Opening a business is no easy task for all business owners. You probably never imagined you’d have to write a dozen documents needed to run your business properly and one of them is writing a loan proposal. It’s very common to need financing for your new business and it requires the process of asking loan from lenders to provide you a specific amount of money that you will use to pay for the different costs in operating your business. Most lenders require business owners for a loan proposal and if you’re going to go through this process, you need to learn how to write a convincing and well-written one. Writing a loan proposal is not as difficult as one will expect. You just need to familiarize what information to put and use your power of persuasion to entice the lender to approve your proposal and assure them you’re deserving enough to have the loan. This article will guide you on how to create a loan proposal.

3+ Loan Proposal for Startup Samples

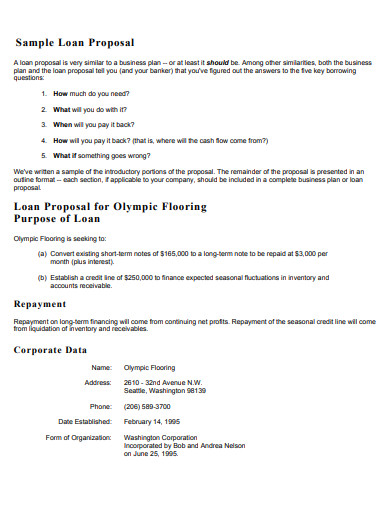

1. Loan Proposal for Startup

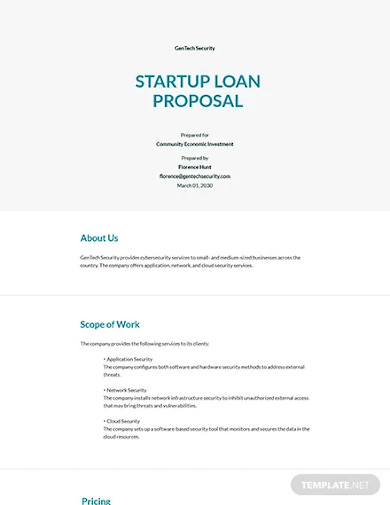

2. Sample Startup Loan Proposal

3. Startup Loan Proposal Example

What Is a Business Loan Proposal?

A business loan proposal is a written document that a businessman uses to obtain funding from a lender to support the costs associated with running their business. The loan proposal serves as proof to convey to the lender that the business is in good operational standing and that they are worth it for the lender to take a risks with them.

Details to Include in a Business Loan Proposal

1. Executive summary

2. Company Description

In the main part of your business plan, you should more fully describe the history, current operations, and strategy of your business.

3. Organization plan

This section is where you showcase the skills, experience, and qualifications of each employee you have in your business.

4. Financial plan

This is where you provide evidence of the financial strength of your business. Provide financial statements and forecasts for the next 2 to 3 years. These documents will be used to examine by the lender to understand your track record and capacity to repay the loan. Be sure to be transparent and honest as possible.

4. Marketing plan

This is where you provide information on your target market’s profile, information about your competitors (their strengths and weaknesses), and your competitive advantage in the market.

5. Production plan

This section is where you will provide important details on your business operations. The lender will want to know how you can handle your projected sales.

6. Human resources management

And lastly, give details on how your business can recruit, develop, and retain employees to help your business run efficiently and ultimately reach your goal.

FAQs

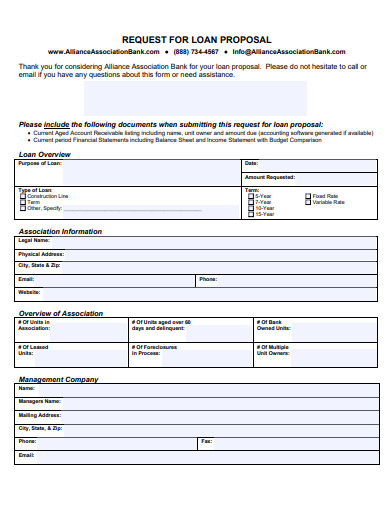

What supporting documents should you include in the proposal?

Aside from handing a loan proposal to your lender, you also need to provide them with the following documents:

- Business plan

- Balance sheet

- Profit & loss statement

- Cash flow statement

- Financial projections

- Market studies or other research supporting your forecast

- Documents that support your financial data

- Client testimonials

Why do lenders request a loan proposal?

Lenders require a loan proposal from businessmen to know where their business stands financially. Furthermore, they want to know how knowledgeable the businessman is in the market and industry they belong to, and how they operate their business in a general sense.

What loans are available for startups?

The loans that are available for startup businesses to obtain are:

- SBA loans

- Microloans

- Personal business loans

- Grants

- Friends and family

- Credit cards

- Crowdfunding

When writing your proposal, make sure to use simple and plain language. Avoid using technical or jargon terms and acronyms. Your proposal should be clear, well-structured, and easy to read so the reader can understand it right away. Don’t forget to highlight the best in your company, after all, your purpose is to sell yourself to them. Focus on showing to them that your venture will succeed and show to them that you are also for anything that may happen to your business by demonstrating your contingency plans to counteract any possible situations or scenarios. Provide images related to the contents in your proposal to break the monotonous look. To help you get started on creating a loan proposal, download our free samples templates above to use as your guide!

Related Posts

FREE 11+ Engineering Project Proposal Samples in PDF | MS Word

FREE 4+ Racing Sponsorship Proposal Samples [ Team, Car, Driver ]

FREE 10+ Nursing Project Proposal Samples [ Community, Health, Clinical ]

FREE 11+ Student Council Proposal Samples in PDF | DOC

FREE 10+ Facilities Management Proposal Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 8+ Joint Venture Proposal Samples [ Commercial, Real Estate, Construction ]

FREE 10+ Scholarship Proposal Samples [ Project, Grant, Sponsorship ]

FREE 10+ Computer Purchase Proposal Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Network Project Proposal Samples [ Design, Security, Bank ]

FREE 14+ Accounting Proposal Samples in PDF | MS Word

FREE 10+ Church Event Proposal Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ History Proposal Samples [ Dissertation, Thesis, Paper ]

FREE 34+ Sponsorship Proposal Samples in PDF | MS Word | Pages | Google Docs

FREE 11+ Cost Proposal Samples & Templates in PDF

FREE 11+ Maintenance Proposal Samples in MS Word | Google Docs | PDF