Are you ready to take some risks and make a profit while doing so? Well all you’ve got to do is decide where to invest your money in. To ensure that nothing goes awry, you need an investment agreement to help you seal the deal. This legal document is among the most important ones that you, as an investor, can ever hope to use. There are even different variations of this, such as the event investment agreement, the investment partnership agreement, and the debt investment contract. For an easy time getting your own simple investment contract, here are some facts and some templates that you may find useful.

26+ Investment Agreement Samples

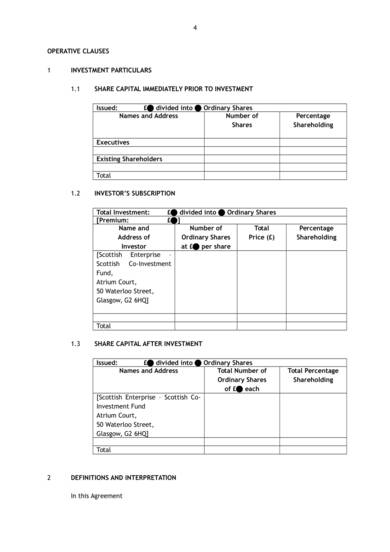

1. Investment Agreement Format in Word

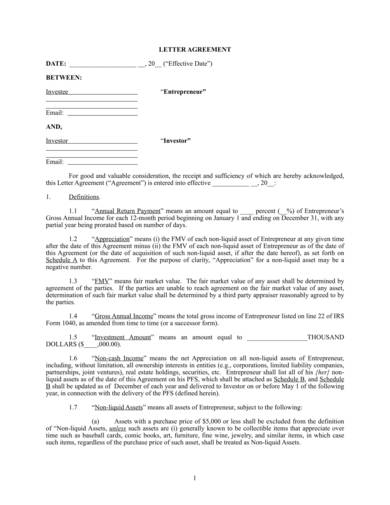

2. Simple Investment Agreement Doc Free

3. Investment Agreement Sample Word

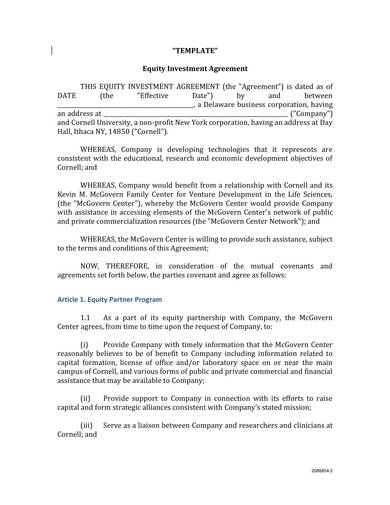

4. Startup Investment Agreement Template

5. Simple Investment Agreement Doc Free PDF

What are the Clauses of an Investment Agreement?

An investment agreement typically contains several key clauses that outline the terms and conditions of the investment. The specific clauses may vary based on the nature of the investment and the parties involved, but some common clauses include:

Investment Amount and Structure:

- Specifies the amount of money or assets being invested.

- Describes the structure of the investment (e.g., equity, debt, convertible note).

Valuation:

- Defines the valuation of the company or asset at the time of the investment.

Use of Funds:

- Outlines how the invested funds will be used by the recipient.

Rights and Responsibilities:

- Enumerates the rights and responsibilities of the investor and the recipient company or individual.

Board Representation:

- Addresses whether the investor will have the right to appoint a representative to the board of directors.

Information Rights:

- Specifies the level of access the investor has to financial and operational information about the company.

Dividends and Distributions:

- Outlines the terms under which dividends will be paid to investors or how profits will be distributed.

Exit Strategy:

- Describes the conditions and mechanisms for the investor to exit the investment, such as through a sale of shares or an initial public offering (IPO).

Anti-Dilution Provisions:

- Protects the investor from dilution of their ownership stake in subsequent funding rounds.

Warranties and Representations:

- Sets forth the assurances and statements made by the parties regarding the accuracy of information and compliance with laws.

Governing Law and Dispute Resolution:

- Specifies the jurisdiction whose laws will govern the agreement and outlines the process for resolving disputes.

Confidentiality:

- Addresses the confidentiality of information shared between the parties during the course of the investment.

Conditions Precedent:

- Lists any conditions that must be met before the investment becomes final.

Termination:

- Describes the circumstances under which the agreement can be terminated and the consequences of termination.

Miscellaneous Provisions:

- Includes other important clauses such as force majeure, amendment procedures, and notices.

It’s crucial to note that the specific clauses and their details can vary based on the negotiation between the parties and the unique aspects of the investment. Parties involved may seek legal advice to ensure that the simple agreement meets their specific needs and complies with relevant laws and regulations.

