Both general and limited partners must be present in a limited partnership. General partners have limitless liability and complete authority over the company. Limited partners have little to no management responsibilities, but their liability is limited to the amount they invested in the LP. A limited partnership deed protects your firm in the long run by laying up each partner’s tasks and responsibilities, as well as how they share earnings. If you wish to form a limited partnership or legalize an existent limited partnership, you should utilize a limited partnership agreement.

8+ Limited Partnership Deed Samples

A partnership is a business established and operated by two or more people. General partnerships, limited liability partnerships, and limited partnerships are the three forms of partnerships. The final sort of partnership from the above list is established through a limited partnership agreement. A limited partnership is one in which one of the partners is a general partner and the other is a limited partner. The general partner is in charge of the company’s operations and has unlimited liability for its obligations. The limited partner, sometimes known as the silent partner, invests funds in the partnership but has no role in its management and is only liable for the amount of their contribution.

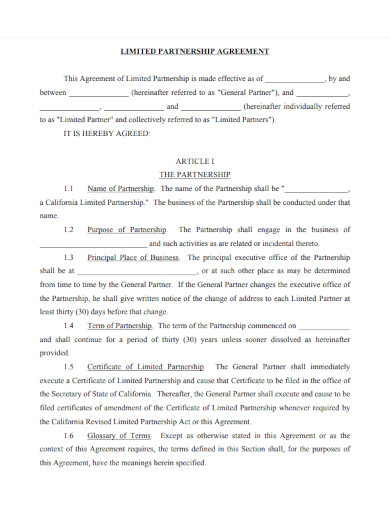

1. Limited Partnership Deed Agreement

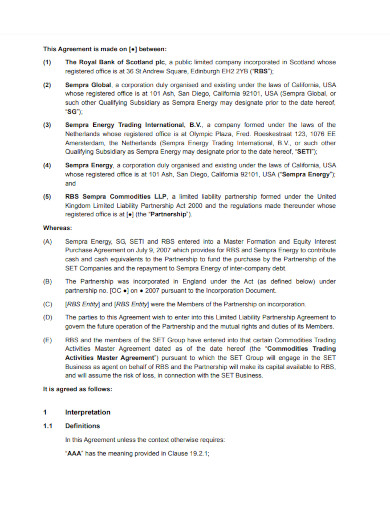

2. Limited Partnership Deed Agreement

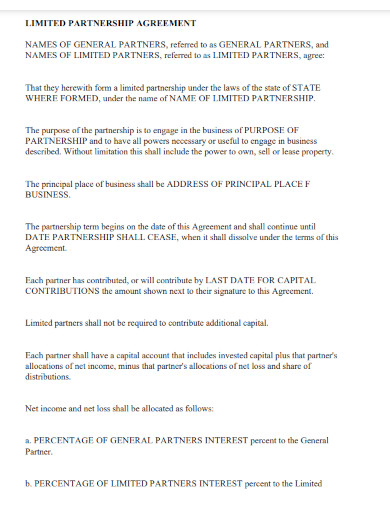

3. Limited Partnership Deed Agreement Example

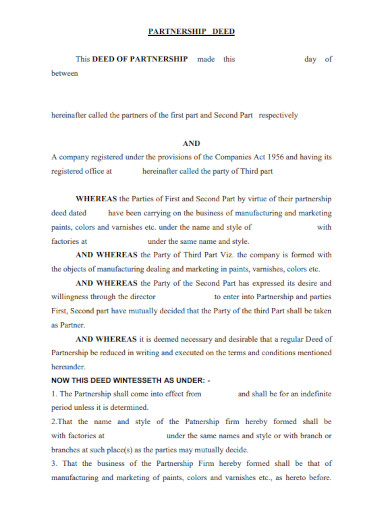

4. Sample Limited Partnership Deed

5. Amendment Limited Partnership Deed

6. Real Property Limited Partnership Deed

7. Partnership Deed Agreement between Two limited Companies

8. Limited Partnership Agreement Template

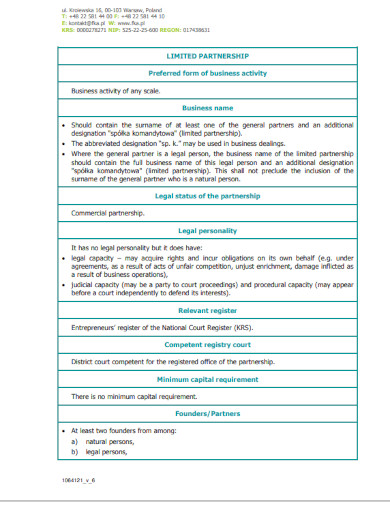

9. Limited Partnership Deed of business Activity

The general partner is identified in the Limited Partnership Agreement as an individual or another business. It also lists the main partner’s and limited partners’ ownership interests, profit percentage interests, and any special rights. In the Certificate of Limited Partnership that is submitted in Pennsylvania, the general partner(s) are also listed. The Limited Partnership will be formed by the Department of State. The Limited Partners do not have to be named in the Limited Partnership Certificate.

A Limited Partnership Agreement may cover the following topics, among others:

- The Limited Partnership’s Purpose in Business

- Duration of Existence

- Partners’ capital contributions

- Profit and Loss Distribution

- Net Cash Flow Distribution

- General Partner’s rights and responsibilities, as well as their limitations

- Employee hiring and dismissal

- Partners’ compensation

- Provisions for bonuses

- Decisions that require the approval of a small number of partners

- Obligations to buy and sell, options, or rights of first refusal

- Events that lead to the Limited Partnership’s demise and dissolution

- Provisions for people with disabilities

- Provisions for retirement

- Arbitration, mediation, or other forms of dispute settlement

A Limited Partnership must have a Limited Partnership Agreement. Limited Partnerships, unlike corporations, usually do not have bylaws, and their statutes provide less constraints than corporations. Limited Partnership Agreements may also include a “right of first refusal,” which allows the Limited Partnership or the other parties to purchase the partnership stake first, at a certain price, before it is marketed to outsiders. If an employee-partner dies, gets handicapped, or departs the Limited Partnership’s service, the Limited Partnership Agreement may oblige the individual to transfer his partnership interest back to the Limited Partnership or to the other partners.

FAQs

What is a joint venture?

A joint venture is a sort of general partnership that lasts until the project is completed or a set length of time has passed. All partners have an equal say in how the company is run and how much profit or loss it makes. They also have a fiduciary duty to act in the best interests of the venture and the other partners.

What is a partnership?

A partnership is a firm that is owned by two or more people. Limited partnerships, general partnerships, and limited liability partnerships are the three types of partnerships. The three versions differ in several ways, yet they all share some characteristics. Each partner in any type of partnership must offer resources such as property, money, talents, or labor in order to share in the profits and losses of the business. At least one of the partners is involved in the day-to-day operations of the company. Every partnership should have a contract that spells out how they will make business choices. These choices include how to distribute profits and losses, handle issues, change ownership structures, and, if necessary, terminate the company.

If you want to see more samples and formats, check out some limited partnership deed samples and templates provided in the article for your reference.

Related Posts

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]

FREE 24+ Sample Payment Schedules in PDF | MS Word

FREE 10+ Return to Work Action Plan Samples in PDF | DOC

Autobiography Samples & Templates