The payslip templates are some of the most used templates for all the good reasons. Payslips are required in every organization. Whether it’s an office or business, a school, college or university, some construction site plan or medical center, you need payslips everywhere to keep a record of the payment of wage slip. The slip templates are mainly used for salary payments. Sometimes they are also used for keeping records of other miscellaneous payments. The templates help you personalize a blank payslip format into your own business or office style with the name of the company, etc.

Payslip Online

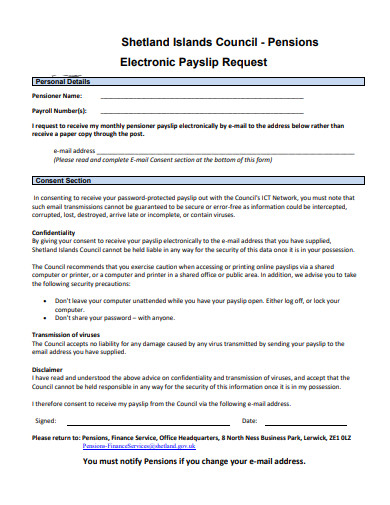

The transition from paper to electronic payslips has become increasingly common in the modern workplace. This shift towards digitalization offers numerous benefits and some drawbacks, primarily concerning security, accessibility, and environmental impact. Here’s an exploration of these aspects:

Benefits

1. Environmental Considerations:

- Reduced Paper Usage: Electronic payslips significantly reduce the need for paper, contributing to environmental sustainability by lowering the consumption of resources and the carbon footprint associated with paper production and disposal.

- Energy Efficiency: Digital processes are generally more energy-efficient compared to the physical production, transportation, and storage of paper payslips.

2. Accessibility:

- Convenience: Employees can access their payslips anytime and anywhere, provided they have internet access. This is particularly beneficial for remote workers or those who are traveling.

- Easy Storage and Retrieval: Electronic payslips can be easily stored in digital format, reducing the risk of loss and making it simpler to retrieve historical data when needed, such as for tax preparation or loan applications.

3. Enhanced Security:

- Data Protection: Digital payslips can be encrypted and secured with passwords, reducing the risk of sensitive information falling into the wrong hands, a risk that’s inherent with physical documents.

- Audit Trails: Electronic systems often have built-in audit trails, making it easier to track access and changes, thereby enhancing security and accountability.

Drawbacks

1. Security Risks:

- Cybersecurity Threats: Despite the encryption and password protection, electronic payslips are susceptible to cybersecurity threats such as hacking, phishing scams, and malware. This requires constant vigilance and up-to-date security measures.

- Data Breaches: The potential for large-scale data breaches can compromise the personal information of numerous employees at once, leading to significant privacy concerns.

2. Accessibility Concerns:

- Digital Divide: Not all employees may have equal access to the technology required to view electronic payslips, such as personal computers or smartphones, potentially leading to inequality in access.

- Technical Challenges: Employees who are not tech-savvy may find it difficult to navigate online systems, leading to frustration or errors in understanding their payslips.

3. Environmental Impact of Digital Infrastructure:

- Energy Consumption: The servers and data centers that store electronic payslips consume a significant amount of electricity, much of which comes from non-renewable sources.

- Electronic Waste: The devices used to access electronic payslips contribute to electronic waste when they become obsolete and are disposed of.

Conclusion

While electronic payslips offer clear advantages in terms of environmental sustainability, convenience, and security, it’s essential to address the potential drawbacks. Companies should invest in robust cybersecurity measures, provide support and training for employees to access their digital payslips, and consider the broader environmental impacts of digitalization. Balancing these factors can help maximize the benefits of electronic payslips while minimizing the drawbacks.