6. Money Investment Agreement Sample

7. Investment Agreement Format

8. Simple Investment Contract Template Word

9. Investment Agreement Example

10. Investment LLC Operating Agreement Template

How Do You Structure an Investment Agreement?

Structuring an investment agreement format is a critical step in formalizing the terms and conditions between investors and the company seeking investment. While the specifics can vary based on the nature of the investment and the parties involved, here is a general outline that you can use as a starting point. It’s important to consult with legal professionals to ensure that your agreement complies with relevant laws and regulations.

Title and Introduction:

- Title: Clearly state that the document is an “Investment Agreement.”

- Introduction: Provide the names of the parties involved (investors and the company) and the date of the agreement.

Recitals:

- Briefly describe the background and purpose of the investment, including the business activities of the company and the reasons for seeking investment.

Agreement Details:

- Specify the amount of investment, the form of the investment (e.g., equity, convertible note, or debt), and any conditions precedent to the investment.

Use of Funds:

- Outline how the invested funds will be used by the company. This can include operational expenses, research and development, marketing, etc.

Valuation and Equity Terms:

- If the investment involves equity, detail the valuation of the company and the percentage of ownership the investor will receive in exchange for the investment.

Conditions Precedent:

- List any conditions that must be satisfied before the investment is finalized. This could include regulatory approvals, due diligence, or other specific requirements.

Rights and Obligations:

- Outline the rights and obligations of both parties. This may include information about board representation, reporting requirements, and any restrictions on the company’s operations.

Warranties and Representations:

- Include statements made by both parties regarding the accuracy of information provided and the legality of their actions. This section helps protect both parties in case of misinformation.

Covenants:

- Specify any ongoing commitments or promises made by either party. This may include agreements on how the business will be conducted or milestones that the company commits to achieving.

Confidentiality and Non-Disclosure:

- Include provisions regarding the confidentiality of information shared during the negotiation and execution of the agreement.

Termination:

- Outline the conditions under which either party can terminate the agreement and the consequences of termination.

Governing Law and Dispute Resolution:

- Specify the jurisdiction whose laws will govern the agreement and the mechanism for resolving disputes (e.g., arbitration, mediation).

Miscellaneous Provisions:

- Include any other relevant clauses such as force majeure, amendments, waivers, and the entire agreement clause.

Signatures:

- Include spaces for the signatures of authorized representatives of both parties.

Remember, it’s crucial to involve legal professionals who specialize in business and investment law to draft and review your investment agreement to ensure its enforceability and compliance with relevant laws.

11. Investment Cooperation Agreement Template

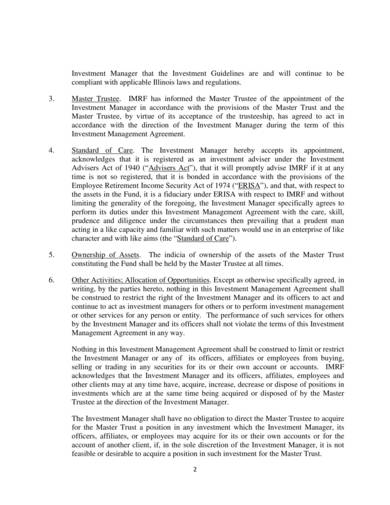

12. Advisory Investment Management Agreement

13. Investment Consulting Agreement Template

14. Investment Banking Agreement Template

Why is an Investment Agreement Important?

An investment agreement is important for several reasons, serving as a legal document that outlines the terms and conditions governing the relationship between investors and the company in which they are investing. Here are some key reasons why an investment agreement is crucial:

Clarity and Understanding:

- An investment agreement provides a clear and comprehensive understanding of the rights and obligations of both parties involved in the investment. This helps to avoid misunderstandings or disputes in the future.

Legal Protection:

- The agreement serves as a legal document that protects the interests of both the investor and the company. It establishes the legal framework for the investment, specifying the conditions under which the investment is made and the rights and responsibilities of each party.

Risk Mitigation:

- By clearly outlining the terms of the investment, including the expected return on investment, exit strategies, and any potential risks, the agreement helps to manage and mitigate risks for both parties. This transparency is crucial for informed decision-making.

Ownership and Equity Distribution:

- The agreement specifies the amount of equity or ownership stake the investor receives in exchange for the investment. It details how the ownership will be distributed and any conditions for changes in ownership over time.

Use of Funds:

- Investors typically want assurance that their funds will be used for specific purposes, such as business expansion, product development, or debt repayment. The agreement outlines how the funds will be utilized, providing transparency and accountability.

Exit Strategies:

- The agreement outlines the mechanisms for the investor to exit the investment, whether through a sale of their stake, an initial public offering (IPO), or other predefined exit strategies. This helps both parties plan for the future and align their expectations.

