As a client or buyer who wants to get a mortgage, it is possible to make your home your collateral for a loan. As you pay off the mortgage, lending firms will receive your payment and if you stop making those payments, they will take your home and offer it to potential buyers to recover their losses. In the same manner, investors can buy collateralized debt responsibilities and make these assets become collateral in case the original borrower stops paying. The documents that can be useful for lenders are loaner agreements, loan payment schedules, loan repayment agreements, loan payoff statements, loan spreadsheets, and more.

10+ Collateralized Debt Obligation Samples

1. Pricing a Collateralized Debt Obligation Sample

2. Risk and Risk Management Collateralized Debt Obligation

3. Basic Collateralized Debt Obligation Template

4. Collateralized Debt Obligations and Credit Risk Transfer

5. Risk and Valuation of Collateralized Debt Obligation Sample

6. Collateralized Debt Obligations by Trust Template

7. Collateralized Debt Obligation in PDF

8. Criticisms of Collateralized Debt Obligation Sample

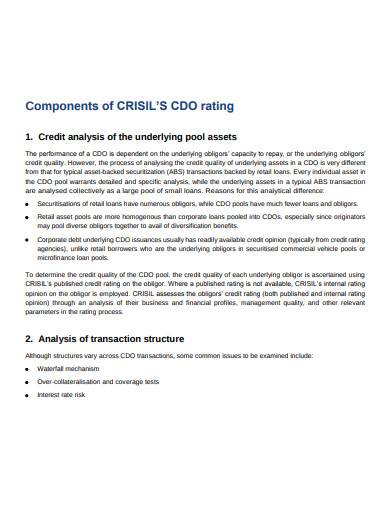

9. Components of Collateralized Debt Obligation Sample

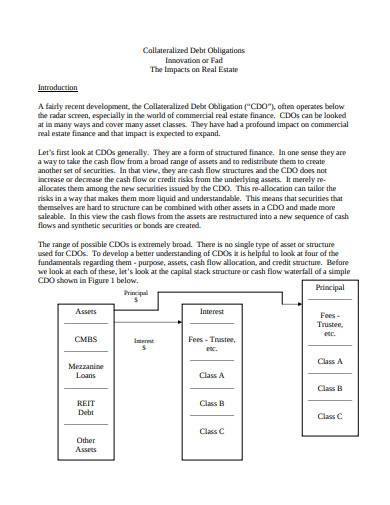

10. Real Estate Collateralized Debt Obligation Sample

11. Optimal structuring of Collateralized Debt Obligation in PDF

What is Collateralized Debt Obligation?

The collateralized debt obligation or CDO refers to the financial tools that banks utilize to recondition individual loans into products that will be sold to investors on the secondary market. Its value is from a contract agreement that repayments of underlying debt will be made in the future or on a particular date. A collateralized debt obligation is also a synthetic investment contract on a product that represents various loans collected together and offered and sold in the market by a lender.

How to Create a Collateral Debt Obligation

The collateralized debt obligation is a type of derivative contract and synthetic investment product that categorizes various kinds of debt to provide a single investment product to institutional investors. It associates different loans and procures its value from underlying assets. Once a loan becomes default, an underlying asset will become collateral for the holder of the OCD. The said holder can collect payment from the original borrower as their loan period ends.

Step 1: Create a List of Pooled Assets

Banking firms create a list of all their pooled, both secured and unsecured, such as car loan agreements, mortgage loan agreements, commercial loan agreements, and more to be provided as a part of the collateral debt obligation.

Step 2: Provide a Diversified Portfolio

After creating the list, the bank will start with the collection of different loan assets like loans issued by corporates and individuals, the bonds that corporates invested in, mortgages, and other types of debt such as credit card receivables. Then this portfolio can be sold to an investment bank.

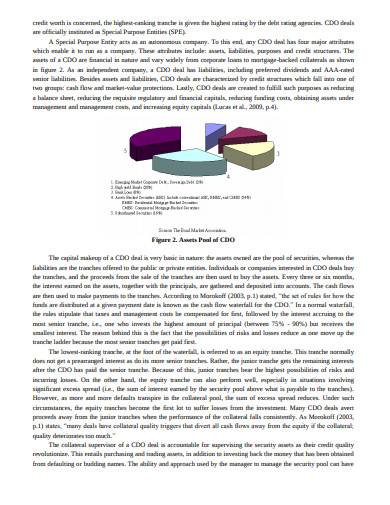

Step 3: Determine Tranches

The portfolio’s cash flows are categorized into a number of investable tranches which are characterized by the degree of their riskiness. These tranches are the super senior which has the lowest rate for its interest, mezzanine financing which has moderate risk, and the junior tranche with the most risk but offers the highest interest rate.

Step 4: Sell These Tranches to the Investors

Tranches are offered based on the risk appetite of certain groups of investors. Senior tranches are commonly sold to groups that look for highly-rated instruments like a pension fund while the lowest-rated tranches are commonly retained by a CDO issuer.

FAQs

What are the benefits of collateralized debt obligations?

With collateralized debt obligations, banks can reduce the amount of risk in holding their balance sheets and enable them to transform relatively illiquid security into relatively liquid security.

What are the common reasons for selling CDOs?

Collateralized debt obligations are often sold to investors by banks because the funds they will receive give them more case to create new loans, moves the loan’s risk of default from the bank to the investors, and provides banks with new and more products to sell which drives more profit.

What are the different kinds of collateralized debt obligations?

The different types of collateralized debt obligations are mortgage-backed securities, asset-backed securities, collateralized bond obligations, and collateralized loan obligations.

A collateralized debt obligation is a complex structured finance product that is supported by a collection of loans and other types of assets that are sold to institutional investors. It is a type of derivative security for the reason that its amount is derived from underlying assets. Banking firms package together various assets such as bonds, mortgages, and other kinds of asset-generating securities into a separate class of investment.

Related Posts

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]