If there are a lot of things you need to list down and remember, would it be easy if you can put them all in one page where you can see all the necessary information? What about listing down interests, principal amounts, payment schedules, and payment amounts of your amortized loan? Imagine how difficult that can be. Why put yourself in a difficult situation when you can download amortization table samples? Stop wasting time thinking about what goes where and where to put what.

An amortization table has all that listed and arranged for you to easily see what you need. You may also find our schedule samples useful.

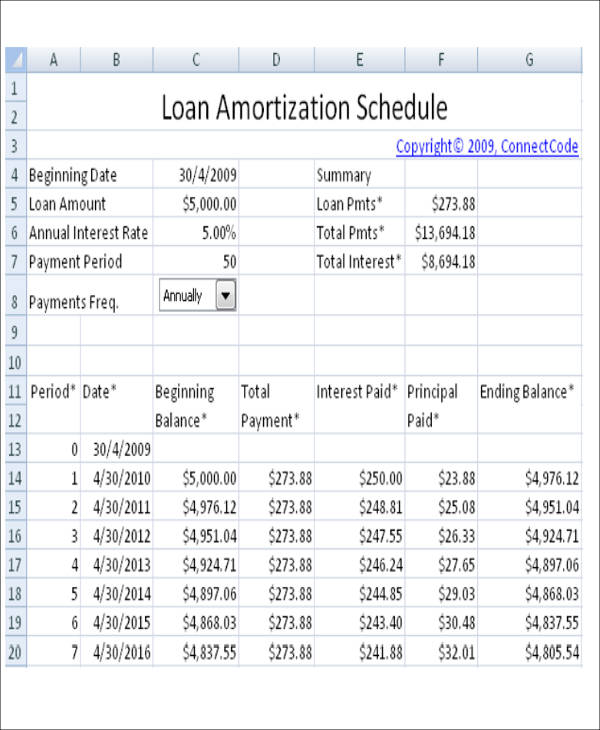

Sample Loan Amortization Table

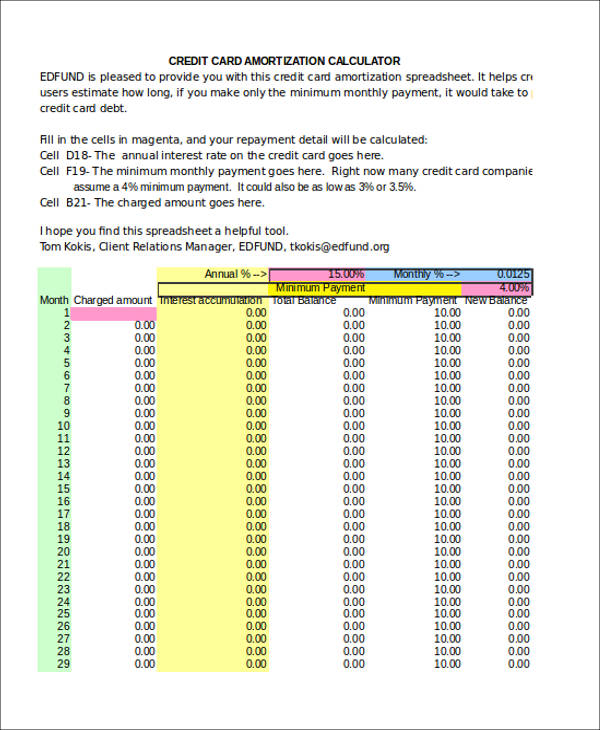

Credit Card Amortization Table in Excel

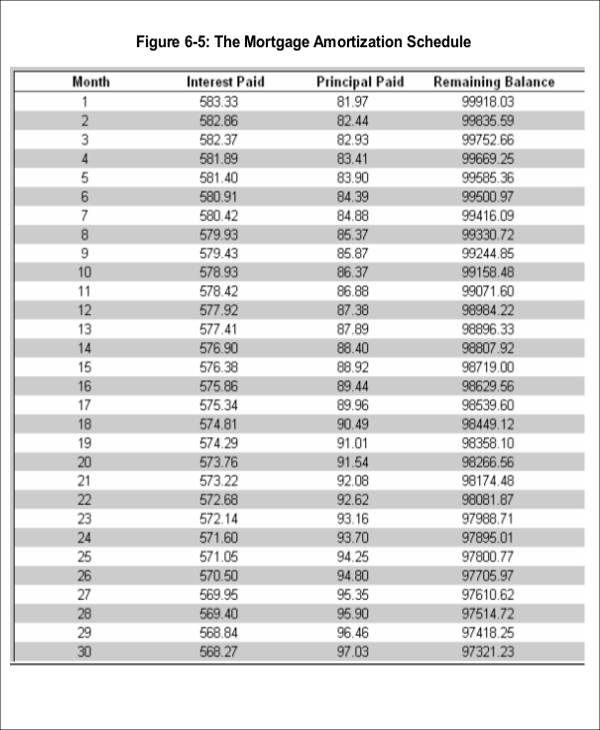

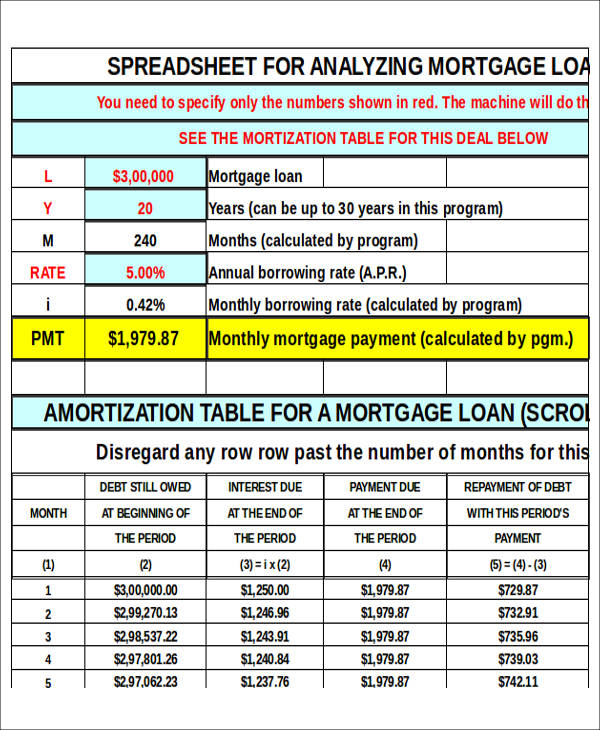

Mortgage Amortization Table

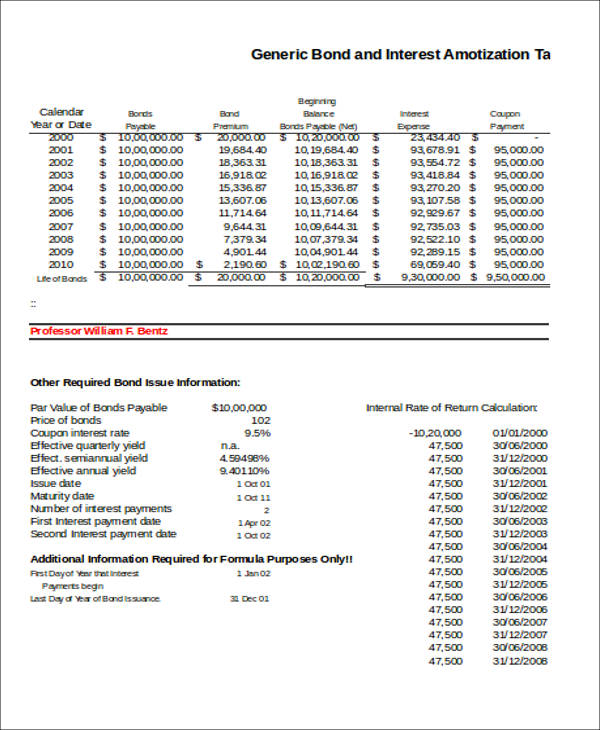

Bond Amortization Table in Excel

Types of Amortization

- The type that is related to how business expenses are deducted

- The type that is related to how a loan is repaid

Amortizable Loans

