A memo, also called a legal memorandum, is a type of document that contains a written message. A memo is commonly used in various businesses in order to communicate with the different departments within the company. Memos are also used in board meetings, company reports, and for several other purposes.

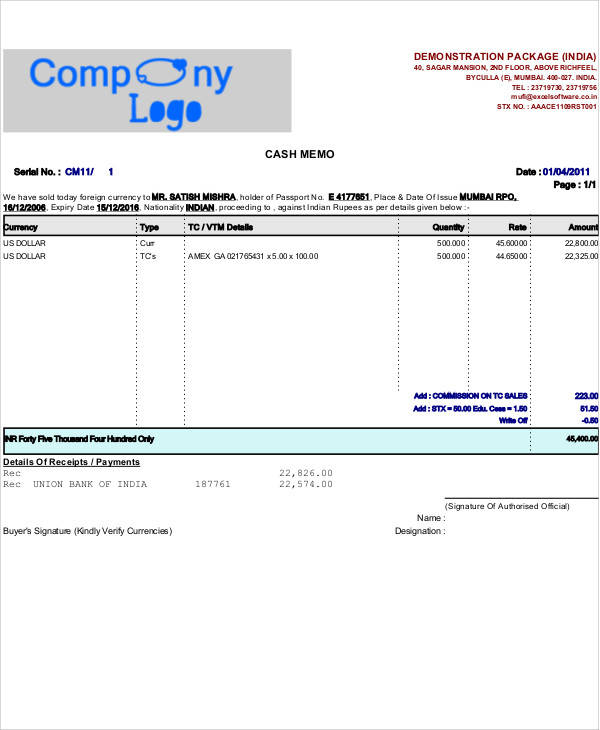

A business memo serves as a form of communication for employees in a business. Another example of a memo is a cash memo. This is used in businesses that provide goods and services. If you want to make a cash memo, you can download from the templates available on this page.

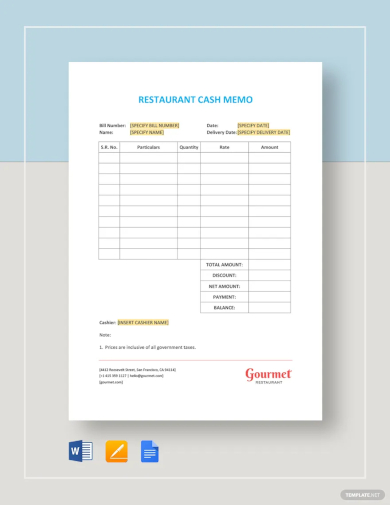

1. Restaurant Cash Memo Template

2. Sample Life Insurance Cash Memo Template

3. Sample Cash Memo Template

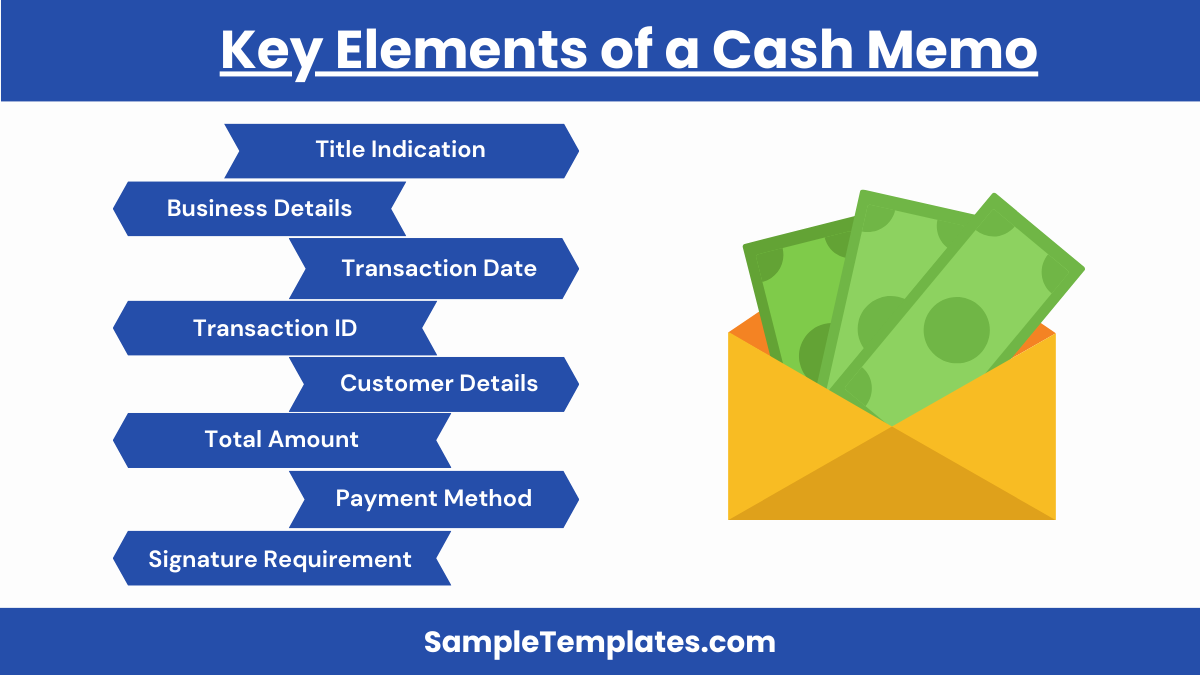

Key Elements of a Cash Memo

- Title: A cash memo typically bears the title “Cash Memo” prominently at the top, signaling its purpose.

- Business Information: The memo includes essential details about the business analysis, such as its name, address, contact information, and logo. This helps identify the seller or service provider.

- Transaction Date: The date of the cash transaction is specified to record when the sale or payment took place.

- Transaction Number: A unique identification number or sample reference number is assigned to each cash memo, enabling easy tracking and referencing.

- Customer Information: The name and contact information of the customer or buyer are recorded to establish their identity. You can also see more on Sample Memo.

- Description of Goods/Services: A detailed list of the goods or services sold is provided, including item names, quantities, unit prices, and any applicable taxes or discounts.

- Total Amount: The total cost of the goods or services is calculated and displayed, considering all relevant factors such as taxes and discounts.

- Payment Method: The cash memo specifies that the transaction was paid in cash. In some cases, alternative payment methods may also be mentioned.

- Signature: The cash memo may include spaces for the signatures of the seller and the customer, acknowledging the completion of the transaction.

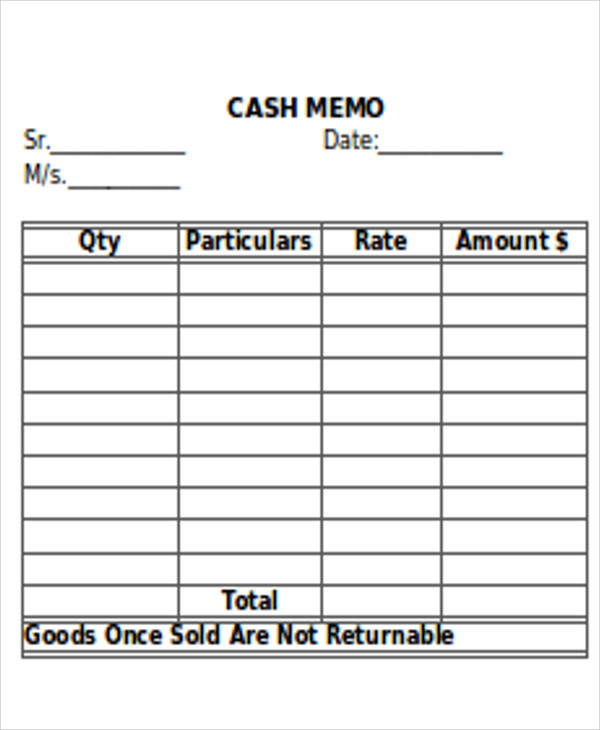

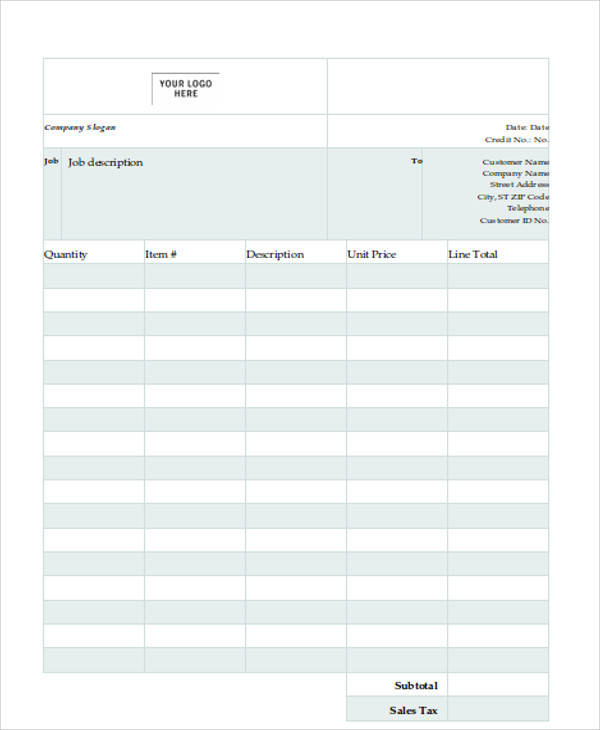

4. Cash Memo Template

5. Blank Cash Memo Template

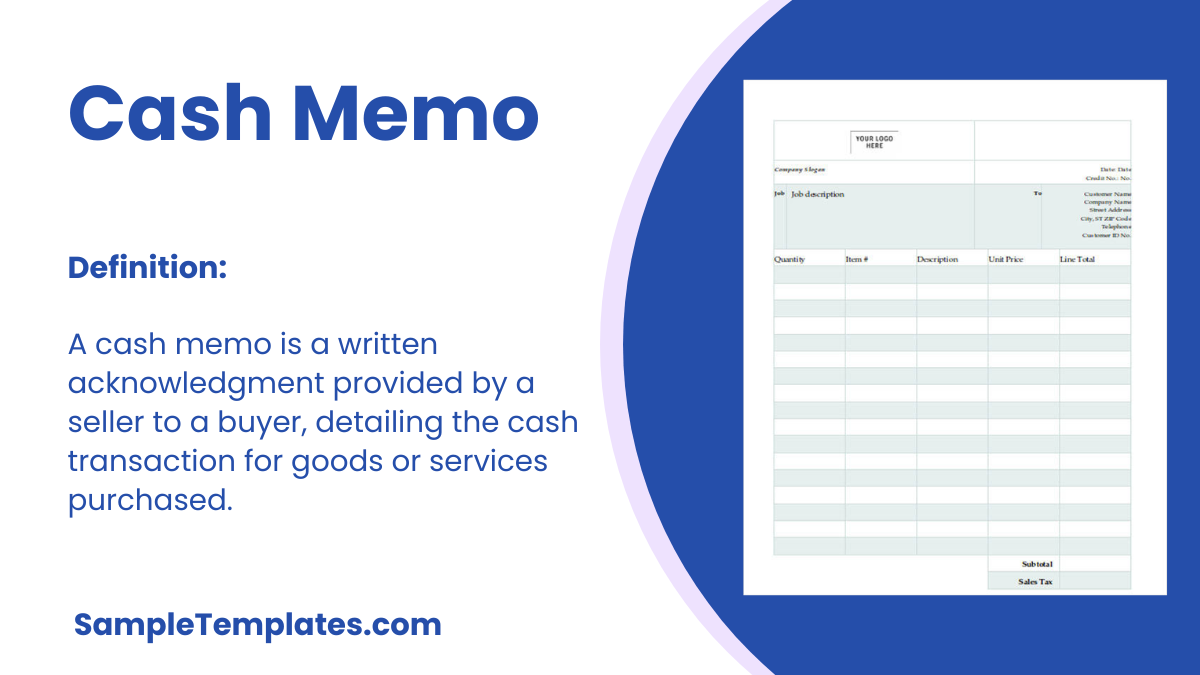

What Is a Cash Memo?

A cash memo is a written document commonly used in many business transactions. Similar to a receipt, a cash memo is given to a client or customer after a payment has been received by the business. The purpose of a cash memo in a business is to have a record of all the transactions of goods and services. A cash memo serves as a legal proof that the business has received the cash from the client. A standard memo template includes the date of purchase, items sold, information of both the seller and the buyer, and the total amount paid.

A cash memo, also known as a cash memorandum or a cash memo voucher, is a commercial document used in business transactions to record details of cash sales or cash payments receipt. It serves as a concise record of the transaction and provides proof of the exchange of goods or services for cash. In this comprehensive explanation, we’ll explore the key aspects of a cash memo, its purpose, content, and importance in business.

Purposes of a Cash Memo:

- Record Keeping: Cash memos are used to maintain a systematic record of cash transactions, providing a historical account of sales or payments.

- Proof of Transaction: They serve as legal proof of the transaction, documenting the exchange of cash for goods or services.

- Accounting and Bookkeeping: Cash memos play a crucial role in financial accounting and bookkeeping. They help in tracking revenues and expenses, which is essential for financial reporting and tax compliance.

- Customer Documentation: Cash memos provide customers with a document verifying their purchase, which can be useful for warranty claims or returns.

- Inventory Control: For businesses that sell goods, cash memos assist in inventory management by tracking the quantities of items sold.

- Tax Compliance: Businesses use cash memos to calculate and report sales taxes, which is essential for meeting tax obligations.

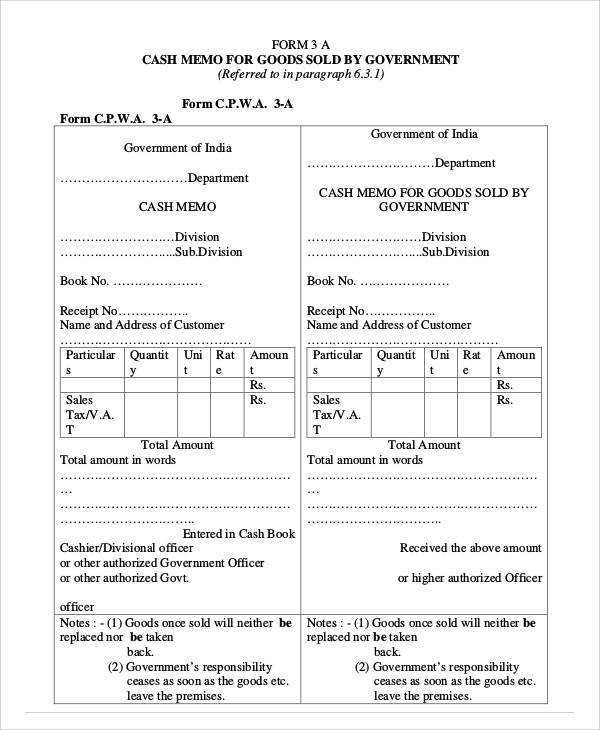

6. Sample Cash Memo For Goods Sold Template

Common Types of Cash Memos

Cash memos are documents issued by sellers to buyers during cash transactions, especially in retail settings. They serve as proof of purchase and detail the transaction between the two parties. Here are some common types of cash memos you might encounter:

- Retail Cash Memo:

- Usage: Commonly used in retail stores and supermarkets.

- Details Included: Lists items purchased, prices per item, total amount paid, and sometimes discounts or taxes applied.

- Restaurant Bill:

- Usage: Used in restaurants and cafes.

