Getting a health insurance is one of the basic considerations that Americans and other nationalities make in order to have a better and more convenient life. True to this is the enactment of the Affordable Care Act (AFA) by the US government in 2013 in which it provides a wider range of freedom and choices to employees of certain industries in the kind and scope of health insurances that they can avail. Under the act, employers are required to notify their employees, both new and old, of the provisions of the act through a health insurance exchange notice which contains options provided to employees to look for health insurance that fits their needs and budget.

These options are mainly provided by a Marketplace or an Exchange which serves as a “one-stop shopping” of available health insurances that an employee can avail after a considerable time of comparing their pros and cons. To free us from confusion, this article answers the most relevant questions pertaining to this health insurance exchange notice. To help you understand more about this notice, you can download our free Health Insurance Exchange Notice Samples tailored fit according to your organization’s needs. Keep reading.

10+ Health Insurance Exchange Notice Samples

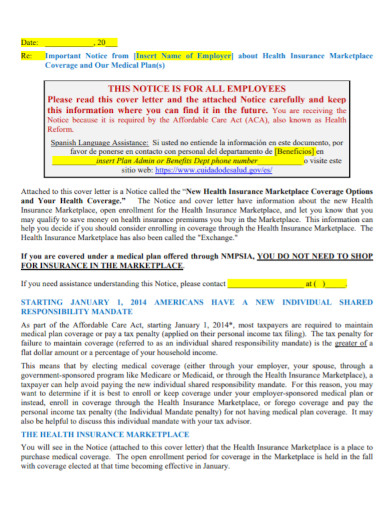

1. Health Insurance Exchange Required Notice

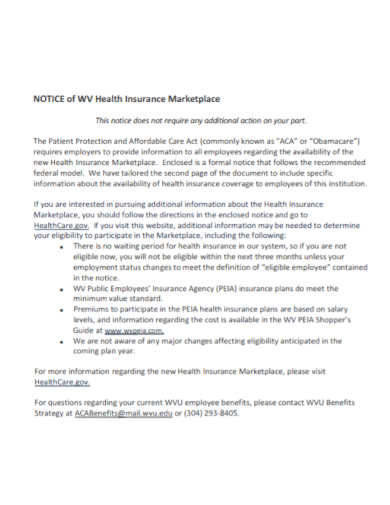

2. Notice of Health Insurance Benefit Exchange

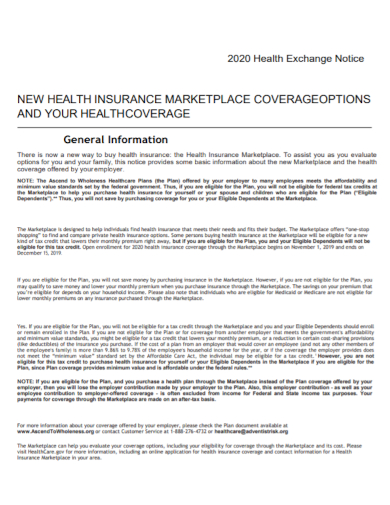

3. Health Insurance Marketplace Employee Notice

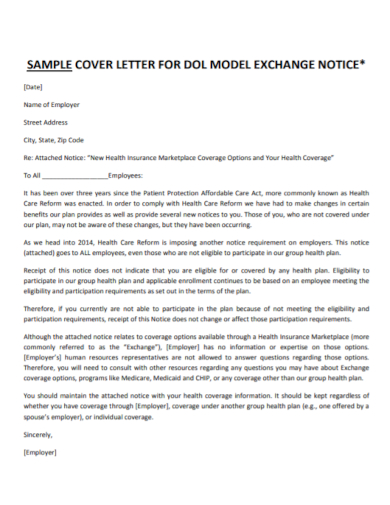

4. Health Insurance Marketplace Summary Notice

5. Medical Health Insurance Marketplace Notice

6. Notice of Health Insurance Marketplace

7. Health Insurance Exchange Coverage Notice

8. Notice of Affordable Health Insurance Exchange

9. Cover Letter for Health Insurance Exchange Notice

10. Notice of Health Care Insurance Exchange

11. Health Care Reform Insurance Exchange Notice

Some things to know on the Health Insurance Exchange Notice of a company

- Why do employees receive this notice?

Companies and institutions are required by the US Federal Law to provide a Health Insurance Exchange Notice to all their employees every year. New recruits also receive this notice within 14 days of their hire dates. This is to inform and remind employees that they have the freedom to unenroll from their employer’s default health insurance and they can avail of any of the health insurances available in the exchange instead.

- What employees should do when they receive the notice?

Upon receiving the notice, the employees are not required to take any action if they are satisfied with the health insurance coverage provided to them by the company. Likewise, they have the option to avail of the health insurances available in the exchange if they see that it suits them better. If the employee wants to know more about particular insurance in the exchange, their employers have no responsibility to discuss it with them and they should be the ones who should take such initiative.

- When can an employee apply for an insurance coverage in the exchange?

The application period for insurance coverage enrollment starts in November of every year. However, an individual is also eligible to apply due to certain circumstances such as losing coverage or having just been qualified for Medicaid or CHIP. Other life changes which make a person eligible to apply at any time of the year include having a child or getting married.

- Can workers apply for a coverage for their dependents?

The exchange offers many different kinds of health insurance coverage according to the needs, income bracket, type of industry, and even the number of years employed in a company, among other categories. Thus, there are private companies that also cater to workers who want to enroll their family members and dependents.

- Can workers revert to their employer’s insurance coverage if they decide to unenroll in the exchange coverage that they currently have?

An employee can enrol back to their employer’s health insurance coverage if they see that exchange coverage doesn’t meet their expectations or their needs. It only depends on the employer’s schedule as to when they will be able to attend to the re-enrolment of specific employees.

FAQs

These are the conditions or situations that go beyond the coverage of the health insurance.What is exclusion or limitation in health insurance coverage?

What is a HMO plan?

HMO stands for Health Maintenance Organization and is a healthcare and financing system that guarantees comprehensive health coverage identified by company employers and geographical area.

What does premium health coverage mean?

It is a type of health insurance that has certain inclusions according to the amount of contribution of both employee and employer.

The Exchange, as a government monitored entity, makes it easier for workers to buy a health insurance coverage from a private company that understands their financial conditions as well as other aspects of life that can affect their financial capacity.

However, the sustainability of this effort still depends on the commitment of businesses to provide the best working conditions for their employees and on the steadfastness of the employees to take advantage of the rights given to them. Either way, its success is reflected in the worker’s workmanship and the quality of output they give towards achieving the goals of the company, and their confidence that the company takes care of them in terms of their health and well-being.

Related Posts

Sample Chart of Accounts Templates

FREE 10+ Business Travel Report Samples [ Market, Industry, Trip ]

FREE 10+ Business Debt Schedule Samples in PDF | MS Word

FREE 17+ Branding Proposal Samples in PDF

FREE 10+ Art Gallery Business Plan Samples in MS Word | Pages | Google Docs | PDF

FREE 6+ Acknowledgement for Audit Report Samples in PDF

FREE 7+ Account Bookkeeping Samples in PDF | MS Word

FREE 10+ Accident Sketch Parking Lot Samples in PDF | MS Word

FREE 7+ 30 60 90 Day Business Plan Samples in MS Word | Google Docs | Pages | PDF

Monograph

Key Log

Report Writing

Discharge Summary

Research Report

Sample Tender