- Home Loans – It is a long-term loan that lasts for 15 years or 30 years with a fixed mortgage. They are either used for rent or mortgage.

- Personal Loans – It is usually a two- to three-year term loan. Borrowers can get this type of loan from banking and lending institutions with fixed interest rates and monthly rates. Personal loans are used mostly for small projects.

- Intangible Assets – These assets are intellectual properties, patents, trademark, copyrights, and brand recognition. They are assets that are not physical in nature.

- Auto Loans – Car loans are paid on a monthly basis and are often paid in a five-year term. This is also paid with a fixed monthly rate.

- Annual Subscriptions – The payment method for annual subscriptions is similar to that of an amortized loan, which is on a monthly basis. It is paid in exchange for products or services.

Loans That Are Not Amortizable

- Credit Cards – Requires you to pay your dues on a fixed due date every month. Failure to make the payment of the amount used will incur additional fees depending on the credit card institution.

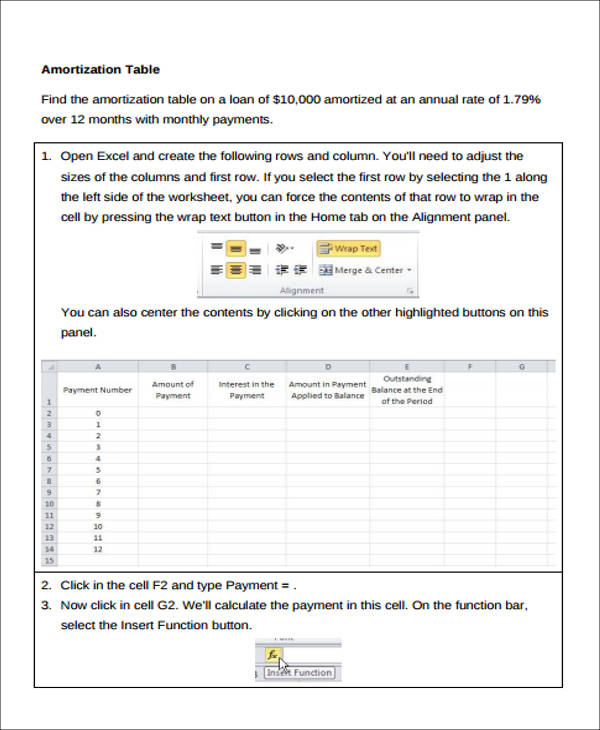

Do check our Excel Amortization Schedule Samples to help you keep your amortization schedules organized and up to date.

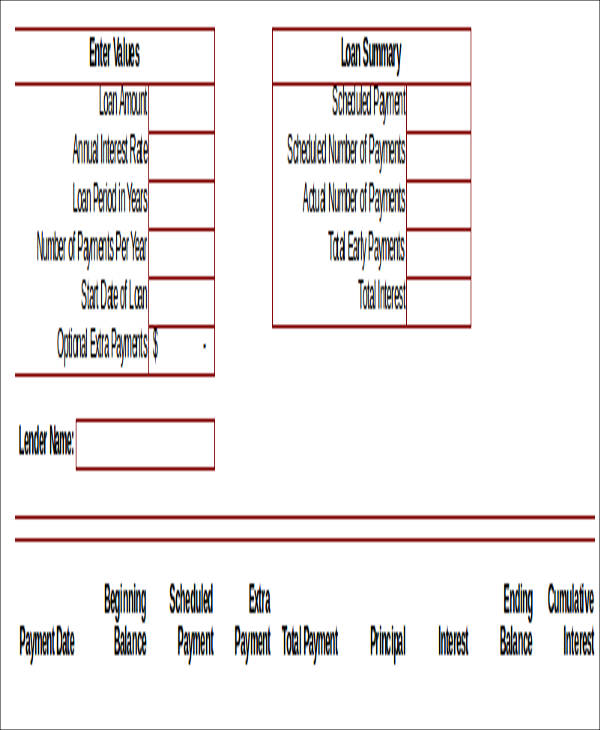

Amortization Table Sample in Excel

Payment Amortization Table in Excel

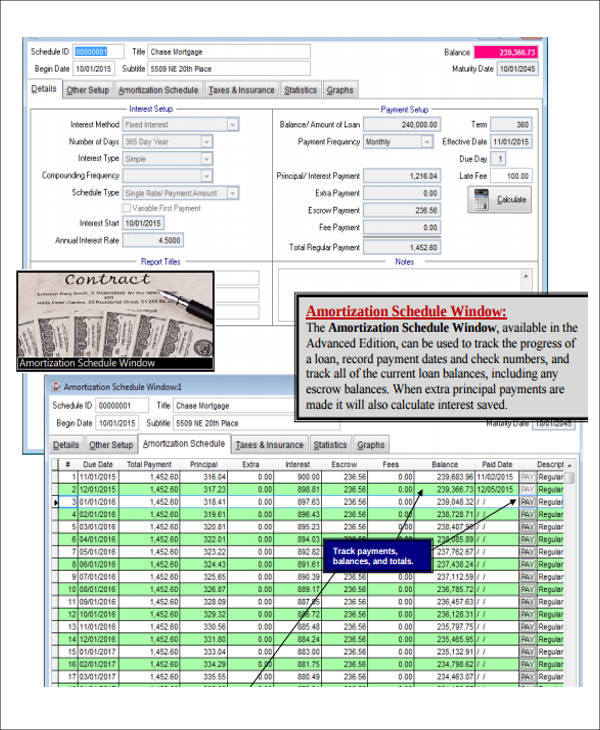

Amortization Table Calculator

Loan Amortization Table

The Importance of Amortization

- Purchasing and payment in large amounts of money is made easy.

- The repayment amount is fixed so you will not be shocked on how much you have to pay over a period of time.

- Allows borrowers to pay the borrowed amount in an installment basis.

- Amortization is usually used to pay for properties such as houses and lots, infrastructures, and vehicles or automobiles.

- Keeps track of how much you need to pay, when you need to pay it, and how much left for you to pay. You can also use our amortization schedule calculator samples.

- It is a simple way to make payments lighter and spread out the payment cost.

- Owning a property is made affordable.

An organized amortization table means hassle-free and on-time payments. Payments are already made easy through amortization because it allows you to pay for your debts through a fixed amount and a fixed schedule. Don’t screw up by missing a payment. Don’t wait for any payment problems before you download our amortization table samples in Excel. Take advantage of this downloadable tool that is extremely useful when it comes to organizing your amortization needs. We already have everything figured out for you.

Related Posts

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]

FREE 24+ Sample Payment Schedules in PDF | MS Word

FREE 10+ Return to Work Action Plan Samples in PDF | DOC

Autobiography Samples & Templates