What do you mean by a voting trust? A voting trust is a type of arrangement that is usually made to transfer the voting rights of the shareholders to a trustee within a specific period. The shareholders will be awarded with trust certificates that shows specific evidence as a proof that they are the beneficiaries of the trust. They are also designed to retain an interest in the company’s stock in order to receive the dividends and distributions of profits which are considered payable to the equity shareholders. When it comes to the voting trust agreements, the trustee may be allowed to either sell or redeem the shares which are all stated in the agreement.

How a voting trust works? They are formed by company directors or a group of shareholders in order to exercise control within the corporation. This can also be utilized when you are going to resolve conflicts of interest, prevent someone from a hostile takeover, or increase the voting power of each shareholders. The voting trust agreement should be able to specify or state that the beneficiaries have to continue to receive the dividend payments and other necessary distributions coming from the corporation. Take note that the rules governed pertaining to the duration of the trust usually varies from state to state. When voting trusts are formed by group of shareholders who do not have a single interest when it comes to the operations of the company, the trustee will have his or her freedom to decide regarding his or her voting rights.

10+ Voting Trust Agreement Samples

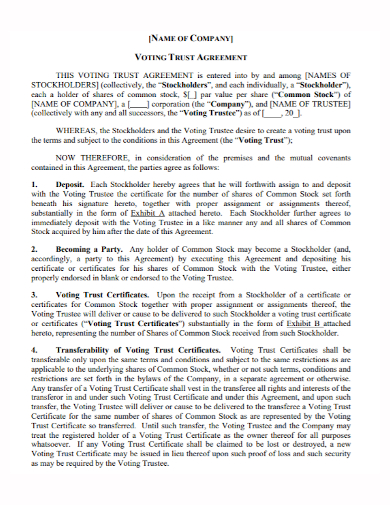

1. Voting Trust Agreement Template

2. Company Voting Trust Agreement

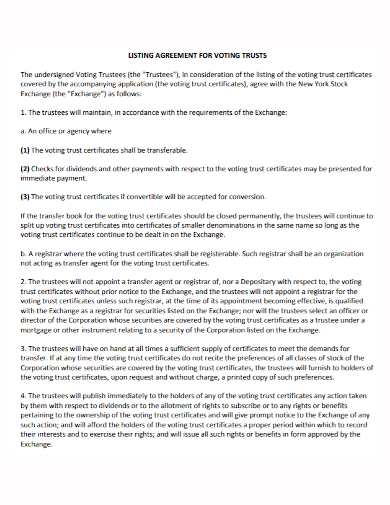

3. Voting Trust Listing Agreement

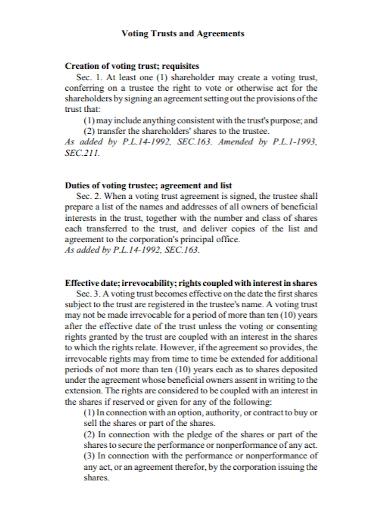

4. Voting Trust Agreement

5. Voting Trust Shareholders Agreement

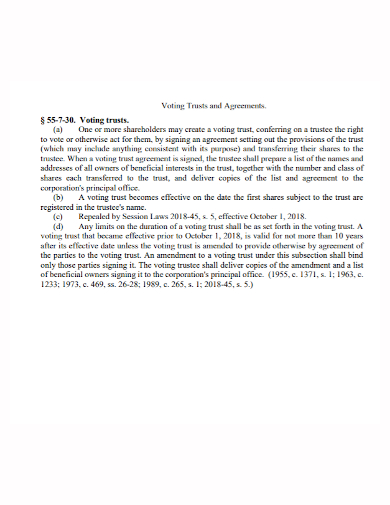

6. Voting Trust Approval Agreement

7. Voting Trust System Agreement

8. Voting Trust Divestiture Agreement

9. Voting Trust Deposit Agreement

10. Sample Voting Trust Agreement

11. Capital Stock Voting Trust Agreement

Purpose of a Voting Trust

There are a lot of reasons why voting trust arrangements exist.

- This is to resolve conflicts of interest – the shareholders have the opportunity to use the voting trust in order to help resolve the conflicts of interest. In an ordinary setting, shareholders would have to transfer their shares to the trustee who would make the vote on their behalf in order to mitigate against the conflicts of interest. You must also know that the usual practice is to have a transfer of shares into a blind trust who has no knowledge about the holdings of the trust. They also have no rights to intervene in the voting process. This way, there will be a conflict of interest that would exist between the shareholders and in the investments.

- There is an increased shareholder voting power – when you are going to vote as individuals, shareholders must be able to exercise power and must limit themselves in performing functions that only large shareholders can. When shareholders decide to transfer their voting rights into a trust, it would mean that they would be getting more voting powers than the individual votes.

- It prevents a hostile takeover – whenever a certain company will face a threat of hostile takeover, shareholders have the choice to lock their shares in a trust. This type of practice prevents the company from continuing with the takeover from trying to have a major portion of the target company shares knowing that a large number of shares will be locked up in a trust for a specific period of time.

FAQs

What is a voting trust agreement?

A voting trust agreement is a type of contractual agreement that allows a record of the transfer of shares coming from a specific shareholder to a trustee. This type of agreement provides the trustee with a temporary control of the voting powers.

What are some of the instances where voting trusts are used?

It can be for company reorganization, transfer of shares from parent to child, and mergers and acquisitions.

What is a voting trust certificate?

A voting trust certificate is a type of document that is being issues to a shareholder in exchange for his or her transfer of shares to the trustees. This usually lasts for the voting trust period right after when the shares are returned to its equitable owners.

If you want to see more samples and format, check out some of the voting trust agreement samples and templates provided in the article for your reference.

Related Posts

Sample Business Agreement between Two Parties

FREE 9+ Shop Rental Agreement Samples [ Commercial, Lease, Tenancy ]

FREE 10+ Charter Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF