10+ Financial Projections Samples

Everyone wants to see what’s in store for them in the future, and for businesses, any entrepreneur would like to know the state of their business in a few years. Financial predictions let you determine when you could require finance and when it’s optimal to invest in capital. They assist you in keeping track of cash flow, adjusting pricing, and changing manufacturing schedules. Need some help with yours? We’ve got you covered! In this article, we provide you with free and ready-made samples of Financial Projections in PDF and DOC format that you could use for your benefit. Keep on reading to find out more!

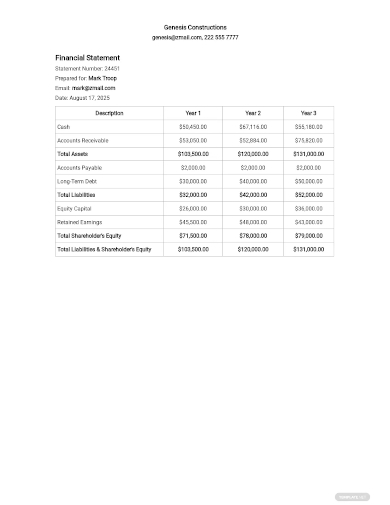

1. Financial Projections 3 Years Template

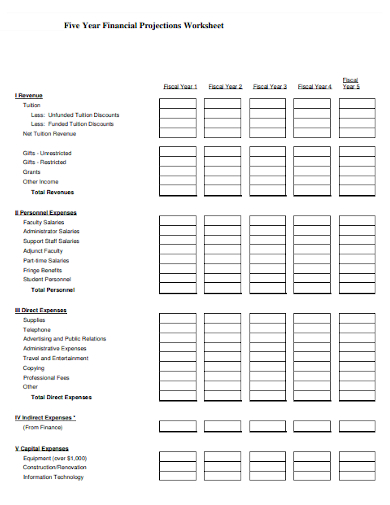

2. Five Year Financial Projections Worksheet

3. Financial Projections for Health Plans

4. Financial Projections and Analysis

5. Sample Financial Projections

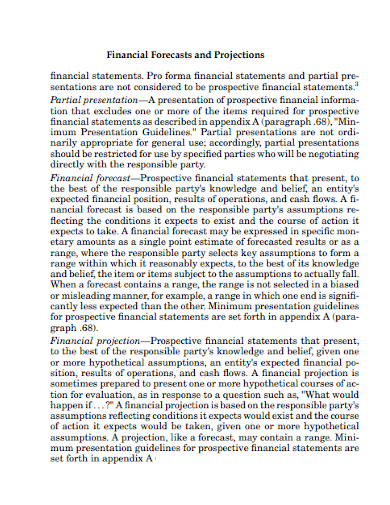

6. Financial Forecasts and Projections

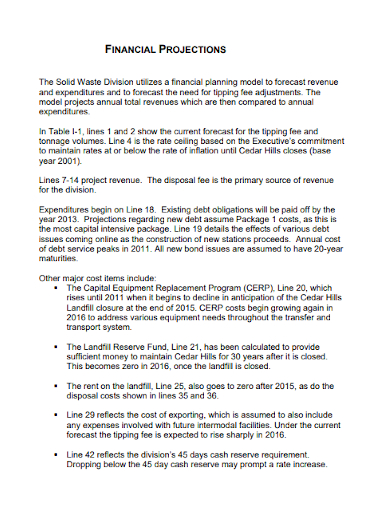

7. Basic Financial Projections

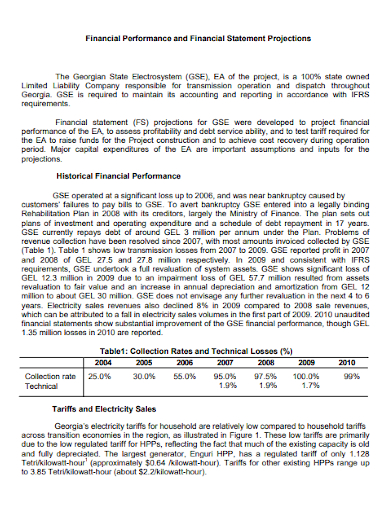

8. Financial Performance and Financial Statement Projections

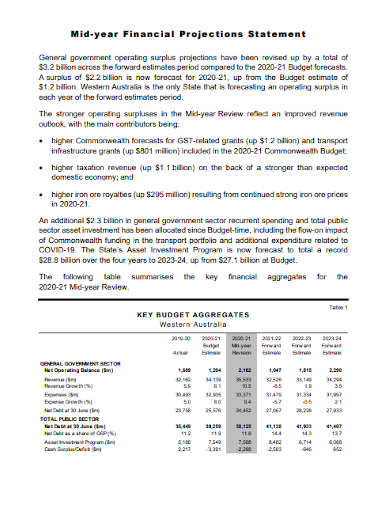

9. Mid-year Financial Projections Statement

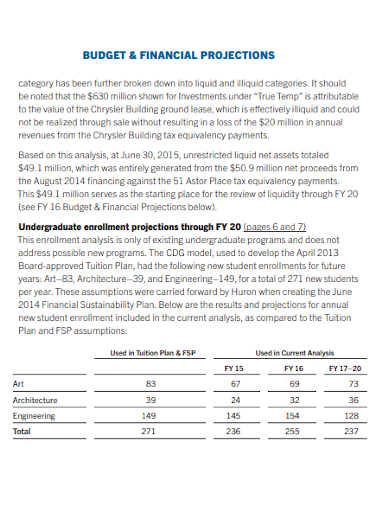

10. Budget & Financial Projections

11. Financial Projections in a Social Services Agency

What Is a Financial Projection?

A financial prediction is what your company anticipates to happen in the future, based on hypothetical scenarios and the facts and data you know. A financial estimate is frequently created to propose a plan for consideration. It’s a pro forma declaration of some sort. Projected income statements, balance sheets, and cash flow statements are examples of pro forma financial statements.

How to Make a Financial Projection

Financial predictions assist you in realizing your company’s potential. A Financial Projection Template can help provide you with the framework you need to ensure that you have a well-prepared and robust projection on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Make a sales projection.

The first thing you need to check is the driving force behind your sales. With your projections, you should start there. For current organizations, you may use financial documents to make estimates based on prior performance. For example, if your sales are stronger in the summer and fall, you should factor it into your forecasts.

2. Make a budget prediction.

It’s easier to estimate probable spending than it is to predict the buying patterns of present or potential consumers, so creating an expense projection may appear to be a little easier at first.

3. Make a prediction for the income statement.

Connect those assumptions to the income statement’s calculations. Revenue, net revenue, COGS, gross profit, gross margin, operating profit, and operating margin will all be forecasted by the financial model. The predicted income statement is the financial model’s output.

4. Make a cash flow forecast.

The cash flow statement is the final stage in completing your financial projection. The cash flow statement is linked to both the income statement and the balance sheet, and it shows any cash or cash-related transactions that have an impact on your organization. If your firm has been active for at least six months, you may utilize your current cash flow statement, while those in the start-up phase can use the data you’ve gathered to build a plausible cash flow estimate.

FAQ

What is the significance of financial projection?

Financial predictions allow you to determine when you could require finance and when it’s optimal to invest in capital. They assist you in keeping track of cash flow, changing pricing, and altering manufacturing schedules.

How do you assess financial forecasts?

Financial prediction and analysis is a company’s internal procedure for explaining current earnings and growth.

What are the financial prediction assumptions?

Assumptions are logical components that are utilized to construct a projection. They go over each revenue and expense assumption in depth. The assumptions will, for example, specify the expected sale price and the projected cost per unit of a certain raw material.

Financial forecasts are an important component of drafting a business plan for a new firm or building a strategic strategy for your present organization. They are frequently used to attract potential investors. To help you get started, download our easily customizable and comprehensive templates of Financial Projections today!

Related Posts

Sample Meeting Minutes Templates

Presentation Speech Samples & Templates

Ukulele Chord Chart Samples & Templates

Retirement Speech Samples & Templates

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]