- Details Included: Itemizes the food and beverages ordered, their prices, the total amount including service charges or tips, and taxes.

- Petty Cash Memo:

- Usage: Used for recording small, routine expenses within a business, such as office supplies or minor repairs.

- Details Included: Details the nature of the expense, the amount spent, and who authorized the expenditure.

- Transport Cash Memo:

- Usage: Used by transport services like taxis, buses, and delivery services.

- Details Included: Includes details such as the route taken, distance covered, fare rate, and total fare.

- Service Cash Memo:

- Usage: Used by service providers such as salons, dry cleaners, and repair services.

- Details Included: Details the specific service provided, the cost of the service, and any taxes or additional charges. You can also see more on Cash Invoice.

- Wholesale Cash Memo:

- Usage: Used in wholesale transactions where goods are sold in bulk.

- Details Included: Lists bulk items sold, unit prices, total price, and often includes information about the buyer like GSTIN for tax purposes.

- Medical Cash Memo:

- Usage: Used by pharmacies and medical supply stores.

- Details Included: Lists medicines or medical supplies purchased, each item’s price, and total cost, including any discounts or insurance adjustments.

Each type of cash memo is tailored to the specific requirements of the transaction type, ensuring that all necessary details are captured for accurate record-keeping and accounting. You can also see more on Credit Memo.

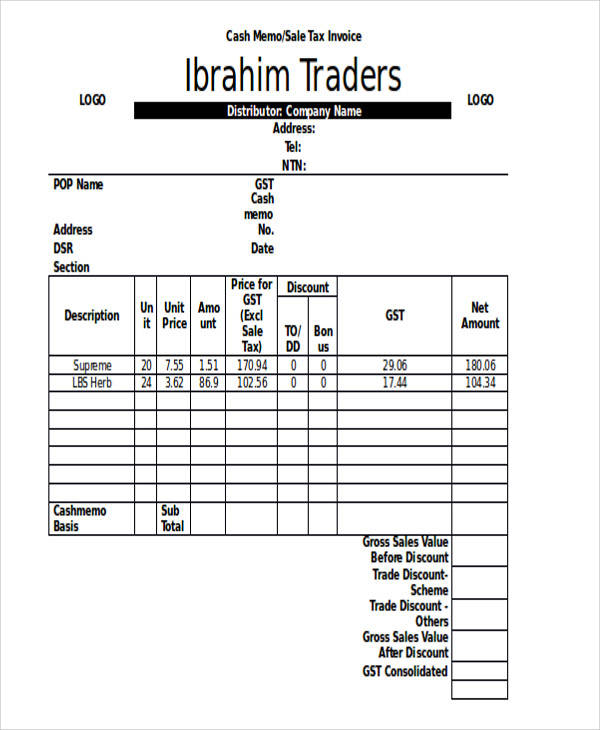

7. Cash Memo Format

Why Do We Use Cash Memo?

8. Editable Cash Memo Template

9. Printable Cash Memo Template

What Is the Difference between an Invoice and a Cash Memo?

An sample invoice and a cash memo are commercial documents essential in recording business transactions. An invoice and a cash memo have different uses in a transaction. An invoice is sent by the seller to the buyer after the goods and services have been delivered. It is used to request for a payment and indicates when a payment should be made. A memo, on the other hand, is given to the customer after he or she makes a payment. You can refer to a memo format sample if you need to format your memo.

