Accounting is required in order to keep track of all of your company’s spending. You will have to spend as well as earn money during your company interactions. You can wind up with a jumble of transactions if you don’t keep good records. That said, accounting firms is critical. Accountants provide clients with a variety of services, including accounts payable and receivable, accounting, and payroll processing. They ensure that financial transactions are both accurate and lawful, and they assist individuals and organizations in understanding the health of their finances through financial statements. Accounting businesses are one of the most lucrative sectors of the economy. In spite of its popularity, you still need a solid plan to guarantee the profitability and success of your business in the long run. You’ve come to the right place! In this article, we provide you with free and ready-to-use samples of Accountancy Firm Business Plans in PDF and DOC formats that you could use for your firm. Keep on reading to find out more!

4+ Accountancy Firm Business Plan Samples

1. Accountancy Firm Business Plan

2. Accountancy Firm and Tax Services Business Plan

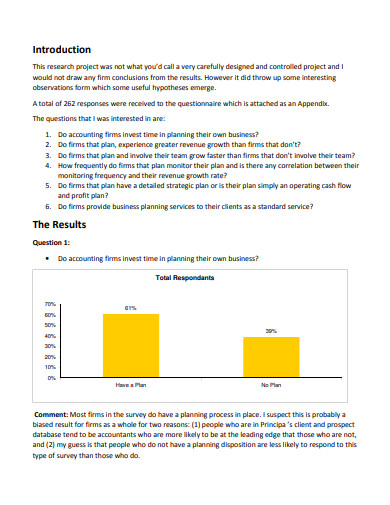

3. Sample Accountancy Firm Business Plan

4. Simple Accountancy Firm Business Plan

5. Accountancy Firm Business Plan Example

What Is an Accountancy Firm Business Plan?

A business plan for an accounting firm is a written document that covers a company’s main activities, goals, and methods for reaching those goals. A strong business plan should include an executive summary, goods and services, marketing strategy and analysis, financial planning, and a budget.

How to Make an Accountancy Firm Business Plan

Beginning an accounting company is similar to starting any other small business in that it takes a lot of time and effort, which is why you need a business plan. An Accountancy Firm Business Strategy Template may help you create the foundation you need to create a well-written and well-structured plan. You may do so by selecting one of the excellent templates shown above. If you wish to write one on your own, use the steps below as a guide:

1. Make an executive summary.

Although the executive summary is the first component of a business plan, many business owners write it last, after all of the other sections have been completed. The executive summary summarizes the plan’s material and serves as an overview. It comprises your accounting firm’s aims and mission, as well as a description of your accounting services and how they vary from those offered by competitors. Your work premises, company equipment, and staff are also described in the executive summary.

2. Analyze the market for your industry.

You determine who your clients are in the market analysis section by demographic data such as age, gender, and socioeconomic status. Because accounting services may be supplied to both organizations and people, you can categorize your clients according to their size or kind of business, such as small business owners or fitness gyms. Determine the appropriate marketing techniques to reach them, such as display advertising, tax articles in trade journals they read, or networking at local groups they would join, once you’ve established your market.

3. Provide details about management and operations.

Make a list of your management team’s names and responsibilities. Include their education and experience in relation to starting and running a successful accounting firm. Next, list the daily duties that must be accomplished in order to run the accounting firm and who is accountable for ensuring that they are completed.

4. Provide financial information about your company.

Make a financial statement for the accounting firm that displays current and predicted costs and income for the coming year. Give details about your assets, such as your equipment, and your obligations, such as your debts. Describe your financial risk management and catastrophe recovery strategy.

FAQs

What is an accountant’s line of work?

An accountant is a person who manages bookkeeping and creates financial papers such as profit-and-loss statements, balance sheets, and other financial paperwork. They conduct audits of your books, create tax returns, and handle all of the financial data that comes with running a business.

Is a CPA required to start an accounting firm?

Although obtaining a certified public accountant license isn’t essential to open an accounting firm, it does limit the sorts of accounting services that can be provided.

Accounting businesses generate money in a variety of ways.

Income per partners income as a percentage of fees are the two most popular metrics. The most lucrative businesses earn more than 40% of fees, with income as a percentage of fees ranging from 30–35 percent.

A business plan, in general, is a documented blueprint for a company’s marketing, financial, and operational goals. To help you get started, download our easily customizable and comprehensive samples of Accountancy Firm Business Plans today!

Related Posts

FREE 9+ 30-Day Marketing Plan Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 3+ Sales Team Action Plan Samples in PDF | MS Word | Apple Pages | Google Docs

Marketing Plan For Small Business Samples

FREE 7+ Fashion Business Plan Samples in PDF

FREE 10+ Sprint Planning Samples In MS Word | Google Docs | PDF

FREE 10+ Wedding Planning Samples in MS Word | Apple Pages | Powerpoint | PDF

FREE 9+ Monthly Study Planner Samples in PSD | Illustrator | InDesign | PDF

FREE 9+ Sample Curriculum Planning Templates in PDF | MS Word

FREE 10+ Teacher Development Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Basketball Practice Plan Samples in PDF

FREE 12+ School Business Plan Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 7+ Client Strategic Plan Samples in PDF | MS Word

FREE 11+ Trucking Business Plan Templates in PDF | MS Word | Google Docs | Pages

FREE 7+ Small Hotel Business Plan Samples PDF | MS Word | Apple Pages | Google Docs

FREE 14+ Bakery Business Plans in MS Word | PDF | Google Docs | Pages