According to TaxSlayer, there are more than 50% of US residents who don’t know or have an in-depth understanding of their taxes. Unfortunately, you may be one of them; but, you don’t have to. All you have to do is to know the tax basics, as well as whether or not you are eligible for tax deductions. And, one of the documents that you can use for verifying and applying for deductions is the personal tax deduction form.

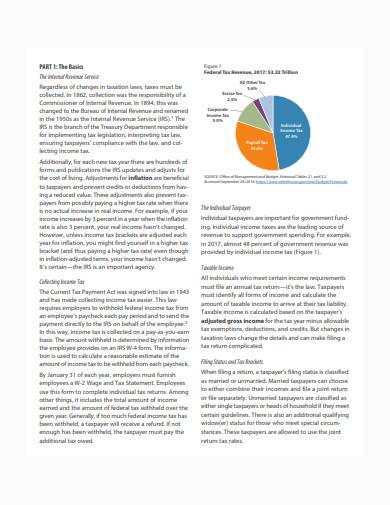

Personal Tax Deduction: Definition

Generally, personal tax deductions are specific amounts or percentages deducted from your actual taxable income. And guess what, there are a lot of ways to gain these deductions, such as when you make charitable donations, or when you buy tax-deductible items. You just have to know what, when, and how you can claim your deductions. Aside from that, you should also be aware of the rest of your tax responsibilities and obligations, so you will be able to fulfill them.

How to Use Our Personal Tax Deduction Sample Templates

If you’re worried that you will be spending a lot of time going to the IRS or maybe searching through the internet for various tax forms, then you’re lucky, for we are here to help you. Our personal tax deduction sample templates are all editable, compatible with any electronic device, and printable. Apart from that, it also comes in two varying file formats, specifically in PDF and DOC. Great, isn’t it? So, take note of the step-by-step guide below to begin using our templates with ease:

Step 1: Determine what type of deduction you want to claim

Personal tax deductions allow your bank account to relax and breathe. That’s why you must research the type of deduction that you are eligible in since there are many things that you may not know are tax-deductible items. After knowing your deduction type, you can proceed in looking up which among our templates cater to your needs.

Step 2: Choose and download the personal tax deduction template that suits you

Some template-creation sites will require you to have a subscription or an account before you can download their products. But, fortunately, you will not be worrying about that with us. You simply have to hit the download button of your chosen template, then you can proceed with extracting it from its zip file once it’s downloaded.

Step 3: Edit and fill out your downloaded template

If what you downloaded is in PDF format, then you can use a PDF editor to customize its contents. On the one hand, if it’s a DOC formatted form, then you can use a word-processing software application program such as Microsoft Word. And since we made all our templates editable, you will have the freedom to move, rearrange, delete, and change its contents. Just make sure that you are modifying it with the legal requirements of the IRS in mind.

10+ Personal Tax Deduction Samples in PDF | DOC

Creating any legal form, especially a tax form for claiming benefits and deductions, can be a daunting task. So, instead of doing that from scratch, why not consider using our personal tax deduction forms below? Each sample form template serves different purposes related to filing deduction and reduction claims. Also, it’s downloadable and compatible with every type of device, editable and printable. Go ahead and scan through our templates now, so you can have the form that you will use to get your tax deductions:

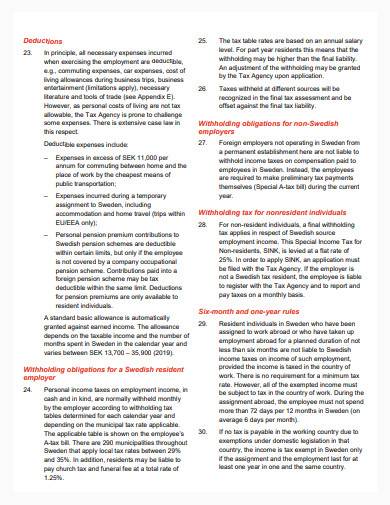

1. Personal Tax Deduction Changes Sample

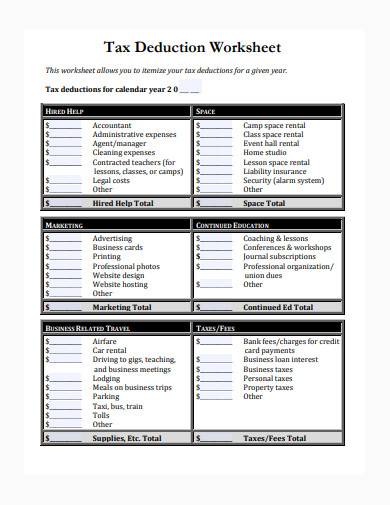

2. Personal Tax Deduction Worksheet Template

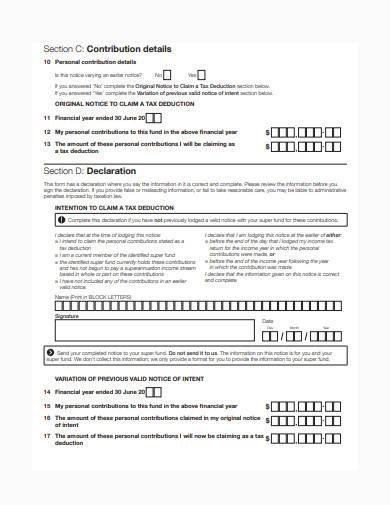

3. Personal Tax Deduction Notice Example

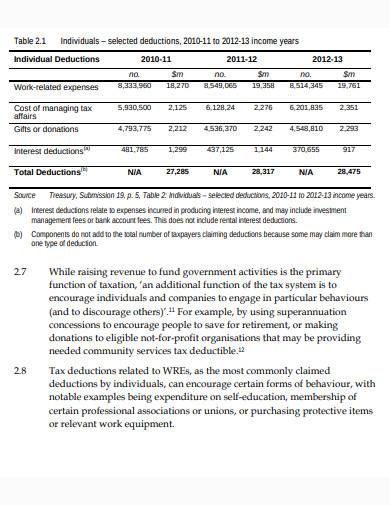

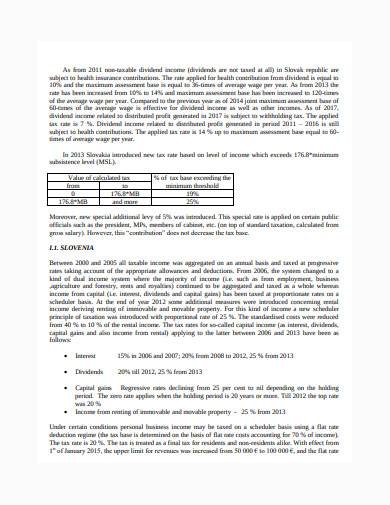

4. Personal Income Tax Deduction Sample

5. Personal Tax Deduction Template

6. Personal Tax Deduction in PDF

7. Personal Tax Deduction Example

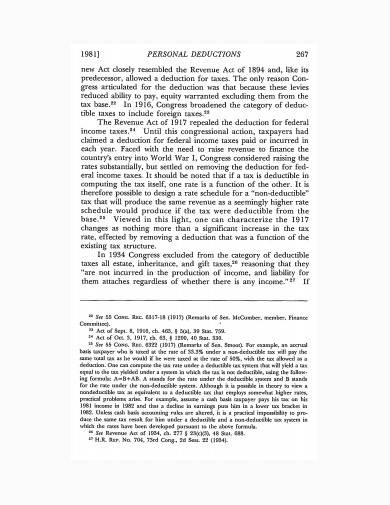

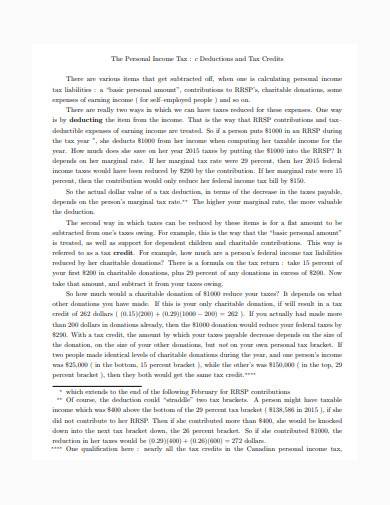

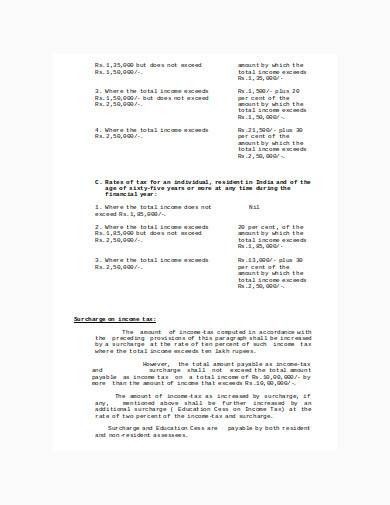

8. Evaluating Personal Deductions in Income Tax

9. Personal Income Tax Deduction Template

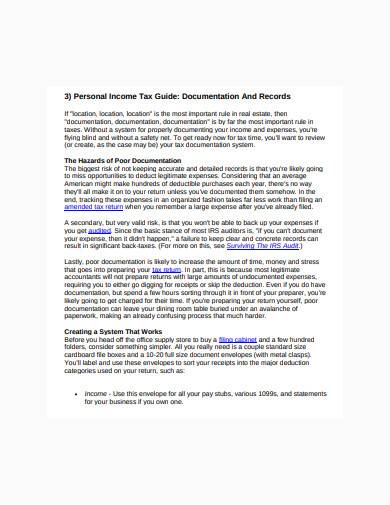

10. Personal Income Tax Deduction in PDF

11. Personal Tax Deduction in DOC

Tips in Filing Personal Tax Deductions

Harris Poll and NerdWallet conducted a survey about Americans and what they think about tax-saving strategies. Unfortunately, many believe that deductions or tax reduction strategies are not legal, even if it’s eligible and allowed by the IRS. And, if you’re still in the dark about that, then let us help you with the following tips below on how you can file and claim your personal tax deductions:

Tip #1: Make a list of all deductible items and contributions

You can use a tax deduction worksheet template instead of writing it on a blank sheet of paper that you may misplace at any time. In the worksheet, you have to specify the amount and description of your deductions. Aside from that, the date and details of tax-related transactions you made should also be in the worksheet.

Tip #2: Download or get the document you need

There are many types of deductions that one can be eligible for, so you should know what document or tax form to use. Aside from that, preparing your other requirements should also be your priority, so you won’t be facing ay delays in claiming your benefits and deductions.

Tip #3: Keep copies or duplicates of your submitted documents

Before you submit your personal tax deduction form and your requirements, you should have a duplicate copy of each. What for? So, you will have a substantial proof of what you are filing in the future, especially when the IRS will request you to provide supporting documents of your tax claims.

Personal tax deduction forms are essential, not only to the taxpayer but also to the IRS and other tax agencies. Also, taxpayers must claim their deductions immediately and with the right documents to prove their claims, regardless if it’s a large sum or a small number of tax deductibles.

Related Posts

9+ Money Receipt Samples

Employer Responsibilities for Payroll Taxes

6+ Blank Rent Receipt Samples

FREE 15+ Receipt for Goods or Services Templates

7+ Payroll Accountant Job Description Samples

5+ Sample Business Tax Receipts

Sample Payment Received Receipt Letter

6+ Sample Unreimbursed Employee Expenses

Sample Donation Receipt Template

Donation Letter Examples

9+ Sample Fundraiser Receipt Templates

FREE 3+ Charity Evaluation Samples

6+ Sample Self Employment Tax Forms

7+ Rent Receipt Word Samples

7+ Sample Indesign Invoice Templates