Most people around the world retire as soon as they are in their 60s. In the U.S., the average American retires at 66 and above. Retirement is a big transition in a person’s life as they have to deal with a new life after years of working. Preparing to retire is no easy task. You want to retire when you’re still strong to enjoy your retirement and at the same time, you should be financially secure. To make sure you’ll be able to follow this goal and have a happy retirement life, this article can provide you a guide on what to prioritize on your retirement plan checklist and some sample printable retirement checklist templates that you can follow from.

10+ Planning for Retirement Checklist Samples

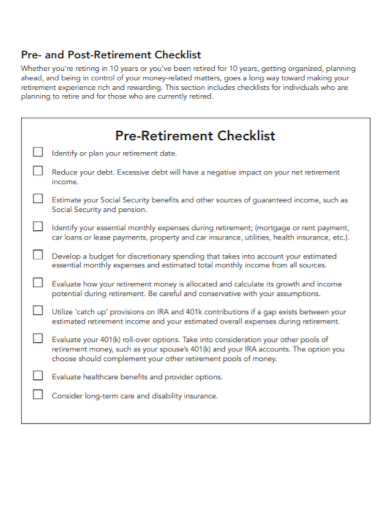

1. Pre Retirement Planning Checklist

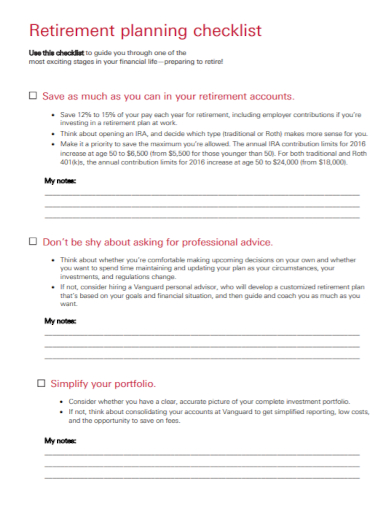

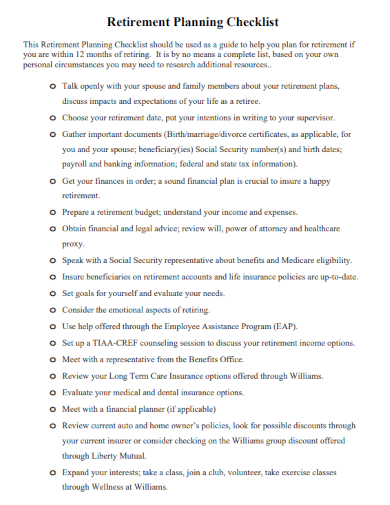

2. Retirement Finacial Planning Checklist

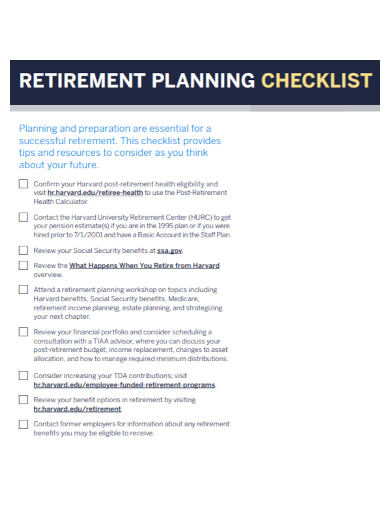

3. Retirement Planning Benefits Checklist

