As a company owner, you don’t get a pay stub as your employees do. But understanding a paycheck solves several issues for you and your business. You must know how to make and interpret a worker’s pay stub. If an employee suddenly resigned or is fired, you may need to pay them quickly. Knowing how to pay stub information makes the whole process easier. The more familiar you are with the paycheck parts, the faster you can check for accuracy and pay the employee. Thus, if you are not that familiar yet, you can use sample templates to help you. We have shared our downloadable paycheck stub templates. They’re customizable and easy to edit. Want to learn more? Read this whole article.

FREE 10+ Paycheck Stub Samples

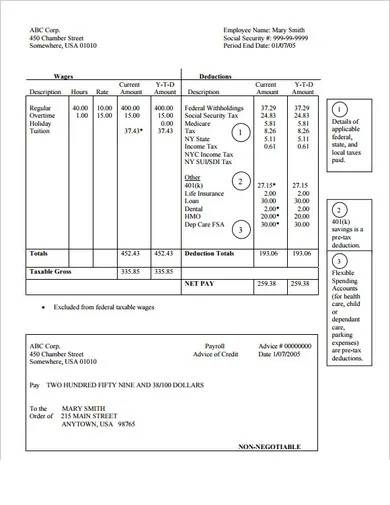

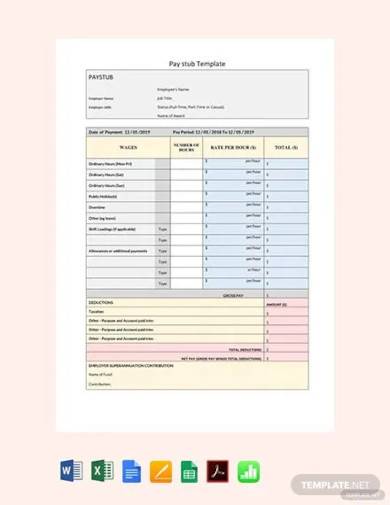

1. Free Pay Check Pay Stub Template

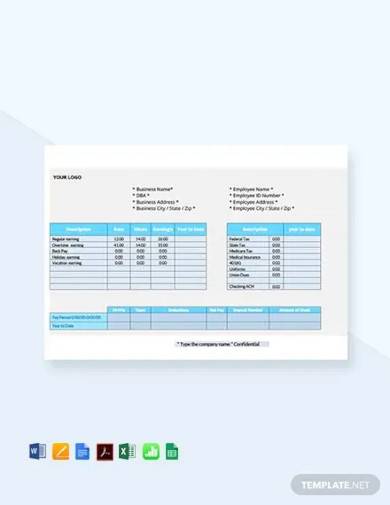

2. Free Bonus Pay Stub Template

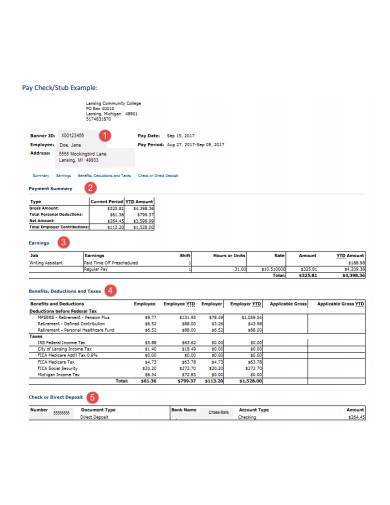

3. Free ePay Stub Template

4. Free Employee Pay Stub Template

5. Sample Pay Stub Template

