10+ Payroll Analysis Report Samples

Pay day, for a lot of working people, is the most important day of the month. Getting your salary is sent through the pay roll. The procedure through which employees get their pay is referred to as payroll. Balancing and reconciling payroll data, as well as depositing and reporting taxes, are all part of the job. Wage deductions, record keeping, and confirming the accuracy of pay data are all handled by the payroll department. A payroll is necessary since most, if not all, employees in any office will leave if they do not receive their financial compensation on time. Most businesses’ payroll operations are handled by either the finance or human resources departments. If you belong in either of these departments, then it is your responsibility to accurately check and analyze the payroll of the month. If you’re looking for some help with this, look no further! In this article, we provide you with free and ready-to-use samples of Payroll Analysis Report in PDF and DOC formats that you could use for your convenience. Keep on reading to find out more!

1. Payroll Executive Summary Analysis Report

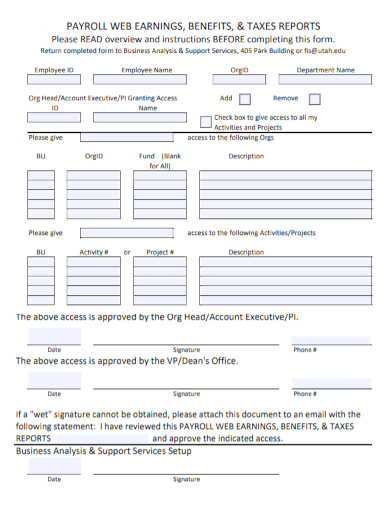

2. Payroll Business Analysis Services Report

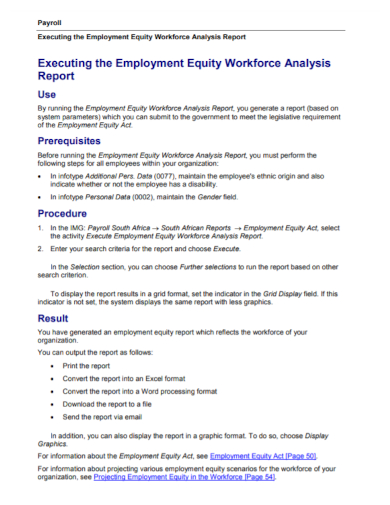

3. Employment Payroll Analysis Report

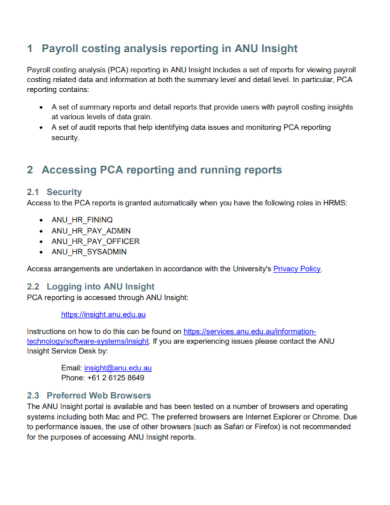

4. Payroll Cost Analysis Report

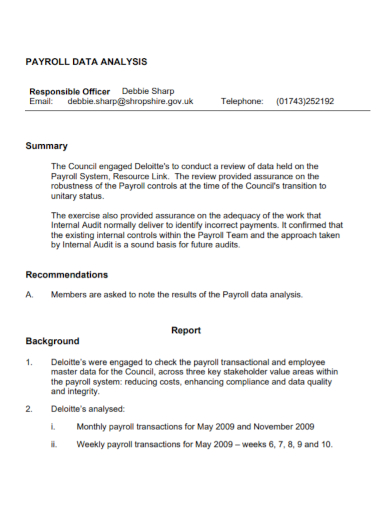

5. Payroll Data Analysis Report

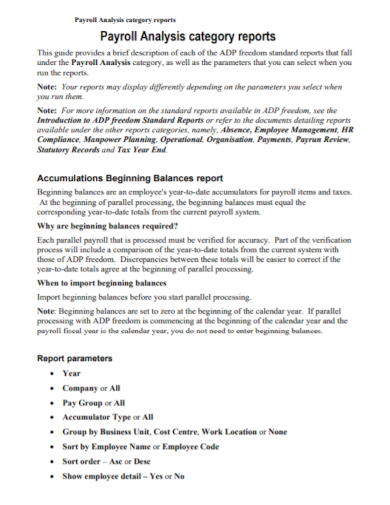

6. Payroll Analysis Balance Report

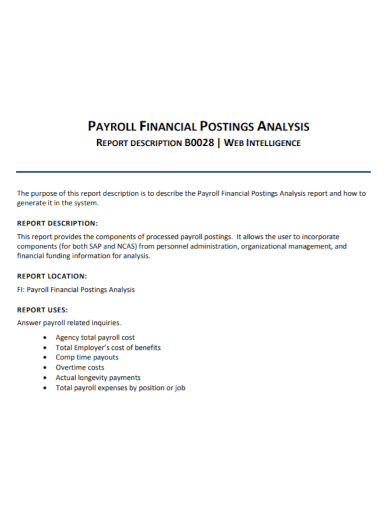

7. Payroll Financial Analysis Report

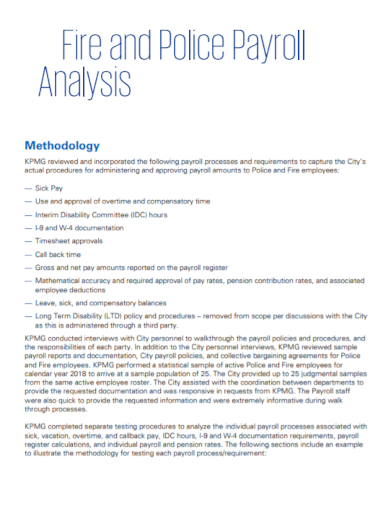

8. Police Payroll Analysis Report

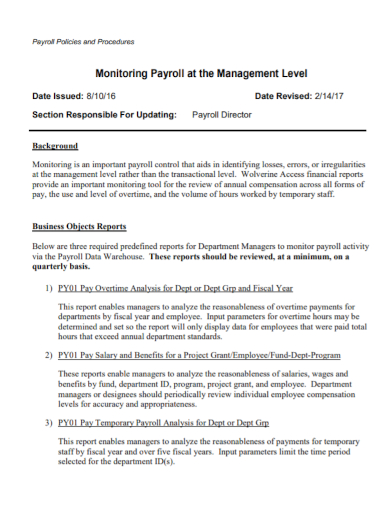

9. Management Payroll Analysis Report

10. Project Payroll Cost Analysis Report

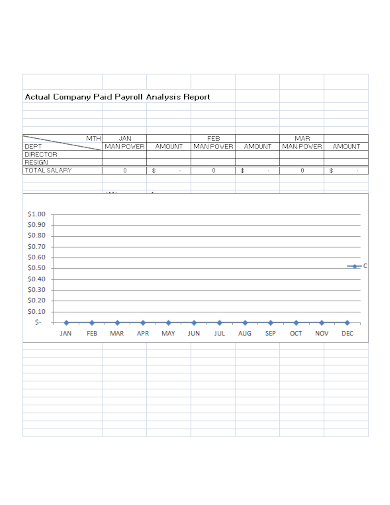

11. Company Payroll Analysis Report

What Is a Payroll Analysis Report?

Traditional payroll services are enhanced by payroll data analysis, which provides a distinct perspective on payroll data. The analysis reveals the frequency of payments, the number of payees, and the amounts paid, but it does not reveal specific workers. The Payroll Analysis Report is a comprehensive report that can be utilized in a variety of situations since it includes all financial data about employees and can be sorted and examined in a variety of ways. It contains extensive information about pay and perks provided by the company. This report should be performed on a regular basis to reconcile payroll costs to financial statements and ensure that no inactive workers have been paid in mistake.

How to Make a Payroll Analysis Report

There are a lot of things to include in your payroll analysis report, such as: payroll expenses, errors, financial statements, quarterly data. To ensure that you have a comprehensive and well-structured analysis report, you can choose the excellent templates listed above so that you don’t have to go through the hassle of writing one from scratch. Other than that, if you want to write your own, you can follow these steps below to guide you:

1. Determine what information is required.

Begin by determining the data you need to share with others or evaluate internally. A simple report that covers employee earnings, employer taxes, and employer-paid fringe benefits would be preferable.

2. Select a pay period for the payroll.

Select the paycheck period for the report. For example, instead of four quarterly payroll reports, your creditor will receive 12 monthly payroll reports. It provides you greater leeway to explain why payroll expenses fluctuate.

3. In this area, enter paycheck information.

Select a software that allows you to enter payroll information as seamlessly and accessibly as you could possibly could. Microsoft Excel is a widely used program. After you’ve created your template, populate it with data from your payroll system. If you’re manually entering data, be careful not to commit a transposition error.

4. Examine the outcomes.

After you’ve completed creating the report, go through it again for errors and to see what you can learn. If a lender or investor asks a probing inquiry, you want to be an authority on your company’s financial papers.

FAQ

What is a payroll report’s purpose?

A payroll report is a document that companies use to double-check financial data or verify their tax responsibilities. Pay rates, hours worked, overtime accumulated, taxes deducted from paychecks, employer tax payments, vacation balances, and other information may be included.

What are the benefits of keeping correct payroll records?

Payroll records that are accurate and exact capture a key aspect of your business’ finances and help you achieve consistency in bookkeeping procedures like reconciling tax liabilities with cash flow predictions, balance sheets, and profit-and-loss statements.

What kinds of payroll reports are common?

Employers use payroll reports to alert government authorities about payroll and employment tax responsibilities. Payroll reports include information like: Employees’ remuneration. Income taxes have been deducted from your pay.

All in all, analyzing your payroll performance can help you manage budgets and cash flow during times of change or growth by providing more accurate yearly projections. To help you get started with this, download our easily customizable and cohesive Payroll Analytics Report today!

Related Posts

FREE 10+ Workload Analysis Samples

FREE 8+ Sample Compensation Analyses

FREE 8+ Sales analysis

FREE 7+ Sample Strategic Analysis Reports

FREE 7+ Sample Forensic Report

FREE 43+ Printable Payroll Templates

FREE 11+ Forensic Audit Report Samples

FREE 10+ Sample Data Analysis

FREE 8+ Sample Payroll Report

FREE 7+ Payroll Accountant Job Description Samples

FREE 39+ Sample Reports

FREE 11+ Variance Analysis Report Samples

FREE 11+ Sample Analysis Report

FREE 10+ Consultant Report Samples

FREE 10+ Sample Job Analysis Reports