A partnership is a type of business in which two or more persons sign a formal agreement. They agree to be co-owners, share management responsibilities, and split the profits and losses generated by the business. These characteristics of partnerships are recorded in a document called as a partnership deed. Although having a partnership deed is not essential, it is advised to have it as it helps control each company partner’s rights, duties, and liabilities. The Indian Partnership Act of 1932 has no time limit for registering a partnership firm. The company can be registered at the moment of its formation or after it has begun, depending on the approval of all partners.

10+ Business Partnership Deed Samples

When two or more persons come together to run a business, a partnership deed is a legal arrangement. This document outlines all of the important terms and conditions of the business, such as profit/loss sharing, responsibilities, admission of new partners, established rules, salaries, and the exit process, among other things. It is extremely important, and it can even be used as a legal document if the company ends up in court for some reason. Because a Partnership Deed, also termed as a Partnership Agreement, is listed under the Indian Registration Act 1908, there is no possibility of the Deed of Partnership being destroyed while in the partners’ ownership.

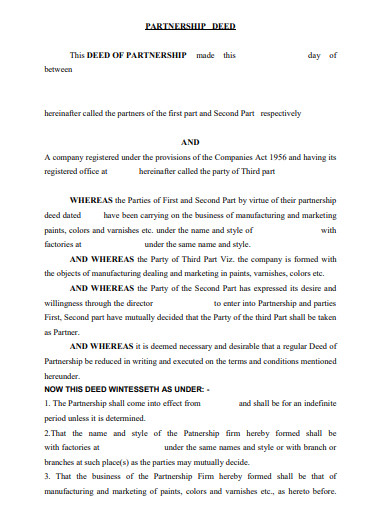

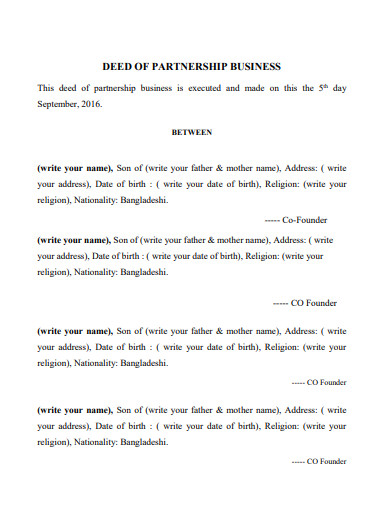

1. Business Partnership Deed

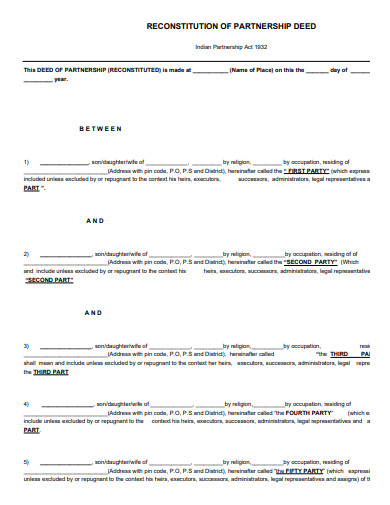

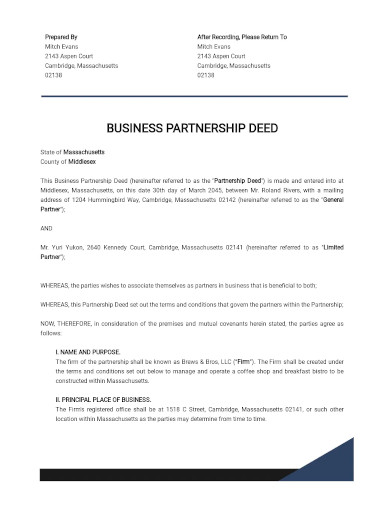

2. Sample Business Partnership Deed

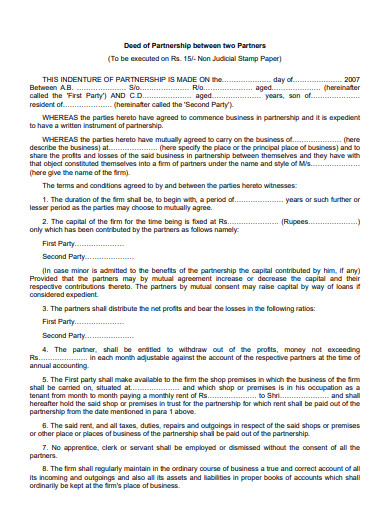

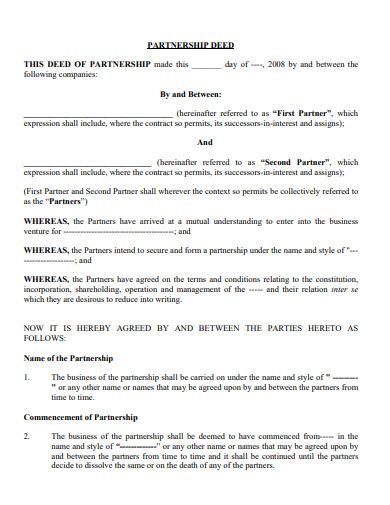

3. Deed of Business Partnership between two Partners

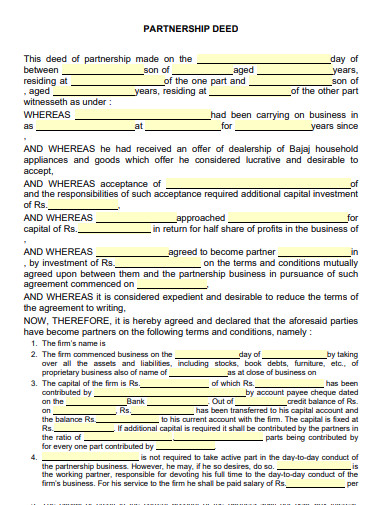

4. Deed Small Business Partnership Grant

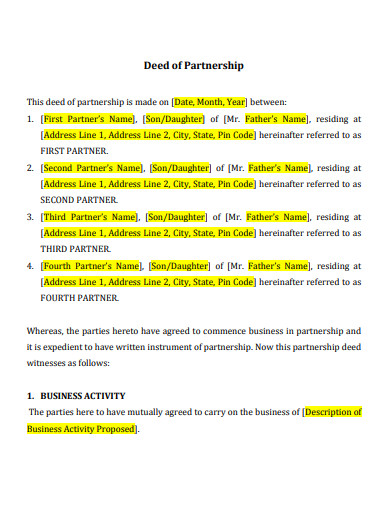

5. Simple Business Partnership Deed

6. Business Partnership Deed Example

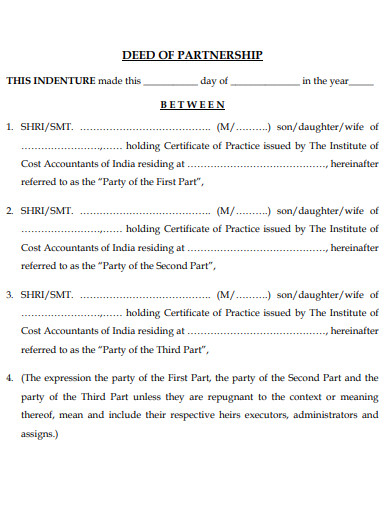

7. Basic Business Partnership Deed

8. Formal Business Partnership Deed

9. Professional Business Partnership Deed

10. Business Partnership Deed Format

11. Printable Business Partnership Deed

Contents of Partnership Deed

If there is a disagreement or ambiguity about something, a Partnership Deed can safeguard your interests. As a result, the Deed must include all of the firm’s legal information. Although there is no common template for designing a Partnership Deed, we have given you with a list of data present in the partnership agreement to provide you a reasonable grasp of its contents:

The following information is included in a partnership deed:

Purpose of Partnership: The contact details of all the parties and other required facts to indicate the type of business done by the partners.

