In business, there are few things that can trump the feeling of a successful project and seeing its implementation’s effect. However, the road to victory is narrow and lined with pitfalls, beartraps, and bandits. Plenty of things can go wrong: a lack of resources and motivation from your workforce, unexpected technical issues, and ill-mannered individuals plundering from your project’s proposed budget. If you want to raise that trophy of valor and—possibly—a salary increase, you should know how to find these anomalies by using a project audit report.

What is a Project Audit Report?

It’s a given that marketing and financial skills are one of the most sought-after qualities in the business industry. From creating a budget plan to managing assets, these traits assist greatly in the success of company endeavors such as projects. In this day and age where business stagnation equates to “choosing death”, projects are well-recognized as the lifeblood of a corporation. As such, it’s in your best interest to eliminate any factor that hinders a project’s success.

The fear of every entrepreneur is employee theft or fraud, and so they find ways to combat this problem—one of the mentioned methods is through daily inventory checks and audit reports. Audit reports are documents that examine the value or truth behind documents. These documents range from purchase orders, credit card history, and bank statements. The reason for the prevalence of this methodical way of finding monetary information is because of its scrupulous nature and the enforcement of checks and balances.

The Great Financial Detective

There are few symbols more iconic together than the trinity of sleuthing: the calabash, the deerstalker, and the magnifying glass. Does this sound familiar? Even as a fictional character, the story of Sherlock Holmes resonates through the media—and for good reason. Mr. Holmes is the hallmark of detective work as he deduces each problem from various angles, finds the most probable causes, and sticks to the evidence at hand.

With that said, auditing financial transaction documents follows the same principles. To audit, after all, is find the truth among a sea of green dollar signs, so the process of contrasting and comparing the report to the given receipts and records is comparable enough to sleuthing. Perhaps combarable enough that assuming an experienec auditor is a “great financial detective” doesn’t seem like much of a stretch.

8+ Project Audit Report Samples

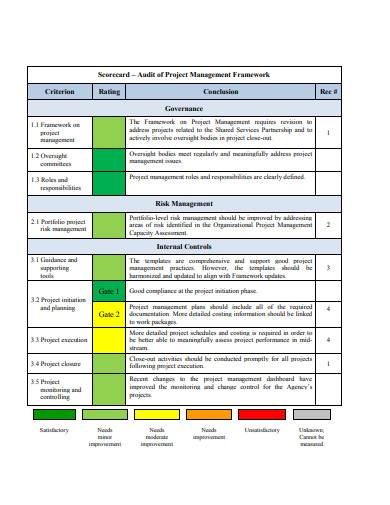

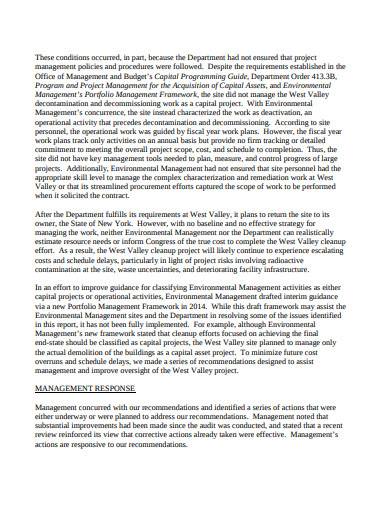

1. Audit of Project Management Report Framework Sample

2. Project Performance Audit Report Template

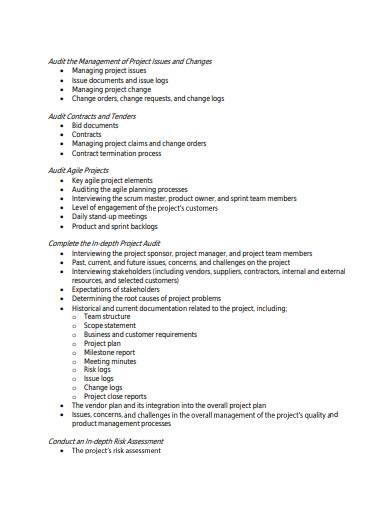

3. Project Audits and Quality Reviews to Reduce Project Risk

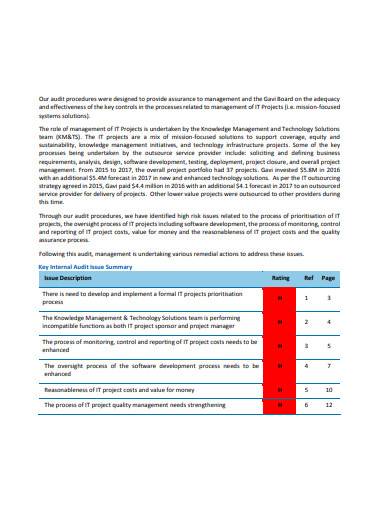

4. IT Projects Audit Report Sample

5. Internal Audit Project Report Template

6. Projects Governance Audit Report Sample

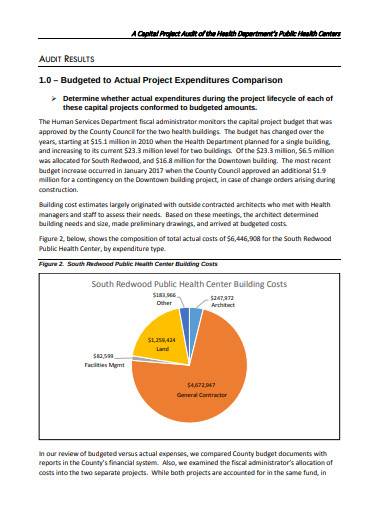

7. Capital Project Audit Report Sample

8. Construction Project Audit Report Sample

9. Project Audit Report in PDF

How to Audit Project Documents

Your project’s success relies on the availability of manpower, resources, and funding. If any of these factors have defects, lack morale, or are inadequite, then the project’s probability of success decreases. As such, knowing how to audit your project’s financial documents ensures that at least one area is secured.

1. Review the Document

Much like any other contract agreement or legal document, your project’s finacial report should have a defined format. This type of “format” isn’t necessarily about font style or size but rather a set of critea to be met. For example, it’s a good idea to set a limit for how many purchased items can be present at a given time in a report, which also means that fewer expenses should be made to cut down costs.

2. Check the Validity of Evidence

How trustworthy is a market receipt if the date provided doesn’t coincide with what’s written on the report? As horrid as it may be to assume that receipts could potentially be doctored, it’s better safe than sorry. Check for discrepencies, a fault on the stamp, maybe the prices in the text is different from what’s written on the report. These are all red flags of potential fraud and a project audit report aims to locate these.

3. Note Down Anomalies

If you do find anomalies during your inspection, note them down. Include details such as where they came from, for what expenditure, date, and what makes them a discrepency. Your goal is to gather evidence if there are any, so not recording your findings kills that objective.

4. Be Impartial

Admittedly, this is easier said than done; however, it is necessary to effectively audit a document. To both audit a document and report your findings irrelevant of who submits them requires iron-clad resolve and an entrepreneur’s mindset. When done right, your project audit report becomes the check and balance of power within your corporate hierarchy.

Auditing the financial documents of a company project may not be as dangerous as solving a crime, but it’s by no means easier. From scanning through various forms of budget reports and proofs of expenditure to jotting them down in a report of your own, the tension that comes with auditing is heavy to bear. However, despite the sour taste it leaves in your mouth, this is a necessary process to protect your business from theft and fraud.

Related Posts

6+ Audit Program Samples & Templates

FREE 9+ Sample Report in PDF Word

49+ Sample Report

9+ Budget Report Sample

15+ Sample Internal Audit Reports

14+ Data Audit Report Samples & Templates

12+ Sample Company Reports

17+ Audit Report Samples

22+ Sample Inventory Reports

8+ Weekly Report Samples

How to Create a Daily Construction Report

10+ Tax Audit Report Samples & Templates

9+ Annual Report Sample

9+ Stock Audit Report Samples & Template

8+ Access Audit Report Samples