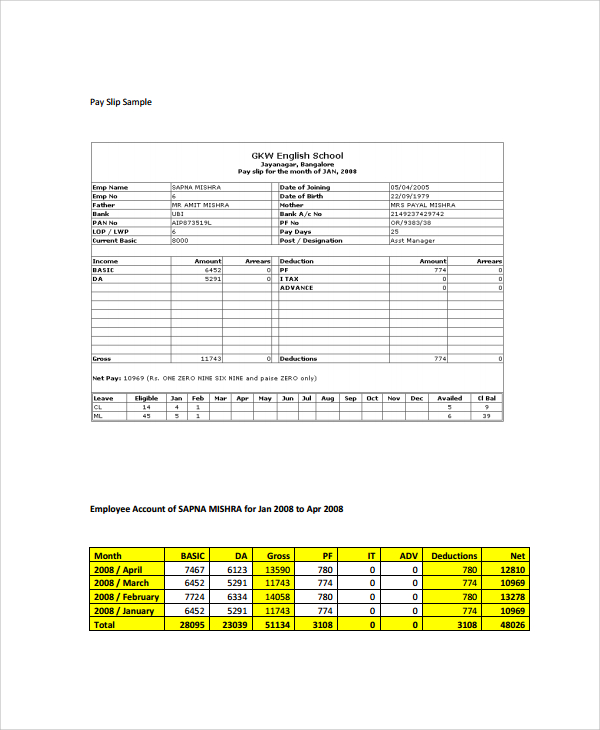

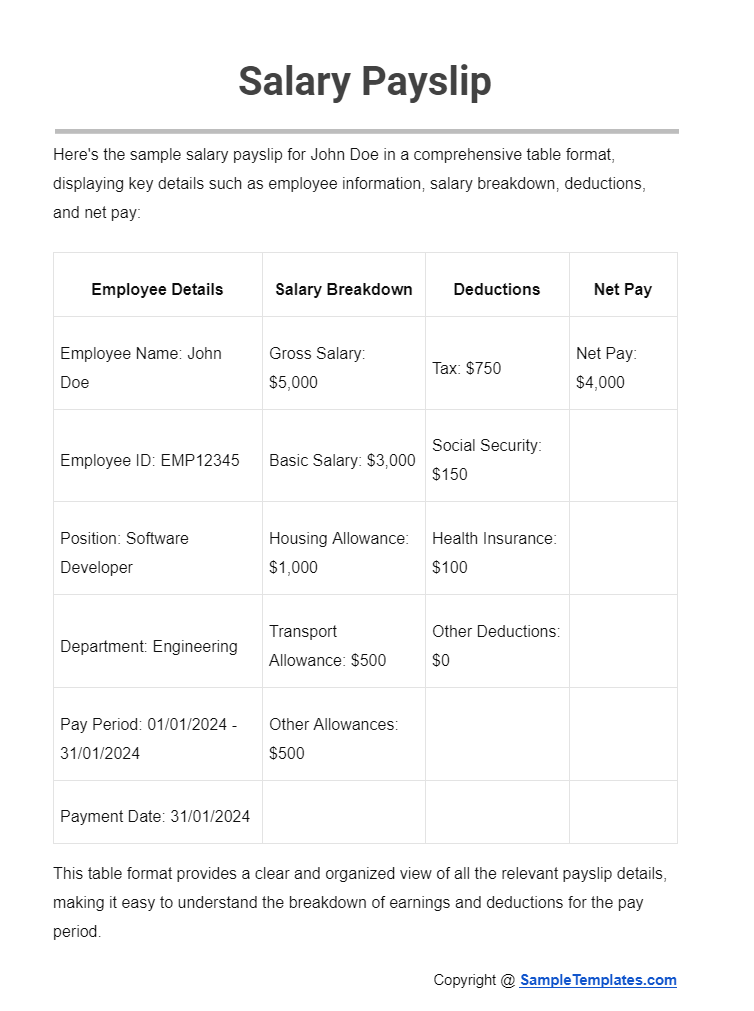

Salary Payslip

Here’s the sample salary payslip for John Doe in a comprehensive table format, displaying key details such as employee information, salary breakdown, deductions, and net pay:

| Employee Details | Salary Breakdown | Deductions | Net Pay |

|---|---|---|---|

| Employee Name: John Doe | Gross Salary: $5,000 | Tax: $750 | Net Pay: $4,000 |

| Employee ID: EMP12345 | Basic Salary: $3,000 | Social Security: $150 | |

| Position: Software Developer | Housing Allowance: $1,000 | Health Insurance: $100 | |

| Department: Engineering | Transport Allowance: $500 | Other Deductions: $0 | |

| Pay Period: 01/01/2024 – 31/01/2024 | Other Allowances: $500 | ||

| Payment Date: 31/01/2024 |

This table format provides a clear and organized view of all the relevant payslip details, making it easy to understand the breakdown of earnings and deductions for the pay period.

