Inexperienced entrepreneurs often make the mistake of solely relying on information about the here and now without consideration for long-term sustainability. Though the simpler solution to strategically analyzing the stock market constantly ascending growth, this is a grave mistake. The worst thing you can do to your business is to assume positive growth based on unrefined data. In terms of long-term sustainability, it’s best to assess your revenue, your profit and loss, and your price-earnings ration.

What Is a Price Earnings Ratio

The words “price” and “earnings” are relatively self-explanatory; they are concepts we encounter during all financial transactions. However, they’re more than just indicators of possible expenditure and revenue as they are regularly utilized to indicate stock profit. For business people, this formula is known as the price-earnings ratio.

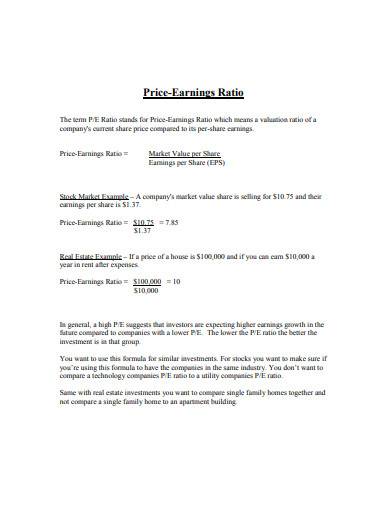

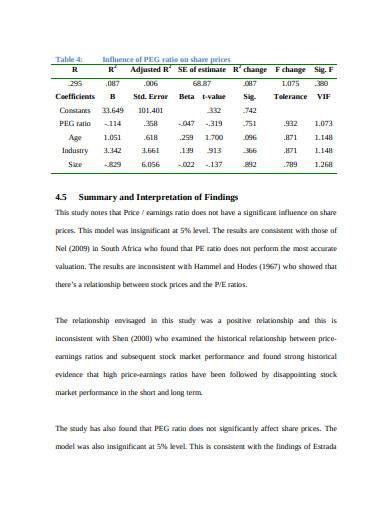

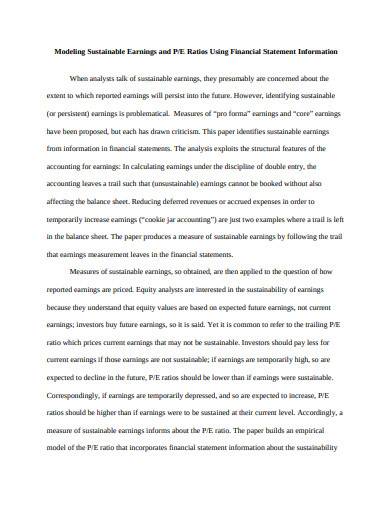

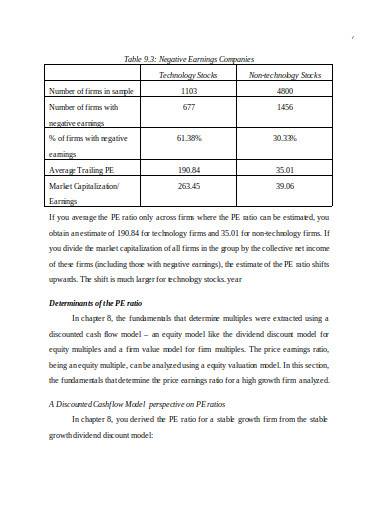

A price-earnings ratio (or p/e ratio) may throw you off guard, but it isn’t as complicated as it first seems. All you have to do is divide the Market Value Price per share with earnings per share. Though simple in nature, this is considered one of the most basic, the quickest, and most effective ways to measure the revenue generated in an investment. It utilizes various documents and multiple formats to approach and analyze financial ratios.

Ration Your Supplies

Though fictional in circumstance and horrific in nature, a zombie apocalypse proves to be effective for financial ratios and stock market analysis. Illustrated on various forms of media, surviving in such a dangerous world, requires a particular skillset. You will need to understand threats and perils, rationing supplies you currently have, making good use of your time to search for promising opportunities, and sometimes taking a few risks to reap high rewards. Doesn’t this sound familiar?

Investors continuously struggle in the same way survivors do everyday. Searching for good quality investments with high price-earning ratios is as tedious as any survival tactic. Though various tools like cash flow analysis, profit and loss templates, and sheet templates are available to them, this doesn’t gurantee a sucessful stock. It’s an entrepreneur’s ability to utilize these resources is what separates them from revenue and a stable monetary status and the cold, dead hands of a financial apocalypse.

12+ Price Earnings Ratio Samples in PDF | DOC

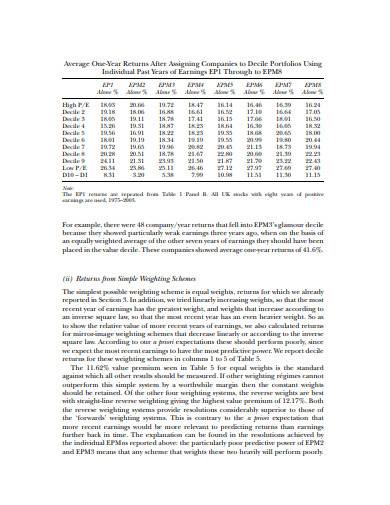

1. Price Earnings Ratio Sample

2. International Price Earnings Ratio Template

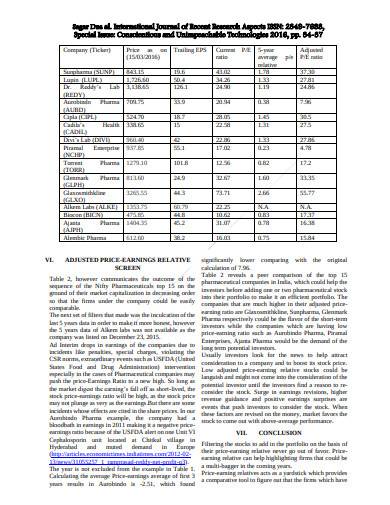

3. Adjusted Price-Earnings Ratio Sample

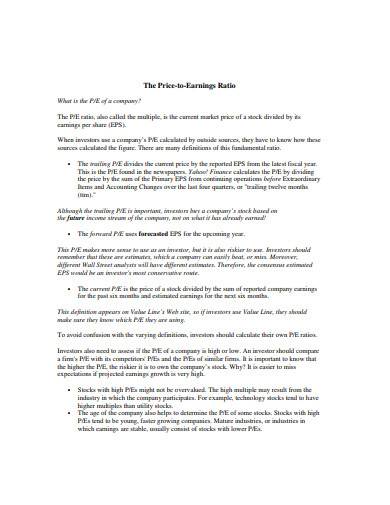

4. Price to Earnings Ratio Template

5. Price Earnings Ratio in PDF

6. Long Term Price Earnings Ratio Sample

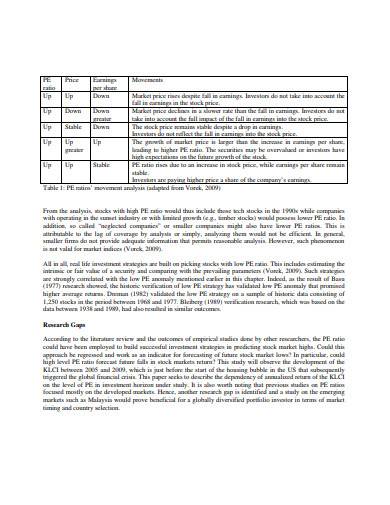

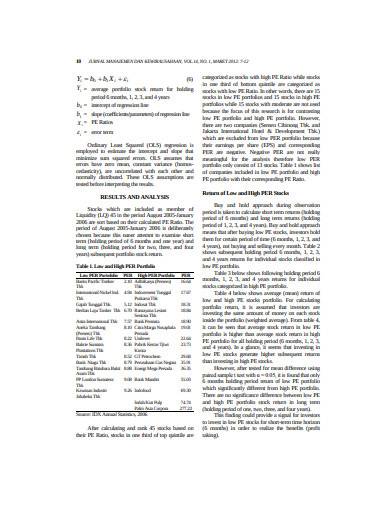

7. Price Earnings Ratio and Stock Return Analysis

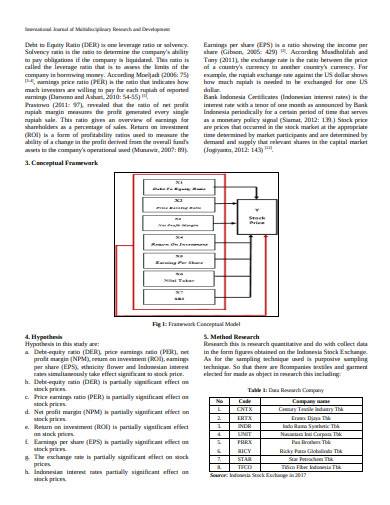

8. Sample Price Earnings Ratio in PDF

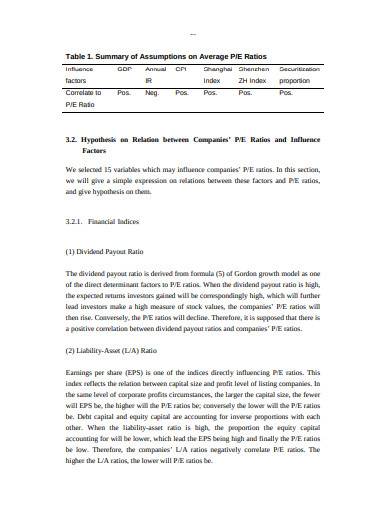

9. Formal Price Earnings Ratio Template

10. General Price Earnings Ratio Template

11. Price Earnings Ratio Example

12. Basic Price Earnings Ratio Template

13. Price Earnings Ratio in DOC

How to Create a Price Earnings Ratio Document

A price-earnings ratio’s formula is not a very complicated concept to grasp. Unfortunately the same cannot be said about the documents that utilize it. With various bars, graphs, and financial budget sheets, these documents are as meticulous as any research analysis. However, despite the scrupulous nature of accounting, there are a few general suggestions and tips you can apply to your P/E ratio documents.

1. Identify Your Method of Data Presentation

