As a business owner, it is important that you have a full grasp or understanding of your business’s financial plans and management plan to know how your money flows and is being spent. Tracking your expenses is one of the important parts to determine the success of your business. With an expense report template, you can capture the most important details of the purchases relevant to your business which includes your budget plans, finances, as well as the cost of travel needed by your employees as part of their roles and responsibilities.

10+ Expenses Report Samples

1. Free Monthly Business Expense Report Template

2. Free Contractor Expense Report Template

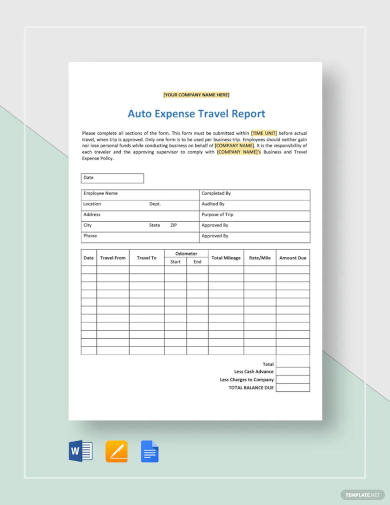

3. Free Auto Expense Travel Report Template

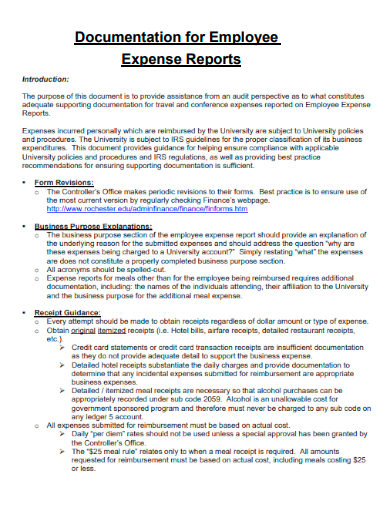

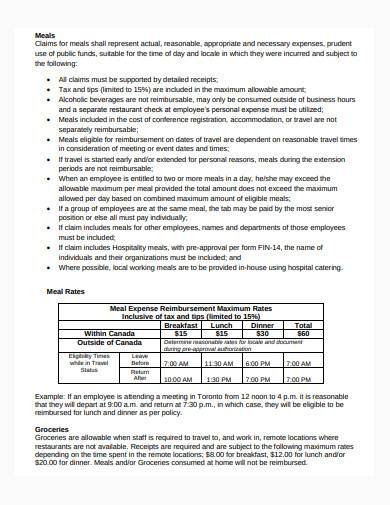

4. Documentation for Employee Expense Reports

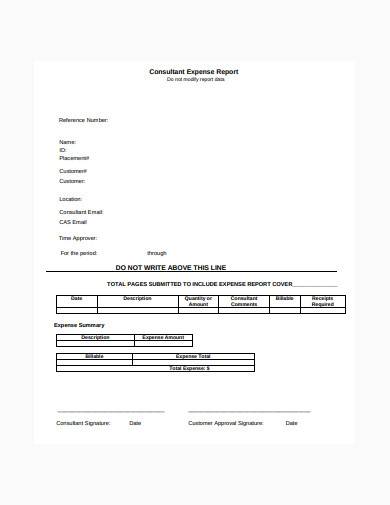

5. Consultant Expense Report Sample

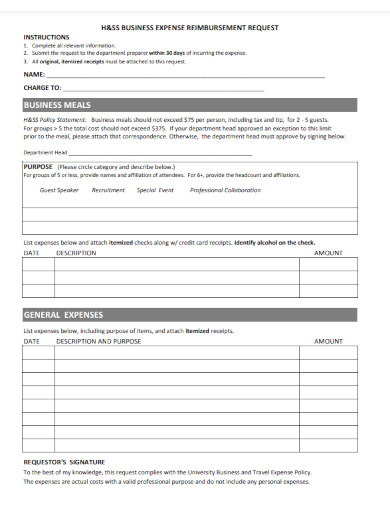

6. Small Business Expense Report

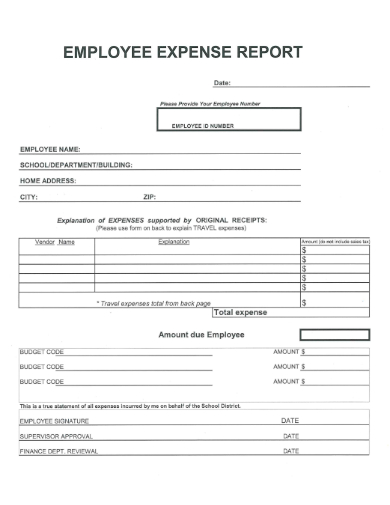

7. Sample Employee Expense Report

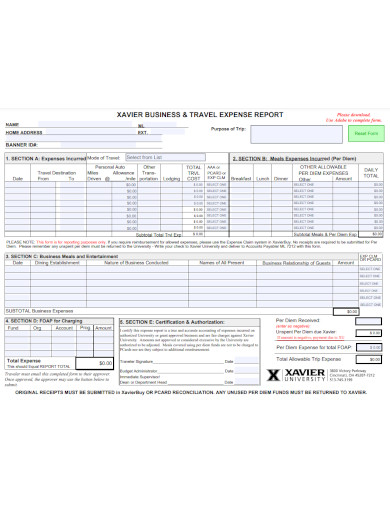

8. Travel Expense Reports

9. Employee Consultant Expense Report Sample

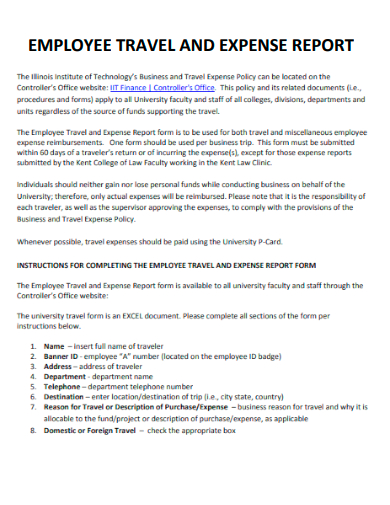

10. Employee Travel & Expense Report

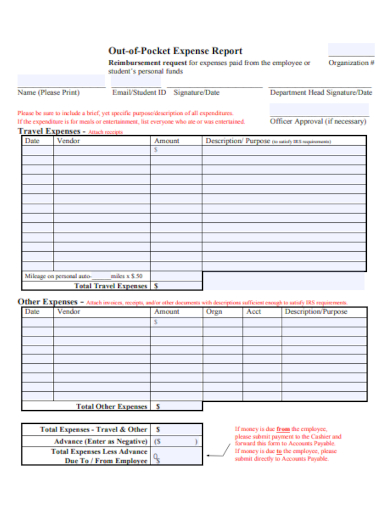

11. Pocket Expenses Report

What is an Expense Report?

An expense report is a document that contains an itemized and categorized list of expenses that were made in place of the company or business. This enables the employer or finance team to identify what type of money was spent, what product or service was purchased, and how much of the expense was approved for reimbursement, a procedure based on the company policy which is the expense reimbursement policy.

How to Write an Expense Report?

To track their business spending, companies and organizations utilize an expense report. It contains detailed information on any purchases made to make sure that the business keeps running such as daily meals, parking fees, hotel accommodations, and more. This report also contains information on the expenses made for a department, project, or team member and employees can use this document to claim reimbursements for business-related transactions or expenses.

Step 1: Choose a Template You Want to Use

Making an expense report involves choosing the appropriate template. You can customize it with your business name, the period date you are reporting on, and your name. Then, edit the columns of the template as you add details on the date, your vendor, client, project title account, notes to explain the expenses, and the amount of the expense.

Step 2: Include the Itemized Expenses

