Are you working on your retirement? Perhaps you are very much concerned about how you will survive the possible risks which could derail your retirement and your whole life. There are times that you’re thinking about inflation, healthcare costs, rising interest rates, long-term care, and many more things that you might be worrying about right now. So what do you need to do first when planning your retirement? One of the things that you should consider is having a retirement income checklist. Read on in this article as we share relevant steps that will help you in this matter.

FREE 10+ Retirement Income Checklist Samples

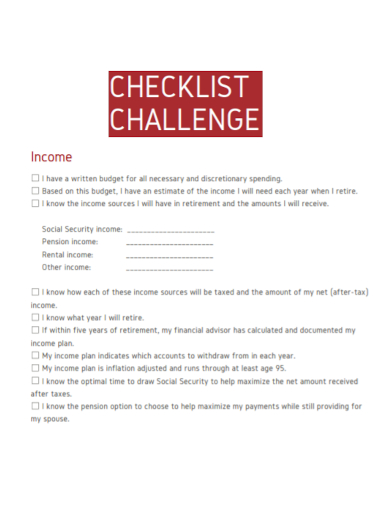

1. Retirement Income Challenge Checklist

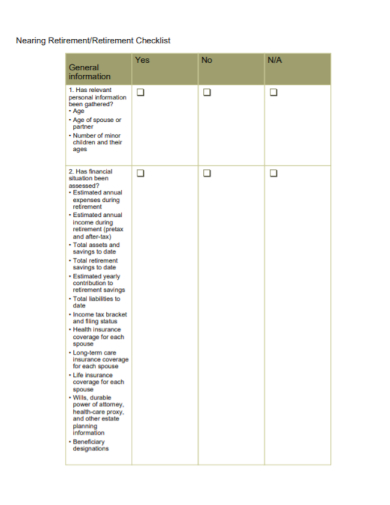

2. Retirement Income Information Checklist