Confidentiality and Non-Disclosure:

- Investment agreements often include clauses to protect sensitive information about the business. This helps maintain confidentiality and prevents the misuse of proprietary information by either party.

Governance and Decision-Making:

- The agreement may include provisions related to the governance structure of the company, specifying the rights of the investor in decision-making processes. This ensures that investors have a say in important matters affecting the business.

Compliance with Regulations:

- Investment agreements often include clauses ensuring compliance with relevant laws and regulations. This is crucial for both the investor and the company to avoid legal complications.

Dispute Resolution:

- In the event of disagreements or disputes, the agreement typically includes provisions for dispute resolution mechanisms, such as arbitration or mediation, providing a structured process for resolving conflicts.

In summary, an investment agreement is a vital tool for establishing a clear and legally binding relationship between investors and companies, promoting transparency, managing risks, and protecting the interests of all parties involved in the investment.

15. Investment Advisory Agreement Template

16. Sample Restaurant Investment Agreement Template

17. Business Investment Agreement Sample

18. Basic Investment Agreement Template

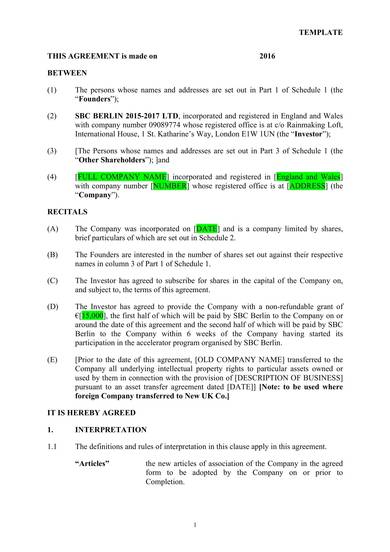

19. Draft Investment Agreement Template

20. Investment Protection Agreement Template

What are Trade and Investment Agreements?

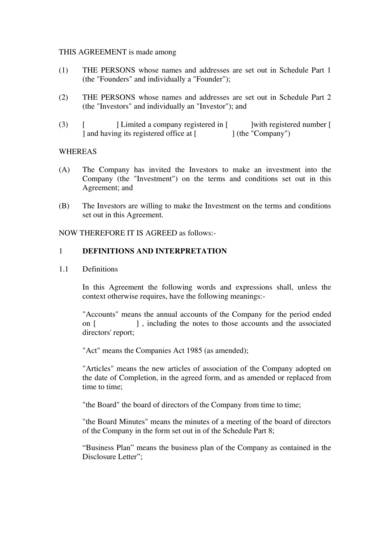

21. Detailed Investment Agreement Template

22. Sample Investment Contract Agreement

23. Sample Equity Investment Agreement Template

24. Investment Manager Agreement Template

25. Sample Agreement Between Investor and Company

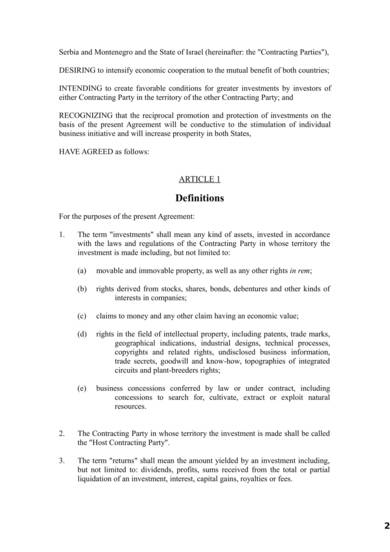

26. International Investment Agreement Template

Difference Between Investment and Shareholder Agreement?

| Aspect | Investment Agreement | Shareholder Agreement |

|---|---|---|

| Purpose | Specifies terms of an investment, typically by an external investor or funding entity. | Governs the relationship between shareholders of a company. |

| Parties Involved | Usually between the company and an external investor or funding entity. | Between the shareholders of the company. |

| Focus | Primarily focuses on the terms and conditions of the investment, such as funding amount, valuation, and use of funds. | Focuses on the rights, responsibilities, and obligations of shareholders within the company. |

| Capital Injection | Outlines the details of the capital injection, including the amount, payment terms, and conditions. | Deals with the existing shareholders’ equity, transfer of shares, and potential issuance of new shares. |

| Return on Investment | Specifies the terms under which the investor will receive a return on their investment, such as through dividends or capital appreciation. | Does not necessarily address the financial return but may cover issues like voting rights, information rights, and dispute resolution. |

| Control and Management | May include provisions on the investor’s involvement in decision-making or management of the company. | Addresses governance matters among shareholders, including voting rights, board representation, and decision-making processes. |

| Exit Strategies | Typically includes provisions on exit options for the investor, such as buyback clauses or selling their stake to a third party. | May include provisions on exit strategies for shareholders, like rights of first refusal, drag-along, and tag-along rights. |

| Duration | Generally focused on the specific investment round and its terms. | Pertains to the ongoing relationship among shareholders for the entire duration of their ownership. |

| Enforceability | Enforces the specific terms of the investment and the investor’s rights. | Enforces the rights and obligations of shareholders regarding their ownership in the company. |