On each line, add each expense, and be sure to provide as much detail as you can. Indicate which of your clients and projects the expenses are for to ensure that your expense tracking is accurate. You can arrange your expenses in chronological order with the most recent expenses at the bottom.

Step 3: Determine the Total

Each of your categories has a subtotal on your expense report and a grand total for all of your expenses. You can include this information on your template to better showcase how you are spending based on each category.

Step 4: Include Receipts If You Have Any

If you are an employee who is submitting an expense report for reimbursement, you will need to attach the appropriate and accurate receipts to justify your claims. If you are a business owner, you will need to keep your cash receipts or sales invoices to generate expense reports.

FAQs

What is the importance of expense reports?

With expense reports, businesses and companies can facilitate efficient tracking of their expenses and cost control, helps in monthly budget management and planning, make accurate reimbursements, and simplifies tax deductions.

What are the business expense categories?

Business expense categories include advertising expenses, car and truck expenses, commissions and fees, contract labor, employee benefit programs, insurance, interest, mortgage, legal and professional services, office expenses, rent or lease, travel and meals, wages, and more.

What are the different kinds of expense reports?

The different kinds of expense reports include one-time expense reports, recurring expense reports, and long-term expense reports.

An expense report is a document that contains the expenses for a company or business, a department, a project, or an employee and accounts for certain expenses that happened on an individual basis or a collection of expenditures over a given period of time based on a given category, payee, and other factors. This report allows organizations or businesses to track their cash flows which is an important element when assessing the financial health of a business, determining efficiencies, and measuring the development of a company’s profit.

Related Posts

Sample Chemistry Lab Reports

School Accomplishment Report Samples & Templates

Field Report Samples & Templates

Sample Science Project Reports

Business Report Samples & Templates

Survey Reports Samples & Templates

Sample Feasibility Reports

Psychological Assessment Report Samples [ Clinical, Child, Intake ]

Report Format Samples & Templates

Acknowledgement for Internship Report Samples [ Hotel, Hospital, Teaching ]

Field Trip Report Samples [ Agriculture, Educational, Environmental ]

Student Counseling Report Samples

Narrative Accomplishment Report Samples [ Science, Teacher, Reading ]

Sample Acknowledgment Report Templates

Internship Narrative Report Samples