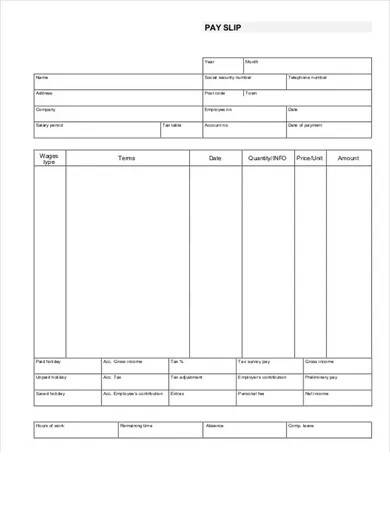

6. Blank Paycheck Stub Template

7. Pay Check Stub Template

8. Pay Roll Paycheck Stub Template

9. Simple Paycheck Stub Template

10. Printable Paycheck Stub Template

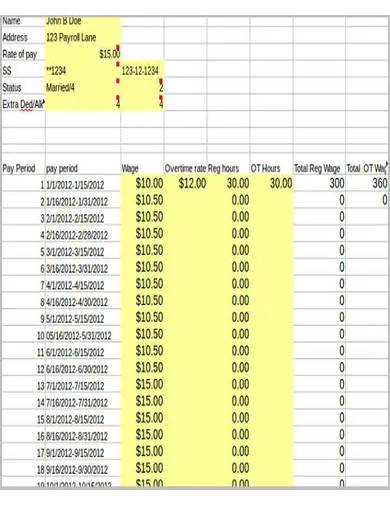

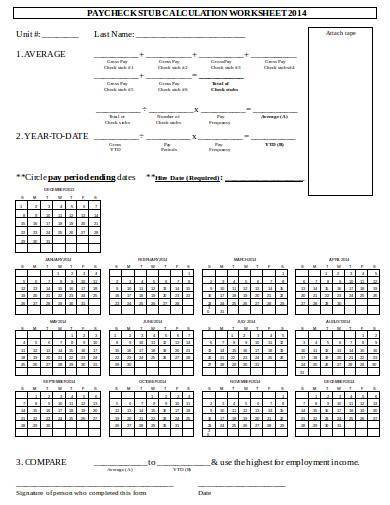

11. Paycheck Stub Calculation Worksheet

What Is a Pay Stub?

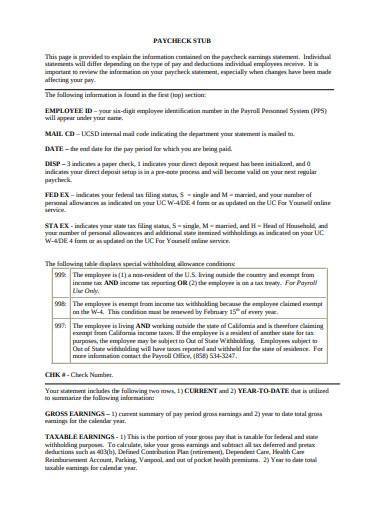

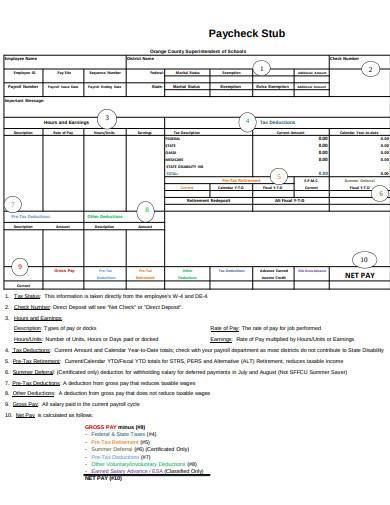

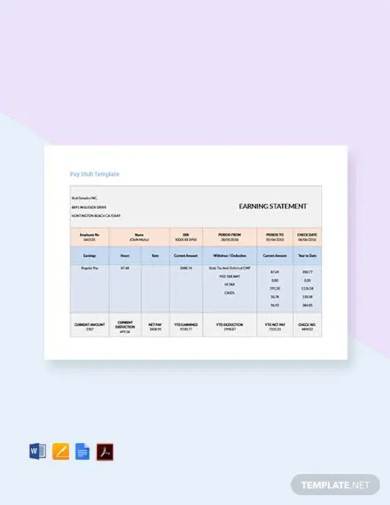

A paycheck stub, also known as a pay stub, is a paper that records all the wages that your employees receive and the taxes they pay. It will show the gross pay and net pay of an employee. In other words, it will display how much money was subtracted from your employee’s paycheck to pay for all the taxes and other necessary deductions. You can give an electronic or printed pay stub to your employees. You’re required to provide pay stubs in some counties or states. The data you need to include in the pay stub varies by state. You can keep copies of each payroll stub for your payroll files.

How to Create a Paycheck Stub?

A paycheck consists of a lot of details. That’s why creating it is very time-consuming and tricky. You should know the needed items to make a detailed and accurate paycheck. There are many specific features included in the pay stub. It can help you and your employee monitor payments, taxes, and other deductions. Here are the three factors that you must include in your paycheck stub:

1. Gross Pay

Gross pay is a worker’s total income throughout a given time before the deductions. Deductions such as mandated taxes, medical contributions, and health insurance or pension funds deductions are not accounted for when calculating gross pay. To calculate the gross wages, you can use this formula: Gross pay= Net pay + Tax deductions. Paycheck or payroll stub shows an employee’s gross pay. It has two columns. The first column shows the present gross wage or information for the, while the other column gives the total of year-to-date. A pay stub should include the pay rate, hours worked, and the total gross pay.

2. Taxes and Other Deductions

Employees will not take home their entire gross pay. Taxes and other necessary deductions reduce their income. The pay stub categorizes the deductions so that employees could see the amounts taken from their salary. Taxes and deductions also have two categories. The first category shows the recent or current deductions, while the other shows the year-to-date amount of deductions. There are common deductions that you should put in paychecks or pay stubs. These deductions are employee tax and benefits deductions and employer contributions.

3. Net Pay

Net pay is the employee’s earnings after deducting all the needed all deductions. In other words, net pay is the amount left over after subtraction of gross pay deductions. It’s the employee’s salary cut. It is the amount that you will write to your employee’s paycheck and the amount of money that they will receive. You can get your employee’s net pay using this formula: Net pay= Gross income – Tax and deductions. Its difference is the net pay that your employee can take home.

FAQs

What’s on a paycheck?

The paycheck stub is a list of the income details of the employee. It sets out the salaries earned during the pay period and year-to-date payroll. It shows taxes and other deductions and the amount that the employee receives (net pay).

Who is responsible for preparing paychecks?

The one responsible for preparing paychecks is the payroll officer. Since they have to manage all the compensation, they are considered the most knowledgeable when it comes to handling payroll and pay stubs.

Where do paychecks and pay stubs come from?

The paycheck or pay stub is a check issued by the employer to pay the employee for the work completed. It may be delivered on paper, just like traditional checks, or deposited electronically.

How to get a paycheck?

Even employees who use a direct deposit can get their paychecks from their employers. Employers can create paychecks based on your direct deposit and either e-mail them or give them directly to their employees. You can also ask your employer for a copy of your pay stub.

A pay stub or paycheck stub plays a vital role in every organization. It comprises the employee’s total amount of income that they earn by working in your company. Understanding and knowing how to make it is essential. It can make sure that you can pay your employee correctly and avoid confits. Though creating it is a bit of a hassle and tricky, you can do it now easily. You can use our downloadable paycheck stub templates as your layout or outline. Download it now and get started!

Related Posts

FREE 12+ Paycheck Calculator Samples & Templates in Excel PDF

FREE 7+ Sample Marketing Calculator Templates in PDF

FREE 8+ Sample Payroll Report Templates in MS Word PDF

FREE 12+ Gym Membership Receipt Samples & Templates in PDF ...

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

FREE 6+ Sample Check Templates in PDF PSD

FREE 10+ Payment Plan Templates in PDF

FREE 9+ Sample Remittance Templates in PDF MS Word

FREE 9+ Sample Payroll Deduction Forms in PDF MS Word

FREE Printable Statement Forms in PDF

FREE 6+ Proof of Income Letter Templates in PDF

FREE 6+ Sample Proof of Funds Letter Templates in PDF MS Word

FREE 10+ Prinatable Overtime Calculator Templates in PDF MS ...

FREE 7+ Blank Payroll Form Templates in PDF MS Word

FREE 7+ Sample Insurance Agent Job Description Templates in PDF