Project financial management is crucial when establishing your plan. You can’t carry on with the task without paying close attention to handling your finances. This also becomes significant mainly when looking for partners or investors to fund your ideas. This is why a project financial analysis becomes an integral part of the picture. This allows you to assess your budget plan, examine its components, and determine if you’re spending money wisely on matters that promote efficiency and gain. Evaluating your project’s financial performance through the analysis also helps you keep track of your debts and expenditures. Browse through our options below and learn more from our article about this document.

FREE 10+ Project Financial Analysis Samples

1. Financial Analysis Template

2. Financial Statement Analysis Template

3. Financial Impact Analysis Template

3. Company Financial Analysis Template

4. Project Analysis Template

5. Project Analysis Report Template

6. Real Estate Financial Analysis Template

7. Project Financial Analysis Template

8. Project Financial and Economic Analysis

9. Financial Analysis Overview Template

10. Mining Project Financial Analysis

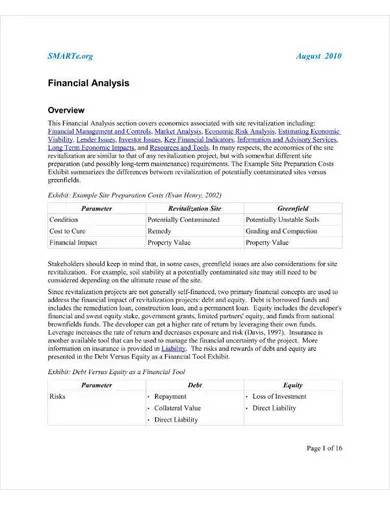

11. Sample Financial Analysis Overview

What Is a Project Financial Analysis?

A project financial analysis is making use of financial information to assess a project’s performance and results. This process can help in decision-making and identify what needs to be changed in the project’s blueprint financial-wise to make way for the proper changes and determine the right decision track.

Significance of Financial Analysis

According to the Small Business Financial Health Analysis featured in American Express, businesses who are financially aware or knowledgable generate more profits, more revenues, and more human resources. No business strives in the market without a deep sense of their financial statement. Every business owner’s obligation is to dig through their reports and be updated with their enterprise monetary matters. These are among the reasons why it’s significant to pay attention to financial status, whether on a personal or entrepreneurial level.

Financial analysis helps you assess your finances to weigh your options, identify inconsistencies, and provide the best decisions. It lets you relearn your past by urging you to refer to your previous financial reports and either show you what to avoid or present you with what already worked well and apply it to your current situation. It also keeps you updated on your financial statement to keep an active eye on loopholes and anomalies. It also improves your debt management. It allows you to direct your cash flow responsibly so you can promptly attend to your loan obligations. It also ensures that a company or organization is compliant with the right accounting standards to ensure no prohibited activities within the system. If you’re presenting a business proposal, a comprehensive financial analysis will be among your powerful pitches. It will serve as your investor’s assurance of how they’ll secure their investment return through a well-planned analysis.

How to Make a Project Financial Analysis

If you’re looking for a way on how to make your financial analysis efficiently, here are some steps for you:

1. Ask the Necessary Questions

When you start making your financial analysis, begin by asking the right questions. This paves the way for identifying the goal of the activity. Performing the analysis without knowing what your goal should be would fail to meet its purpose. It would also subject you to impertinent strategies because you don’t know your end goal. Start by asking, “What are the details all about? , “Who will benefit from the findings? , and “How will they use the results?” Doing this shapes your perspective in pushing through with the project plan because you’ll know which points to focus on to get the right answer.

2. Determine the Problem Scope

Now that you have your questions, it’s time to determine what you’re trying to solve. Do you want to identify the project’s feasibility? Do you want to predict its profitability? Do you want to identify what needs to change when it comes to its financial matters? There are various reasons that only a financial analysis can make sense of. Doing this helps you identify what information to gather and which aspect of the analysis you’re going to focus on. If your questions help you determine your goal, your problem scope defines your documents’ details. As an example, if you want to find out your plan’s probable profit a year after its implementation, you may have to provide an estimate by calculating your sales through research.

3. Specify Your Deliverables

The deliverables are both the tangible and intangible content of your financial plan. These include materials, maintenance, and labor costs. You can never really perform a financial analysis without going through your project budget’s deliverables list. This may cover your budget for direct personnel and outsourced workers. For this, you also need to calculate your project’s timeline to determine how much you’ll be spending on the number of supplies and the length of your workforce’s service.

4. Do a Cost-Benefit Analysis

After you’ve gathered all this information, it’s time to execute the cost-benefit analysis (CBA). This is the core of your financial analysis as this will produce your desired results. A CBA determines if the benefit of an action is more than the value of its cost. Basically, it determines if a plan is feasible and profitable. This is also useful in making the best decisions when presented with different plan options. When it comes to project management plans, this determines if your spending on the right factors and deliverables. For example, if you’re paying thirty men to man your productions, but you only have limited equipment and producing limited products, you’re paying more than you’re earning. You may want to cut down on your workforce and add another machine to speed the process.

FAQ

What are some of the documents used in financial analysis?

Some of the documents used in financial analysis are balance sheets, income statements, and cash flow statements.

What are the different types of financial analysis?

The different type of financial analysis include:

- Vertical analysis

- Horizontal analysis

- Profitability analysis

- Growth

- Leverage analysis

- Rate of return

- Liquidity analysis

- Efficiency analysis

- Cash flow

- Variance analysis

- Valuation analysis

- Sense and sensitivity analysis

What is the process of financial planning?

The steps of financial planning follow the following procedure:

- Define present financial status

- Establish objectives

- Employ methods for action

- Generate alternative method

- Execute financial plan

- Evaluate and revise the plan

Meticulous financial planning ensures that as your project progresses, it’s standing on a formidable financial plan. you can be sure that you won’t run out on funds because you’ll be spending your resources with full awareness of your financial status. If you’re in need of this document, skip the hassle and get yours from our financial analysis templates today. Download now!

Related Posts

FREE 10+ Soar Analysis Samples in PDF

FREE 10+ Rhetorical Analysis Samples in PDF

FREE 10+ Analysis of Alternatives Samples in PDF

FREE 10+ Failure Mode and Effects Analysis Samples in PDF

FREE 10+ Make or Buy Analysis Samples in PDF

FREE 10+ Fishbone Root Cause Analysis Samples in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 6+ Corporate Portfolio Analysis Samples in PDF

FREE 10+ Fault Tree Analysis Samples in PDF

FREE 10+ Comp Analysis Samples in PDF

FREE 10+ Fishbone Analysis Samples in PDF

FREE 10+ Individual Swot Analysis Samples in PDF

FREE 10+ 5 Year Analysis Samples in PDF

FREE 10+ Benefit Costs Analysis Samples in PDF

FREE 10+ Job Hazard Analysis Samples in PDF