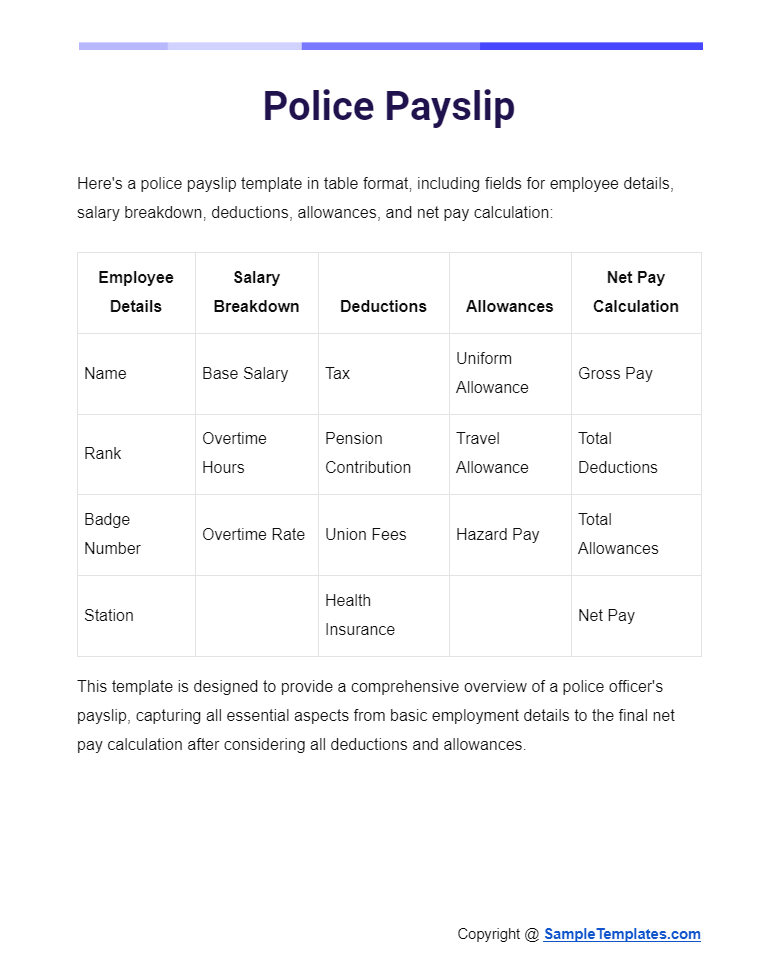

Police Payslip

Here’s a police payslip template in table format, including fields for employee details, salary breakdown, deductions, allowances, and net pay calculation:

| Employee Details | Salary Breakdown | Deductions | Allowances | Net Pay Calculation |

|---|---|---|---|---|

| Name | Base Salary | Tax | Uniform Allowance | Gross Pay |

| Rank | Overtime Hours | Pension Contribution | Travel Allowance | Total Deductions |

| Badge Number | Overtime Rate | Union Fees | Hazard Pay | Total Allowances |

| Station | Health Insurance | Net Pay |

This template is designed to provide a comprehensive overview of a police officer’s payslip, capturing all essential aspects from basic employment details to the final net pay calculation after considering all deductions and allowances.

Payslip Portal

Developing a user-friendly online payslip portal involves a thoughtful approach to design, functionality, and security to ensure employees can securely access and understand their salary details. Here’s a guide to creating such a portal:

1. Planning and Requirements Gathering

- Identify User Needs: Conduct surveys or interviews with employees to understand what they need and expect from the payslip portal.

- Compliance and Security: Ensure the portal will comply with data protection laws (e.g., GDPR) and adopt industry-standard security measures.