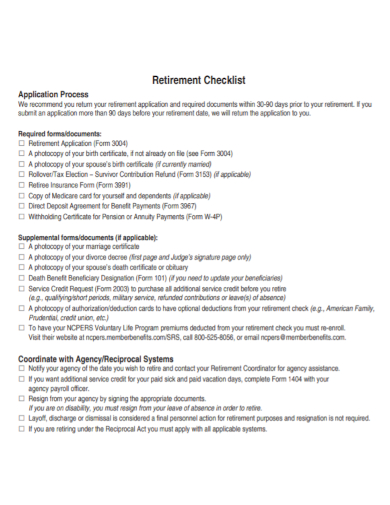

3. Retirement Income Process Checklist

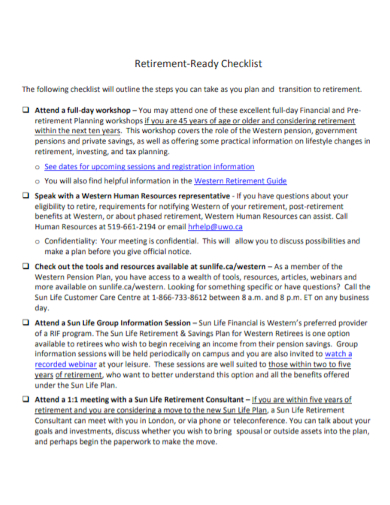

4. Retirement Ready Income Checklist

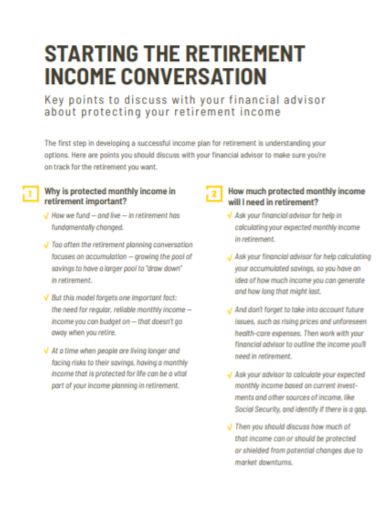

5. Retirement Income Conversation Checklist

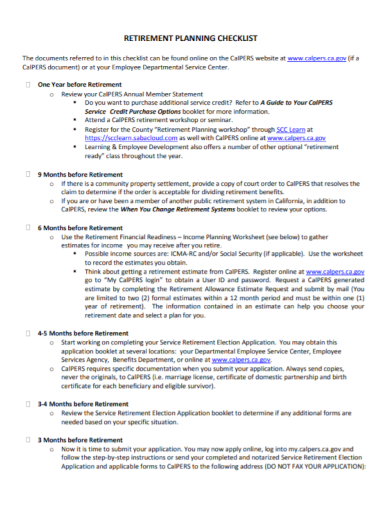

6. Retirement Income Planning Checklist

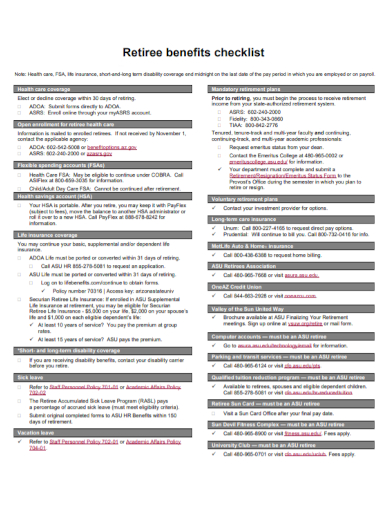

7. Retirement Income Benefit Checklist

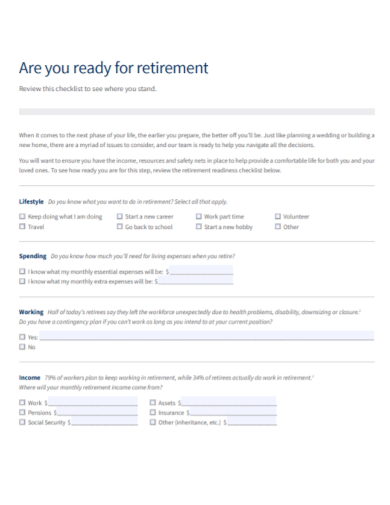

8. Editable Retirement Income Checklist

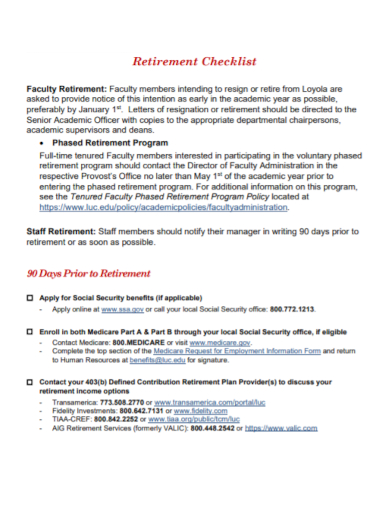

9. Faculty Retirement Income Checklist

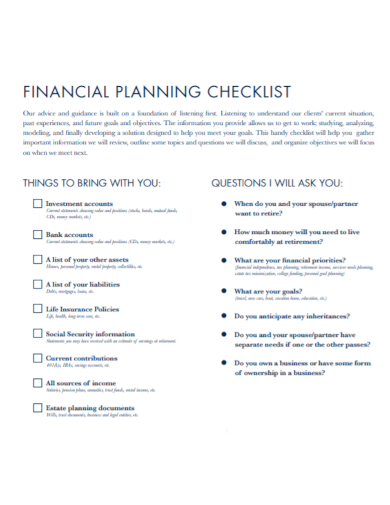

10. Retirement Financial Planning Income Checklist

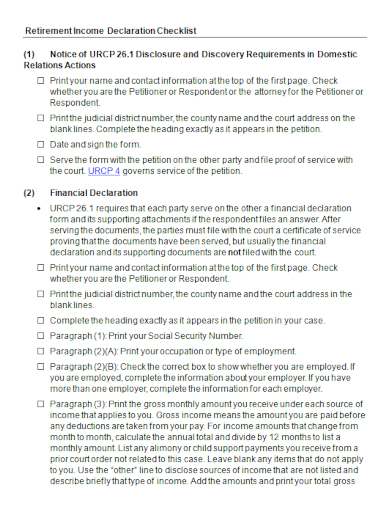

11. Retirement Income Declaration Checklist

What is a Retirement Income Checklist?

