Making a budget is a great way for financial management. However, that doesn’t end there. Keeping track of your finances is a never-ending task. Because your requirements and goals will change over time, the key to making your budget work is to approach it as a progressing document that you can analyze and update as needed to suit your current financial objectives. Ideally, you should check on your finances from time to time. If you’re looking to control your expenses better, look no further! In this article, we provide you with free and ready-to-use samples of Budget Evaluation Report samples. Keep on reading to find out more!

7+ Budget Evaluation Report Samples

1. Budget Research Evaluation Report

2. Budget Expenditure Evaluation Report

3. General Budget Evaluation Synthesis Report

4. Participatory Budget Evaluation Report

5. Participatory Budgeting Research Evaluation Report

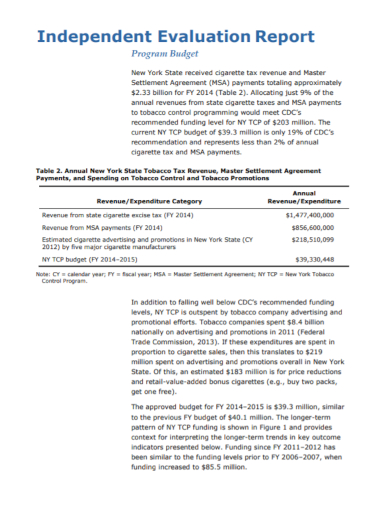

6. Independent Program Budget Evaluation Report

7. Budget Forecast Evaluation Report

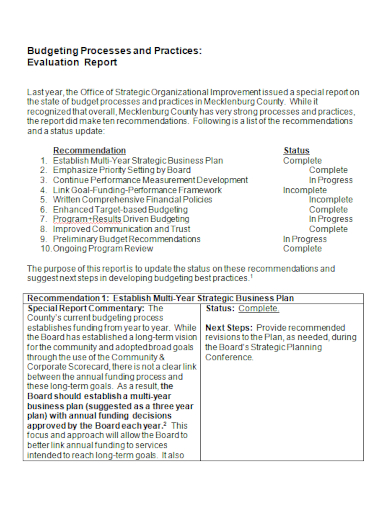

8. Budget Process Evaluation Report

What Is a Budget Evaluation Report?

A budget evaluation report is created to show how a company manages its finances. The goal is to determine how the company spends its available finances and how much is left over for new product development, for example. It’s used to double-check previously calculated budget forecasts for a given time period. It’s often utilized to compare budget estimates to the actual results produced by the company. Payroll expenses, utilities, and other facility overhead costs, monthly revenue, and any fluctuations in spending from a time period are all included in reports.

How to Make a Budget Evaluation Report

It takes a few steps to evaluate your budget, but it’s a low-effort procedure that doesn’t take as long as creating your first budget. It is critical for your organization to analyze your budget in order to avoid any financial shortfalls. Aside from the variety of free templates provided above, you can make one of your own from scratch. Here are the following basic information that comprises a Budget Evaluation Report that you should consider:

1. Keep track of your spending and compare it to your actual costs.

Following the creation of a monthly budget, you should keep track of your spending in a budget spreadsheet, ideally on a regular basis. Assess whether you overspent, underspent, or kept on budget for the month with your budget and cost monitoring in front of you.

2. Examine new earnings and projected expenses.

It’s critical to determine your revenue and expenses for the following month at the conclusion of each month. These could be the same as last month’s or drastically different. Any lifestyle change might result in an increase or decrease in income or expenses, which should be reflected in the following month’s budget.

3. Adjusting your budget to meet your needs.

Make changes to your budget to reflect the new income, spending, and financial goals you’ve set for the month. You may need to re-allocate funds to each expenditure category if any of these financial circumstances have changed drastically.

4. Identify and resolve any budget discrepancies you may have.

The process of evaluating your budget may reveal hidden problems in your spending, referred to as budget leaks or loopholes, as well as allowing you to adjust your budget to fit your financial circumstances. Setting these self-imposed spending limits can help you stick to your budget throughout the month.

FAQ

What is the 50/20/30 rule in terms of budgeting?

In her book, All Your Worth: The Ultimate Lifetime Money Plan, Senator Elizabeth Warren popularized the so-called “50/20/30 budget rule” (also known as “50-30-20”). The main approach is to divide after-tax income into three categories and spend 50 percent on necessities, 30 percent on desires, and 20 percent on savings.

What does a budget report contain?

The cost of products sold is mentioned first, followed by selling expenditures, general and administration charges, other expenses, and ultimately a net operating income amount.

What makes a financial report different from a budget report?

A budget report just reveals the company’s incoming and outgoing cash flow and expenses, not how well it is performing or how it uses its available funds.

In conclusion, a budget evaluation report is created to show how an organization manages its finances. Furthermore, your current budget is a good sign of how you should plan for your future budgets. Thus, this report is crucial. To help you with this, download our easily customizable and printable Budget Evaluation Report samples today!

Related Posts

Sample Chemistry Lab Reports

School Accomplishment Report Samples & Templates

Field Report Samples & Templates

Sample Science Project Reports

Business Report Samples & Templates

Survey Reports Samples & Templates

Sample Feasibility Reports

Psychological Assessment Report Samples [ Clinical, Child, Intake ]

Report Format Samples & Templates

Acknowledgement for Internship Report Samples [ Hotel, Hospital, Teaching ]

Field Trip Report Samples [ Agriculture, Educational, Environmental ]

Student Counseling Report Samples

Narrative Accomplishment Report Samples [ Science, Teacher, Reading ]

Sample Acknowledgment Report Templates

Internship Narrative Report Samples