2. Designing the User Interface

- Simple and Intuitive Design: Ensure the portal is easy to navigate with a clean, straightforward layout that works on both desktop and mobile devices.

- Accessibility: Design with accessibility in mind so that it’s usable for everyone, including those with disabilities.

3. Core Features and Functionality

- Secure Login: Implement secure authentication methods, like two-factor authentication, to protect each employee’s personal and financial information.

- Payslip Viewing and Downloading: Allow employees to view current and past payslips, with options to download or print.

- Salary Breakdown: Clearly display the breakdown of gross pay, net pay, deductions (taxes, pension contributions, etc.), and allowances.

- Tax Information: Provide details on tax deductions, including year-to-date totals, to help employees understand their tax commitments.

- Benefits and Deductions Details: Offer explanations or tooltips for various deductions and benefits for better understanding.

- Personal and Employment Details: Enable employees to view and request updates to their personal and employment details to ensure accuracy in records.

- Search and Filter Options: Allow users to filter payslips by date range, making it easier to find specific documents.

4. Security Measures

- Data Encryption: Use encryption for data storage and transmission to protect sensitive information.

- Regular Security Audits: Conduct security audits and penetration testing regularly to identify and fix vulnerabilities.

- Privacy Policy and Terms of Use: Clearly communicate how employee data will be used and protected.

5. Testing and Feedback

- User Testing: Before launching, conduct user testing with a small group of employees to gather feedback on usability and identify any issues.

- Iterative Improvements: Use feedback to make iterative improvements to the portal’s design and functionality.

6. Launch and Training

- Employee Training: Offer training sessions or create instructional materials to help employees navigate the new portal.

- Support Channels: Establish support channels (e.g., helpdesk or FAQ section) to assist employees with any questions or issues.

7. Ongoing Maintenance and Updates

- Regular Updates: Keep the portal up-to-date with new features, security patches, and compliance requirements.

- Continuous Feedback: Encourage ongoing feedback from employees to make improvements over time.

By following these steps, companies can develop a secure, user-friendly online payslip portal that empowers employees to access their salary information easily and securely, enhancing transparency and trust within the organization.