It’s important to sample note that these agreements can sometimes overlap in certain areas, and the specific terms and conditions can vary based on the agreement’s drafting and the parties involved. Additionally, legal advice is recommended when drafting or reviewing such agreements to ensure they meet the specific needs and circumstances of the parties involved.

27. Investment Agreement Sample PDF

How to Draft an Investment Agreement

Now that you’re better aware of what an investment agreement example does, you should be quite ready to come up with your own. Although there’s nothing wrong with downloading templates like the restaurant investment agreement template or the business investment agreement template, it is always better to have knowledge of creating an agreement from scratch. The following steps will serve as your guide.

Step 1: Begin with the Opening Recitals and ‘Whereas’ Statements

The first step is to write your investment management agreement’s opening recitals. This will involve both parties’ names and addresses. If it is applicable, then add your company name as well. For the ‘whereas’ statements, this is where you point out which party is seeking investment and which one is providing it.

Step 2: List the Agreement’s Articles and Payment Terms

The articles are what both parties have already discussed and agreed to, only now it is in writing. This will include details like how much money is one party willing to invest, for example. Speaking of payment, you should also describe the sample contract payment terms in full at this point.

Step 3: Specify the Agreement’s Term and Termination Aspect

This is where your terms and conditions will be placed, not just in regards to how long the agreement will be considered legally valid, but also what can allow for its termination.

Step 4: Clarify What the Choice of Law is

The last step is the clarification of the law since it changes depending on where one party is located. In the event that the two parties are based in separate states, choose the state that is going to have jurisdiction over this investment agreement. The only thing left to do afterward is to sign the legal contract.

FAQ’s:

What is an investment a agreement?

An investment agreement is an arrangement that takes place between an investor and another entity needing the investment. It is only legally binding once all of the conditions of the agreement are met. For an sample agreement to be possible, there should be a party making the offer and another party accepting the offer. Without these two things, an agreement of any form cannot exist.

What are the two investor types?

The first type of investor is a retail investor. After that, there’s the institutional investor.

How can I start investing?

The first thing you need to decide on is your investment approach. Follow that up with the opening of your investment account. From there, you just need to provide your account with an initial deposit, set up automated money transfers to each of your investment accounts, and then buy assets in an attempt to build up your sample portfolio.

How can you purchase your first stock?

If you have enough money saved up, the first step would be to fund a chosen stock broker account. Once that’s done, you can start researching on companies whose stock you want to buy. Then decide how many shares you want and then place your specific order.

Is an investment agreement legally binding?

Yes, an investment agreement is typically legally binding, outlining terms and conditions agreed upon by parties involved in an investment, and subject to legal enforcement if breached.

What is an investment contract?

An investment contract is a legally binding agreement between parties, typically involving the exchange of capital for a share of profits, ownership interest, or future financial returns.

Before you can assume that anything you do when it comes to investing is safe, you need the right contract or agreement by your side. Even more than that is the knowledge of what it is and how you can get your hands on one. Take what you’ve learned here and use it to your full advantage. Either create your own investment agreement sample or download the best investment agreement template from our varied list. Don’t waste any more time and act now!

Related Posts

Sample Contract Agreement Letter - 9+ Examples in Word, PDF

Sample Project Development Agreement - 9+ Documents in PDF

Retainer Agreement - 10+ Download Documents In PDF, Google ...

Sample Vendor Confidentiality Agreement - 7+ Documents in PDF ...

8+ Construction Loan Agreement Samples, Examples, Templates

8+ Construction Loan Agreement Samples, Examples, Templates

Sample Employment Separation Agreement - 11+ Free Documents ...

Memorandum Of Lease Agreement Samples , Examples & Format ...

Sample Horse Lease Agreement - 7+ Free Documents in Word, PDF ...

20+ Dealership Agreement Templates - PDF, Word

Sample Contractor Confidentiality Agreement - 8+ Documents in ...

Sample Room Rental Agreement - 8+ Documents in Word, PDF

Sample Partnership Dissolution Agreement Templates - 7+ Free ...

16+ Letter of Agreement Templates - PDF, DOC

Sample Business Service Level Agreement - 8+ Examples in Word ...