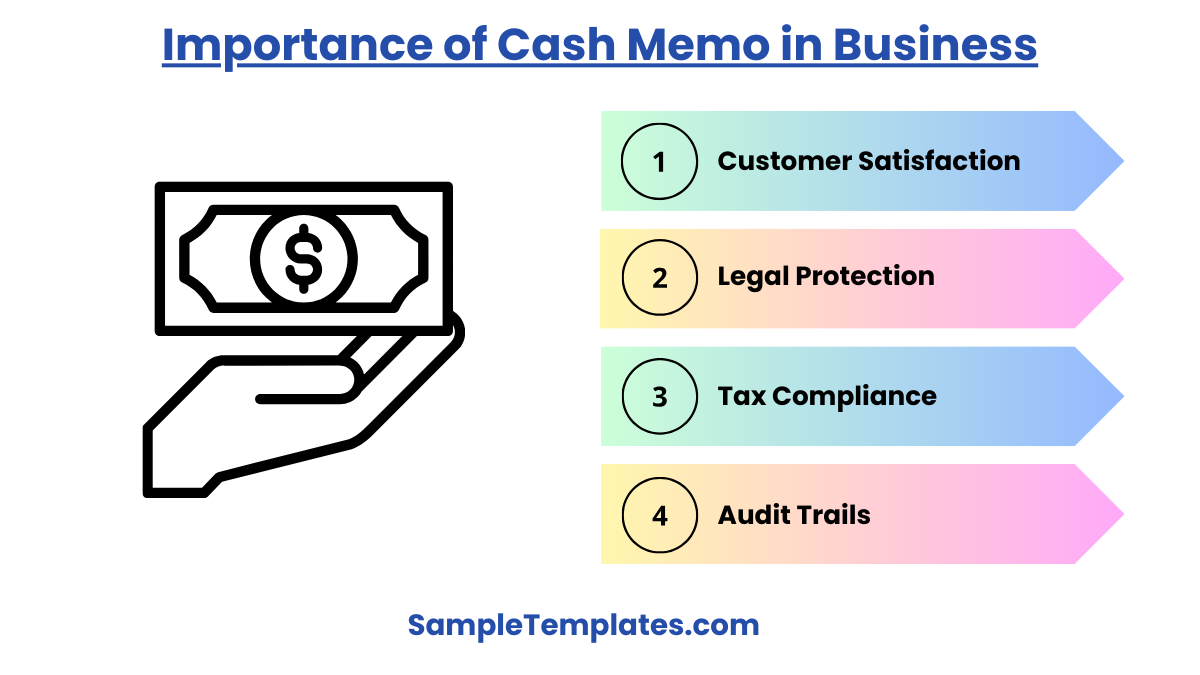

Importance of Cash Memos in Business

- Legal Protection: Cash memos provide legal protection to both buyers and sellers. They offer evidence of the transaction terms and the products or services exchanged.

- Financial Transparency: Cash memos contribute to financial transparency and accuracy in business operations. They help prevent financial irregularities and fraud.

- Tax Compliance: Properly maintained cash memos facilitate accurate calculation and reporting of sales taxes, ensuring compliance with tax regulations.

- Inventory Management: For businesses that deal with sample inventory, cash memos play a vital role in tracking stock levels, reordering, and preventing stockouts.

- Customer Satisfaction: Cash memos give customers confidence in their purchases and serve as a reference point for any issues or disputes.

- Audit Trails: In case of audits or financial reviews, cash memos provide a clear audit trail, helping auditors verify transactions. You can also see more on Debit Memo.

10. Sample Cash Memo Template

How to Make a Cash Memo?