Browse More Templates On Payslip

Payslip Template

Payslip Template Free Download

Payslip Template Word

Payslip Sample

Pay Slip Template Word

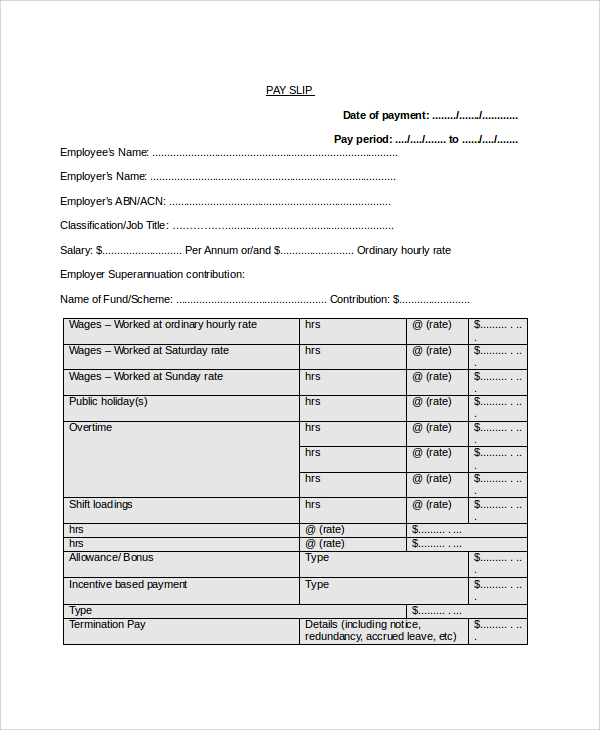

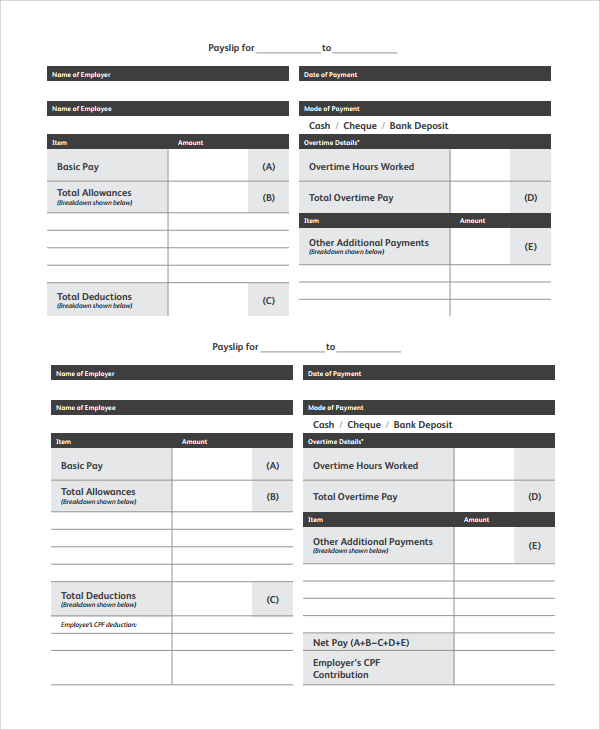

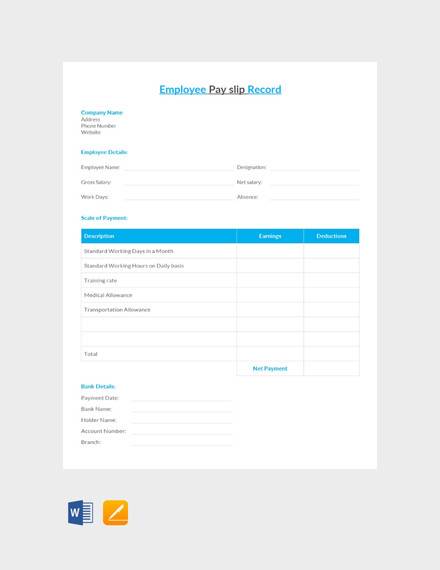

Use this employee payslip record template to help yourself keep track of your important business transactions. Note its supported formats of MS Word and Mac Pages. You can download this template on any electronic device you like best. You can take a look at the printable payroll templates that are available online. Try it out now!

Editable Payslip Template

The basic payslip format is for every business or organization. This one can be molded as you want to. The template can have your office or sample label name and some fields can be added or removed. Since these formats are in the DOC or PDF format, they are easy to edit and print.

Free Payslip Template

The blank payslip template is another format where the blanks can be filled or customized prior to printing so that you get a very own customized copy of the payslip. Use it for paying salaries to employees, or for keeping sample note of small and big expenditures as you pay money to non-salaried individuals or freelancers.

