3+ Payroll Verification Report Samples

That sweet email notification from the HR department giving us our pay slip document might be one of the things we all look forward the most. Getting paid after hours of labor and hard work is a victory in of itself. Receiving our salary and wages is crucial as it is our main avenues of livelihood, it finances us for our day to day expenses. If one of your responsibilities is handling the employee payroll, this article is for you! Payroll is the process by which a company pays its employees. It entails the distribution of funds via paychecks and direct deposits. It also comprises keeping track of such payments and paying taxes on the employees’ behalf. In this article, we provide free and ready made samples of Payroll Verification Reports for you to use in managing your payroll efficiently with minimal to zero errors for your employees. Keep on reading to find out more!

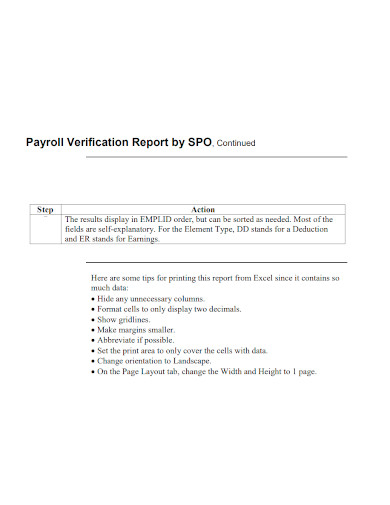

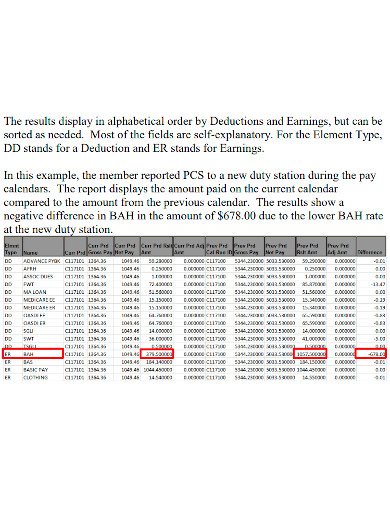

1. Payroll Verification Report Sample

2. Formal Payroll Verification Report

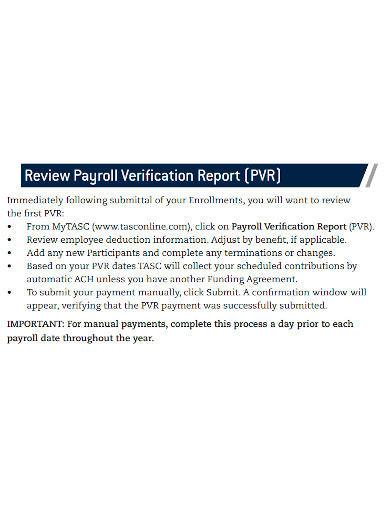

3. Review Payroll Verification Report

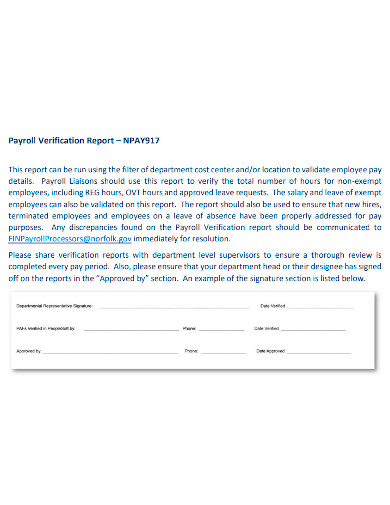

4. Printable Payroll Verification Report

What Is a Payroll Verification Report?

Employee hours worked, wages received, national taxes withheld, and other withholdings are all documented in payroll verification reports. Payroll software is used by many organizations to prepare tax forms for payroll reports. Each payroll period, quarterly, and annually, payroll reports are generated. The Payroll Verification Report double-checks pay entry data and guarantees that the organization and employees are set up correctly. Use it to double-check that new staff, clients, taxes, and companies are all properly defined. Transactions should be documented, authorized, and checked in such a way that the general ledger reflects actual payroll activity. All payroll transactions should be evaluated, and supporting evidence should be prepared and kept. Reviews should be completed as soon as possible. Departments must at the very least verify payroll numbers to ensure that errors are issued promptly.

How to Verify Your Payroll Report

Aside from the ready-made templates of Payroll Verification Account provided above, you can also make one of your own from scratch. If you’re interested in verifying the payroll report that is specific to your own company policies and regulations, here are some general steps you should consider taking to guide you:

- Review the List of Employees on Your Payroll.

Examine the personnel who are listed on your payroll. Check that the list of employees on your payroll aligns to your employment records, and remove any employees who are no longer employed by the company. Because employee population reduction and turnover can occur at any moment throughout the year, it’s critical to guarantee that everyone who received a payment worked during that pay period.

- Check that the time categories are correct.

Paid leave, sick time, and other types of payroll time are common in most businesses. Because it’s vital to verify and compare pay rates against employee attendance records, these hours must be labeled accurately. Check each employee’s record for overtime hours, sick leave, and vacation days to confirm that they have not been over or underpaid on their paychecks.

- Assess Payroll Data.

Because promotions, bonuses, and salary increases can happen at any point during the year, it’s critical to double-check that the values for each employee are correct for specific pay periods. Verify that the pay rates are current and that they correspond to the employee’s records. Verify that any employees who earned a raise or promotion throughout the audit period had their pay rate modified on the appropriate dailies.

- Identify places where the payroll process might be improved.

In order to continuously improve your payroll process, think about updating your policies from time to time in order to minimize errors and payroll liabilities as the years pass by.

FAQ

How long does it take to do a payroll audit?

The payroll tax audit procedure should not take more than six months if everything is done correctly.

What is payroll testing, and how does it work?

Testing payroll transactions during an audit entails looking for employees who should not have been paid and ensuring that valid employees are paid the correct amount. Payroll transactions must also be recorded in the right financial statement accounts, according to auditors.

What could possibly go wrong during the payroll process?

According to the same poll, “organizational inconsistencies” in the payroll process, inaccurate tax withholding, and over-and-under payments to employees were among the most common payroll concerns. Employee misclassification concerns and overtime miscalculations are common in addition to these.

It’s important to make sure that your payroll report is verified correctly. Set up routine reviews and evaluations to minimize things going haywire which might lead to disputes and payroll liability. Download our free, editable, and printable samples of Payroll Verification Report for your company’s advantage!

Related Posts

FREE 5+ Employment Authorization Forms

FREE 39+ Sample Reports

FREE 25+ Sample Community Service Letter Templates

FREE 14+ Sample Editable Pay Stub Templates

FREE 13+ Sample Security Incident Reports

10+ Self-Employment Ledger Samples

FREE 10+ Employment History Templates

FREE 9+ Sample Employee Verification Forms

FREE 9+ Sample Income Verification Forms

FREE 6+ Payroll Authorization Forms

FREE What Is Tenant Verification Forms

What Is the Advisor Invitation Verification Forms

FREE 47+ Sample Employment Letter Templates

FREE 10+ Sample Rental Verification Forms

FREE 9+ Sample Employee Forms