No entrepreneur becomes successful in a day—in the same way, no one becomes an entrepreneur in a day. As the old saying goes, “nothing of worth ever comes easy.” This ranges from something as simple as having daily bottle-flipping sessions daily to get the perfect shot, to understanding the intricate aspects of accounting. As such, a training program focused on finance skills proves to be quite a useful investment in improving your company’s competence.

What are Finance Skills?

Cash flow analyses, budget plans, and financial spreadsheets: what these documents have in common is that they require expertise honed from years of understanding. A single mistake in the calculations and your document will become the source of scrutiny, fraud claims, and—worst-case scenario—lawsuits and court appearances. How is this relevant? Because these colossal problems can be well avoided by having competent staff able to handle financial dilemmas. With that said, financial skills are what various corporations and businesses seek in new recruits. However, it’s also these abilities that employers want to incorporate into their tenured employees. Businesses that have individuals trained in the art of money management are the most successful in this day and age.

Essential Training Programs

Most everyone has gone through the experience of being a brand new employee on their first job. The feeling of undergoing a new process and system is not uncommon among fresh recruits and is natural in this circumstance. However, lack of experience and knowledge shouldn’t be an excuse not to reach for excellence in your field of duty. The effective utilization of training programs, coaching sessions, and skills enhancement activities isn’t a tool that’s exclusive to financial abilities, but for all types and varieties of work.

10+ Finance Skills Samples

With the importance of money management and financial skills, it’s best to have a few training action plans and other types of sample templates that can assist you in your employee-enhancement crusade.