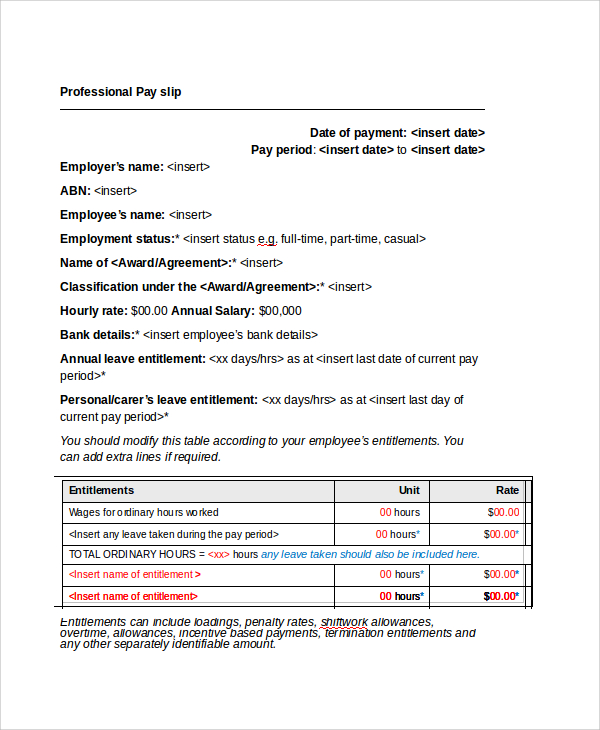

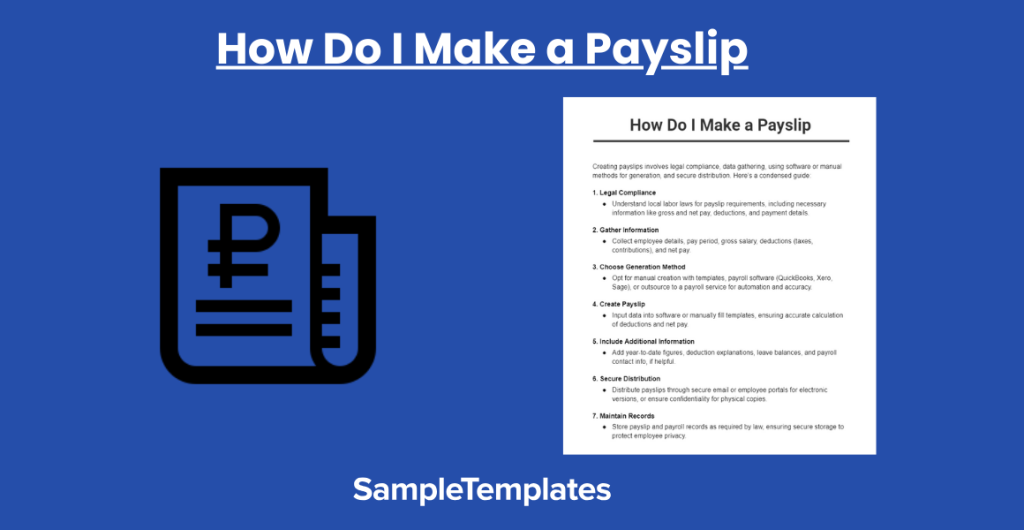

How Do I Make a Payslip

Creating payslips involves legal compliance, data gathering, using software or manual methods for generation, and secure distribution. Here’s a condensed guide:

1. Legal Compliance

- Understand local labor laws for payslip requirements, including necessary information like gross and net pay, deductions, and payment details.

2. Gather Information

- Collect employee details, pay period, gross salary, deductions (taxes, contributions), and net pay.

3. Choose Generation Method

- Opt for manual creation with templates, payroll software (QuickBooks, Xero, Sage), or outsource to a payroll service for automation and accuracy.

4. Create Payslip

- Input data into software or manually fill templates, ensuring accurate calculation of deductions and net pay.

5. Include Additional Information

- Add year-to-date figures, deduction explanations, leave balances, and payroll contact info, if helpful.

6. Secure Distribution

- Distribute payslips through secure email or employee portals for electronic versions, or ensure confidentiality for physical copies.

7. Maintain Records

- Store payslip and payroll records as required by law, ensuring secure storage to protect employee privacy.

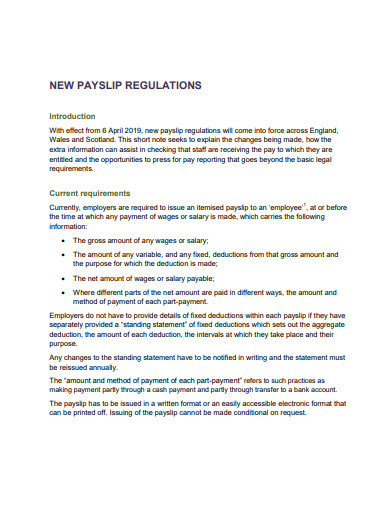

Legal Considerations

- Comply with data protection laws for handling and storing personal information and ensure employees’ right to access their payslip information.

This streamlined process ensures legal compliance, accuracy, and security in generating and distributing employee payslips.

