While a sole proprietorship is an ideal way to establish your business successfully, there’s no telling how far you can go when you employ the help and resources of another party to join your business. Revenue sharing offers the same benefits of being in a partnership minus the complications of equity and other matters involving other forms of doing business and other people. The revenue-sharing agreement also contributes to making the work in the best ways possible. Learn more about this below.

FREE 15+ Revenue Sharing Agreement Samples

1. Consulting Agreement with Sharing of Software Revenues

2. Restaurant Profit Sharing Plan Template

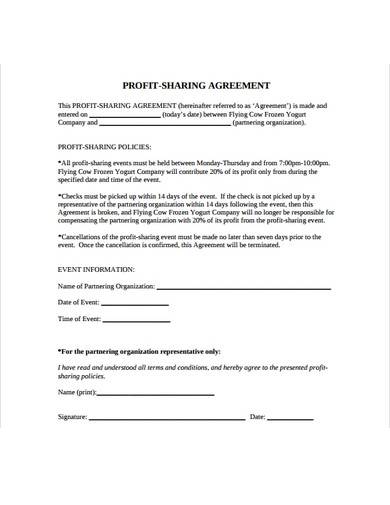

3. Profit-Sharing Plan Template

4. Restaurant Profit Sharing Agreement Template

5. Revenue Sharing Agreement Template

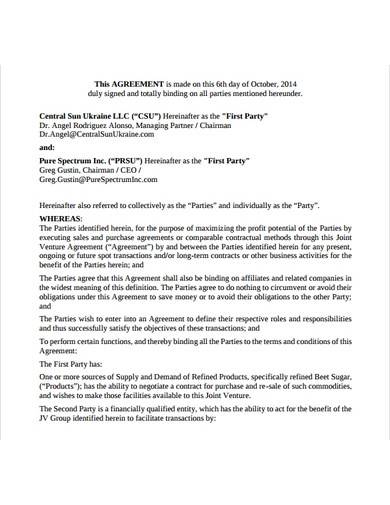

6. Sample Revenue Sharing Agreement

7. Basic Revenue Sharing Agreement

8. Revenue Profit Sharing Agreement

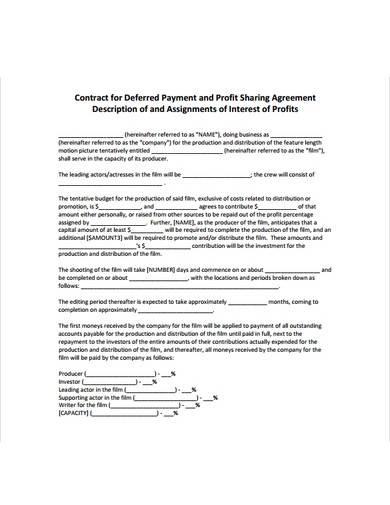

9. Payment & Profit-Sharing Agreement

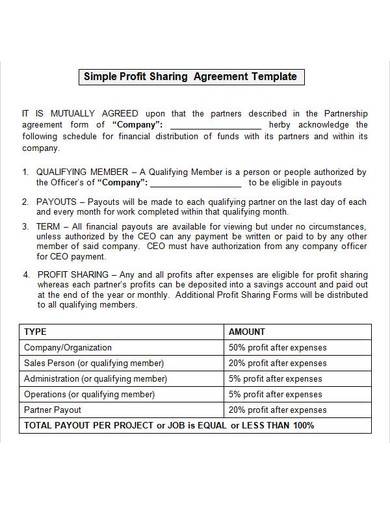

10. Simple Profit Sharing Agreement Template

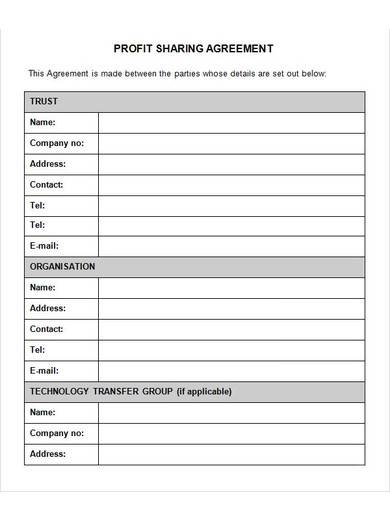

11. Printable Profit Sharing Agreement

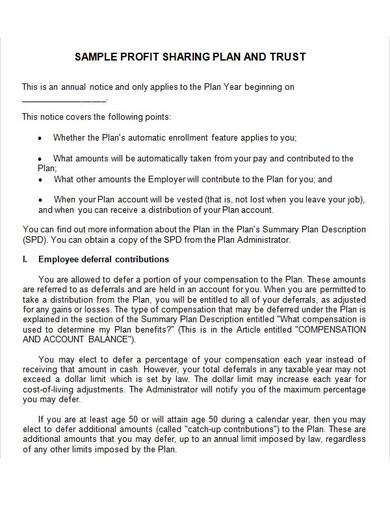

12. Sample Profit-Sharing Plan Template

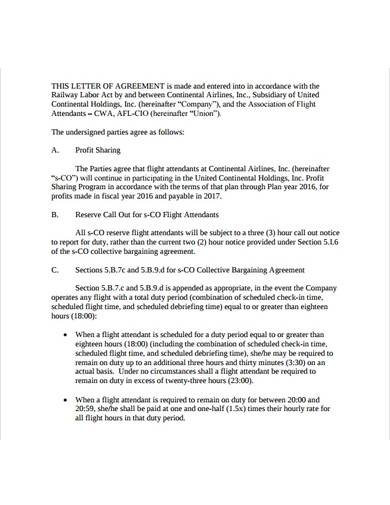

13. Sample Profit-Sharing Agreement

14. Formal Profit Sharing Agreement

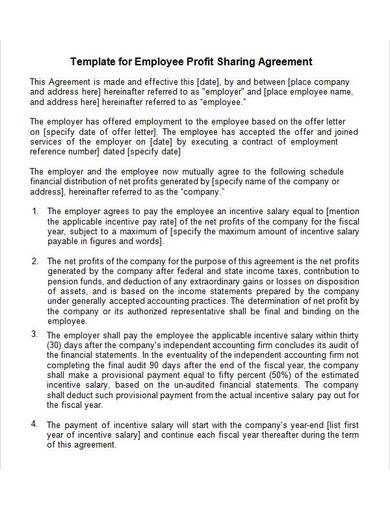

15. Employee Profit Sharing Agreement Template

16. Printable Profit Sharing Agreement Template

What Is a Revenue Sharing Agreement?

A revenue-sharing agreement, also known as a profit-sharing agreement, is a document involving businesses in a partnership to determine how they’ll share the profits and losses in their business. It’s often an attachment in partnership agreements to help business partners determine how they’ll split their shares and minimize the future risks of complications over this matter.

Different Revenue Models

Revenue is a business’ income from its daily transactional activities. It’s how they measure their profitability in the market. As of 2019, Walmart bagged the title as the biggest-revenue generating company with $514 billion. The ways by which companies earn their revenues are called revenue models. They are as follows:

1. Direct Sales. This is the most traditional form of revenue-generation involving a face-to-face transaction of exchanging goods and services for a price. It has now extended to the digital medium through online shopping.

2. Subscription. This is a common scheme in popular websites and applications (e.g., Netflix and Spotify). This requires periodic payment from customers for using a product or service.

4. Advertisement. An ad-based revenue model helps a business earn through traffic or ads placed on its pages or sites.

5. Markup. A markup is buying a product from one business and adding another percentage to the original price prize. The business earns a profit from the added price. This is common among retailers who purchase tier supplies from wholesalers.

6. Licensing. Licensing is lending your business’ ideas, materials, and other licensed original works.

7. Channel Sales. This involves businesses that employ the help of resellers to sell their products on their behalf.

8. Affiliation. This is a popular mode in online businesses where businesses ask the help of people to promote links to their products and services in exchange for a commission. This is where businesses seek out social media influencers as their ambassadors, which can work as their marketing plan.

How to Write a Revenue Sharing Agreement