11. Cash Memo in Excel

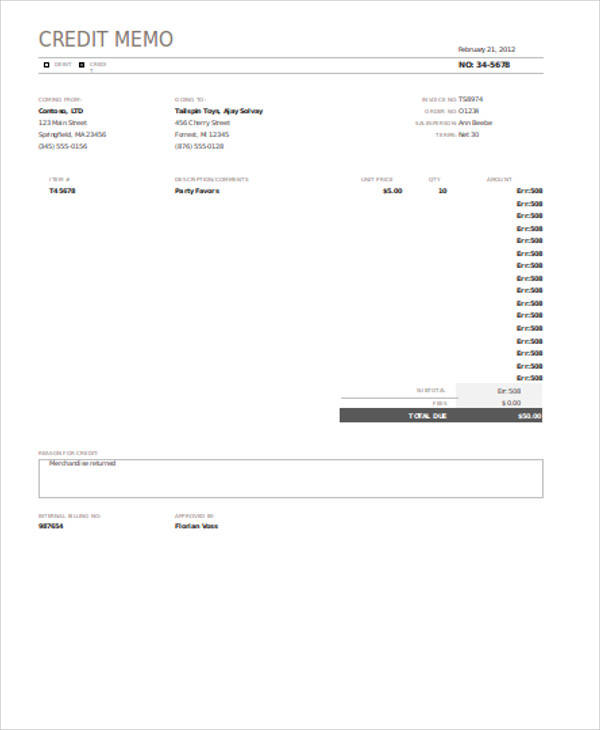

What is difference between cash memo and credit memo?

Here’s a comparison between a cash memo and a credit memo in table format:

| Aspect | Cash Memo | Credit Memo |

|---|---|---|

| Purpose | Records a cash transaction where | Records a refund or credit to a |

| goods or services are sold for | customer for previously purchased | |

| immediate payment in cash. | goods or services. | |

| Payment Type | Cash is the primary payment method | Typically issued in response to a |

| for goods or services. | previous credit sale or a return. | |

| Transaction | Represents a completed sale | Represents a reversal or adjustment |

| Status | Reflects a positive transaction, | Reflects a negative transaction, as |

| as payment is received. | it involves a refund or credit. | |

| Issued By | Issued by the seller or business | Issued by the seller or business as a |

| as a record for the sale. | credit to the customer’s account. | |

| Recipient | Typically provided to the buyer | Sent to the customer who receives |

| as proof of purchase. | the credit or refund. | |

| Payment Details | Includes information about the | Provides details about the amount |

| amount paid, goods or services | being credited, including the reason | |

| purchased, and payment date. | for the credit. | |

| Effects on Account | Increases revenue and cash | Reduces revenue and accounts |

| and decreases inventory for | receivable. Increases a liability | |

| inventory-based sales. | (accounts payable). |

This table outlines the key differences between cash memos and credit memos, highlighting their respective purposes, payment types, and effects on business accounts.

General FAQs

What is a cash memo?

A cash memo is a document used in retail or business transactions, providing a concise summary of the cash sale. It includes details such as items purchased, quantities, prices, and the total amount paid.

Is cash memo a receipt?

A cash memo and a receipt are related but not the same. A cash memo is a document that records the details of a cash transaction, while a receipt acknowledges payment. You can also see more on Audit Memos.

Who issues a cash memo?

A cash memo is typically issued by the seller or business involved in a cash transaction. It serves as a record of the sale or payment for goods or services.

What is the size of cash memo?

The size of a cash memo can vary depending on business preferences, but it is typically designed to be a standard letter-size document, which is 8.5 inches by 11 inches (or approximately 21.6 cm by 27.9 cm).

Where is cash memo used?

Cash memos are commonly used in various business sectors, including retail, hospitality, and services. They document cash transactions, providing a record of sales or payments for goods or services.

Is cash memo a source?

A cash memo can serve as a source document in accounting. It provides evidence of a cash transaction and is used to record financial transactions for record-keeping and accounting purposes.

Is cash memo and invoice same?

While both serve as transaction records, a cash memo is typically used for cash transactions at the point of sale, whereas an invoice is a more comprehensive document used for credit transactions.

Related Posts

FREE 13+ Business Memo Templates in MS Word | PDF | Google Docs

FREE 15+ Memorandum Samples in MS Word | PDF

FREE 10+ Strategy Memos in MS Word | Google Docs

FREE 8+ Executive Memo Templates in MS Word | Google Docs

FREE 6+ External Memo Templates in MS Word | PDF | Google Docs

FREE 8+ Bid Memo Templates in MS Word | PDF

FREE 8+ Notice Memos in PDF

FREE 9+ Budget Memo Templates in MS Word | PDF

FREE 8 Board Memo Templates in PDF

Monograph

Key Log

Report Writing

Discharge Summary

Research Report

Sample Tender