It is customary for the majority of people in the world to avoid discussing their pay openly. The majority of us do not believe that it is appropriate to inform strangers about how much money we earn in our jobs. Nonetheless, it remains the primary reason people take and leave jobs. Businesses must ensure that whatever they pay their employees is accurate, timely, and in compliance with applicable employment and payroll laws and regulations. If your payroll is not in order, your business may simply cease to exist within a few months. Payroll is typically delegated to human resources, and they are responsible for ensuring payroll accuracy. A payroll report is an excellent way to ensure this is the case.

Everyone desires accurate compensation. Every employee wishes for their taxes to be filed correctly, their health insurance and other payments to be calculated correctly, and their wage deductions to be legal and accurate. The overall objective of a payroll audit is to ascertain whether the employer is adhering to the terms established by the local or national government regarding the employer’s contributions to benefit funds. A payroll register report verifies the accuracy of the company’s payroll processes. The document examines the number of active employees at the business or company, the pay rates, wages, and total tax withholdings at the business or company. Typically, a payroll audit is conducted at least once a year to ensure that the overall process is current. Anyone who has ever managed payroll knows that it is not an easy task and is frequently a lengthy process. It’s a largely overwhelming process, owing to the sheer number of details to keep track of and the ease with which errors can occur. That is why checklists exist to facilitate the process. To learn more about payroll reports and how they work, take a look at the payroll register report samples listed below. Once you’ve familiarized yourself with the document, feel free to use these sample payroll audit checklists as guides or, in some cases, as a template for your own document.

3+ Payroll Register Report Samples in PDF

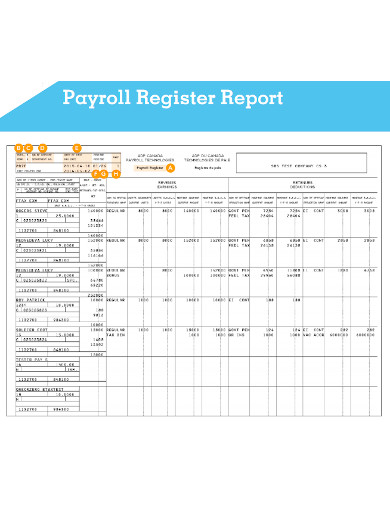

1. Payroll Register Report Sample

2. Printable Payroll Register Report

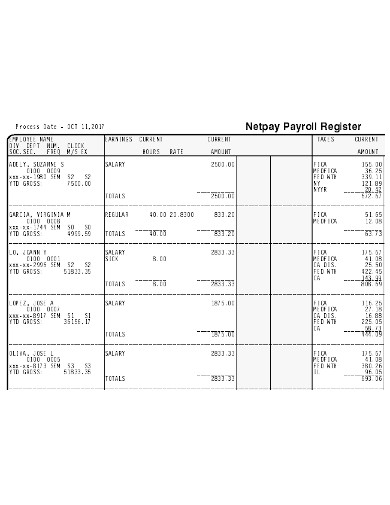

3. Standard Payroll Register Report

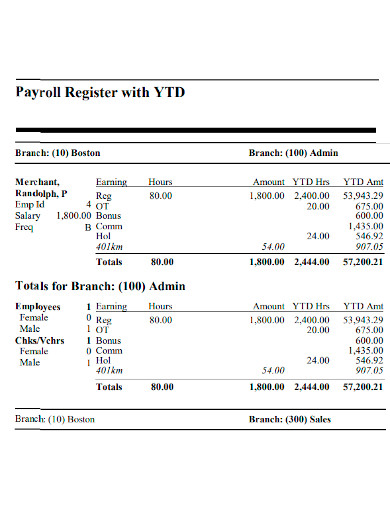

4. General Payroll Register Report

What Is a Payroll Register Report?

A payroll audit checklist is a document that supplements an audit’s effectiveness. A payroll audit enables businesses to ensure that all employees are paid correctly and that all deductions, such as benefits and taxes, are reported accurately. While some employees are immediately aware of a payroll discrepancy, others are not. Payroll audits assist you in identifying these errors, which are a critical component of your compensation and benefits strategy. It is essentially a systematic examination of a company’s or business’s payroll operations in order to determine compliance with a well-established set of local or national labor standards. Typically, an appointed auditor or a team of auditors conducts the inspection. Payroll audit procedures can take anywhere from a few minutes to several weeks, depending on your organization’s size and the scope and coverage of the audit. Certain payroll or human resources departments automate this entire process in order to provide faster and more efficient service.

What Should Be Included in a Payroll Register Report

Bear in mind that the majority of the more specific details on your payroll audit checklist are dependent on your business, the entire payroll process, or the nature of your business in general. You may have additional considerations when it comes to employee compensation. Regardless of the shape or form of the document, it should be able to encompass the majority, if not all, of these components.

- Review any changes to your employees

Take note of changes in these details of your employees;- Employee address

- New hires

- Terminations

- Status changes

- Rate changes

- Complete, approve and submit timecards or timesheets

Review your employees’ hours and determine whether they are accurate and reasonable. Indicate the pay period you’ve established. Weekly, biweekly, or semi-monthly? The critical point here is to ensure that you are tracking these three activities in your timesheets.- They’re accurate

- They’re approved

- They’re submitted

- Enter and review any needed additional payments

Payroll accumulates a large number of hours. Anything that stands out should be verified and verified again. Ascertain that you have backup copies of all documentation you use. Additional payment types may include the following:- Retro pay

- Bonuses

- Commissions

- Review taxes and deductions

Once payroll has been calculated, proceed to taxes and deductions. Examine your taxes and deductions to determine if they are accurate and reasonable. - Before you print checks, do a final review of all the changes

After verifying that everything is in order, you can print payroll checks or initiate direct bank deposits. - Make sure everyone who needs payroll information has access to it

Following the completion of the payroll process, you’ll have department heads, managers, vendors, and other shareholders who will be relying on the data you’re about to present. Once you’ve completed a final review of the completed payroll process, ensure that these appropriate individuals receive the necessary information. Payroll may be the largest budget item in your business, and it’s critical that you manage it properly and adhere to the required payment schedule.

FAQs

What is payroll?

Payroll refers to the amount of money that the employer pays its workers.

Is payroll accounting or HR?

Payroll, for the most part, is an employee-facing function. That is why the majority of people agree that it belongs to human resources. Pay changes, employee termination, start dates, and benefit information all fall under the purview of human resources.

What are payroll procedures?

Payroll procedures entail calculating total wage earnings, deducting withholding, filing payroll taxes, and distributing payments. While the majority of these steps can be completed manually, many payroll departments now automate the entire process.

Once human resource professionals or other designated individuals have a basic understanding of a payroll audit and a payroll audit checklist, they can identify areas for improvement and ensure compliance and accuracy to improve the overall employee experience. Naturally, your employees deserve that as well.

Related Posts

Sample Chemistry Lab Reports

School Accomplishment Report Samples & Templates

Field Report Samples & Templates

Sample Science Project Reports

Business Report Samples & Templates

Survey Reports Samples & Templates

Sample Feasibility Reports

Psychological Assessment Report Samples [ Clinical, Child, Intake ]

Report Format Samples & Templates

Acknowledgement for Internship Report Samples [ Hotel, Hospital, Teaching ]

Field Trip Report Samples [ Agriculture, Educational, Environmental ]

Student Counseling Report Samples

Narrative Accomplishment Report Samples [ Science, Teacher, Reading ]

Sample Acknowledgment Report Templates

Internship Narrative Report Samples