Whether you started a small business or have employed a new employee, you’re likely to receive a notice of assessment if you owe a tax from the government. Even if you belong to a construction company, fast food business, clothing business, or agency worker, you’ve automatically obliged the tax compliance; however, failure to do this will result in an issuance of notice of assessment and other legal actions. To avoid this, make it a habit to pay and track your tax obligation monthly or annually.

10+ Notice of Assessment Samples

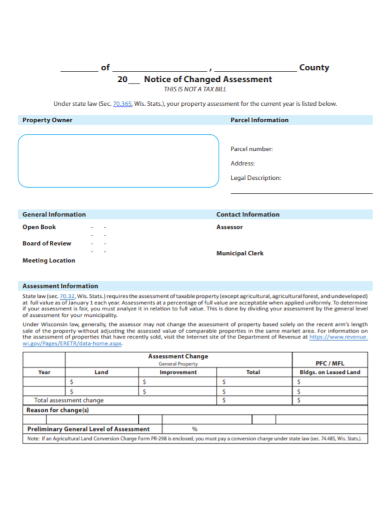

1. Notice of Changed Assessment

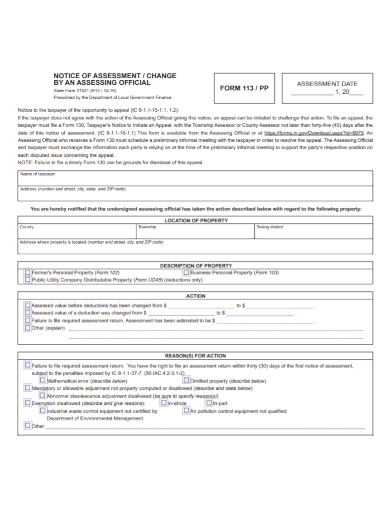

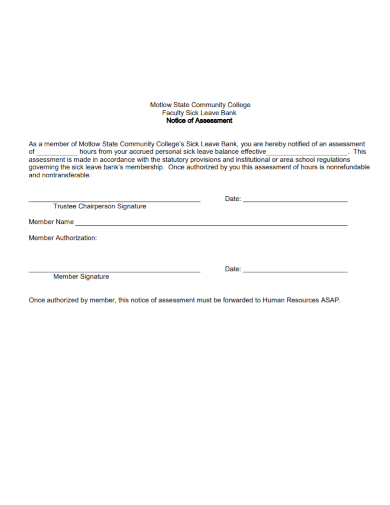

2. Official Notice of Assessment

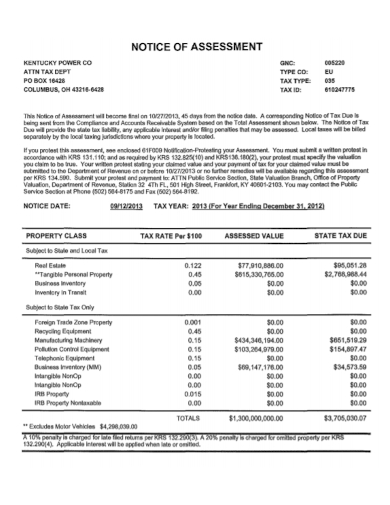

3. Property Notice of Assessment

4. Insurance Notice of Assessment

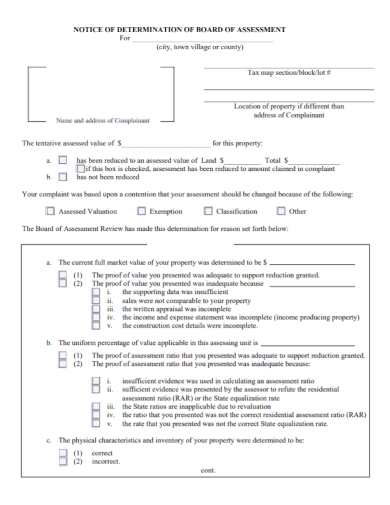

5. Notice Board of Assessment

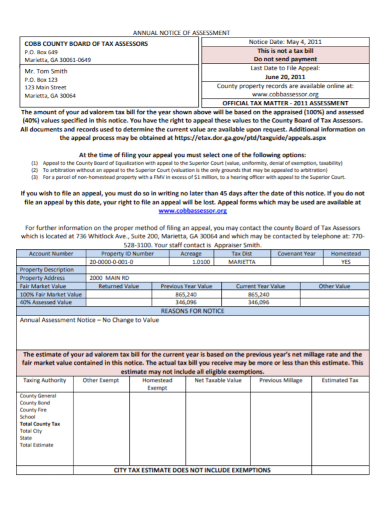

6. Annual Notice of Assessment

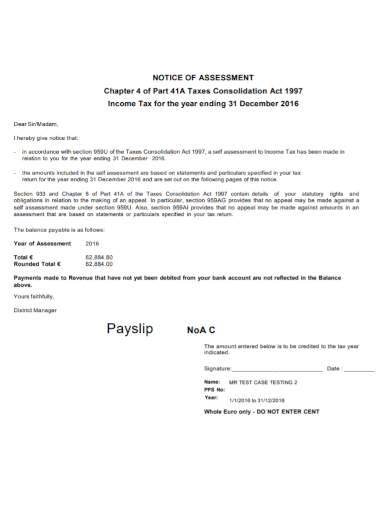

7. Payslip Notice of Assessment

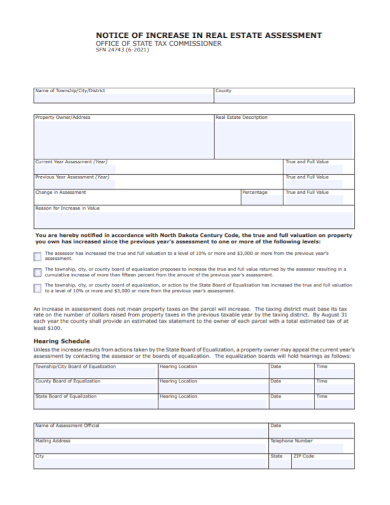

8. Notice of Real Estate Assessment

9. Bank Notice of Assessment

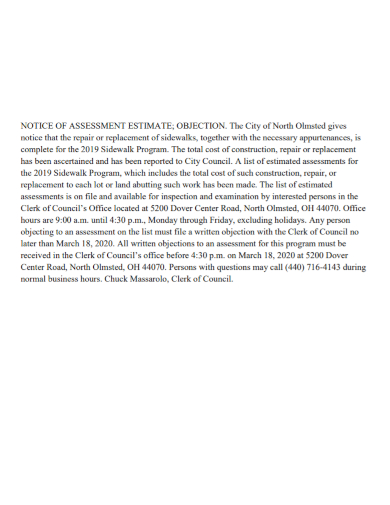

10. Notice of Assessment Estimate

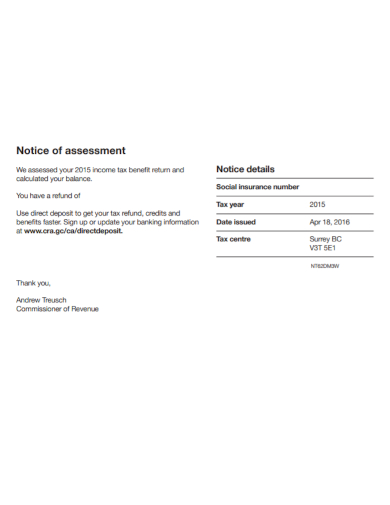

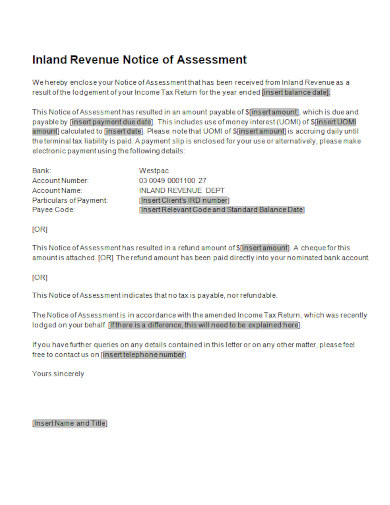

11. Revenue Notice of Assessment

What Is a Notice of Assessment?

A notice of assessment (NOA) is an evaluation of your tax that the government sends to you. It is an annual and legal statement to taxpayers with the amount of income tax an individual owes. Other than that, it also includes details such as the amount of their tax credit, tax refund, and income tax already disbursed. It also lists deductions from total income, total nonrefundable federal tax credits, etc.

How to Make a Notice of Assessment

Corrections made for the cost estimates will also appear on a notice of assessment. Besides, this notice works like a delivery note that signals an individual or a business has been identified for a tax audit. The components of such notice should be well-written to showcase comprehensive details regarding the taxes owed by a particular individual or business entity. So, take your time and read the following steps in making a notice of assessment.

1. Contact Information

First, you need to write down the complete information of the recipient of the notice of assessment. Make sure to write the full and legal name of the person. However, if it’s a company, write its complete company name. After that, you can follow the payer’s address and see that it’s the official and exact address. Then, the active contact number, such as a mobile or telephone number. Moreover, you may also include the email address for your options.

2. Statement of the Information

This section is vital since it contains the statement details such as the business number and date. It should also have the exact and correct digits to avoid any mistakes in identifying the recipient of your notice of assessment. So, always try to recheck your NOA for any possible errors.

3. Action You Need to Take

This section should contain the action needed to take with your case. This is essential since the details should be comprehensive. Once it’s unclear, it can cause misinterpretation and confusion among the receiver.

4. Current Balance

Lastly, the particular section contains the current balance of the notice of assessment. It should have the current year balance, so type it in correctly.

FAQs

How Do I Get an NOA Notice of Assessment?

You can get your NOA through email or when it is sent to you via mail.

What Is the Difference Between an Income Tax Return and a Notice of Assessment?

A notice of assessment reflects your taxable income after deductions, not your gross income and the sources it came from.

What Happens After the Notice of Assessment?

You’ll receive a notice for every tax return you file. It is completed every year to calculate whether you owe tax on your income.

In any case, it is your role as a citizen to become a responsible taxpayer. So, comply with your tax obligation to avoid any legal power to take action. Complying will save you from any future problems you may encounter in your business or career. Nevertheless, you must preserve a record of the tax records and appropriate documents for the past six years, including the current year.

Related Posts

FREE 10+ Joint Assessment Samples [ Strategic, Risk, Needs ]

FREE 10+ Teleworker Self-Assessment Samples in PDF | DOC

FREE 10+ Market Assessment Samples in PDF | MS Word

FREE 10+ Quality Risk Assessment Samples [ Control, Assurance, Management ]

FREE 6+ Immediate Termination of Lease Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Qualitative Risk Assessment Samples in PDF | DOC

FREE 10+ Comprehensive Needs Assessment Samples in PDF

FREE 10+ Evaluation Quality Assessment Samples [ Self, Loss, Data ]

FREE 10+ Promotion Assessment Samples [ Health, Self, Employee ]

FREE 10+ Environmental Impact Assessment Samples in PDF | DOC

FREE 10+ Employee Competency Assessment Samples in PDF | DOC

FREE 10+ Safety Assessment Samples [ Home, Health, Risk ]

FREE 10+ Change Impact Assessment Samples [ Management, Control, Request ]

FREE 10+ Qualitative Assessment Samples in PDF | DOC

FREE 10+ Staff Assessment Samples [ Workplace, Health, Risk ]