Foreclosure can be a complex and lengthy process, and it is important for borrowers to seek legal advice if they receive a Notice of Foreclosure or are struggling to make their mortgage payments. Borrowers may have options to avoid foreclosure, such as loan modification, forbearance, or a short sale. These options may allow the borrower to keep their home or sell the property without facing the negative consequences of foreclosure.

FREE 10+ Notice of Foreclosure Samples

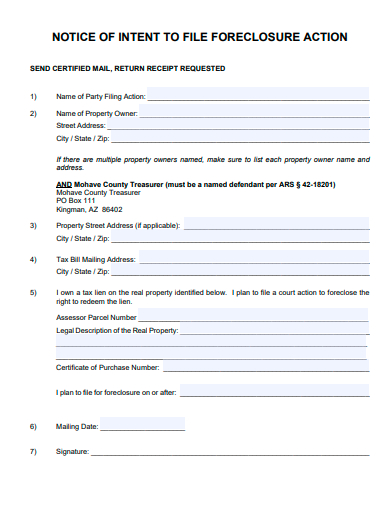

1. Notice of Intent to File Foreclosure Action

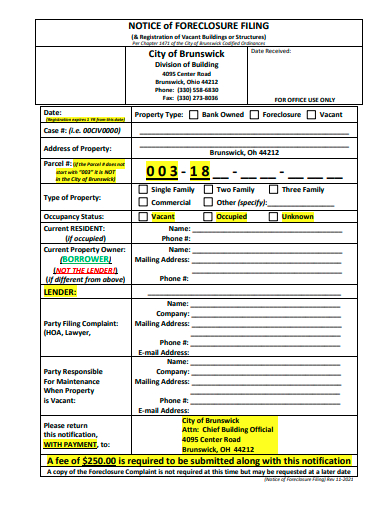

2. Notice of Foreclosure Filing

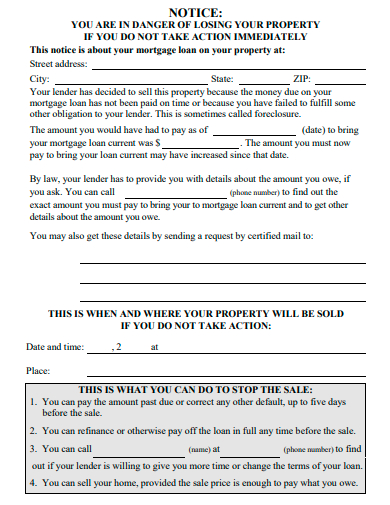

3. Notice of Foreclosure Example

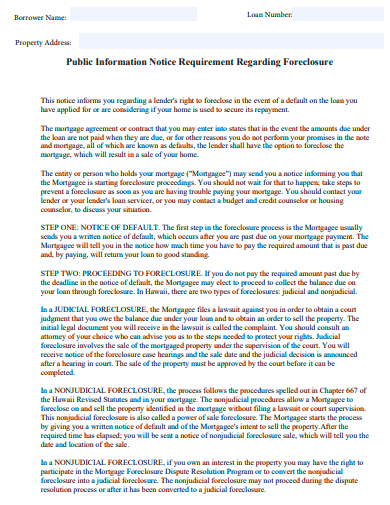

4. Public Notice of Foreclosure

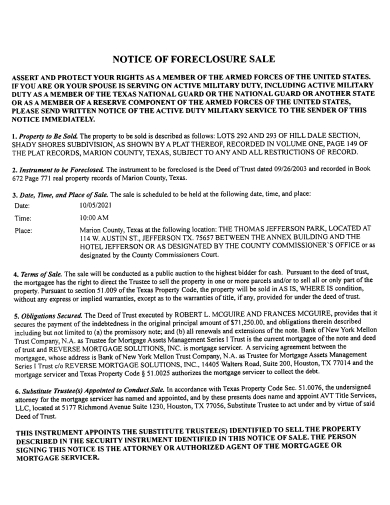

5. Notice of Foreclosure Sale

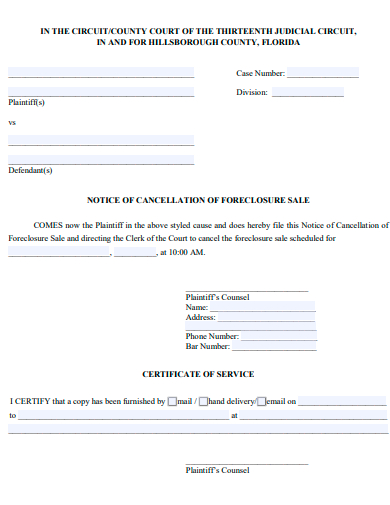

6. Notice of Cancellation of Foreclosure Sale

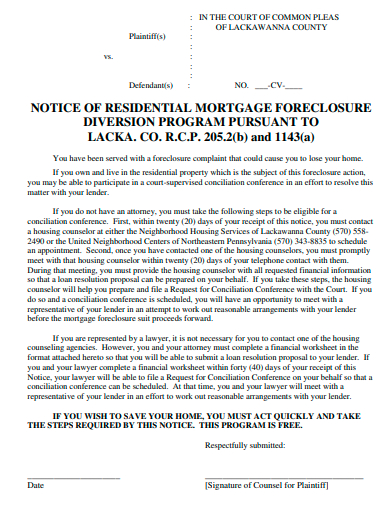

7. Notice of Residential Mortgage Foreclosure

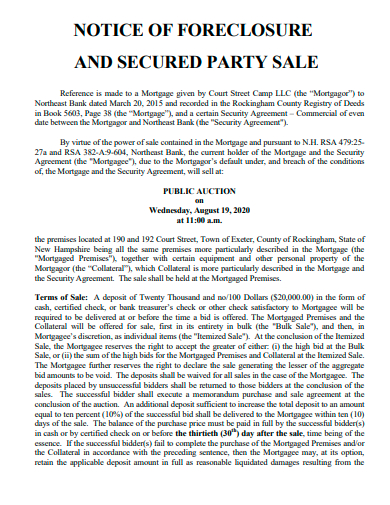

8. Notice of Foreclosure and Secured Party Sale

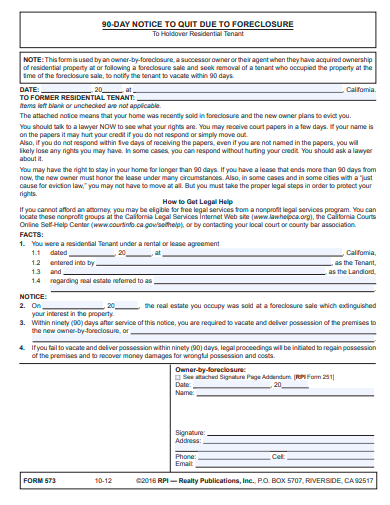

9. 90-Day Notice to Quit Due to Foreclosure

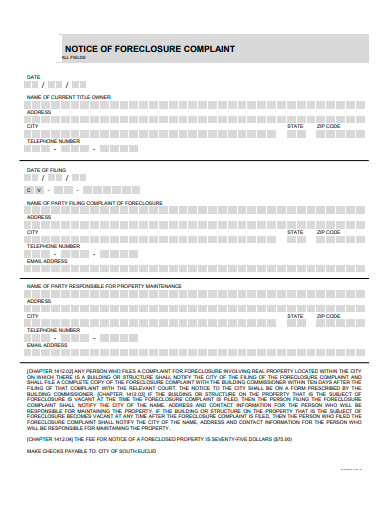

10. Notice of Foreclosure Complaint

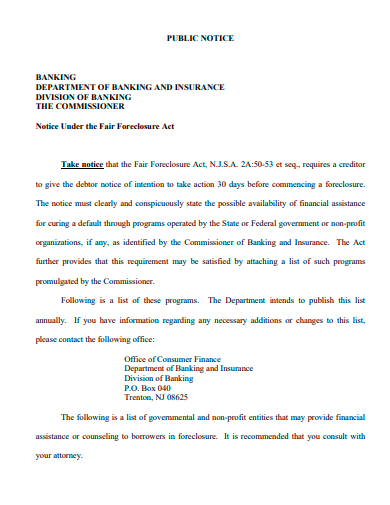

11. Public Notice of Fair Foreclosure Act

What is Notice of Foreclosure?

A Notice of Foreclosure is a legal document that is issued by a lender or creditor when a borrower fails to make timely payments on a mortgage or loan secured by property. This document is the beginning of a legal process that can result in the loss of a borrower’s property if they are unable to bring their payments current or come to an agreement with the lender.

How To Make Notice of Foreclosure?

The Notice of Foreclosure typically includes information about the amount of money owed, the date by which the borrower must pay the outstanding balance, and the consequences of failing to do so. This notice is sent to the borrower and any other parties with an interest in the property, such as lienholders or tenants. In most cases, the notice must be served to the borrower in person or sent via certified mail. Foreclosure laws may vary by state or country, and it is important to consult with an attorney or legal professional to ensure that the notice is compliant with local laws and regulations. Here are the general steps to make a Notice of Foreclosure:

Step 1- Determine the Reason for the Notice

A Notice of Foreclosure is usually issued when a borrower has failed to make timely payments on a mortgage or secured loan. The notice should clearly state the reason for the foreclosure.The notice should include important information, such as the amount owed, the due date for the outstanding balance, and the consequences of failing to pay. The notice should also include the name and contact information of the borrower and the lender.

Step 2-Follow legal requirements

Foreclosure laws may vary by state or country, and it is important to follow the legal requirements for issuing a notice of foreclosure. In some cases, the notice must be served in person or sent via certified mail.

Step 3-Consider Offering Options

Lenders may want to consider offering options to borrowers to avoid foreclosure. These may include loan modification, forbearance, or a short sale. Including information about these options in the notice may be helpful.

Step 4-Review Notice

It is important to have the notice reviewed by an attorney or legal professional to ensure that it is compliant with local laws and regulations.

How is a Notice of Foreclosure served to the borrower?

Foreclosure laws may vary by state or country, but in most cases, the notice must be served in person or sent via certified mail.

What are the consequences of failing to respond to a Notice of Foreclosure?

If the borrower does not bring their payments current or come to an agreement with the lender, the lender may initiate foreclosure proceedings and eventually take possession of the property. This can result in the borrower losing their home or other property and potentially facing a deficiency judgment.

What options do borrowers have to avoid foreclosure?

Borrowers may have options to avoid foreclosure, such as loan modification, forbearance, or a short sale. These options may allow the borrower to keep their home or sell the property without facing the negative consequences of foreclosure.

In conclusion, a Notice of Foreclosure is a legal document that signals the beginning of a potentially serious legal process for borrowers who have failed to make timely payments on their mortgage or secured loan. It is important for borrowers to understand their rights and options if they receive a Notice of Foreclosure, and to seek legal advice if necessary. By taking action early, borrowers may be able to avoid foreclosure and protect their home or other property.

Related Posts

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]

FREE 24+ Sample Payment Schedules in PDF | MS Word

FREE 10+ Return to Work Action Plan Samples in PDF | DOC

Autobiography Samples & Templates