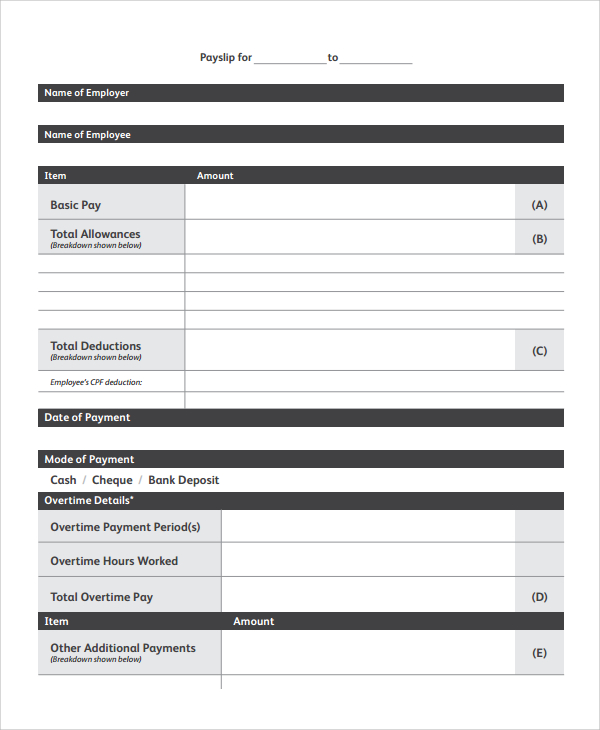

Payslip PDF

The employee payslip templates are typically for the employees. If you have a set of fixed employees you can then keep a name entered a customized copy of the payslip for each employee to be printed every month for payment. Otherwise, you may keep the name field blank to be filled manually. These are extremely easy to handle and use. You may also see payroll samples.

Why use Payslip Templates?

The requirement for keeping accounts up to date and all expenses recorded is a primary necessity in any business, office, organization or nonprofit, etc. But new organizations and offices often take time in arranging their personalized office files and formats.

That is why when it comes to payslips they often take time in making a style, and may even get hiccups in making a stable format which they would be satisfied with while conforming to the global financial standards. That is why as you have started your new office and are still organizing, you may rely on the useful slip templates. You may also take a look at the permission slip templates that are available online for more.

Payslip PDF Download

Is salary a payslip?

A salary is not a payslip; rather, a payslip is a document that provides a detailed breakdown of an employee’s earnings and deductions for a specific pay period. While these terms are closely related in the context of payroll and compensation, they represent different aspects of an employee’s financial transaction with their employer. In this comprehensive explanation, we will explore the distinctions between salary and payslip, highlighting their roles, components, and importance in the employment relationship.

Salary:

A salary refers to the fixed, regular payment that an employer agrees to pay an employee for their work. It is typically expressed as an annual amount, although it can be divided into various pay periods, such as monthly, bi-weekly, or weekly. Salaries are agreed upon as part of the employment contract and are usually associated with exempt employees, who are not eligible for overtime pay and receive a consistent amount regardless of the hours worked.

Payslip:

A payslip, also known as a paycheck stub, pay stub, or salary slip, is a document provided by an employer to an employee for each pay period. It outlines the specific details of an employee’s compensation and serves as an official record of their earnings and deductions. Payslips are typically distributed with each paycheck and are also accessible electronically through payroll systems.

Importance of Payslip Templates

The payslip or wage slip template is an extremely useful format that can help you from giving time and effort in developing a payslip format from scratch. The payslip formats are meant to give you total freedom from designing. Every worker needs loans and financial assistance from time to time in life and in such cases they depend on the payslips to prove to a financial company analysis that they are salaried.

But if the format of the payslip is a substandard one, which no financial company would accept as a valid one for incomplete details, then the worker would also be affected and harassed and the reputation of the payslip providing company would also be put to question. These templates just provide you a standard format that gives you relief from unnecessary designing and formatting. The packing slip templates will help you make the right decision on how to make packing slip templates.

Simple Payslip Template

Editable Payslip Template

How to use the Payslip Templates?

