9+ Employee Payroll Report Samples

We all look forward when we all our hard work is paid off, and that is why “pay days” may be considered as one of the best days in the month for most of us. A fair salary and wages enable employees to earn a living from their labor. Hence, it is crucial. If you’re from the finance or human resource department, the payroll function is one of your responsibilities. In this article, we provide you with free and ready-made samples of Employee Payroll Report in order to guide you. Keep on reading to find out more!

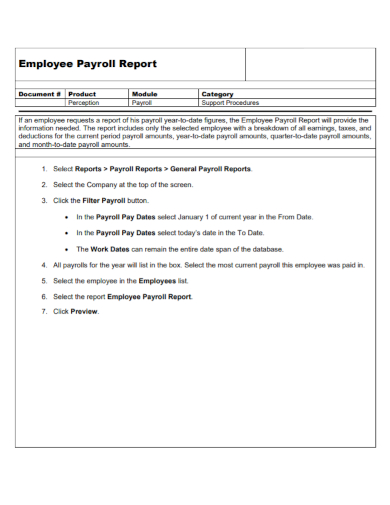

1. Employee Payroll Report

2. Employee Payroll Hours Report

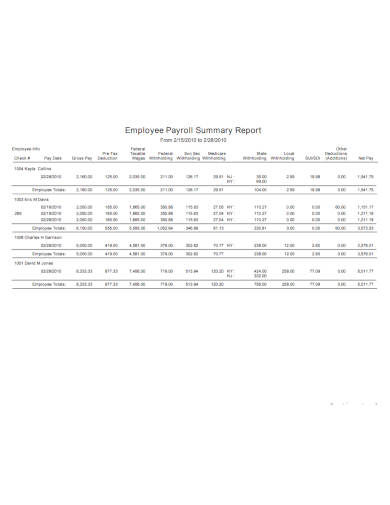

3. Employee Payroll Summary Report

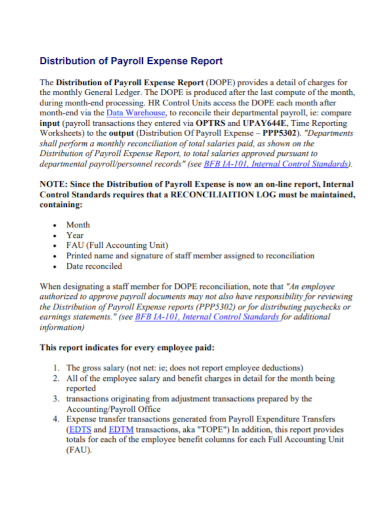

4. Employee Distribution Payroll Expense Report

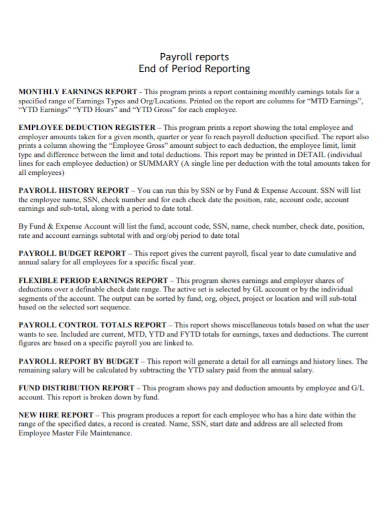

5. Employee Payroll End of Period Report

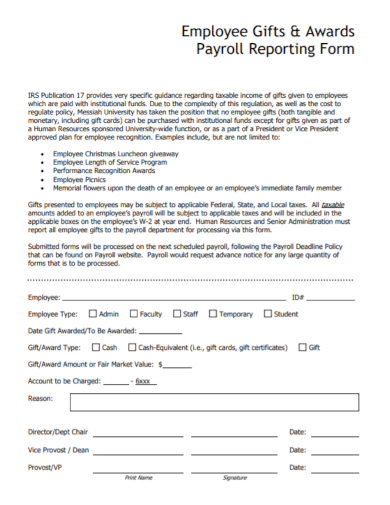

6. Employee Awards Payroll Reporting Form

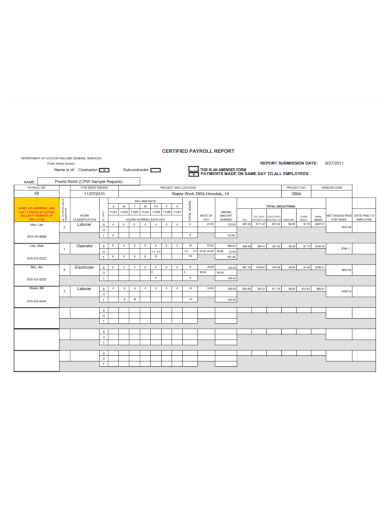

7. Employee Certified Payroll Report

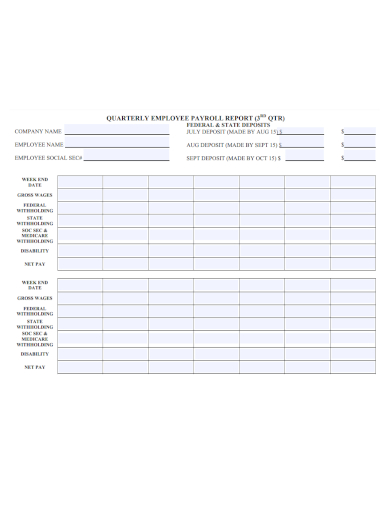

8. Quarterly Employee Payroll Report

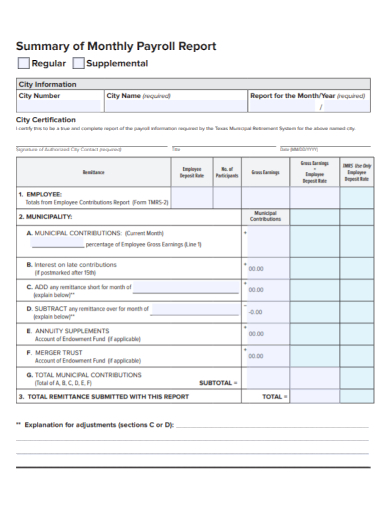

9. Employee Monthly Payroll Summary Report

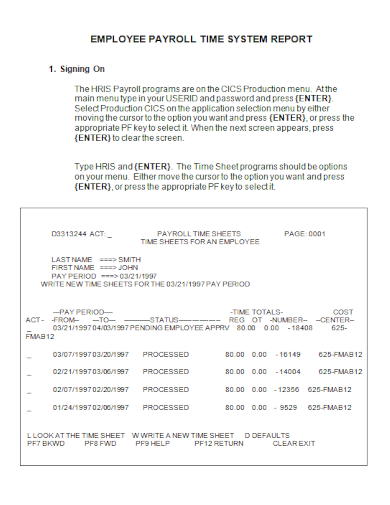

10. Employee Payroll Time System Report

What Is an Employee Payroll Summary Report?

An employee payroll summary report is a usually a is a spreadsheet that displays a summary of an employee’s payroll activity. It is a useful tool for examining all payroll data for paid employees over a specified time period. In this case, the time period is a sum total within the year. Here are some details that a payroll summary report should include:

- Gross Pay: Simply put, a gross pay is the amount received by an employee before taxes and deductions.

- Adjusted Gross Pay: The adjust gross pay, after pre-tax deductions like a contribution to an employee’s 401(k), it is what is left for each employee.

- Net Pay: The net pay is the actual pay the employee receives after it is being reduced from taxes and other deductions.

- Employer Taxes and Contributions: This section of your payroll summary report displays the proportion of unemployment taxes you paid, as well as any other tax liabilities you incurred, such as leave or vacation time.

How to Create an Annual Employee Payroll Summary Report

A payroll summary report may vary from company to company as they might use different methods. However, if you’re interested in making your own summary report, here are some basic components that can be included in the document:

- Employee Identity code

This field shows the employee’s unique identifier.

- Employee name

This field displays the full name of the employee.

- Job

This section specifies the role of the employee and which department he/she is under in.

Note: this salary reflected must be the salary from the current time period.

- Invoice details

An invoice is a detailed description of the goods or services you’re charging for, as well as the date you gave them.

- Deductions

Deductions include the tax deductions and other penalties.

FAQ

What is a 401k and how does it work?

A 401k is a type of retirement plan offered by an employer. It enables an employee to save aside a portion of their pre-tax earnings towards retirement.

What is the payroll process in HR?

It begins with the creation of a list of employees who must be paid and concludes with the recording of those charges. It’s a complicated procedure that necessitates collaboration across several departments such as payroll, HR, and finance.

What is a year end payroll report?

It’s all about balancing the books, making sure you’ve paid everyone the correct amount of money, and double-checking that you’ve sent the government the correct amount of taxes.

Should HR process payroll?

Employee confidentiality is something that should be handled by the human resources department. If an employee has a payroll question, HR is the person to contact. Because the majority of payroll data comes through HR operations, HR is the best department to deal with payroll.

What is the use of payroll report?

Employers use payroll reports to tell government agencies (such as the IRS) about payroll and employment tax liabilities. Wages paid to employees, for example, are summarized in payroll reports.

Our free and downloadable sample reports could guide you in doing your annual payroll summary report. Get the hard work done for you and check out our other samples. Print them out and you’re good to go.

Related Posts

FREE 10+ Employee Report of Injury Form Samples

FREE 10+ Paycheck Stub Samples

FREE Payroll Tips from a Tax Professional

FREE 9+ Sample Payroll Deduction Forms

FREE 9+ Sample Employee Uniform Forms

FREE 7+ Payroll Accountant Job Description Samples

FREE 8+ Payroll Officer Job Description Samples

FREE 6+ Payroll Authorization Forms

FREE Benefits of Outsourcing Payroll

FREE 22+ Monthly Report Templates

FREE 16+ Employee Incident Report Templates

FREE 16+ HR Audit Report Templates

FREE 10+ Employee Performance Evaluation Report Samples

FREE 10+ Facilities Management Report Samples

FREE 8+ Payroll Analyst Job Description Samples