1. Finance Skills Sample

2. Trustee Finance Skills Template

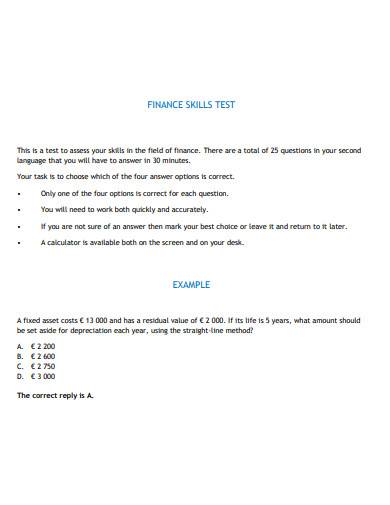

3. Finance Skills Test Sample

4. Skills for Future Finance Professionals Template

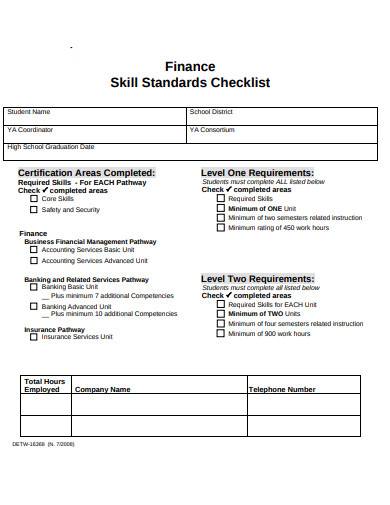

5. Finance Skill Standard Checklist Sample

6. Personal Finance Skills Sample

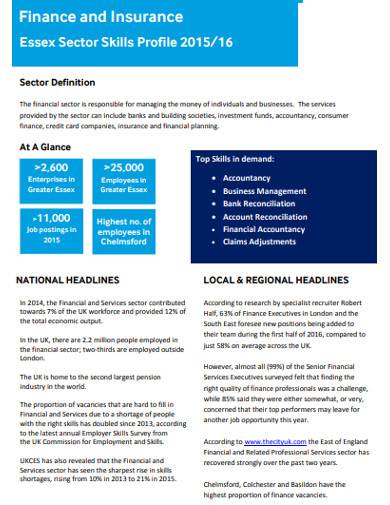

7. Finance and Insurance Skills Template

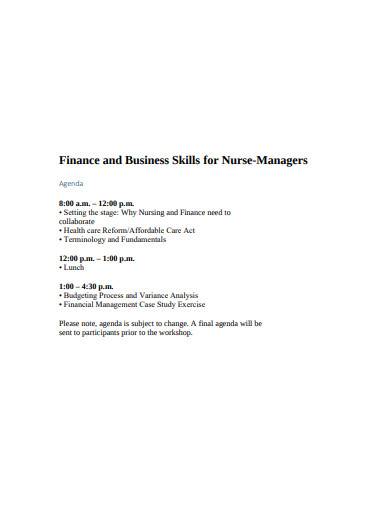

8. Finance and Business Skills for Nurse Managers Template

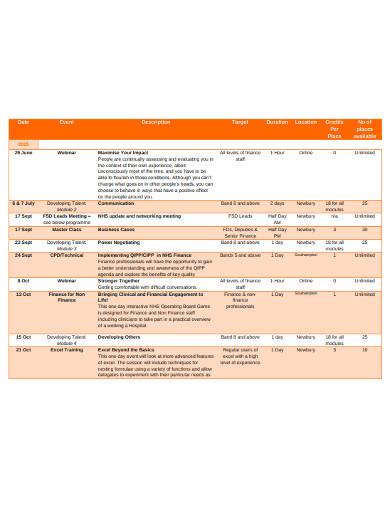

9. Finance Skills Development Programme Sample

10. Pensions Finance Knowledge and Skills Framework Template

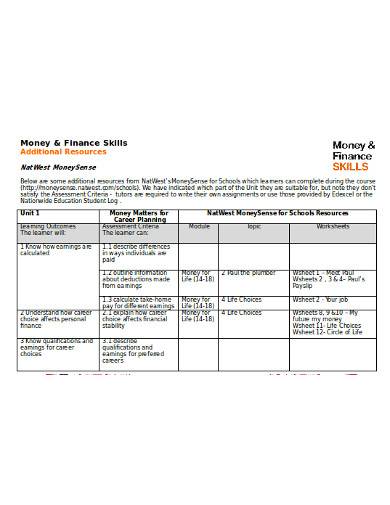

11. Money and Finance Skills in DOC

How to Create a Financial Skills Plan

As convenient as it would be to upload financial skills into your employees like software programs on a computer, unfortunately this isn’t the case. Training employees is a lot more hands-on and requires time and effort. However, the payoff is a more competent workforce who won’t run away every time the words “someone audit these transactions” is said in the office. With that said, drafting your training plan requires a balance of finesse, authority, and compassion, or you could follow the general tips given below for convenience.

1. Establish Training Goals

Your training goals should be achievable, practical, and coincide with what your company needs. Do not expect to have a team of fully-fledged financial auditors and expense inspectors within a day. Rather, it’s best to take it slow, and slowly—but surely—hone their financial skills to near perfection.

2. Observe Progress

It is said that it takes 21 days for a human being to develop a habit, so use this to your advantage. Allow your employees to master their techniques one at a time before slowly moving up the ranks to more complicated tasks. For example, you can begin with simply comparing the budget report with the receipts given on certain project expenditures as this is simple to do for many people.

3. Target Weakpoints

Whether you target weakpoints as a team or individually, addressing the chink in your company’s armor is crucial to establishing a powerful team. It’s best to have coaching sessions that are designed to improve on these vulnerabilities to strengthen your employees as a whole. Remember that you’re only as strong as your weakest link, so make sure that everyone can pull their own weight of financial pressure.

4. Encouragement is Crucial

Though less about financial skills and more about training as a whole, encouraging your team always yields better results than treating them like a pack of animals. Praise little achievements and make them feel like they are individuals capable of learning the necessary financial skills needed to succeed. Slow progression is still steps made towards your end goal, and it’s better to create a high-quality team of financial titans overtime than to rush and tire them out before they even reach a small checkpoint.

Though financial skills are important to running a business, your goal shouldn’t be to force-feed them onto your employees. Rather, if you want effective and high-quality outputs from your workforce, then take the time and effort to train and assist them in their progress. Remember that at the end of the day, skills and abilities only matter if the individual is willing to share them in the name of the company’s advancement.

Related Posts

9+ Resume Example for Student

11+ Sample Student Request Form

12+ Director Job Description Sample

10+ Sample Financial Manager Job Description

9+ Commercial Manager Job Description Sample

13+ Internship Cover Letter -

9+ Sample Personal Brand Statement

40+ Fresher Resume Examples

6+ Sample Financial Reference Letter Template

9+ Chief Financial Officer Job Description Sample

40+ Sample objective

14+ Sample Accountant Resume

12+ Skills Inventory Templates

6+ Sample MBA Marketing Resume

9+ Senior Director Job Description Sample