If you’re looking for ways to make your revenue-sharing agreement here are tips you can use:

1. Name All Parties Involved

Start the process by ensuring that you’ve named all the parties involved in the agreement correctly. While the rest of this document may involve more complex issues such as the ratio of the shared profits and the different policies, even something as basic as getting the names of the parties right matters. It’s important to identify the who’s who of your agreement because this contributes to its overall clarity. This helps determine which roles are responsible for certain responsibilities and who can be held accountable when an issue arises.

2. Detail the Responsibilities

This provides an outline of what each party should do to make this partnership work for the best. This will also dictate the different participating entities in the agreement, their roles, and how they can perform their function once the papers are signed. When writing this part of the agreement, aim to be as detailed as possible without compromising its comprehensibility. This means provide a comprehensive account of the clause without being vague or complex. Consider the variety of your audience and prioritize keeping your document understandable. This paves the way for an easier discussion and interpretation.

3. Highlight Restrictions

A partnership with an individual or a company doesn’t only contain perks, but it also draws the line of limitations. This means that restrictions are inevitable. In this case, the restrictions may include prohibiting a partner from making huge purchases without the other’s consent and illegally using the company’s resources. Another example of restrictions may hinder any member of the party from disclosing any information about the partnership with a non-disclosure clause. Include disciplinary measures when a breach occurs, such as the sending of a notice letter for misconduct. You can also cite which action will ultimately lead to contract termination.

4. Address Partnership Continuity

Termination isn’t the only method by which an entity can’t perform their duties anymore. There is an even more grave and permanent circumstance—death. This might sound ominous and not the best thing to address in an agreement, but it’s probable that any partnership may encounter. Discuss what happens when a party dies. Will there be a legal heir, or any of the remaining partners can buy the shares? How will this procedure go? These are some questions that you need to include in your discussion’s agenda.

FAQs

What are the different revenue-sharing criteria?

The different revenue-sharing criteria are capital contribution, management input, and custom criteria.

What are the different revenue varieties?

The different revenue varieties are sales, rent, dividend, interest, and contra revenue.

What are the different types of revenue-sharing?

According to Investopedia, the different types of revenue sharing are company revenue-sharing, professional sports teams, and online business.

If you’re planning to expand the reach of your business, revenue-sharing maybe your best option. It allows you to receive the funds and resources of other stakeholders which you can use in a variety of ways to promote your brand. If you plan on doing so, a revenue-sharing agreement will help you straighten your plan for this scheme and let everyone involved in the partnership know their responsibilities. Get yours from our collection now!

Related Posts

Sample Business Agreement between Two Parties

FREE 9+ Shop Rental Agreement Samples [ Commercial, Lease, Tenancy ]

FREE 10+ Charter Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF