Did you know that American consumer debts ended up to $14 trillion at some time in 2019? And that report from Debt.org is nothing to belittle especially when debts are nothing new. People still continue to depend on debt to buy their needs and wants. Although debts are helpful, there are costs involved as well. Do not drown from it. Instead, figure out smart ways to slowly repay what needs to be paid. And proposing a well-thought-out payment plan is one way to do it.

Payment Plan Template

Simple Sales Plan Template

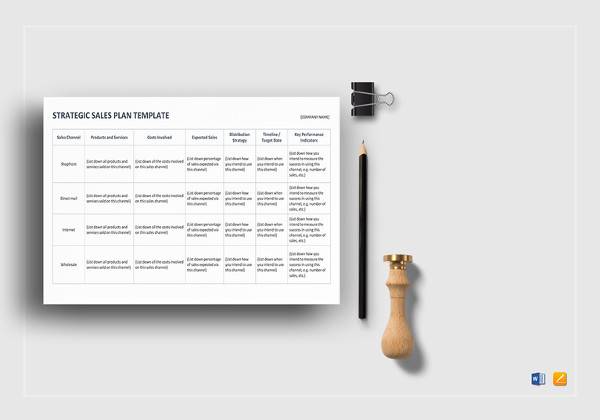

Strategic Sales Plan Template

Financial Plan Template

Fundraising Plan Template

Free 30 60 90 Payment Plan Template

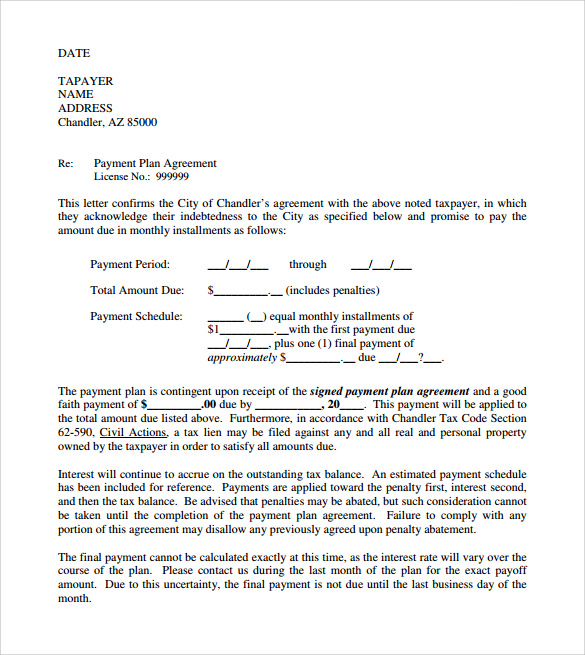

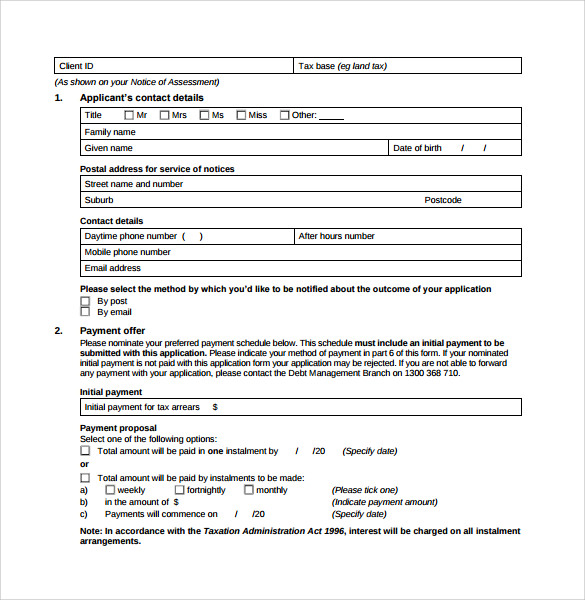

Sample Payment Plan Template

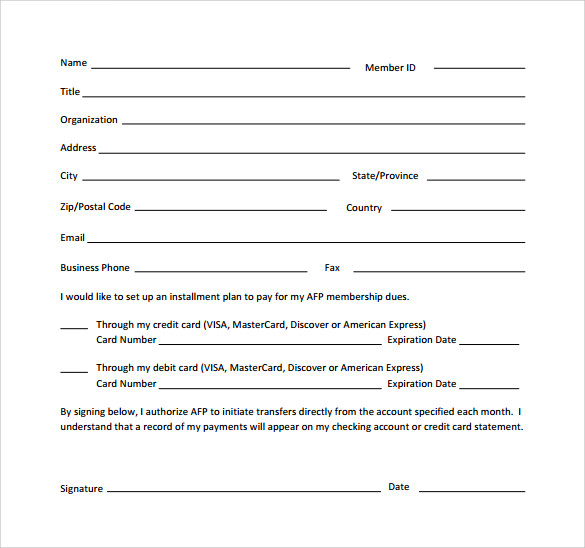

Installment Payment Plan Template

Payment Plan Sample Template

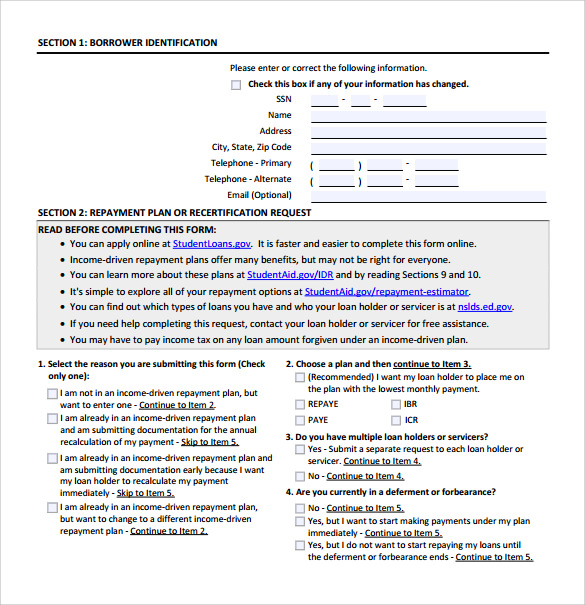

Income Driven Payment Plan Template

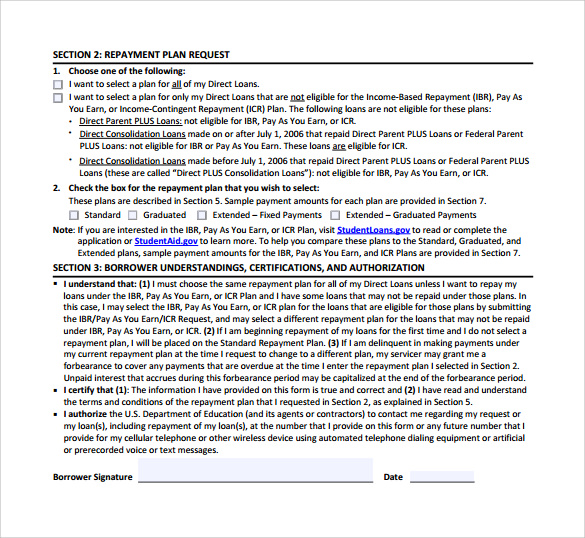

Repayment Plan Request Template

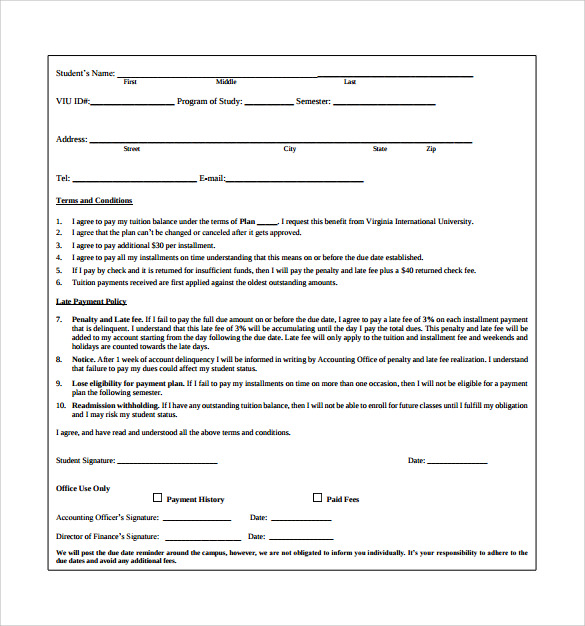

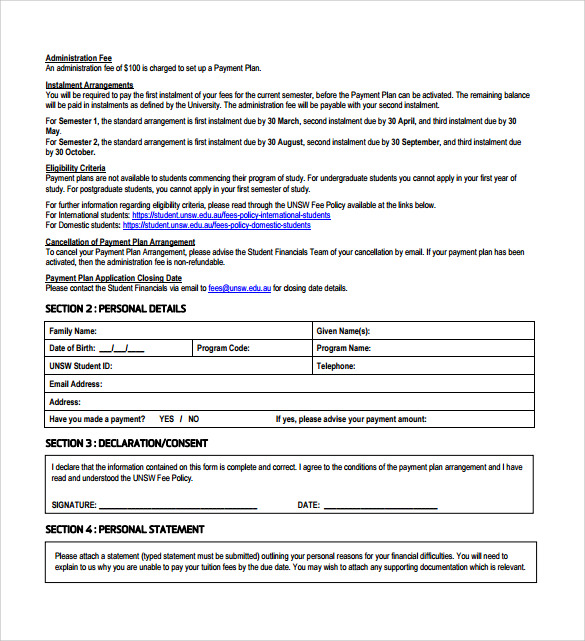

Tuition Payment Plan Template

Payment Plan Template

What Is a Payment Plan?

Payment plans are official documents that contain all the information on outstanding debt to repay. It is a document used by both the borrower and creditor where an agreement outlines the amount, and both are liable to that amount. In this plan, all the details like the money amount, payment time, payment method are all mentioned, and it is a very much transparent action plan template. However, such plans are not only limited to paying debts. You can create a payment plan for different applications like managing a personal budget, planning a wedding, calculating school fees, etc.

How to Make a Smart Payment Plan

A payment plan is generally presented as a proposal or an agreement between two or more parties. The document will plot how much to pay and when to pay, including other essential elements in managing payments. But do not assume that every plan would work properly. Some flawed plans may be present. And to boost the success rate, familiarize the steps on how to make a well-planned payment plan.

Step 1: Introduce the Plan and Its Parties

Be sure that the form used for the payment plan serves its purpose, meaning anyone who checks that document can easily tell it is specifically a payment plan. If it is an agreement, then a formal introduction is expected. After that, identify the parties. Be sure to state the names of everyone involved and mention their roles. Who is the creditor, and who is the debtor? Note it down.

Step 2: Identify the Payment Amount and Methods

Payment plans need to mention both the payment option and the amount. Of course, creditors would want to know how much debtors promise to pay at a particular period. Is it a monthly installment, or maybe a one-time payment only? Also, specify how the payment will be made. Are payments done via cash, check, credit card, insurance, or digital wallet? Be specific in mentioning these elements as they are the meat of the plan.

Step 3: Explain the Terms and Conditions

A perfect plan would need terms and conditions. These factors help to avoid any issue or messy situation between parties at some point. For example, what if a party suddenly decides not to continue the plan? It would be unfair to the obedient party. Hence, a termination clause is expected in its terms. And as you slowly write all the necessary rules and regulations, think about how feasible they are too. Incorporating a lot of unnecessary and unjust rules would only worsen the situation.

Step 4: Organize All Details

After you finish adding what needs to be written or printed in the sheet, review if changes are necessary. Maybe there were a lot of grammatical errors and other mistakes in the form. Flawed payment plans are doomed for sure. And do not forget to arrange or organize the information. There should be a sense of narrative in how the plan goes. For example, you can mention the steps on how the plan works instead of not having a sequence on what should be done first until last. Once you are happy with the results, launch your plan.

FAQs

What is MPP?

MPP is an acronym for the monthly payment plan. And it is a payment plan outlining the installments. For example, tuition fees are divided into four installments every semester. Or, your plan consists of a rent-to-own car and how often you should pay. The point is this plan focuses on an installment or payment schedule done per month.

What happens to my credit score in paying an installment loan early?

Nothing really happens in paying off installment loans early. It does not improve nor lessen your score. However, open installment loans for the life of a loan helps in maintaining credit scores.

What are modern examples of installment plans?

Many current installment accounts are relevant today. Examples include a mortgage loan, vehicle loan, student loan, and home equity loan.

Whether you are a debtor or a creditor, payment plans are not to be taken lightly. Who knows where money might go at some point? And remember that a lot of things can be measured by money, so learn to use it wisely. Thankfully, proposing a payment plan is hassle-fee when you download from our sample templates. Your only challenge is to choose which template suits your goal the best and fill in the details to complete it. Download now!

Related Posts

Sample Meeting Minutes Templates

Presentation Speech Samples & Templates

Ukulele Chord Chart Samples & Templates

Retirement Speech Samples & Templates

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]