An annuity review checklist is an important tool for evaluating the suitability of an annuity application for an individual’s needs. An annuity is a business financial product that provides a stream of income over a period of time, often used as a retirement sample savings vehicle. When reviewing an annuity, there are several key factors to consider to ensure that the contract meets the individual’s financial goals and needs.

FREE 7+ Annuity Review Checklist Samples and Templates in MS Word | PDF

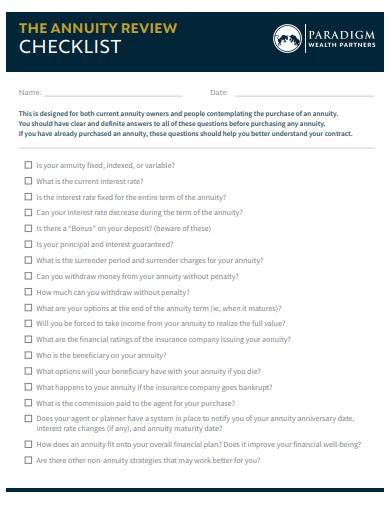

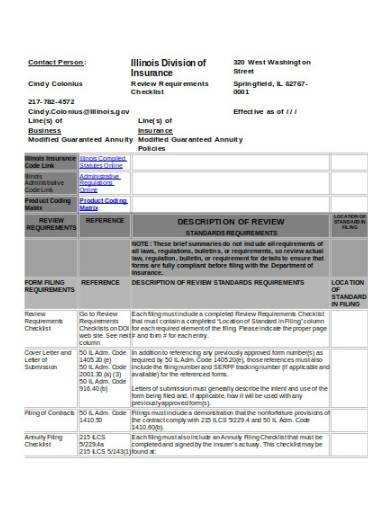

1. Annuity Review Checklist Template

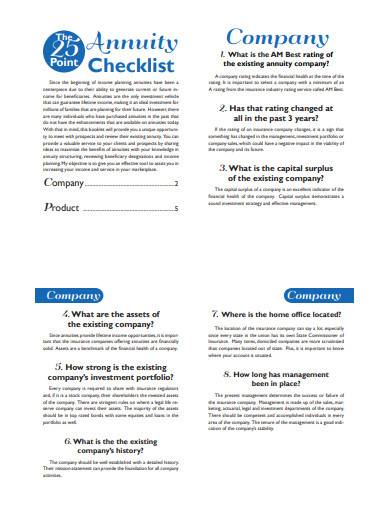

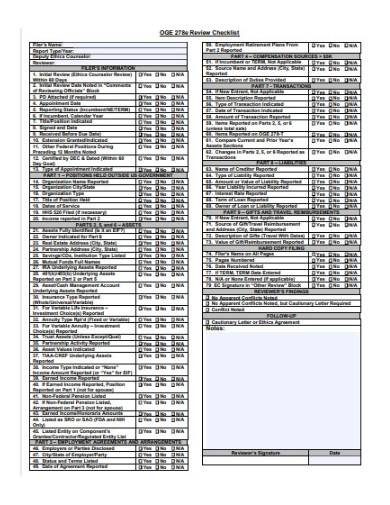

2. Point Annuity Checklist Template

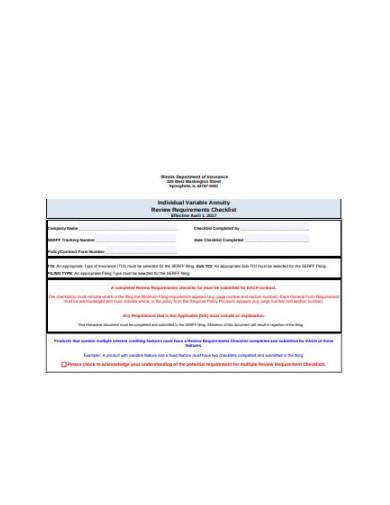

3. Variable Annuity Review Checklist

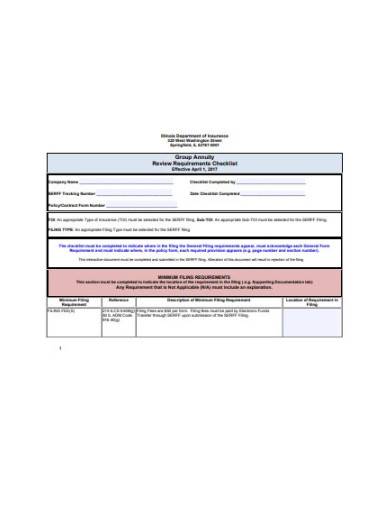

4. Group Annuity Review Checklist

5. Annuity Review Checklist in Word

6. Review Checklist Template

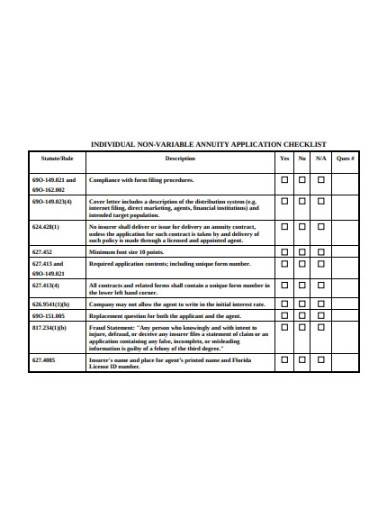

7. Individual Non-Variable Annuity Review Checklist

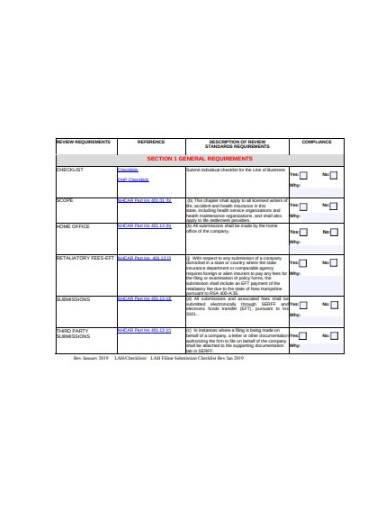

8. Sample Annuity Review Checklist Template

What is Annuity Review Checklist?

An annuity review checklist is a list of items or factors that should be considered when reviewing an annuity contract. This may include items such as the type of annuity (fixed, variable, indexed, etc.), the terms and conditions of the contract, the fee proposals and charges associated with the annuity, the insurance company’s financial projections, strength and stability, and the potential risks and benefits of the annuity. Additionally, it may also include a review of the annuitant’s current financial situation and personal goals, as well as any changes in their life circumstances that may impact their decision to continue with the annuity. The purpose of the checklist is to ensure that all relevant information has been considered and that the annuity is suitable for the annuitant’s needs.

How To Make Annuity Review Checklist?

Creating an annuity review checklist can be a helpful tool for evaluating the suitability of an annuity contract for an individual’s needs. Here are some steps to create an annuity review checklist:

Step 1- Determine the Purpose

Before creating the checklist, it is important to understand the individual’s financial goals and needs. This will help to determine which factors are most important to consider when evaluating the annuity contract. Obtain all the relevant information about the annuity contract, including the type of annuity, terms and conditions, fees and charges, and any guarantees provided by the insurance company.

Step 2- Research the Company

Review the financial stability of the insurance company that issued the annuity contract. This information can be found through rating agencies such as A.M. Best, Standard & Poor’s and Moody’s. Consider the potential risks and benefits of the annuity contract and how they may impact the individual’s financial situation.

Step 3- Create a List to Review

Create a list of items to review, including the type of annuity, terms and conditions, fees and charges, insurance company’s financial stability, and potential risks and benefits. Consider the individual’s current financial situation and goals, such as retirement income and estate planning needs, when evaluating the annuity contract.

Step 4- Review any Changes

Life events such as marriage, divorce, or the birth of a child may have an impact on the individual’s financial goals and needs and should be considered when reviewing the annuity contract. Review the checklist periodically to ensure that the annuity contract still aligns with the individual’s financial goals and needs. If there are any changes in the individual’s circumstances, the checklist should be reviewed again.

What should be included in an annuity review checklist?

An annuity review checklist should include items such as the type of annuity, terms and conditions, fees and charges, the insurance company’s financial stability, and the potential risks and benefits of the annuity contract. It should also take into account the individual’s current financial situation and goals, as well as any changes in their life circumstances that may impact their decision to continue with the annuity.

How often should an annuity review checklist be completed?

An annuity review checklist should be completed periodically, such as every year or every time there is a significant change in the individual’s financial situation or life circumstances. This will help ensure that the annuity contract continues to align with the individual’s financial goals and needs.

Can an annuity review checklist be used without consulting a financial advisor?

An annuity review checklist can be a helpful tool, but it is not a substitute for professional advice. It’s important to consult a financial advisor before making any decisions about an annuity contract.

An annuity review checklist is a tool used to evaluate the suitability of an annuity contract for an individual’s financial goals and needs. It helps to ensure that all relevant information about the annuity has been considered and that the contract is suitable for the individual.

Related Posts

FREE 10+ Equipment Inspection Checklist Samples [ Safety, Daily, Maintenance ]

FREE 10+ Turnover Checklist Samples [ Project, Apartment, Cleaning ]

FREE 12+ Vehicle Maintenance Checklist Samples [ Preventive, Service, Routine ]

FREE 20+ House Checklist Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 18+ Hospital Bag Checklist Samples in MS Word | Google Docs | PDF

FREE 20+ Student Enrollment Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Improvement Checklist Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 23+ Education Checklist Samples in MS Word | Google Docs | PDF

FREE 21+ Course Checklist Samples in MS Word | Google Docs | PDF

FREE 11+ Freelancer Checklist Samples in MS Word | Google Docs | PDF

FREE 23+ Party Checklist Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 18+ Scheduling Checklist Samples in MS Word | Google Sheets | PDF

FREE 17+ Response Checklist Samples in MS Word | Google Docs | PDF

FREE 17+ Survey Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Background Checklist Samples in MS Word | Google Sheets | PDF