From generic price lists to quotations, sheets, to company-tailored financial analyses, there are various document formats you can use to present a price-earnings ratio. To top it all off, each one serves a specific purpose or can solve multiple problems when used correctly, but is also as capable of ruining your entire output when incorrectly used. As such, the first thing you do is identify which document works best with your current situation to ensure the highest probability of success.

2. Use a Visual Aid

More often than not, a financial document utilizing a price-earnings ratio will have raw data that is incomprehensible to the general public. These are usually numbers, calculations, budget plan contents, and cash flow analysis details. When documenting this type of information, it’s best to utilize visual aids such as bars, graphs, spreadsheets, and many others.

3. Incorporate the P/E Ratio

At first, this might seem like a blatantly obvious tip, but the significance of p/e ratios cannot be understated. When incorporating the formula onto your document, it’s best to first take a look at how the data is presented and what the document is all about. Doing so allows you the need for the p/e ratio formula such as estimating the price of a stock or calculating future revenue if the venture succeeds.

4. Provide a Summary

Providing an executive summary of your document is an efficient way of rounding up all the data found within your text into concise and more manageable portions. Observed and used in various other financial documents, this format also provides you a window of opportunity to explain to your readers what a price-earnings ratio. Though this may seem unnecessary, take note that not everyone who reads your document knows what a p/e ratio is, so it’s better to be safe than sorry.

Not everything integral to a functioning business is either overly simple or excruciatingly challenging to comprehend. An ideal example of this notion is a price-earning ratio document: the formula itself is understandable to a fault. On the other hand, the documents in which it’s used aren’t the simplest formats to draft. However, no one can deny the exceeding usefulness of this particular financial formula.

Related Posts

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]