The payslip formats can be used in simple steps. You must first pick a format you like the most. Next, you should be checking in where you need to add the extra details about the company name, the employees, the designation, etc. finally after customization and removing any unwanted fields, you can then print the formats. The easy to use PDF or doc style files can be printed in one go. These help in quick organizing as you simply don’t give in time and effort to make the payslip or design them, and yet get them ready to use. You may also see appointment slip templates

The best thing about payslip formats or cash slip templates is that you start using a globally accepted structure of payslip which will never be questioned by any organization, bank, etc, and yet you do not give in effort in making or designing the same. It’s available free and is ready to use. Deposit slips are used in the bank to make sure that you deposit the right amount of money in the account you wan to.

Payslip Sample PDF Free Download

Is it safe to share payslip?

Sharing a payslip can be safe, but it’s important to exercise caution and consider the context in which you are sharing it. Payslips contain sensitive and personal financial information, so it’s essential to be mindful of who you share this information with and why. Here are some considerations:

- Legitimate Requests: It is generally safe to share your payslip with legitimate entities that have a valid reason to request it, such as government agencies, banks for loan application samples, or employers for employment verification. Ensure that the request is genuine and necessary.

- Privacy and Security: Always be cautious about the security of the method you use to share your payslip. If you’re sharing it digitally, use secure and encrypted channels, such as email with encryption, secure file sharing services, or a secure portal provided by your employer.

- Redact Sensitive Information: Before sharing a payslip, consider redacting or masking certain sensitive information, such as your Social Security Number, bank account details, or any other information not directly related to the purpose of the request.

- Phishing Awareness: Be vigilant about phishing scams. Scammers may pose as legitimate organizations or individuals to trick you into sharing sensitive information, including payslips. Verify the authenticity of requests and the identity of the requesting party.

- Employer Policies: If you are sharing your payslip with your employer for any reason, review your company’s policies and procedures regarding the sharing of payroll information to ensure compliance.

- Third Parties: If you are sharing your payslip with a third party, such as a financial institution, ensure that they have secure data handling practices and comply with privacy regulations to protect your information.

- Limited Information: When sharing your payslip, consider providing only the specific information necessary for the purpose of the request and avoid sharing the entire document if possible.

- Data Protection Laws: Be aware of data protection laws in your region, as they may have specific requirements and regulations regarding the sharing and handling of personal and financial information.

What is on a Payslip?

A payslip is often referred to as a wage slip. It has the following details mentioned in it:

- Employer details

- Employee details like name, designation, employee number, etc.

- Deduction of taxes

- The income you earned over the period

- Year-to-date payroll

- Details of the person who issued the payslip.

Who issues the Payslip?

A payslip can be issued by any of the following people in an organization:

- Human resource management department

- Finance and administrations

- A payroll service provider who manages salaries and wages on an outsourcing basis

- Your bank, if the earnings go directly into your bank account.

General FAQs

What is A Payslip?

A payslip is a note that is provided to an employee, outlining details like the amount they have been paid for the work done for a specific period. It also has the details of the tax form that is deducted, if any. This makes sure that the employee knows what he/she lost their pay in.

Why do you need a Payslip?

A payslip serves as proof of salary that a person draws from the employer statement. Apart from this, a payslip is an essential document that is used when a person applies for a loan or mortgage. Payslips are one of the most important documents when applying for loans.

Are Payslips confidential?

Payslips contain highly confidential information related to salary, bonuses, commissions receipts, taxes, etc. Only the employee can view this confidential information as they need to enter their secure login details to access the payslip on an electronic device. This must not be seen by anyone else other than the employee himself/herself.

How can I see my salary slip?

To access your salary slip, log in to your company’s employee portal or HR system. Look for a designated section related to payroll or pay information to view and download your salary slip.

How do I get my payslip?

Retrieve your payslip by accessing your company’s payroll system or employee portal. Navigate to the designated section for pay information, where you can typically view and download your payslip.

In conclusion, a payslip is a vital financial document that provides a detailed breakdown of an individual’s earnings and deductions for a specific pay period. It plays a key role in financial planning, tax compliance, and proof of income for various purposes, making it an essential tool for both employees and employers.

If you have any DMCA issues on this post, please contact us!

Related Posts

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]

FREE 24+ Sample Payment Schedules in PDF | MS Word

FREE 10+ Return to Work Action Plan Samples in PDF | DOC

Autobiography Samples & Templates