properly enter this Agreement, the Debtor must sign it. On the “Creditor’s Signature” line, the Creditor must write his or her name, then fill in the date he or she signed this document on the empty line next to it.

FAQs

Is it bad to accept a debt settlement?

Sure, settling a debt rather than paying the entire amount might have an impact on your credit score. The creditor agrees to take a loss by taking less than what was owed, hence settling an account rather than paying it in full is deemed negative.

What is a reasonable settlement offer?

One of these elements is the defendant’s capacity to prove liability in exchange for a settlement offer. Another issue is the defendant’s ability to show that another party, or even the plaintiff, is somewhat to blame for the injuries in the case.

Is Debt Settlement worth it?

Yes, debt settlement is worthwhile if all of your debt is with a single creditor and you can settle your obligation with a lump sum payment. A settlement offer may be the best alternative for you if you have a large credit card amount or a lot of debt.

Overall, debt settlement agreements are a crucial aspect of borrowing money since they safeguard both the borrower and the lender. To help you get started with this, download our easily customizable and compelling Debt Settlement Agreements today!

Related Posts

FREE 26+ Investment Agreement Samples in PDF | MS Word | Google Docs | Pages

Agreement Between Two Parties For Money Samples & Templates

Land Purchase Agreement Samples & Templates

Sample Business Agreement between Two Parties

FREE 10+ Trial Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 9+ Shop Rental Agreement Samples [ Commercial, Lease, Tenancy ]

FREE 10+ Charter Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF