An audit is an official inspection or assessment of the accounts of a company or entity, which usually refers to the assessment of the financial side of things. Private companies and organizations need regular auditing to ensure that their financial health is in good shape and that they have a good financial standing in the industry. A private company audit report is produced after the audit has been conducted. Here are some useful private company sample audit report and templates that will serve as your reference as we learn more about it.

Private Company Audit Report Sample Template

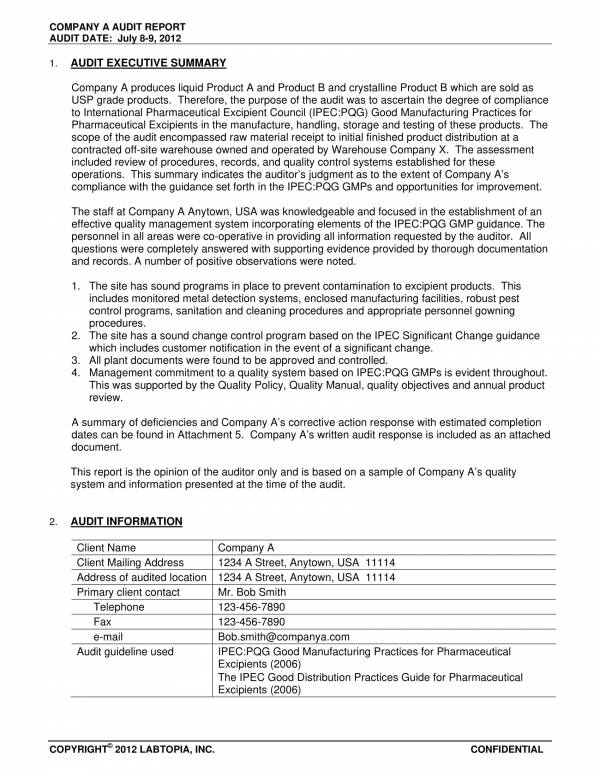

Sample Private Company Financial Audit Report Template

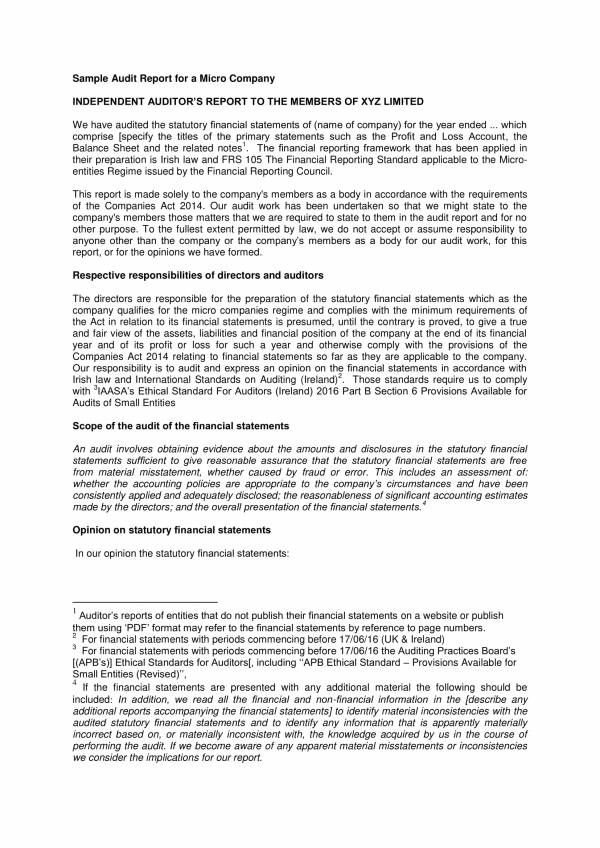

Sample Audit Report for a Micro Company

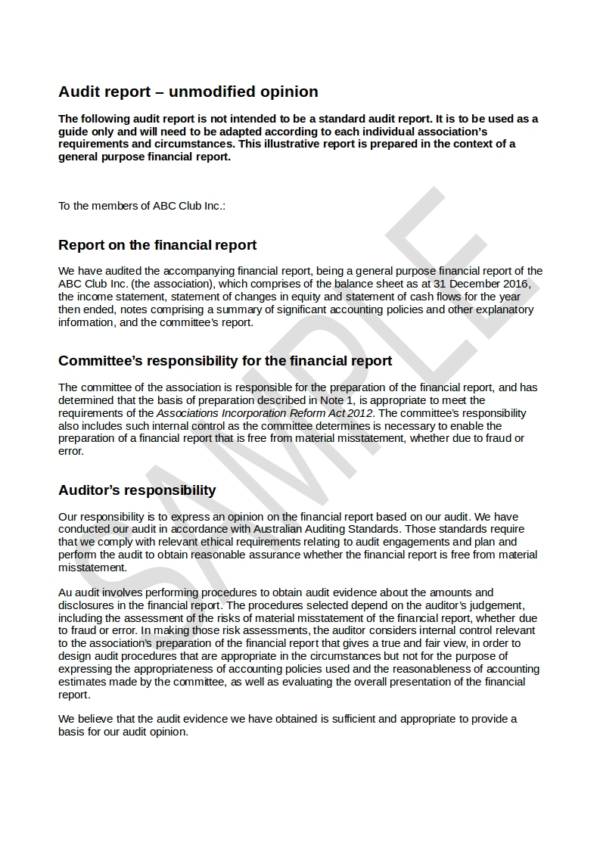

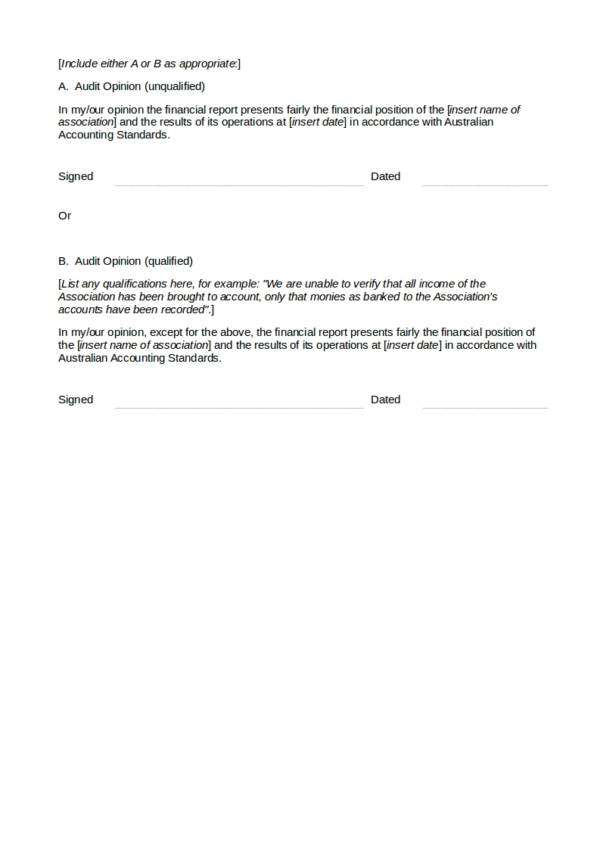