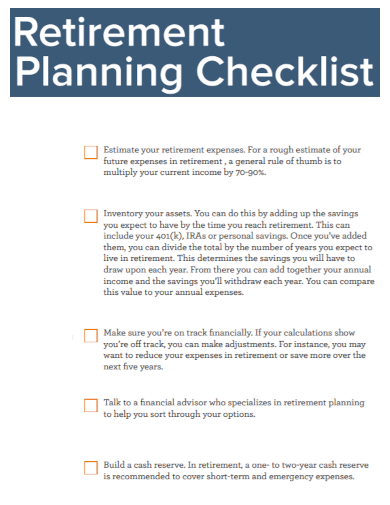

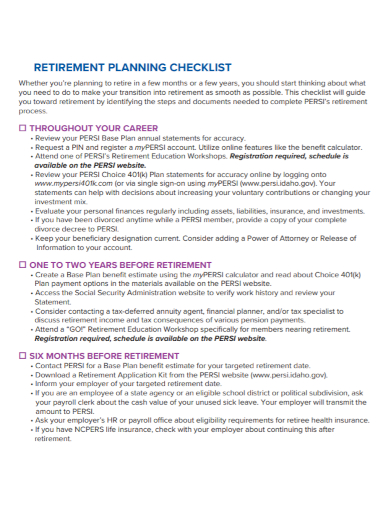

4. Before Retirement Planning Checklist

5. Professional Retirement Planning Checklist

6. Retirement Planning Schedule Checklist

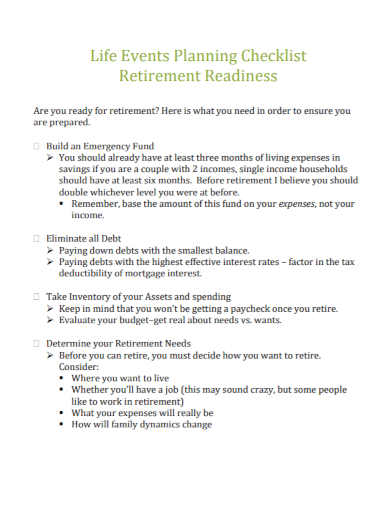

7. Planning Checklist Retirement Readiness

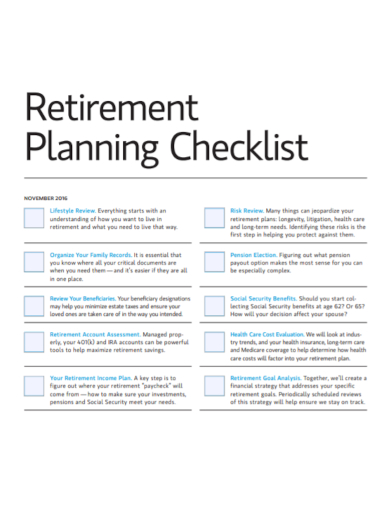

8. Editable Retirement Planning Checklist

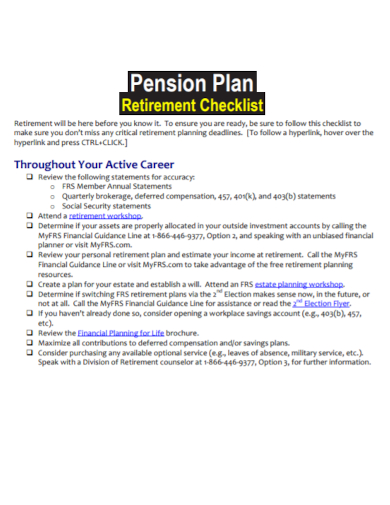

9. Pension Plan Retirement Checklist

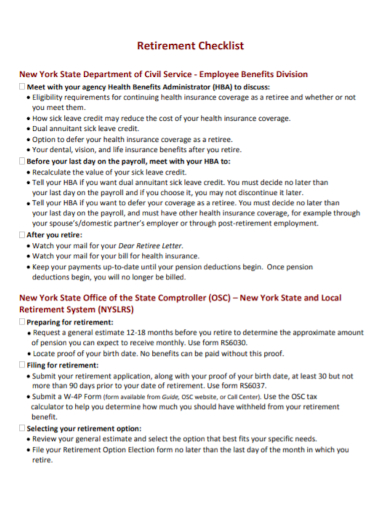

10. Employee Retirement Planning Checklist

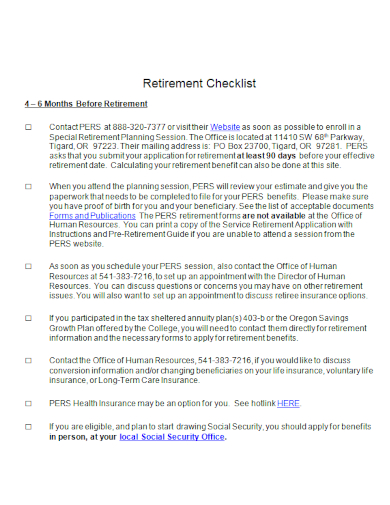

11. Printable Retirement Planning Checklist

Why Planning for Your Retirement is Important

Planning for retirement especially in 2021 is crucial more than ever because it will help you avoid running out of money and depend financially on your children or relatives. It is also important to cover your expenses, enjoy your retirement, and help you during emergencies.

