Payroll is essential in every business, company, and organization. It is the process of paying every employee working in that particular entity. Without payroll, there would be no employees working because nobody works for free. The payroll process is important not only for paying employees but to also keep track of their work and make sure to pay the required income taxes. This can be too complicated for a payroll officer to remember every detail to include in payroll, so they need a checklist to help them remember. Read the article to know what to include in the payroll checklist and how to do payroll.

10+ Payroll Checklist Samples

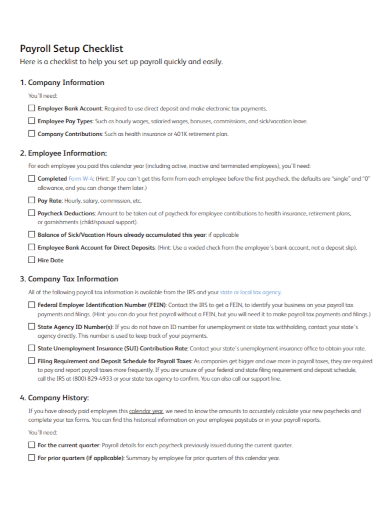

1. Payroll Setup Checklist

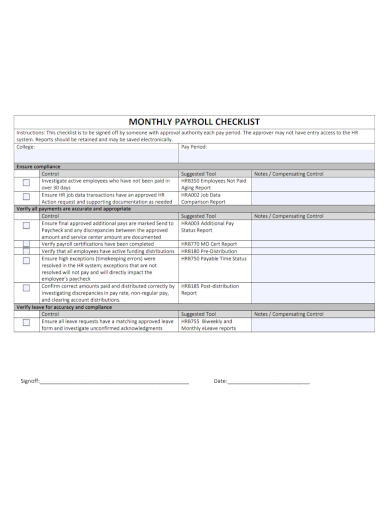

2. Monthly Payroll Checklist

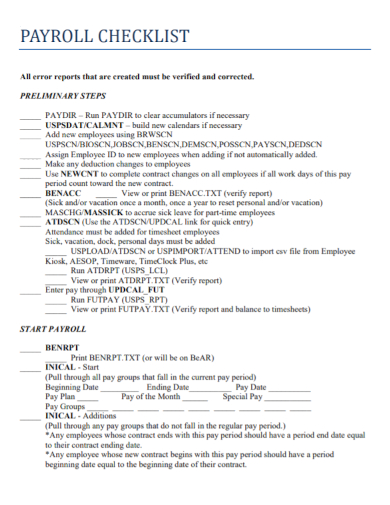

3. Payroll Checklist

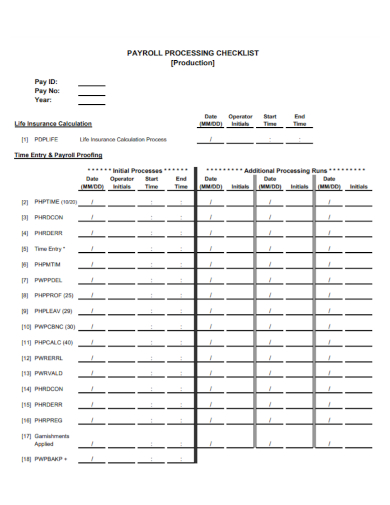

4. Payroll Process Checklist

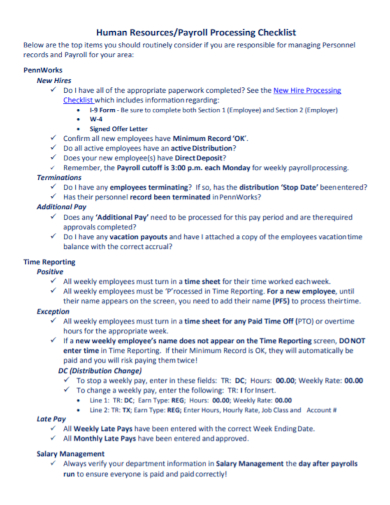

5. Human Resources Payroll Checklist

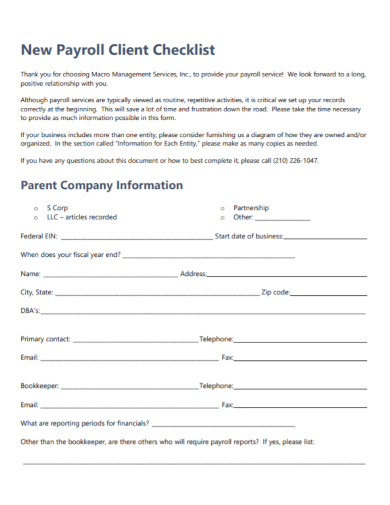

6. Payroll Client Checklist

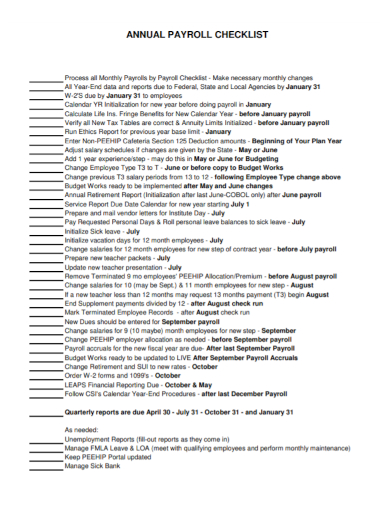

7. Annual Payroll Checklist

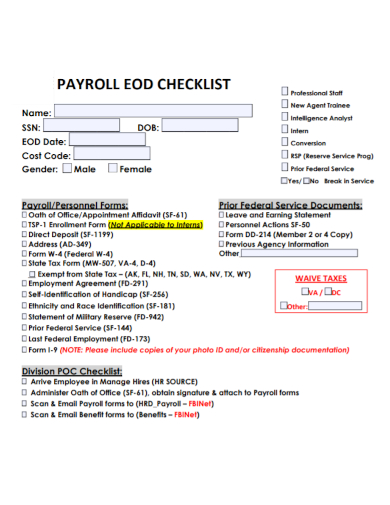

8. Payroll EOD Checklist

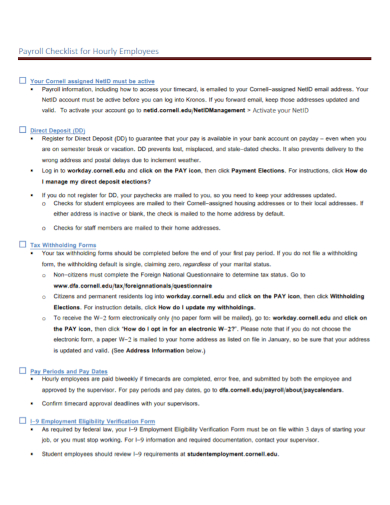

9. Hourly Employees Payroll Checklist

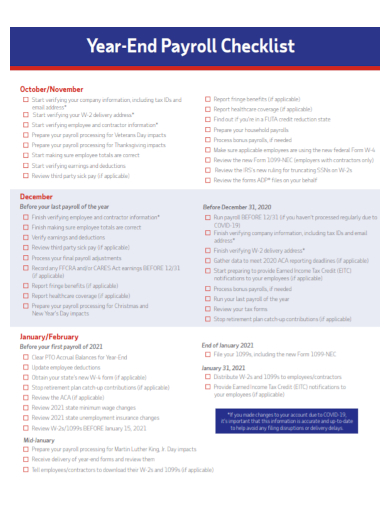

10. Year-End Payroll Checklist

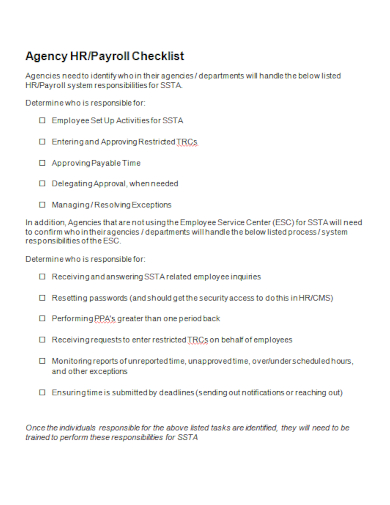

11. Agency Payroll Checklist

What is a Payroll?

