As a financial obligation, liabilities may result in the business’s sacrifices of economic benefits to other entities. However, a company’s liability can be an alternative source of financing. What is behind this? Well-managed liabilities can help a business to become successful in every business operation. Additionally, it determines the company’s ease with its financial flow. That said, having a transparent accounting journal with a comprehensive liability report will best represent what is ahead for the business.

The future of a business can be cloudy. To clear things, there should be no debts that might approach the number of its assets. The liability report defines what the business owes to a party. With that, settling debts in terms of cash payments or service deliveries become more convenient.

What Is a Liability Report?

A financial statement provides a sneak peek of a business’s accounts. And it has a balance sheet that lists the business’s assets, liabilities, and equity. All these are important parts of every business operation. If it loses a hand in one of these accounts, things could go downhill. That is why it is important to disclose the condition of each account.

What is a business account, and why is it important? Every business has a system that manages its money. Business accounts, which could be a source of finances or where the finances are going, help in monitoring the cash flow, debts, and other business credits. In most cases, the debts of a business, which is a liability, need to be paid before it is due. And reporting this in accounting means the difference between the number of assets and the number of equity. If a business does not document debts, it could disrupt cash flow. So, to have a full picture of what a business owes to other entities, such as suppliers and loan providers, recognizing business liabilities through a report must take place. Without this report, tracking where the finances started to decline could be more difficult.

Classification of Liabilities

1. Current Liabilities (Short-Term Liabilities). These are the debts the business has to pay within 12 months. More so, it is a part of the regular financial transactions, operations, and processes. In dealing with this liability, a business has to consider the ratio of existing assets and existing liabilities.

2. Non-Current Liabilities (Long-Term Liabilities). This type of liability is payable after a year or more. Additionally, the entry of this liability is in a separate balance sheet, away from other existing liabilities.

3. Contingent Liabilities. This liability could occur depending on certain business deals. Since it is a special category, recognizing its occurrence depends on the following conditions: a) the probability of the outcome b) the estimation of the liability amount.

FREE 12+ Liability Report Samples and Templates in PDF | MS Word

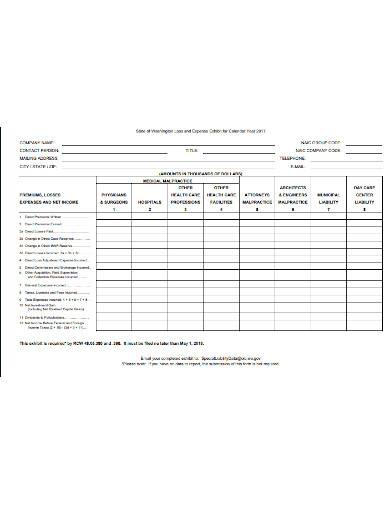

1. Special Liability Report Form Template

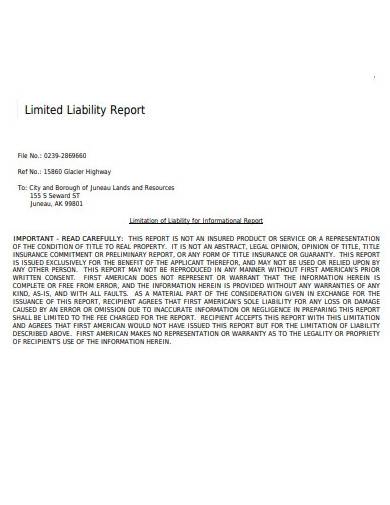

2. Limited Liability Report Template

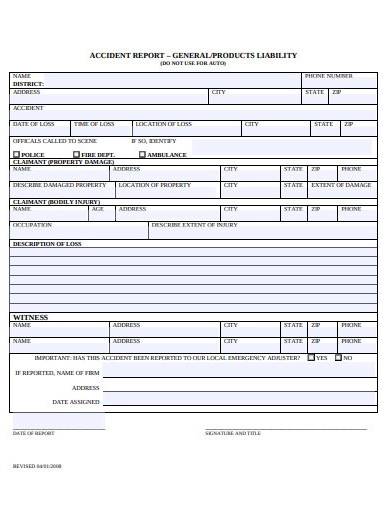

3. Product Liability Report Template

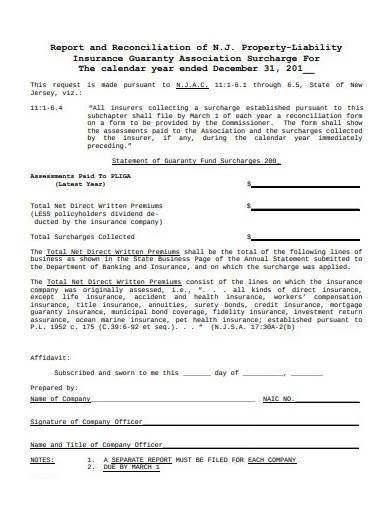

4. Property Liability Report Template

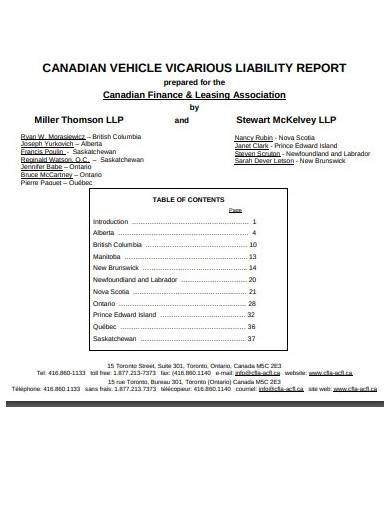

5. Vehicle Vicaurious Liability Report

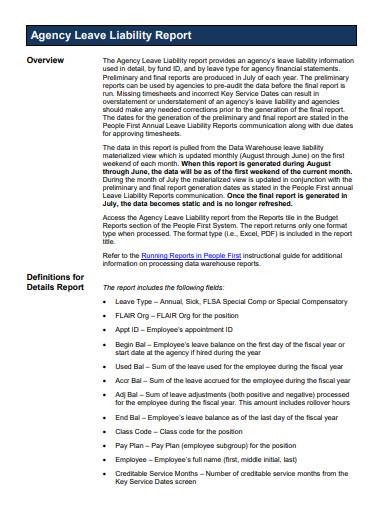

6. Agency Leave Liability Report

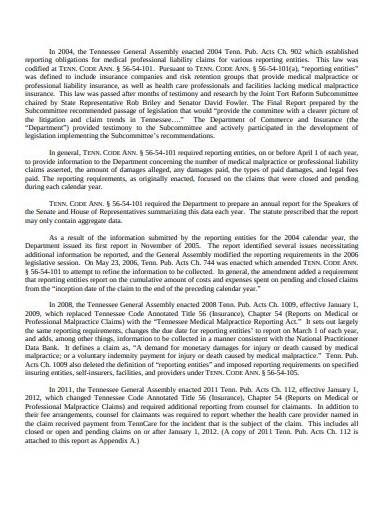

7. Health Care Liability Report Template

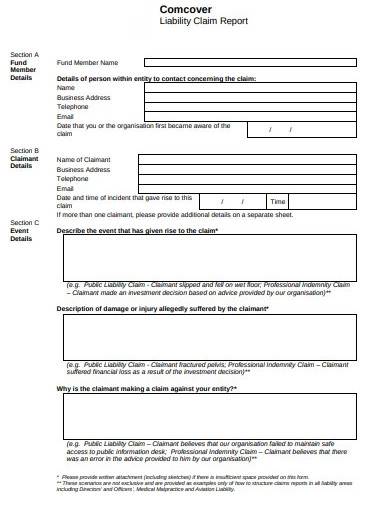

8. Liability Claim Report Template

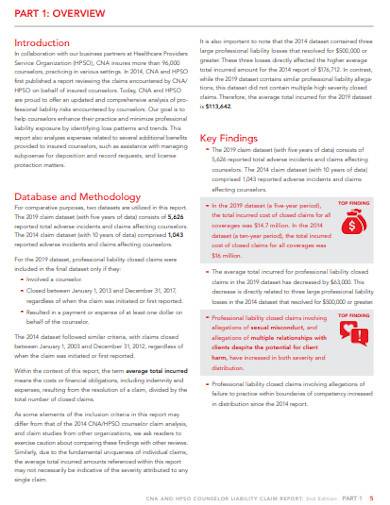

9. Counselor Liability Claim Report

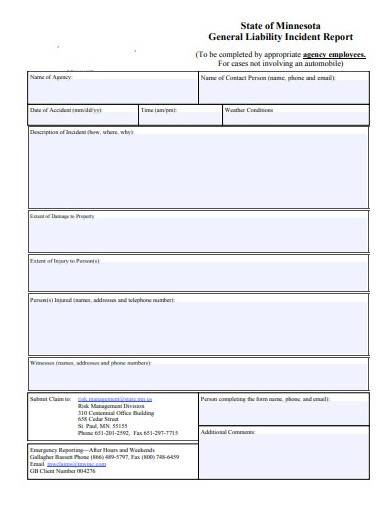

10. General Liability Incident Report

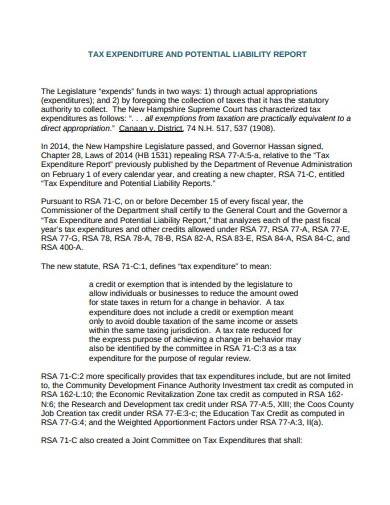

11. Tax Expenditure & Potential Liability Report

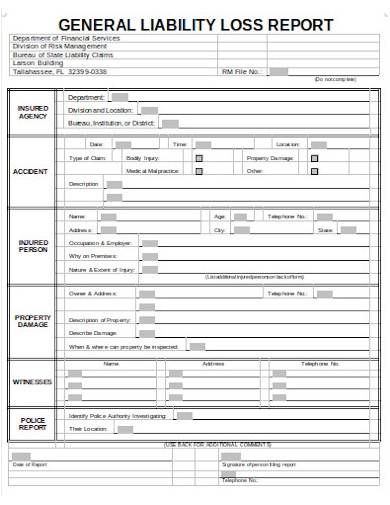

12. General Liability Loss Report Template

13. Sample Liability Data Report Template

How to Make a Liability Report

Making a liability report for a business is a demanding task. The expectations from the report creators—accountants or bookkeepers—are high because it is part of their education. However, whether you have mastered making a liability report or not, any can happen and things could go unexpected. Hence, writing a perfect report means hitting all the requirements to make it informative, comprehensive, and complete as much as possible. So, we come up with simple steps in creating a liability report. Continue reading below.

1. Prepare and Plan

Structuring the report in which it leads the readers to a course of thinking, action, and a decision is important. So, before writing the report’s content, begin with a plan. The plan will let you come up with a process that does not only make it easier to complete the report but also in making it more organized and cohesive. You can consider the plan as the framework of the liability report. It will help in setting the goals. With these goals in mind, the report will have a purpose that makes it convincing and reliable.

2. Know the Brief

If you are tasked to make a report for a business liability agreement, you will usually receive a brief for the report. The brief will contain instructions about the content of the liability report. It includes the subject of the report, relevant information about the subject, reasons why the report needs to push through, and whom the report is for. Considering all these can be a little overwhelming. However, if you miss out on anything from the brief, the outcome will be incomplete. Take note that an effective report makes the readers think. So, let them agree on a decision or make recommendations instead.

3. Stick with the Brief