How to Make a Retirement Checklist

Now that you’re prepared to make your retirement plan, list down the important things you need to know and have to be able to live financially independent when you’re finished having a job. These considerations will help you determine if you’re ready to permanently leave your job or you need some assistance and work to do before you retire.

Determine Your Post-Retirement Budget

Try to foresee your future once you’re retired. Your income and expenses will drastically change compared to when you were working steadily. To prepare for these changes, consider the following points: Knowing where your income will come from (e.g. pension, retirement account, allowances from family members, etc.), evaluating your lifestyle, getting an easy part-time job or volunteer work, choosing where to live, and calculating your expenses. Once you’ve listed down your answers to these questions, it’ll be easier for you to come up with an estimated budget you’re going to need and prepare to set aside some money for it.

Settle Your Debts Before You Retire

Debt is usually what people set back when retiring early. Most older adults have loans or debts to pay, and it’s most likely you have at least one. If you’re dead set on retiring or soon be forced to retire, you should take care of paying off all of your debts. Your income will likely decrease and paying for debts can make a dent in your budget. Now is the time to study your debt inventory and plan on how to pay all of them. Add up how much you owe in each debt plus the interest rates. Whether you’re paying off your personal loans or credit card debt, track your payment schedule and record your progress to help keep you on track.

Take inventory of your assets

For you to be able to work out your budget for retirement and paying all your debts, figure out your finances while you’re still working. Note all your financial assets and liabilities such as your savings, investments, your income stream, loans, and any insurance policies you have. Include also your properties, vehicles, jewelry, and other valuable possessions you have. Knowing your financial situation can help you budget your needs and lifestyle post-retirement, and figure out which debt or loans you can pay off first.

Have an emergency fund

For sure, you might have some money stuffed away for emergency purposes. Having an emergency fund is especially important once you’ve entered retirement since your income is likely to be less. Props to you if you already have an emergency fund set aside for the future. If you haven’t or you used it up due to some unfortunate instances, save up accordingly to your living expenses. Set aside six months to a year’s worth of funds to help cover emergency cases. Safely keep your money where nobody can find it and help you avoid being tempted to spend all of it.

FAQs

What is the best age to retire for Social Security?

There is no definite answer for the ideal age to retire but it is suggested to delay collecting your Social security benefits while you’re still healthy and financially stable.

What is a good amount of money to retire with?

It is suggested that your retirement income must be about 80% of your income from your work pre-retirement. This amount can assure you live a comfortable lifestyle in retirement.

What do retirees do all day?

Most retirees enjoy their hours of recreation, socializing, and travel. Some stay at home and read or watch television.

Preparing to retire is unpredictable as you’re never sure of the length of your retirement and the drastic events that could upturn your retirement life. But if you’ve taken care of everything you need in your retirement checklist, you are ready to leave your working life behind and embrace retirement. If you need to see more checklist tips and templates regarding personal responsibilities, click on the link for tips and downloadable sample templates.

Related Posts

12+ Entrepreneurial Checklist for Success in PDF MS Word

FREE 14+ Project Management Checklist Samples in PDF DOC

FREE 10+ Travel Checklist Samples in Excel Google Docs | MS ...

FREE 9+ Newborn Checklist Samples in Google Docs MS Word ...

FREE 12+ Sample Beach Checklists in MS Word PDF | MS Word ...

FREE 10+ Opening Checklist Samples in MS Word Pages | Google ...

FREE 20+ Contract Checklist Samples & Templates in PDF MS ...

FREE 16+ Meeting Checklist Samples & Templates in PDF MS ...

FREE 10+ Client Onboarding Checklist Samples in MS Word ...

FREE 19+ Sample Inventory Checklist Templates in Google Docs ...

FREE 12+ Sample Due Diligence Checklist Templates in PDF MS ...

FREE 5+ Retail Audit Checklist Samples in PDF Excel

FREE 13+ House Cleaning Checklist Samples in Google Docs MS ...

FREE 11+ House Cleaning Checklist Templates in PDF MS Word ...

FREE 25+ Sample Restaurant Checklist Templates in Excel PDF ...