Payroll is the process of paying employees in a business for the services they rendered, track the hours the employees worked to calculate the employees’ pay, and distribute the payments by direct deposit to the employees’ bank accounts or by check.

Details to Include in a Payroll Checklist

Using a sheet of paper and a writing instrument, list the following details mentioned below. This will be the basis of your checklist. You can add or omit some of the details below depending on your company’s requirements for payroll.

- Employer identification number (EIN) for tax purposes

- State and local tax identification numbers for taxation and recordkeeping

- Employees’ tax information

- Employees’ wage or salary information

- Employees’ direct deposit information if the company use bank accounts to deposit payment

- Federal and state withholding accounts to hold deducted taxes until paid to respective recipients

- Payroll budget account

- Payroll schedule

- Direct deposit service or paper checks

- Tax payment schedule

How to Do the Payroll Process

1. Review the Employee’s Information

Review all of the employees’ information relevant to payroll (look out for the full name and mailing address of the employee, tax withholding, employment status, job title, salary amount, commissions, and benefits since they can be change any time) before running the payroll to ensure you there are no mistakes.

2. Calculate Gross Pay and Net Pay

Calculate how much money each employee will receive before deductions. This will be the gross pay. Make sure to include the information in the payroll.

Next is to calculate how much money will be deducted from the employee’s pay for taxes and withholdings. Calculate the contributions such as benefits, health savings account contributions, retirement fund contributions, and reimbursement for expenses. Next, calculate the taxes and withholdings such as federal and state income tax, local taxes, medicare, and social security withholdings. Once you know how much money will be taken out of each employee’s paycheck for the details mentioned above, subtract the money from their payment amount. This will be the net pay or also called the take-home pay of the employee.

3. Conduct a Final Review

Before depositing the payment or writing the check, make a final review of all calculations to identify any information discrepancies. Correct them right away if you spotted them. Don’t forget to provide your company’s stakeholders payroll reports to make them aware of the budget and the payment that the employees receive.

4. Pay the Employees

It’s time to pay the employees. Print and sign the paper checks and enter the payment in each employee’s bank account and approve the direct deposit. Deposit the money withheld from the employee’s payment for the state, local, and federal taxes, retirement funds, and benefits providers.

FAQs

What are the different types of payroll schedules?

The different types of payroll schedules are monthly, semi-monthly, bi-weekly, and weekly.

Is payroll officer a good career?

Working in payroll accounting is a stimulating career for accountants to keep their focus and give a sense of satisfaction at the end of the day when their work is done. It helps develop organizational and management skills.

The payroll checklist above is a guide for you on how to properly do the payroll so make sure your checklist doesn’t omit any important details. However, your checklist can greatly depend on your company, but if you’re a starting business and don’t have any experience in payroll, this sample checklist is perfect for you. To help you get started, download our sample templates above to use as your guide!

Related Posts

FREE 17+ Response Checklist Samples in MS Word | Google Docs | PDF

FREE 17+ Survey Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Background Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Facilitator Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Complaint Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Internship Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Statement Checklist Samples in MS Word | Google Sheets | PDF

FREE 20+ Voluntary Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Summary Checklist Samples in MS Word | Google Sheets | PDF

FREE 14+ Sponsorship Checklist Samples in MS Word | MS Excel | PDF

FREE 18+ Conference Checklist Samples in MS Word | Google Sheets | PDF

FREE 17+ Lesson Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Progress Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Enrollment Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Graduation Checklist Samples in MS Word | Google Sheets | PDF