Partnership’s principal place of business: The firm will operate from whatever location(s) the Partners choose from time to time.

The tenure of the partnership must be specified in the Deed, as well as the date of the firm’s founding and the deal period.

Capital contribution: An agreed-upon commitment of the firm’s capital, cash, property, goods, or services (partnership contribution share wise).

Capital Withdrawals: Specifics on the types of capital withdrawals that each partner is entitled to make, as well as whether or not any interest is to be paid to the firm on such withdrawals.

Salary & Commission: A breakdown of the partners’ salary ratios or percentages.

Profit/Loss Ratio: Profit/Loss Ratio that will be accruing to and carried by the Partners.

Details of the firm’s accounts and how they will be managed if the firm is dissolved are detailed in the regulation for dissolving partnerships.

Guidelines for a new partner’s admittance: Specifics on a future partner’s admission, retirement, and exit.

Rules to follow: Procedures to follow if one of your partners goes bankrupt.

Account and audit details: The firm’s operations’ thorough books of account must be accessible at all convenient times and open to review and examination by any partner.

Voluntary Withdrawal of a Partner: The Partnership Deed must include rules for voluntary withdrawal.

Partners’ Roles and Obligations: It specifies each partner’s position and responsibilities.

Banking and Partnership Funds: Funds held in the company’s name will be transferred to a bank account specified mutually by the Partners.

Borrowings: Taking loans and mortgages, financial institutions, or other third parties for the company’s financial needs will demand the written permission of all partners.

Financial Year of the Partnership

FAQs

What are the advantages of partnership deed?

Two advantages of the partnership deed are as follows:

It aids in the regulation of the partners’ liabilities, rights, and responsibilities.

By stating all of the terms and conditions in advance, it helps to avoid misunderstandings between the partners.

What are the characteristics of a partnership?

The following are the most crucial aspects of a partnership:

Contractual agreement

There are two or more people

Profit and loss are shared.

If you want to see more samples and formats, check out some business partnership deed samples and templates provided in the article for your reference.

Related Posts

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]

FREE 24+ Sample Payment Schedules in PDF | MS Word

FREE 10+ Return to Work Action Plan Samples in PDF | DOC

Autobiography Samples & Templates