There are many aspects when you are planning for your retirement. When creating and implementing plans, a retirement income checklist serves as a guide that prevents your effort into waste. It will help you determine the things done and missed out. It helps you to keep track of your financial statements and income sources, investment assets, and how closer you are in reaching your goals and objectives of your retirement plan.

How to Create a Retirement Income Checklist

Creating an employee retirement income checklist enables you to monitor and control your income sources easier. You may use a retirement income calculator to calculate your income accurately. On the other hand, our retirement income checklist templates provide you more convenience that works accordingly with your plans. Here are the following steps that guide you after downloading:

1. Establish your retirement goals and objectives

Know the things that you want when you are considering your retirement. Check your income and examine how much money that you need to spend during your retirement. Do you have investment assets? Do you have other income sources right now? How much will your pension be? Use these questions to establish your retirement goals and objectives. You may discuss this matter with your financial planner or financial advisor. So, this information will help you to know if your present financial status is sufficient to provide you what you need down the road.

2. Analyze and evaluate your financial status

After showing every aspect of your financial life and exact guest estimates on what you want for retirement, you need to use the information such as your expenses, estimated taxes, income, and other things to research the number necessary for your retirement so that you may fully fund your retirement goals. Some details that you need to consider are spending goals, investment assets, current asset allocation, retirement date, and life expectancy.

3. Create an inventory of your assets

When you’re done evaluating your budget, include some information about your debt, liability, savings balance, income stream, and insurance policy, as well as your properties, vehicles and more. So, create an inventory worksheet of your assets so that you are able to assess your current financial condition and plan in an orderly manner.

4. Understand and apply retirement investments

Some of the good options for retirees are retirement income mutual funds, government bonds, real estate, closed-end funds, dividend income funds and annuities.So, you must decide the best option that is suitable for you. Sample checklist templates provide you efficiency and convenience because it usually lists all of the tasks necessary in a specific plan.

FAQ

Based on an article, a realistic retirement income recommended by retirement experts is somewhere near $1 million or 80% to 90% of your annual pre-retirement income or simply, 12 times your pre-retirement salary. What is a realistic retirement income?

You need to multiply your current annual spending by 25. This means that you can safely get 4% of your retirement income every year.How to calculate my retirement income needs?

Business Insider suggested in their article that you need to have $3.45 million invested on the day you leave work. Your starting balance should be about $2.2 million in a taxable investment account. The five stages of retirement are pre-retirement, full retirement, disenchantment, reorientation, and reconciliation and stability. How much money do you need to retire comfortably at age 55?

What are the five stages of retirement?

There are many ways that you can do your retirement. Some examples of retirement plans are traditional plan, hybrid plan, cash balance hybrid plan, pension enquiry hybrid plan, and many others. So, creating a structured retirement income checklist is a big help for you when you get started your retirement. To help you in planning, download an income checklist template today so that you won’t miss out on any of your retirement planning tasks!

Related Posts

FREE 17+ Survey Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Background Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Facilitator Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Complaint Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Internship Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Statement Checklist Samples in MS Word | Google Sheets | PDF

FREE 20+ Voluntary Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Summary Checklist Samples in MS Word | Google Sheets | PDF

FREE 14+ Sponsorship Checklist Samples in MS Word | MS Excel | PDF

FREE 18+ Conference Checklist Samples in MS Word | Google Sheets | PDF

FREE 17+ Lesson Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Progress Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Enrollment Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Graduation Checklist Samples in MS Word | Google Sheets | PDF

FREE 15+ Consent Checklist Samples in MS Word | Google Sheets | PDF