Incorporated Associations Sample Audit Report

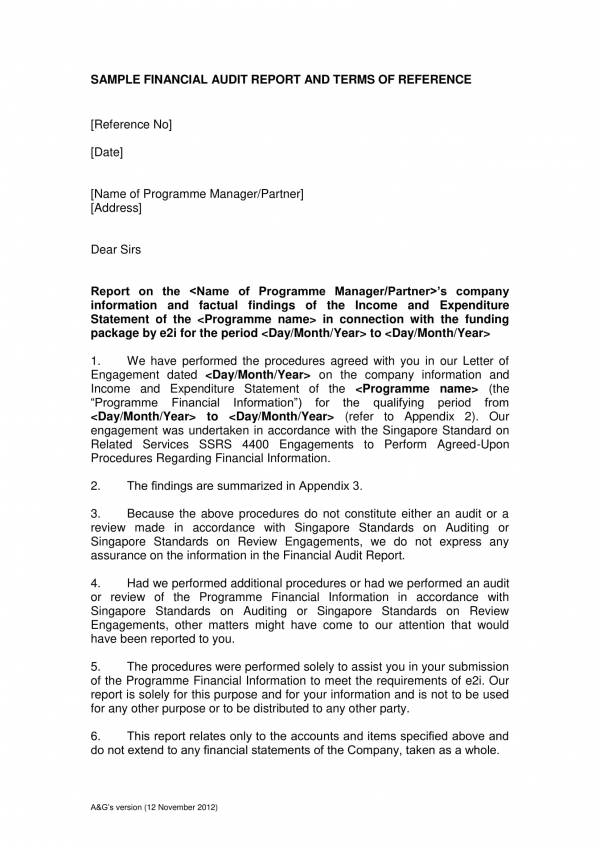

Sample Financial Audit-Report Template and Terms of Reference

Editable Private Company Audit Report Template

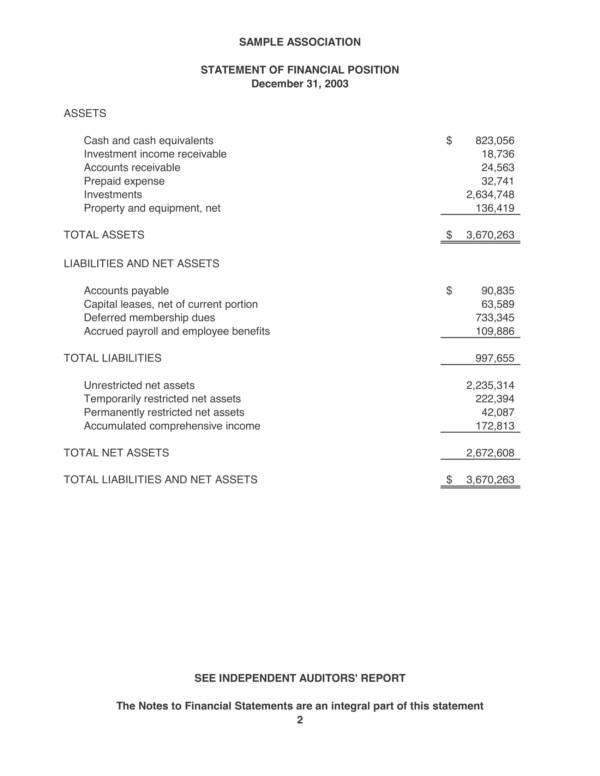

Sample Association Audit Report

Printable Private Company Audit Report Template

Private Company Audit Report Sample

Simple Private Company Audit Report Sample

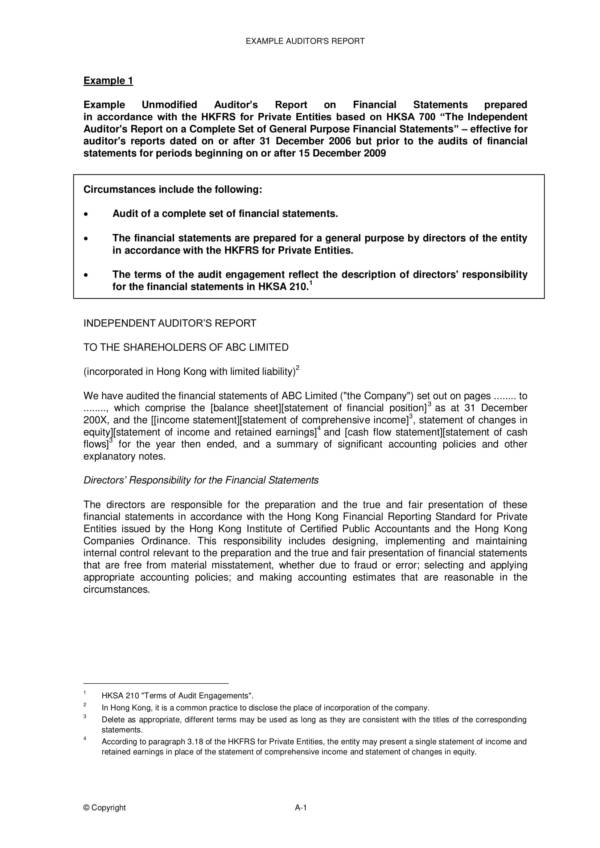

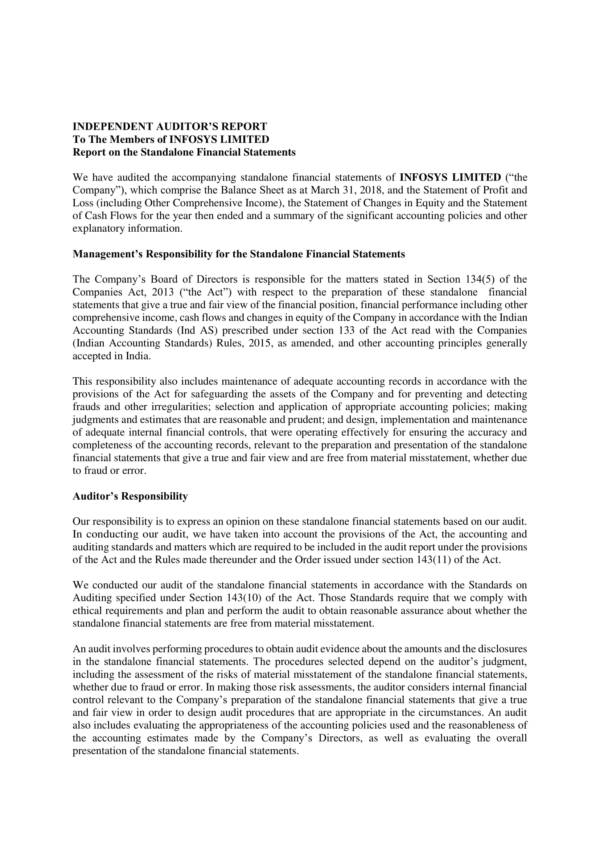

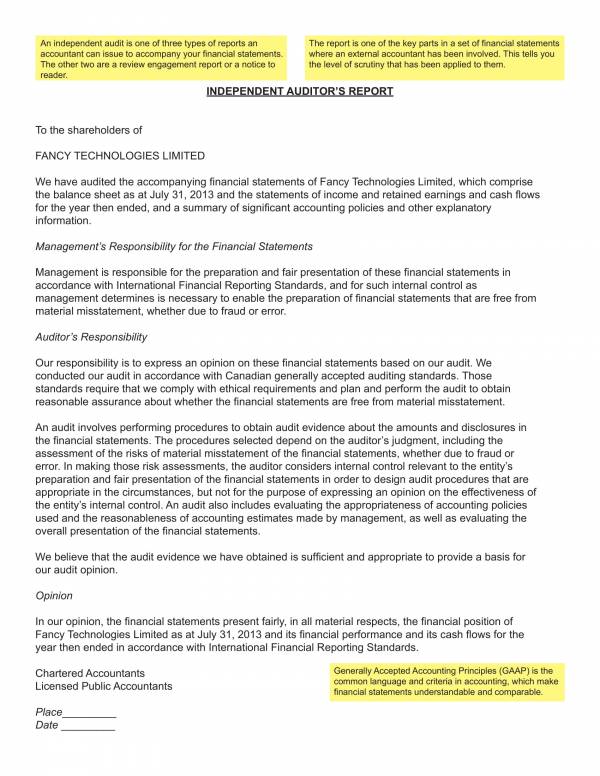

Independent Auditors Report on Private Company

What Is the Difference Between an Internal Audit Report and External Audit?

An audit report includes important information that is related to the audit, as well as the result of the audit or the audit opinion. Through an audit report, a lot of things are determined, which allows a lot of things to be done.

There are two main types of audit and these are internal audit and external audit. Judging from how they are named, you would automatically think that an internal audit is an audit done within a company or organization and an external audit is done outside a company or organization. Yes, you got the internal audit part right. But conducting an audit outside of a particular company or organization doesn’t really make any sense does it? To help you, here are some of the differences between an internal audit and external audit.

The Auditor

Just by their names, you can pretty much tell that an internal audit is done by an external auditor and an external audit is done by an external auditor. The internal auditor works for the company as an employee an not as an independent agent. An external auditor on the other hand is not an employee of a company. They could be from a private or public firm or an independent entity providing auditing services.

Hiring Party

Now, is there really a difference? Both internal and external auditors work for the company so they are of course hired by the company. If you try to look deeper a company is really big and it is made up of a lot of departments with their own employees supervisors, managers, and there is the CEO, president, vice president among others. So which one of them hires the auditors? Since internal auditors are employees of the company, they are hired by the management. External auditors are appointed by the shareholders of the company through a shareholders vote. Why can’t they just hire and agree with one auditor? That is because there are things that only management will know that will never reach the higher ups unless an audit is done.

