Before completing a transaction, the buyer and seller must negotiate on the price of the item to be purchased as well as the parameters of the transaction. The SPA acts as a negotiation framework. When making a large purchase, such as real estate, or a series of transactions over time, the SPA is typically used. SPAs also contain a wealth of information on the buyer and seller. The agreement tracks any deposits made and highlights sections of the agreement that have already been fulfilled as the conversations advance. The date of the final sale is also included in the agreement.

10+ Share Sale and Purchase Agreement Samples

A shareholder can utilize a Share Purchase Agreement to transfer ownership of firm shares (also known as stock) to a buyer. To be clear, a share is a unit of ownership in a company, and a shareholder is a person or entity who purchases shares in a firm (thus legally owning a percentage of the company). If a firm issues 10,000 shares and a shareholder holds 1,000 of them, the shareholder owns 10% of the company legally. Typically, this entails receiving 10% of the company’s income as well as 10% of the votes in business resolutions.

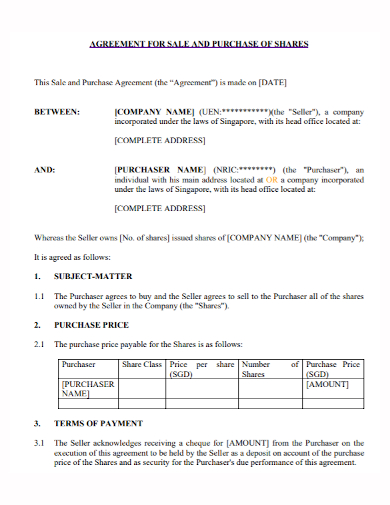

1. Share Sale and Purchase Agreement Template

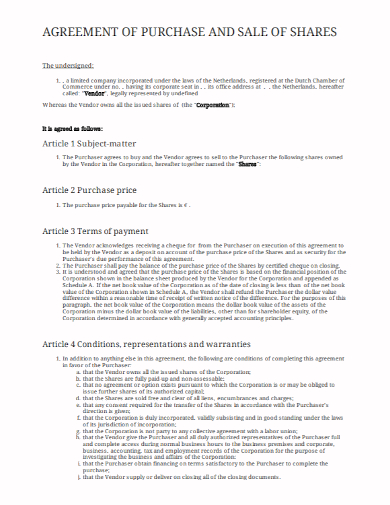

2. Agreement Of Purchase And Sale Of Shares By Shareholder

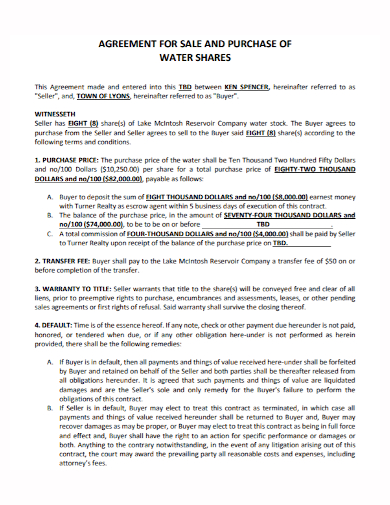

3. Industry Share Sale and Purchase Agreement

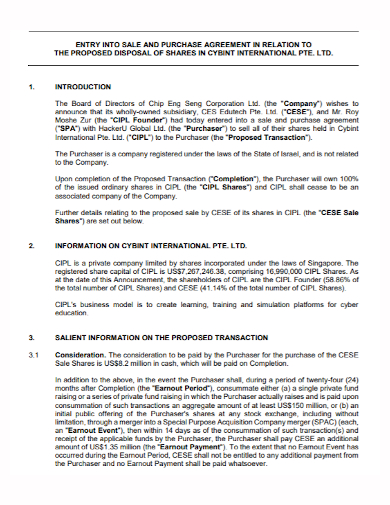

4. Editable Share Sale and Purchase Agreement

5. Hotel Share Sale and Purchase Agreement

6. Stock Share Sale and Purchase Agreement

7. Agreement for Sale and Purchase of Shares

8. Agreement for Purchase and Sale of Shares

9. Purchase and Sale of Water Shares Agreement

10. Company Purchase and Sale of Shares Agreement

11. Management Purchase and Sale of Shares Agreement

SPAs are used in the supply chains of large, publicly traded companies. An SPA may be used when ordering a significant amount of materials from a supplier or making a large-scale single purchase. For example, 1,000 widgets will be delivered at once.

An SPA can also be utilized as a revolving purchase agreement, such as a yearly supply of 100 widgets on a monthly basis. Even if delivery is delayed or extended, the purchase/sale price can be determined ahead of time. SPAs were established to help suppliers and purchasers estimate demand and costs, and their importance grows as transaction quantities expand.

In another case, an SPA is frequently required when one company buys another. The SPA may allow a firm to transfer its tangible assets to a buyer without selling the naming rights connected with the business because it describes the particular nature of what is being bought and sold.

Difference Between Preferred Shares and Common Shares

The type of shares being sold should be specified in your Share Purchase Agreement because it will influence the buyer’s voting rights, dividend yields, and percentage ownership in the company. Preferred and common shares are the two types of shares that a corporation typically distributes to its shareholders. Preferred shares, in most circumstances, have the greatest potential for short-term gains due to the following factors:

- There are no voting privileges.

- Preferred stockholders receive dividends first.

- Interest rates effect share value, which is computed on par (i.e. at face value).

- Shares can be called at any moment (i.e. the share issuer has the right to redeem shares from the market after a time)

Common shares, on the other hand, have the greatest potential for long-term returns for the following reasons:

- The rights of voters

- Dividends are paid to shareholders at the end of the year.

- The value of a stock is determined by market demand and supply.

- Typically, shares are not callable.

FAQs

Who should use a share purchase agreement?

A Share Purchase Agreement should be used when you (as an individual or an organization) acquire or sell stock in a company. Whether your business entity can’t issue shares (for example, if it’s a sole proprietorship, LLC, or partnership), you can utilize an Assignment of Partnership Interest or a Purchase of Business Agreement instead.

What is a sales and purchase agreement?

A sales and purchase agreement (SPA) is a legally enforceable contract between two parties that binds a buyer and seller to a transaction. SPAs are commonly utilized in real estate deals, but they can be found in any industry. The agreement is the result of negotiations between the buyer and the seller, and it sets the terms and circumstances of the sale.

If you want to see more samples and formats, check out some share sales and purchase agreement samples and templates provided in the article for your reference.

Related Posts

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Car Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Horse Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Option Agreement Samples In MS Word | Google Docs | Apple Pages | PDF