Financial management entails the planning, organizing, directing, and controlling of a company’s financial activities, such as procurement and use of funds. It entails applying general management principles to the company’s financial resources. Being able to properly manage your finances can help you figure out how much money you’ll need for taxes, other monthly expenses, and savings. When it comes to managing your finances, it’s also crucial to be able to detect risks that might affect your income, analyze them, and make investment decisions based on accepting or mitigating them. This is called financial risk management, and this responsibility is usually bestowed upon the financial manager. If need some assistance with this, look no further! In this article, we provide you with free and ready-to-use samples of Financial Risk Management Plans in PDF and DOC formats that you could use to help you out. Keep on reading to find out more!

6+ Financial Risk Management Plan Samples

1. Financial Risk Management Plan

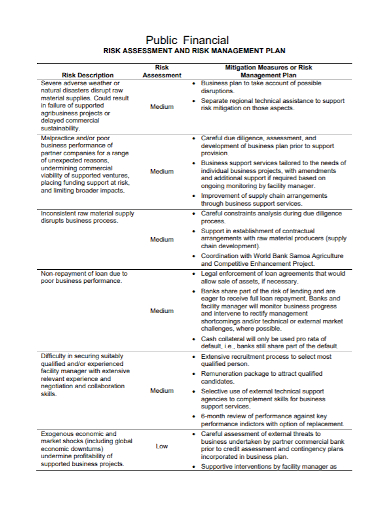

2. Financial Risk Assessment Management Plan

3. Financial Project Risk Management Plan

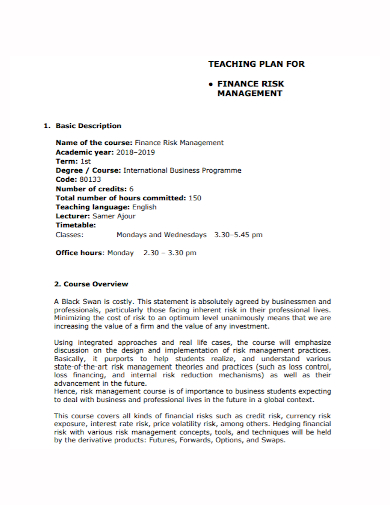

4. Financial Risk Management Teaching Plan

5. Financial Risk Management Business Plan

6. Financial Risk Management Performance Plan

7. Financial Risk Management Policy Plan

What Is a Financial Risk Management Plan?

Transactions such as investments, financing, business activities, sales, and purchases, among others, can result in financial risk. With this in mind, whether on a personal or corporate level, a financial risk management plan is critical because it identifies, measures, and prioritizes risks while also implementing some preventative actions and techniques. The plan of action is the most important aspect of any financial risk management plan. These are the methods, rules, and practices that your company will follow to guarantee that it does not take on more risk than it can handle.

In other words, the strategy will make it plain to employees what they can and cannot do, what choices need to be escalated, and who is ultimately responsible for any risk that arises. Essentially, the goal is to figure out what risks you’re willing to face, which dangers you’d rather avoid, and how you’ll design a risk-averse approach.

How to Make a Financial Risk Management Plan

Financial risk is managed in a variety of ways by businesses. This procedure is specific to the type of business you have, the market it serves, and the level of risk it is willing to take. In any case, you need to implement a financial risk management plan. You can use the great templates listed above so that you don’t have to write one from scratch. Aside from that, you can start your own plan by following these steps:

1. Determining the sources of risk.

Identifying financial hazards, as well as their sources or causes, is the first step in risk management. The balance sheet of the company is an excellent place to start. This gives an overview of the company’s debt, liquidity, foreign exchange exposure, interest rate risk, and commodity price vulnerability. You should also look at the income statement and the cash flow statement to see how income and cash flows change over time and how that affects the risk profile of the company.

2. Analyze and assess the risk.

After you’ve identified and created a list of potential risks, you should examine them. You must determine how likely or unlikely the situation is to occur. You must consider the implications, regardless of how serious or minor the losses are. Once you have a good grasp of the risk’s likelihood and implications, you should make a risk rating table to assess it. This will assist you in managing the risk and making a decision.

4. Treat the risk and prevent it from happening in the future.

You should look into methods for dealing with your company’s unacceptable risks. Keep in mind that certain unexpected dangers require immediate care, while others can be assessed later. You should gather information about the risks before deciding which ones to treat. Developing a risk management plan also includes avoiding the risk. If you don’t want to avoid risk, you’ll have to devote time and effort to building a risk management strategy. You might not be able to achieve the required results this way. As a result, try to stay away from danger as much as possible.

FAQs

What does a risk management strategy entail?

The risk management plan is a document that lays out all of the risk assessment, analysis, tolerance, and mitigation factors.

How can you stay away from financial risk?

- Make sound financial decisions.

- Learn how to diversify your portfolio.

- Make a deposit in your savings account.

- Obtain the services of a reputable management accountant.

How do you spot financial risks?

Start by carefully studying your company’s balance sheet or statement of financial status to identify financial risk. You’ll need to know what your key revenue streams are and how consumer credit terms effect that revenue.

It goes without saying that you need to properly manage your finances and plan for whatever risk you want to take or what might impact your income. This is why implementing a solid financial risk management plan is of the essence. To help you started with this, download our easily customizable and printable samples of Financial Risk Management Plan today!

Related Posts

FREE 9+ 30-Day Marketing Plan Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 3+ Sales Team Action Plan Samples in PDF | MS Word | Apple Pages | Google Docs

Marketing Plan For Small Business Samples

FREE 7+ Fashion Business Plan Samples in PDF

FREE 10+ Sprint Planning Samples In MS Word | Google Docs | PDF

FREE 10+ Wedding Planning Samples in MS Word | Apple Pages | Powerpoint | PDF

FREE 9+ Monthly Study Planner Samples in PSD | Illustrator | InDesign | PDF

FREE 9+ Sample Curriculum Planning Templates in PDF | MS Word

FREE 10+ Teacher Development Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Basketball Practice Plan Samples in PDF

FREE 12+ School Business Plan Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 7+ Client Strategic Plan Samples in PDF | MS Word

FREE 11+ Trucking Business Plan Templates in PDF | MS Word | Google Docs | Pages

FREE 7+ Small Hotel Business Plan Samples PDF | MS Word | Apple Pages | Google Docs

FREE 14+ Bakery Business Plans in MS Word | PDF | Google Docs | Pages