The Scope and Limitations

Although both auditors do the same auditing tasks, there is somewhat a difference between what they can and cannot do when it comes to auditing. For external auditors, they pretty much are not restricted to doing any auditing tasks. They are free to inspect and assess whichever aspect or area of the company they want to look into. Contrary to external auditors, the scope that internal auditors can cover is limited to that of what management allows them to do or not to do.

Issues

Internal auditors focus more on company related issues, like the presence of any possible risks in the company, the company business practices executed, and other related issues. External auditors focus more on the financial side of things, specifically financial records. The findings of an external audit or the audit opinion is based on the financial statement of the company.

Audit Report Format

External auditors are free to use the audit report format that they want to use or that they see is appropriate for the audit that has been conducted. Internal auditors once again don’t have this kind of freedom. They must use the audit report format that is required by the company to be used for any internal audit report.

Reporting

So, to whom should these auditors report to? You might have already known from the hiring party part. Since internal auditors are hired by the management, they are responsible to the management. This means that they report all of their findings and assessments to the management. External auditors are voted by the company shareholders so they are responsible to and report to the shareholders.

Frequency

How frequent should an audit be conducted? Internal audits are done regularly throughout the year. Why not, when you have employed an internal auditor. That is basically an advantage. External audits are done only once a year, so companies better be doing things by the law to avoid getting a bad audit opinion and a bad reputation.

Private companies can have both internal and external audit functions to ensure that their records, financial statements, processes and other company related activities or operations are examined closely on a regular basis. So if you are an auditor, would you want to be an internal auditor or an external auditor? Other related articles you might want to check out are Data Audit Report Samples & Templates, Management Audit Report Samples, and Forensic Audit Report Samples & Templates.

How to Create Effective Audit Reports?

Tips will help you make things better, regardless of the nature of the task or thing that you are doing. And since we are learning about audit reports, here are some useful tips on how you can write effective audit reports.

1. Follow the required audit format

No matter how good or impressive your audit report content is, if you are not following the right format for the report, then you are probably up for some criticizing or you may need to revise the whole thing.

2. Outline

Prepare an outline before you actually start writing about the contents. This way it will be easy for you to arrange the contents of your audit report.

3. Get the Details Right

Address your audit report the right people. Make sure that you spell their names right and use the correct designation or position of each individual on your report.

4. Double check your Work

Take time to proofread your work. Do some spelling and grammar check. Revise your work as necessary. Keep in mind that minor errors such as spelling an grammar errors are a major turn off and will make your work look unprofessional. Don’t lose face and start proofreading.

5. Be Effective

Use clear and simple words to avoid confusion and misunderstanding. As much as you want to impress your manager or client with your vocabulary, your report should focus more on being understandable than impressive. If you have to choose between being impressive and being effective, you should choose the latter. You can’t impress anybody if what you are doing is something that does not work.

FAQs

Are Audits Public Information?

Final reports are distributed to the concerning parties within the organization, so the level of confidentiality will depend on the details of the reports and who are advised to go through it.

Who Will Benefit from Audit Report?

The company’s customers, stakeholders, investors and financial partners. As this will increase the credibility and will help with the organization’s future financial planning.

Why Would a Private Company Want an Audit?

It is beneficial to to audit a Company’s financial statements especially for privately held businesses with revenue over $1,000,000. This will present the highest level of assurance that a Company’s financial statements are fair and true.

It is important that a company maintains its standards, quality and integrity. So, conducting audit reports can give a clear picture of how the business is working, examine the areas that needs improvement, check if the organization is conducting its business in full compliance. This way it gives shareholders the confidence to believe that the business organization is living up by its standards and quality.

Related Posts

40+ Report Format Samples Sample Templates

18+ Sample Inventory Reports Sample Templates

45+ Sample Reports Sample Templates

9+ Committee Report Templates Sample Templates

8+ Sample Audit Plan Templates Sample Templates

7+ Sample Financial Reports Sample Templates

7 Audit Program Samples & Templates Sample Templates

11+ Sample Company Reports Sample Templates

8+ Sample Technical Reports – PDF, Word Sample Templates

9+ Sample Inventory Reports Sample Templates

7+ Sample Forensic Report Templates – DOC, PDF Sample ...

40+ Sample Reports in Doc Sample Templates

10+ Sample Marketing Reports Sample Templates

10+ Business Report Writing Samples & Templates – PDF, Word ...

21+ Professional Report Templates Sample Templates