As you make the report, always keep your brief in mind: what are you writing, why are you writing, and who are you writing for? It will make you focus on the report and discard anything irrelevant. If you need research, make sure to refer to reliable sources. Moreover, writing a report can be misleading, especially if it gets technical and lengthy. So, be mindful of the report’s organization of ideas. Do not mix up the subject by providing supporting details for the main ideas.

4. Get Into Writing

Making a liability report will get you into writing. Yet, if you have no patient in starting from scratch, you can opt to use a report template. However, manually doing the report will make you pay more attention to the content. It is important to remember that a complete liability report is a good communication tool, as well. A complete report conveys the message the writer wants the readers to learn. In business, money is a contentious issue. So, take the time to write the liability report and make sure it does not miss any business deal.

FAQs

Is accrued liability a current liability?

Since an accrued expense is a short debt, it is considered a current liability.

What is an account payable?

The money that a business owed to its supplier is an Account Payable (AP).

Is cash debit or credit?

Cash is an asset account of a business. If cash is used to pay bills, it is being credited.

Everyone knows that business is a competitive industry. Most people in the industry measure success with the total amount of assets a business has. But beyond all there is, the business remains a mixture of debts and capital. The business industry exists because money is directly channeled into it. This means every business account matters in making the industry at work. Not documenting these accounts is a great loss for a business. That said, a document like a liability report makes a great impact on every business endeavor. It prevents the business from spending more than its number of assets to balance the finances of the business.

Related Posts

FREE 15+ Blank Incident Report Samples in MS Word | Pages | Google Docs | PDF | AI

FREE 15+ Restaurant Report Samples in MS Word | Google Docs | Pages | PDF

FREE 10+ Sales Activity Report Samples in MS Word | Pages | Google Docs | Google Sheets | Numbers | MS Excel | PDF

FREE 15+ Company and Financial Report Samples in MS Word | Pages | Google Docs | Google Sheets | Numbers | MS Excel | PDF | AI | Publisher

FREE 10+ Vehicle Report Samples in MS Word | Pages | Google Docs | MS Excel | Numbers | PDF

How to Write an Impressive Data Audit Report Samples in MS Word | Pages | Google Docs | PDF

FREE 10+ Project Summary Report Samples [ Final, Equipment, Pilot ]

FREE 10+ Discharge Summary Report Samples [ Electronic, Materials, Timely ]

Psychological Assessment Report Samples [ Clinical, Child, Intake ]

FREE 6+ Food Incident Report Samples [ Safety, Poisoning, Service ]

FREE 11+ Student Performance Report Samples [ Medical, Academic, Class ]

FREE 10+ Land Appraisal Report Samples in PDF

FREE 10+ Work Accident Report Samples [ Vehicle, Injury, Safety ]

FREE 10+ Desk Research Report Samples in PDF

FREE 5+ Post-Security Incident Report Samples in PDF