The Defense Contract Audit Agency or DCAA conducts contract auditing for organizations such as DOD and other federal agencies to ensure that they are spending their funds correctly and efficiently. The agency provides effective methods in which initially selected government officials perform funded work and negotiate prices based on the services and products being offered. It also provides financial management advisory services to DOD and other agencies that are responsible for acquisition agreements and contract administration.

FREE 10+ DCAA Audit Report Samples

1. DCAA Contract Audit Manual Report

2. DCAA Independent Audit Report

3. DCAA Audit Final Report

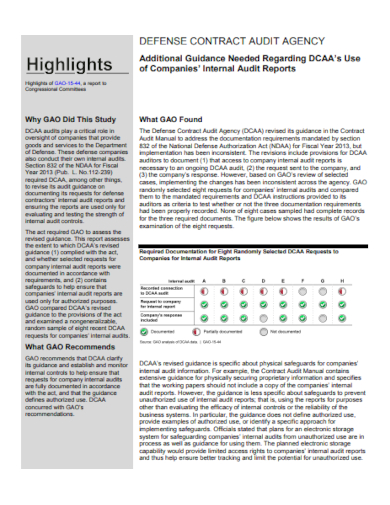

4. DCAA Contractor Audit Report

5. DCAA Internal Audit Report

6. DCAA Compliance Audit Report

7. DCAA General Audit Report

8. DCAA Policy Audit Report

9. DCAA Mission Audit Report

10. DCAA Audit Financial Report

11. DCAA Audit Annual Report

What is a DCAA Audit?

The DCAA is an agency that audits government contracts as well as contractors that have a connection with one or two contracts that they are subjected to audit. The agency will not perform an audit of a contractor that exclusively provides services or products to a large company with fixed-price contracts. The DCAA’s audits, whether conducted at the behest of the DOD or a civilian company, are commanded by a written audit program.

How to Write a DCAA Audit Report?

Companies that were awarded a cost-reimbursement type of federal contract should worry about audits conducted by the DCAA, regardless of the size of the company. Small businesses can also be subjected to audits by DCAA when they are awarded by a federal contract. If your business aims or has acquired a government work contract, you must ensure that your business has established its DCAA compliance.

Step 1: Develop an Evaluation Plan

Before starting, make sure that you have evaluated and produced an analysis plan before you proceed with your audits. Analyze the strengths and weaknesses of the company and find accurate information to support your audit. Researching will also help you get an idea of how your process should be performed.

Step 2: Determine the Tone of your Report

The tone of your report should match the voice and statement of the claim you have selected. With a tone, your audit report can establish clarity, feeling, and quality for the key points you are trying to communicate with your audit report.

Step 3: Make Sure of the Report’s Clarity

There are references used to efficiently write reports which are the condition, criteria, cause, consequence, and corrective action. Make sure that you are direct to the point and relay your idea efficiently. You can also use citations, formatting, and indentations to strategically plan and organize your report writing outline.

Step 4: Establish Consistent Communication

To ensure the establishment of consistent communication, there are steps you can follow to increase your efficiency which start with the identification of the audit findings, preparation of the first draft report with your audit team, discussions about the draft with the audit supervisor, meeting and formal drafting, and submission of the final report.

FAQs

What are the types of DCAA audits?

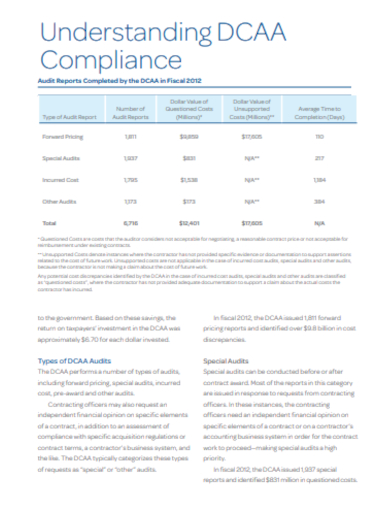

The DCAA conducts various types of audits which include forward pricing, special audits, pre-awarded surveys, incurred cost, and other audits which essentially consists of audits conducted after the awarding of a contract or can be requested by a contracting officer or commenced by the DCAA.

What are the areas in which contractors need to be compliant with the standards of DCAA?

DCAA audits are outlined based on the rules and regulations stated on certain system requirements. The three areas in which contractors need to follow the standards of DCAA are the Federal Acquisition Regulation, Cost Accounting Standards, and Timekeeping and Labor Charging System Requirements.

What will happen if a company is non-compliant with the DCAA standards?

Noncompliance with the DCAA standards can result in civil and criminal penalties, debarment, and voided or terminated contracts.

The DCAA can perform audits on any federal contract if it’s a cost-reimbursement or time and material classification of contract. This audit ensures that private companies awarded government contracts are spending their funds effectively and correctly. The DCAA audits usually assess items that range from direct costs to allowable costs, proscribed costs, indirect cost pools, and direct cost pools.

Related Posts

FREE 15+ Sample Internal Audit Reports

FREE 11+ Sample Audit Reports

FREE 11+ Forensic Audit Report Samples

FREE 11+ External Audit Report Samples

FREE 10+ Quality Audit Report Samples

FREE 10+ Environmental Audit Report Samples

FREE 10+ Tax Audit Report Samples

FREE 9+ Stock Audit Report Samples

FREE 8+ Project Audit Report Samples

FREE 8+ Access Audit Report Samples

FREE 16+ Sample Audit Reports

FREE 14+ Internal Audit Report Templates

FREE 14+ HR Audit Report Samples

FREE 11+ Energy Audit Report Samples

FREE 10+ Audit Incident Report Samples